The good thing about Bitcoin is that it is generally uncorrelated with most other major asset classes. INin particular, outside of liquidity crises, when everything tends to move in parallel, bitcoin and the stock market are largely unrelated. But does it stay the same?

If you remember, all financial assets collapsed in March last year due to the COVID crisis.

Then a lot of people started to worry about diversification: “If bitcoin fell 50% when the stock market crashed, then why am I holding it?”

The answer, of course, was "just look wider." For a fairly long period of time, Bitcoin has not been correlated with the stock market.

The fact that during a short period wheneverything collapsed and then rose, we saw a higher than usual correlation between bitcoin and the SP500 index, it doesn't really matter. This is exactly what you would expect during a money printing liquidity crisis and recovery.

While we have moved away from this event, Bitcoin seems to be more correlated with the SP500 than usual.

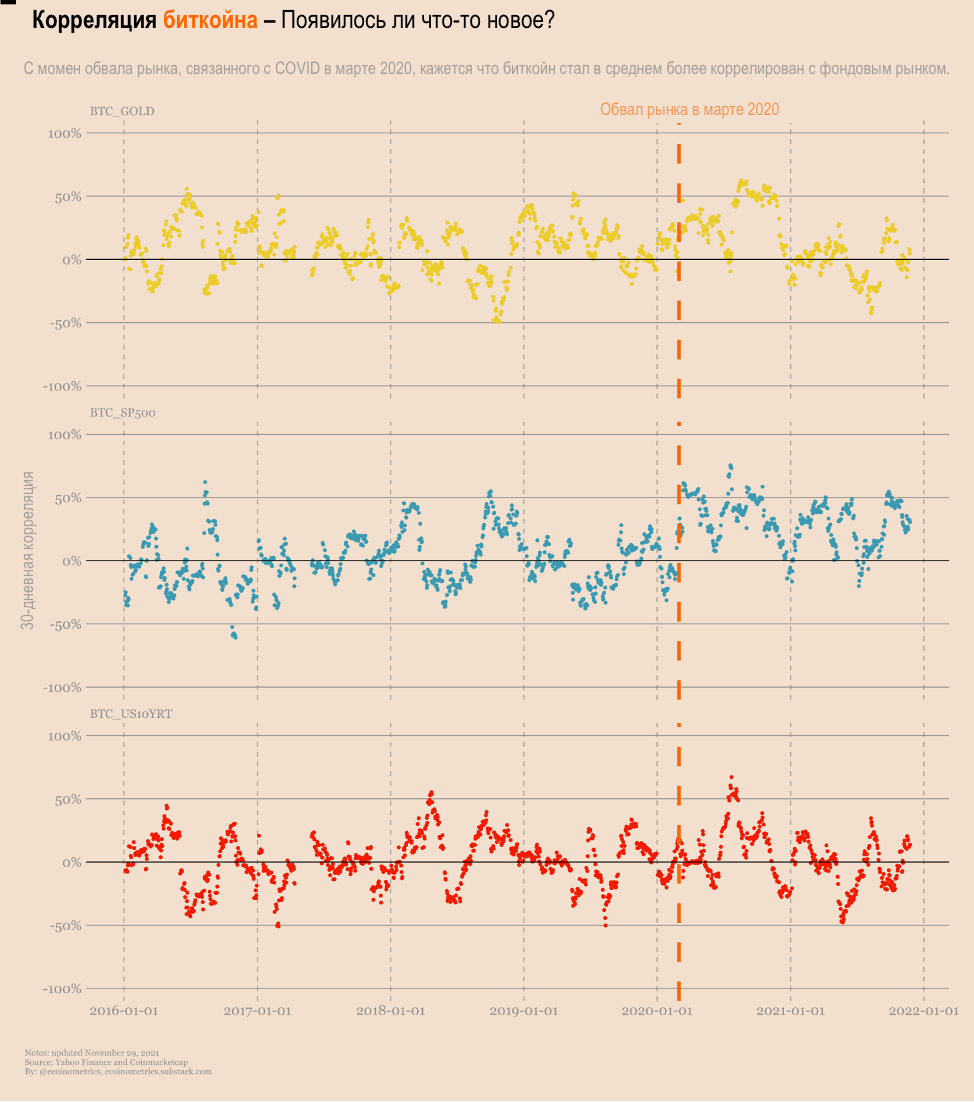

Let's try to refer to the graph. It displays monthly correlation rates between bitcoin and gold, bitcoin and SP500, bitcoin, and 10-year Treasury bond yields.

