In today's article, we'll take a closer look at mining industry data as Q2 turbulentis nearing its end.

Hashrate and mining difficulty

Hashrate gives an estimate of the total amount of computingthe activity that miners expend while working on adding new blocks to the chain. In proof-of-work, miners compete to find the next block by taking data known as the block header (which includes information such as the hash of the previous block and the transactions that will be included in the new block) and hashing that data to find the right decision and win a block reward (6.25 BTC to date) in addition to transaction fees paid by users.

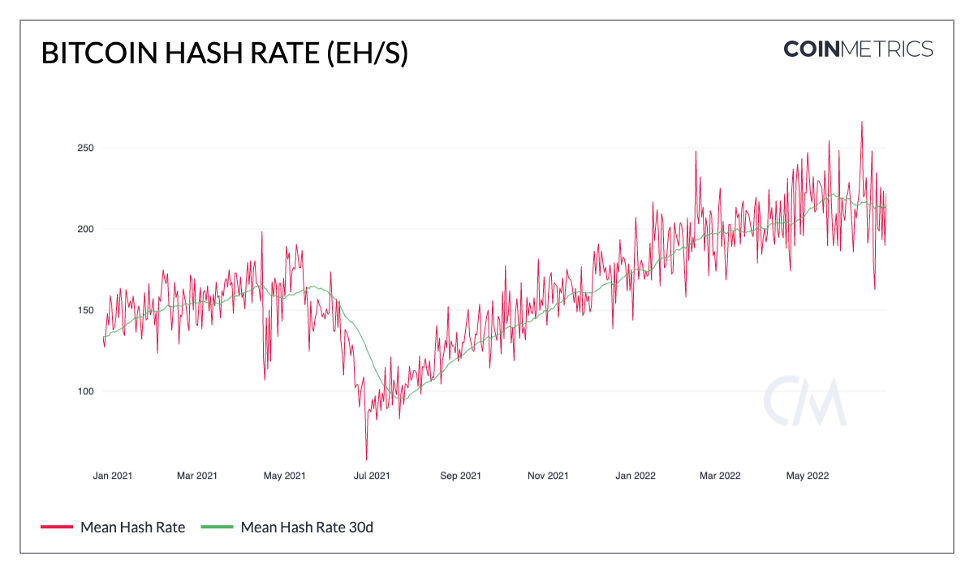

Apart from the fact that hashrate is importantan indicator of the health and security of the Bitcoin network, it is also a macro indicator for the mining industry as a whole. The 30-day moving average hash rate has remained stable despite BTC price movements, hovering around 215 exahash/sec (quintillion hashes per second) after peaking at 220 exahash/sec in May.

Bitcoin hashrate (exahash/sec). : Coin Metrics Formula Builder

Please note that there is no way to directlymeasure the on-chain hashrate, so it is determined by the speed of adding new blocks to the blockchain. Because of this, large daily variations are often explained by statistical noise.

