Today, two powerful economic theories are emerging: Modern Monetary Theory (SDT) and Bitcoin.At that time,how political discussions are still tied toto a primitive but eternal dispute between left and right economies, two nascent opposing theories redraw the current economic debate as we know them. SDT is the thesis, and Bitcoin is the antithesis. Nevertheless, Bitcoin and SDT are united by the fact that they are aimed at moving discussions beyond the framework of traditional intellectual disputes about a liberal and conservative economy.

</p>AOC: Why does this croissant cost $ 7? We should pay the workers who sell it $ 15 per hour!

:: Price of croissants rise to $ 9 ::

AOC: Why does this croissant cost $ 9? We should pay the workers who sell it $ 17 per hour! Https: //t.co/wCUYkKpjFb— Ben Shapiro (@benshapiro) April 1, 2019

With growing dissatisfaction with the currentpolitical-economic spectrum, extremes are becoming more difficult, threatening to destroy or transform the familiar bases. And, as is always the case in the modern era, both themes are subject to a high degree of speculation, distortion and general misunderstanding. The resulting vilification and hatred from external political cliques only fuel the popularity and, consequently, the influence of these topics.

Everything is complicated by the fact that in SDT and Bitcoin there are also internal factions fighting for the right to dictate the basic definitions of their topics.

In other words, both topics are breeding grounds for hostility and group thinking, to the original definition of which one prominent SDT researcher sends us:

"Community of researchers working in"a dominant culture that gives its participants a sense of ownership and a common goal, but also encourages them to ignore new and better ways of thinking and be hostile to them."

Although the generally accepted definition of SDT is that“A country cannot default on a debt denominated in its own currency”some early proponents of the theory are completelyrejected this fundamental position. The problem is that many of the proposals made by SDT supporters are quite rational when it comes to specifics, but a wide public dialogue makes SDT something unrecognizable. Bill Mitchell, one of the authorities in the SDT, claims that the SDT is not a revolutionary new system or a radical threat to the current order, but this is the current order:

“In reality, SDT simply describes the system under which most countries of the world have lived since 1971.”

MDT simply describes the current global economy: the existing fiat currency system. Mitchell also clarifies the generally accepted underlying position:“Governments are not constrained by their need to generate income”. In addition, he states a platitude that is often also a bitcoin anthem:“Currency has no intrinsic value”.

The popular definition of SDT has also extrapolatedsuch fundamental definitions to extremes. The governments of different countries for centuries have increased their debt-to-GDP ratio. The ceiling of this relationship is poorly guarded by various political cliques of budget conservatives. However, in America, the main camps of Republicans and Democrats are united in their determination to spend trillions more in revenue. And that brings SDT to unprecedented new extremes.

By Mitchell’s definition, SDT already servesthe basis for the global economy. However, the elements of SDT, popular and hyped in modern media, seem to want to expand debt faster than ever to solve more ambitious problems.

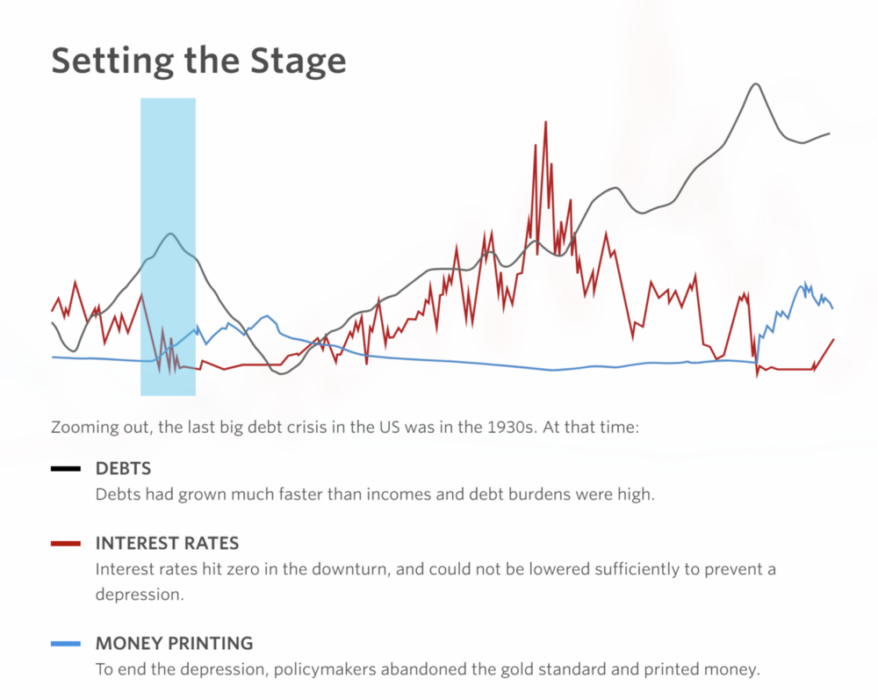

In some respects, despite two toughtemporary collapses this century, many parts of the world economy enjoyed two extended periods of prosperity. Rapid growth in government spending, coupled with dovish central bank policies(historically low interest rates + rising trillions of dollars in balances), provided incentives for the economic landscape as we know it today.