Before the COVID crisis, these correlation rates averaged around 0, which means no correlation.

After the COVID crisis, there are no differences for 10-year bond yields, the correlation with gold is recovering, and the correlation with the SP500 seems to be averaging at a higher level than before the crisis.

See for yourself.

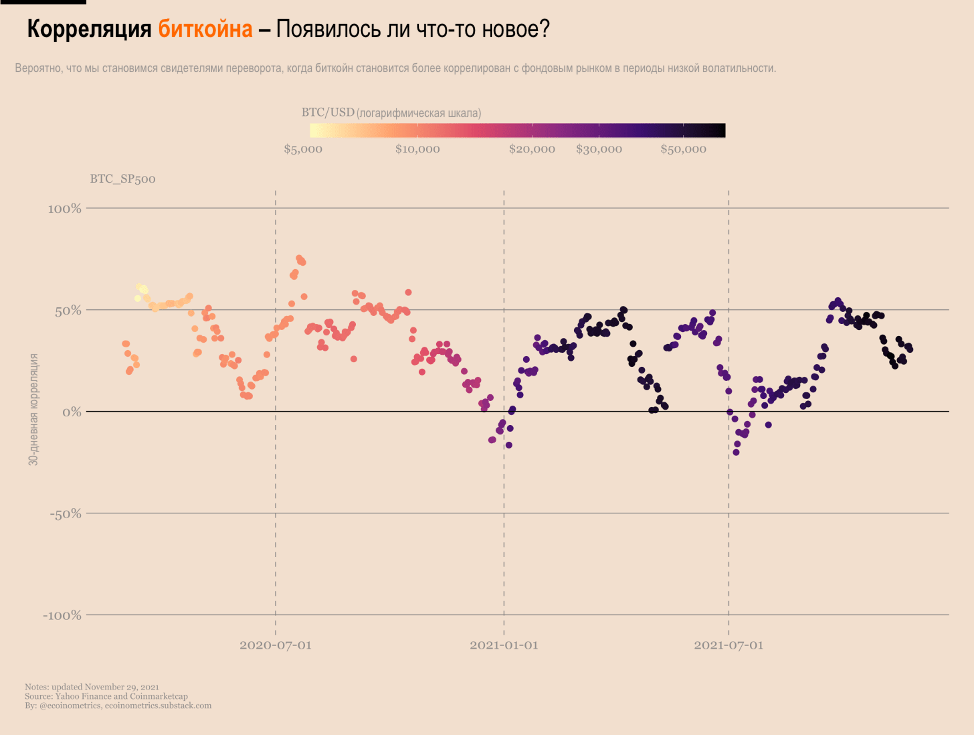

Let's focus on this period and overlay the bitcoin price to see if there is any pattern.

I don't know about you, but I see that when bitcoinplunges into periods of lower volatility, the correlation with the stock market increases. When we see spikes in volatility, the correlation goes back to zero.

This correlation has averaged around 25% since last March, so that's not an insanely high level to be satisfactory.