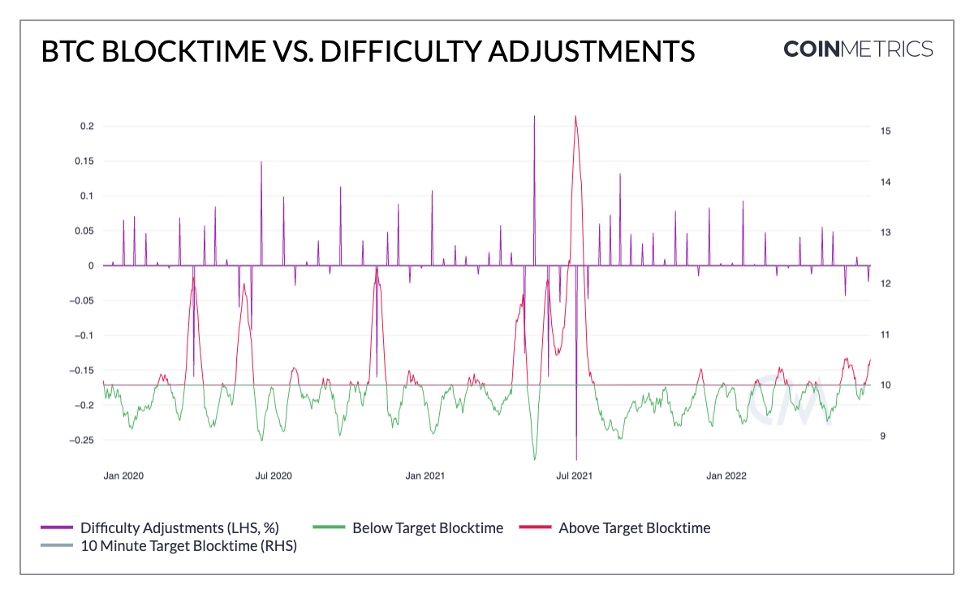

Bitcoin mining difficulty is another importantmetric to monitor. Bitcoin mining difficulty is a network-defined parameter that automatically adjusts approximately every two weeks (2,016 BTC blocks) to set a 10-minute interval between blocks.

Bitcoin difficulty recently dropped 2.3%, the second largest drop of 2022.

BTC Block Interval vs Difficulty Adjustments. : Coin Metrics' Formula Builder

Difficulty directly affects the profitability of a miner, since the average time to find a new block at a constant hashrate increases and decreases with difficulty adjustment.

As mining difficulty increases, revenuesdenominated in BTC (and therefore income denominated in dollars) decrease proportionally. But complexity is only one part of the mining economy.

Rising energy costs

In addition to mining difficulty, miners mustAnother important factor to consider is energy costs. As a result of rising inflation and supply chain bottlenecks, many miners are under pressure from both sides, paying more for energy while earning less revenue at the same time.

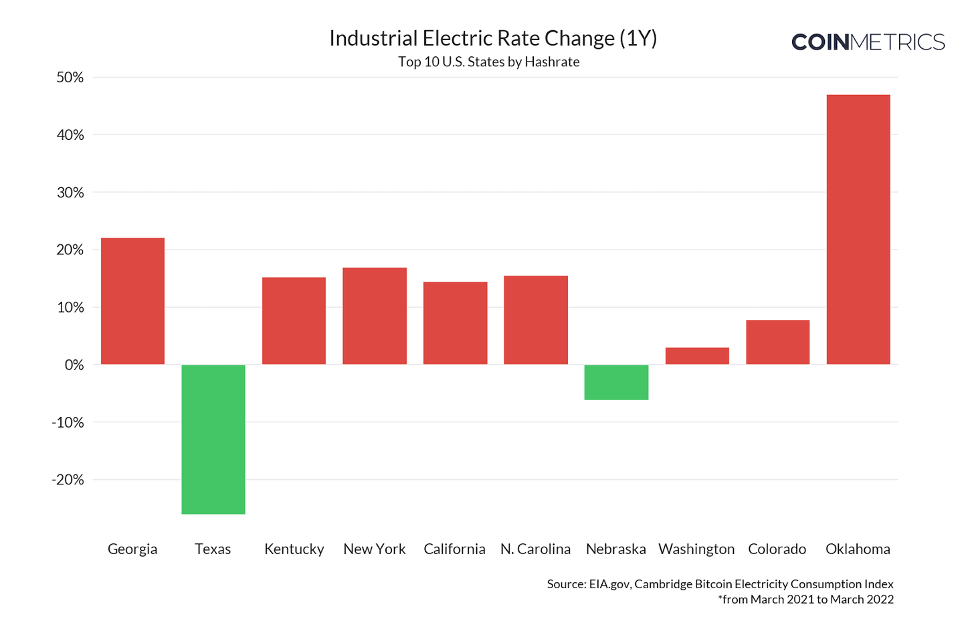

The graph below shows the changeaverage industrial electricity tariff for the ten largest US states by hash rate from March 2021 to March 2022. The pace of industrial production in some states, such as Georgia and Oklahoma, rose more than 20% year on year.