In contrast to SDT, classical economists at the Austrian school believe that short-term stimulation of soft fiscal policies ultimately leads to terrible long-term risks.

At the beginning of the last century, the result of the equation«unlimited government spending + soft central bank policy + money printing» had catastrophic consequences for society. If history is prone to repeating itself, then this century's Great Recession was just a harbinger of what might happen if global credit continues to rise.

When the credit Leviathan of the global economy threatened to collapse in 2008, governments extended the life of the credit system by inventing“Quantitative easing”representing nothing more than typingmoney. Although such unconventional monetary action has prevented the 21st Century Great Depression in the medium term, in the long run this could undermine the viability of capitalism.

For those who fear such a dystopianof the future, the theoretical salvation from the financial crisis designated its creative alternative with a message, now encrypted in an unchangeable digital format:

“The Times Jan 3 2009, Chancellor on the verge of second aid to banks. ”

Bitcoin and its genesis block laid the foundationa digital alternative to central banks and government debt, creating a currency independent of most typical mechanisms of a national economic monopoly.

In contrast to government debt spendingor decisions of central banks that affect the flow, availability and distribution of currency in the world, Bitcoin has restructured money, as we know it, using a program code.

Instead of arbitrary increases or restrictions on the money supply by governments(through spending, capital controls or central banks)Bitcoin has proposed a completely revised alternative. Also known as a distributed registry, or blockchain, Bitcoin is based on the following ideals:

- A predictable and programmed monetary inflation schedule.

- Unlimited geographic and permission-free access to the network.

Increase in government debt historicallyassociated with hyperinflation and, ultimately, social disasters. While a stable / predictable increase in government debt can contribute to medium-term prosperity, there is an increasing risk that a system crash will be more significant if a real shock occurs.

In the case of such hyperinflation as in modernVenezuela and pre-Nazi Germany, innocent people became economic hostages. In theory, Bitcoin could become a universal economic emergency exit, allowing you to insure yourself against a local economic downturn. Anyone with access to the Internet can potentially gain access to this alternative store of value to protect their wealth.

However, Bitcoin is subject to extreme volatility andstill technologically limited. Promising an alternative to the corrupt traditional global economy, Bitcoin has its own political problems, inflated in public space.

Like MDT, the Bitcoin myth can easily get out of control, and there are competing camps in the cryptocurrency space vying for control of the message.However, most likely, the predominant message of Bitcoin will be a predictable and permission-free independent digital currency.Beyond hacks, scams, bubbles, and token hyperinflation, other aspects of cryptocurrencies may emerge after Bitcoin to expand the capabilities of this new financial alternative.

It would be logical to assume that supporters of SDT,regardless of camp, they should consider Bitcoin a theoretical adversary. In contrast to SDT, Bitcoin uses a radically different philosophical approach to government debt. Providing people with insurance against endless government debt can undermine financial monopolies that support the current fiat SDT system.

Some more logical SDT proponents, such as Bill Mitchell, may welcome Bitcoin as an independent free market alternative that actually confirms SDT:

“Any imbalance in the foreign exchange market is resolveddue to fluctuations in exchange rates. This means that domestic political instruments - the central bank and budget policy - can freely pursue domestic political goals, knowing that the exchange rate will resolve currency imbalances arising from trade deficits and surpluses, etc. ”

Today's system of freely floating currencies provides a system of checks and balances for MDT. Bitcoin provides another additional option.While global government debt and the easy money of central banks do pose a long-term threat, the entire global economy is at incredible risk.

In this regard, all the world will be guilty.governments and central banks. And if the world economy is really waiting for an hour of reckoning, there is no safe haven among fiat currencies. And then we will see if Bitcoin is really able to provide asylum ...

The future of the global economy is shaped behind the curtains of evolution and disagreement between Bitcoin and SDT.

Global policy may bring SDT in futureto the extreme, and then Bitcoin may appear to be an even more radical alternative. Only time will tell which of them will prevail, or perhaps what their synthesis will be.

</p>