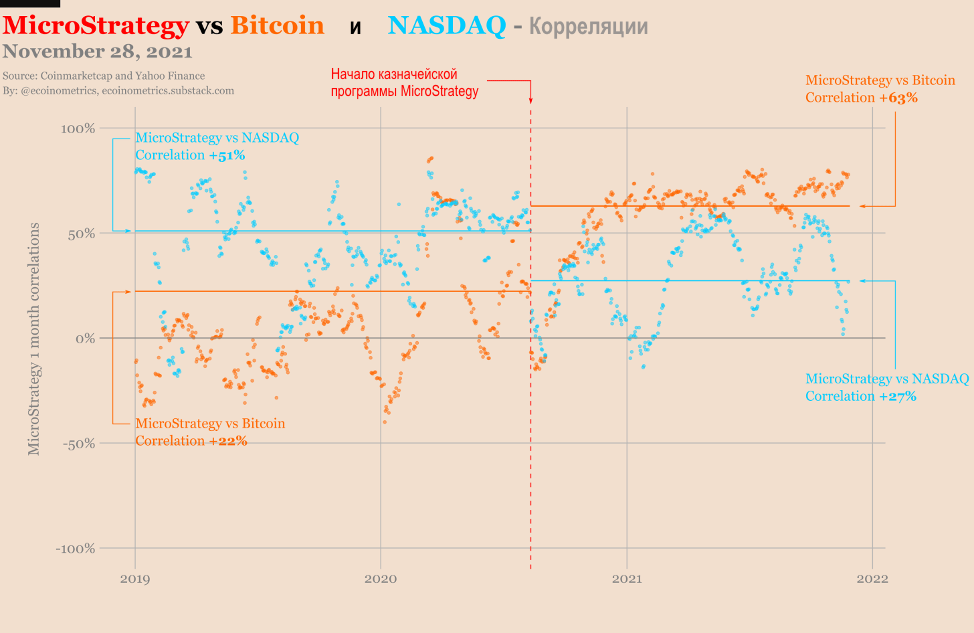

For reference, MicroStrategy (i.e. pseudo ETFs) has had a stable 63% correlation with Bitcoin since they started their Treasury program. That's where the real correlation is!

Thus, for all practical purposes, it is still possible to consider BTC and the stock market as independent bets.

If anything, this new trend is perhaps telling us about how mainstream investors are starting to classify bitcoin:

- stocks = risky assets;

- bitcoin = super-risky asset.

Jokes aside, this could be a hint of what is about to happen.

If Bitcoin becomes more tame financialinstrument, then we will most likely see a growing convergence between investors who own traditional tech stocks and those who own BTC. The correlation between these assets may increase.

Only time will tell.

Market conditions

If this is not your first time investing in crypto markets, you should not be impressed by the fact that Bitcoin is currently around 15% below its all-time high despite attempting a rebound.

Federal Reserve Balance Sheet Onlysystems can get away with parabolic dynamics without having to deal with large corrections. For everyone else, the price to pay for 2x, 4x, 8x is the subsequent double-digit dips.

So just talking about the scale of this correction, and at the same time not considering other market conditions, will not say much.

To get a better understanding of the situation, let's dig deeper.