Change in industrial electricity consumption (1 year). Top 10 US states by hashrate. : EIA and Cambridge BTC Electricity Consumption Index

Despite growth, some miners haveunique relationships with their electricity suppliers, which gives them the opportunity to hedge against increased energy costs. Geographic location is ultimately one of the most important factors that determines the power of the miner per kilowatt-hour, and hence its profit.

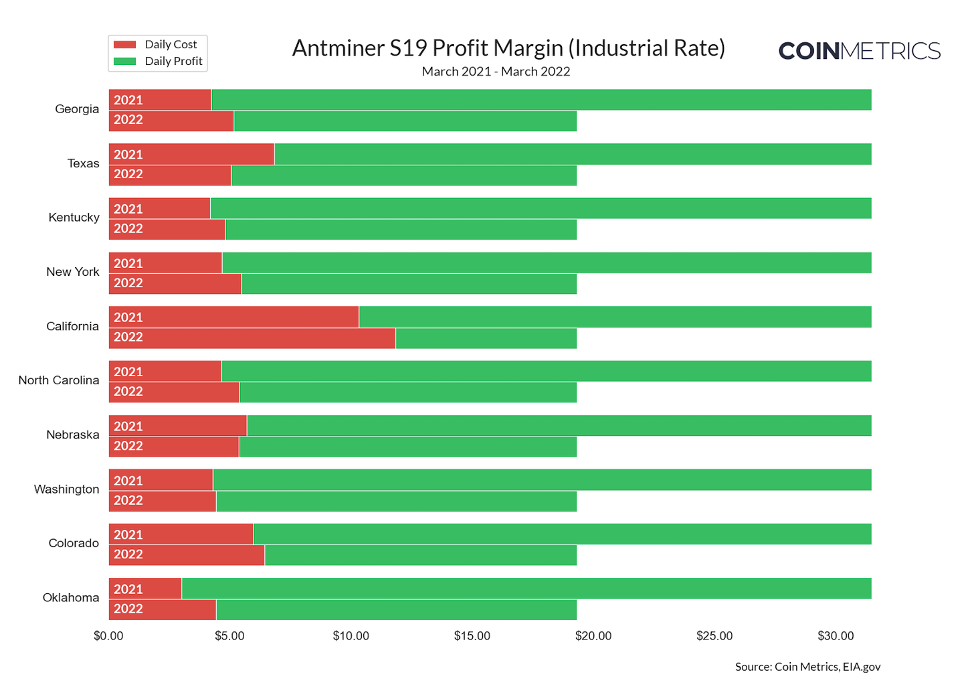

In the chart below, we see the totalthe impact of lower BTC price and energy price fluctuations on miner margins. Even with the most modern mining hardware (such as Bitmain's Antminer S19), the cost per machine is now $1.50 more per day than it was a year ago. For industrial-scale miners with tens of thousands of ASICs, this has significant implications for their business bottom line, especially in a downturn in the market.

Antminer S19 profit margin (industry norm). March 2021– March 2022 and: Coin Metrics Network Data Pro and EIA

Equipment Competitiveness

Another important factor affectingthe competitiveness of miners is their choice of appropriate equipment. While the early days of Bitcoin allowed users to mine using standard CPUs and GPUs, today mining is dominated by a specialized class of computers called ASICs (Application-Specific Integrated Circuits) that are dedicated solely to mining BTC.