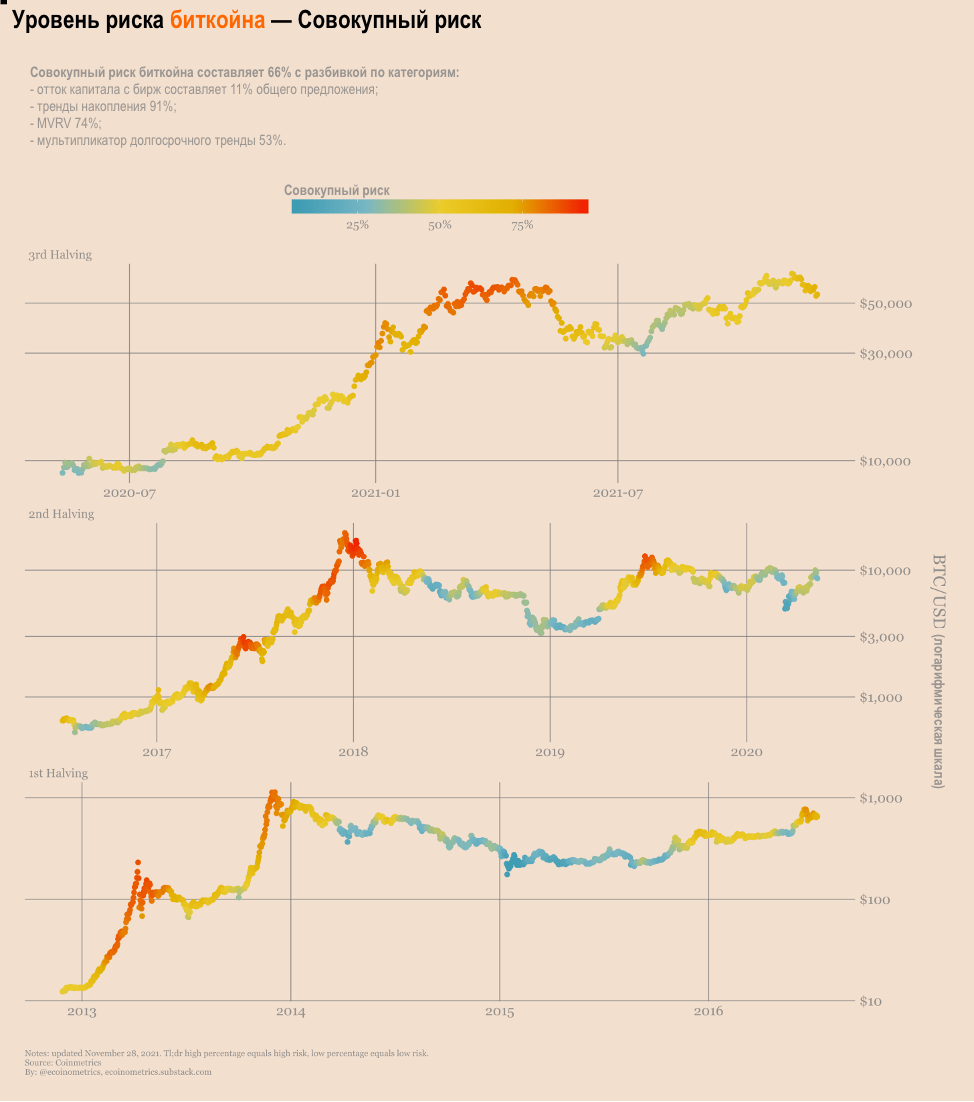

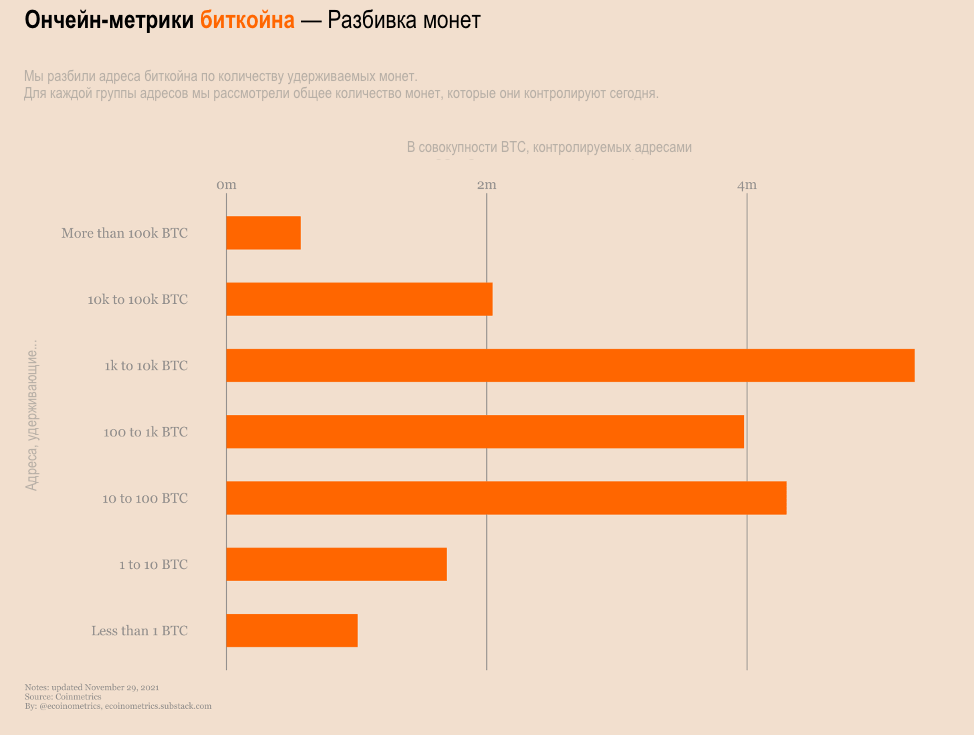

First of all, let's check the level of aggregate risk:

- 66% overall means the market is neither hot nor cold;

- 11% of net capital flow from / to exchanges means that coins are still leaving exchange wallets;

- 53% for the Mayer multiple, i.e. it is not surprising that the price did not reach too high a level;

- 74% for the ratio of market value to realized value, i.e. hodlers are making a profit, but not to extreme levels;

- an extreme value of 91% for an accumulation trend.

So, in order to decide if the situation could get worse in the short term, two questions need to be considered:

- Can we see some kind of sudden capital inflow to the exchanges? That would be bad for the price.

- Can we see a resumption of the accumulation trend? That would be good for the price.

In fact, both of these questions are related.

If the trend towards accumulation resumes, then there is no reason to expect a reversal of capital outflow from exchanges.

If very few hodlers accumulate satoshi all the time, then we are most likely seeing coins being unloaded onto exchanges.

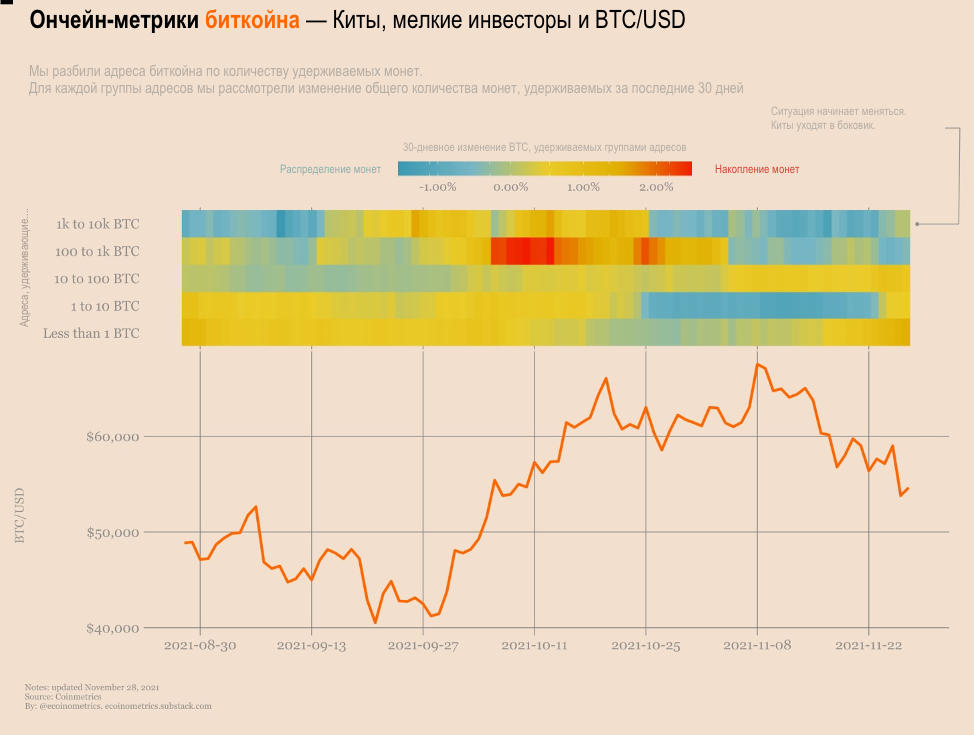

Now the good news: Despite the price action, things seem to be changing.

Yes, the accumulation trend looks bad.But accumulation trends reflect a 30-day average, so even if the situation starts to improve, it will take some time for the state of affairs to be reflected in this metric.

And when we look at the categorization of addresses, that's reassuring. If we continue this trend, the accumulation indicator will move out of the blue zone rather quickly.

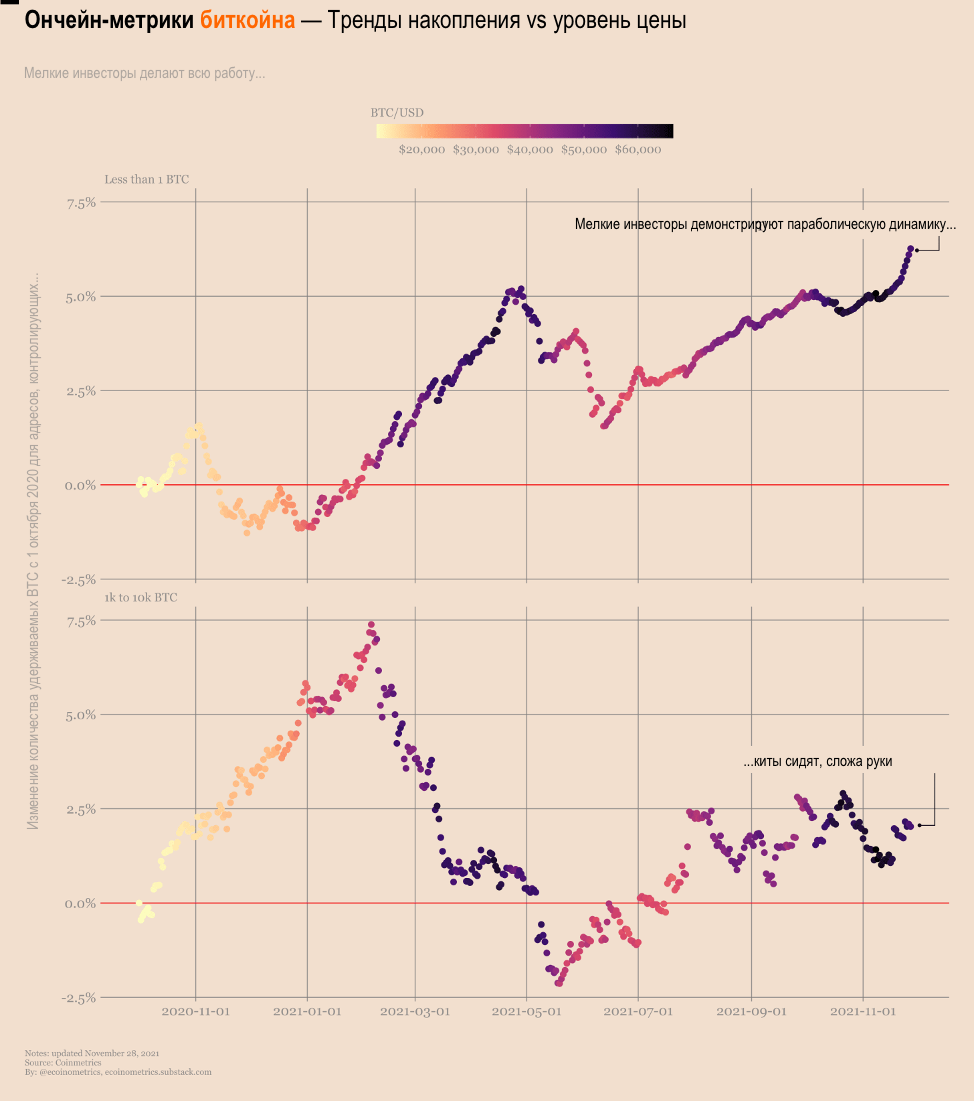

In fact, the most impressive thing here is not that the whales began to buy out the decline, but that the smaller participants are demonstrating parabolic dynamics. Take a look for yourself.

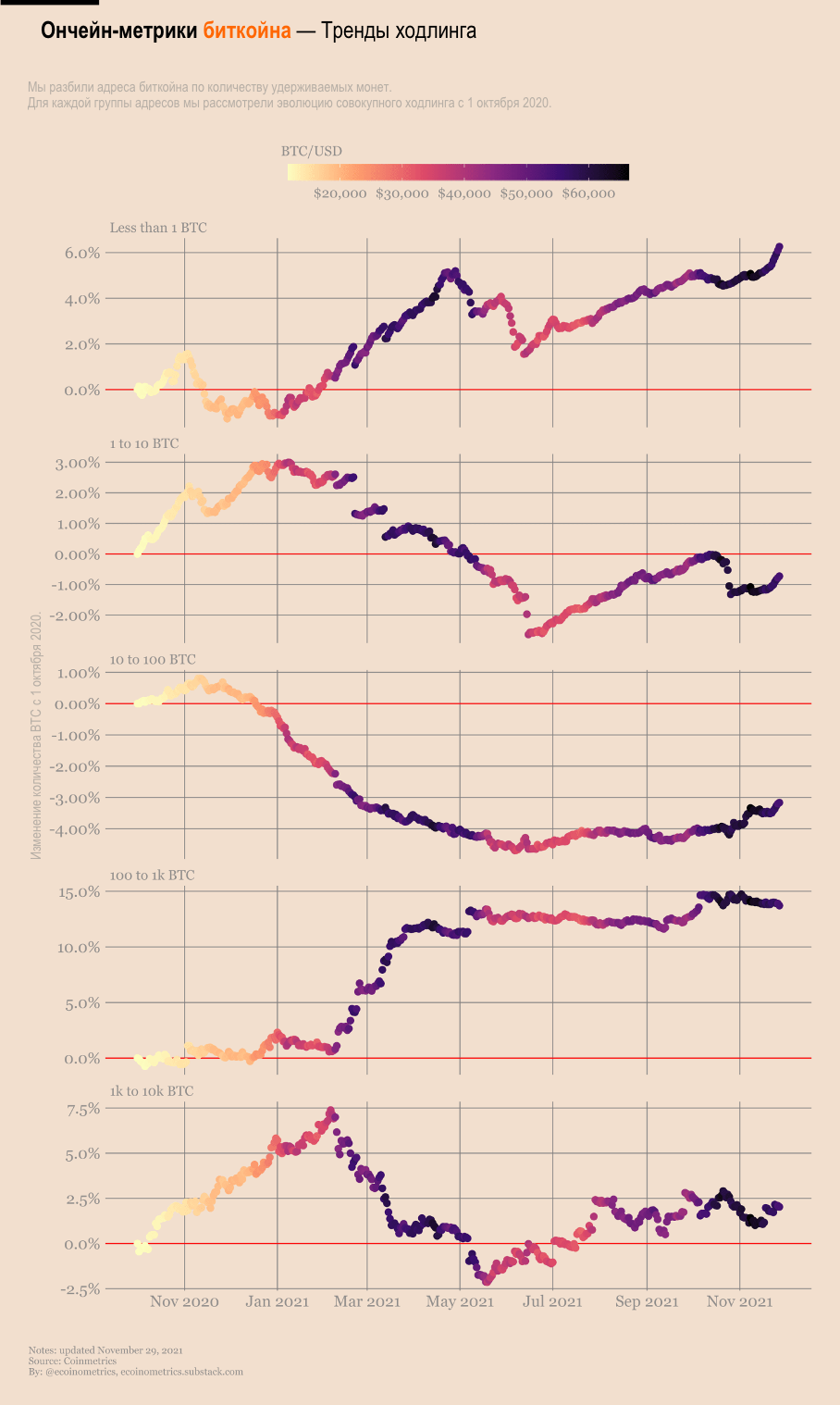

Now, if we take a broader view and focus on the longer trend, the situation is as follows:

- addresses controlling less than 1 BTC are at their highest level since October last year;

- addresses controlling from 1 to 10 BTC sold the price recovery in October, but they returned to accumulating satoshi;

- addresses controlling from 10 to 100 BTC also slowly increase their hodling level;

- addresses controlling from 100 BTC to 1000 BTC are not doing much, but the number of coins they hold has increased by 15% compared to last year;

- addresses controlling between 1,000 BTC and 10,000 BTC have done little since Bitcoin hit its all-time high.

In fact, a picture is worth a thousand words, so see for yourself.

You see the commonality between these trajectories, right? For the most part, starting from the very bottom in May, hodlers are bought.

It is now clear that the area is $ 65,000.represents a strong level as its breakout has triggered sell-offs several times this year. But given that most risk metrics are not at extremely high values, there is no reason why bitcoin cannot break through.

This does not mean that I predict that the price will skyrocket tomorrow. Nobody knows. But are there already conditions on the market for a rapid rise in prices? The answer is yes.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>