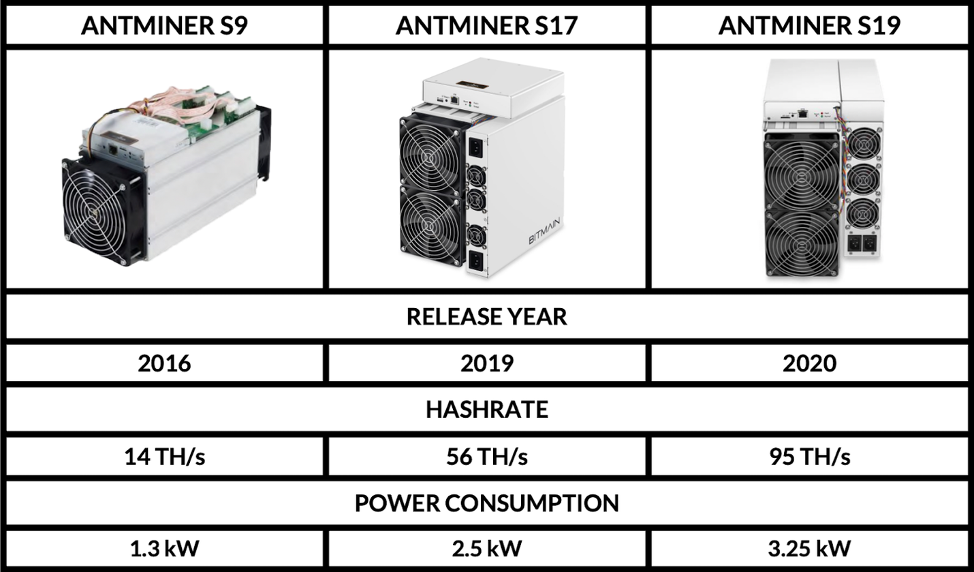

The profitability of an ASIC primarily depends on itshashrate and power consumption. Over time, more efficient ASICs entered the market with advances in chip manufacturing, supplanting older hardware. For example, Bitmain's Antminer S9 was originally released in 2016, offering miners a hash rate per unit of 14 Thesh/s with a power consumption of around 1300W. While the S9 has been one of the most dominant ASIC models for many years, over time it has been superseded by more efficient models like the Antminer S17 and has been deprecated by mid-2020.

: bitmain

However, when in 2021 the price of bitcoin beganskyrocketing, even older models like the S9 have hit the profitability threshold again. At the same time, new models like the Antminer S19 have started to generate huge cash flows, spurring an unprecedented level of investment in the BTC mining industry.

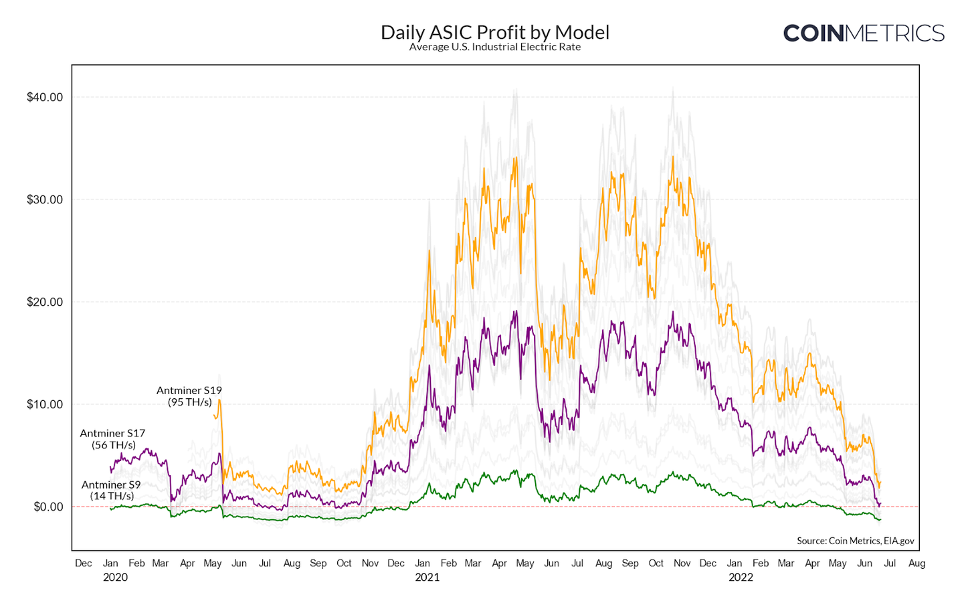

The chart below shows the estimated daily profits for the ASIC model, with the S9 (green), S17 (purple) and S19 (orange) models highlighted. Other ASIC models are shown in grey.

Daily ASIC profit by model. The average tariff for industrial electricity in the United States. and: Coin Metrics Network Data Pro, EIA and ASIC Miner Value (announced model hashrates)

One of the most interesting observations that weWhat we can tell about the profitability of ASICs is the rapid expansion and contraction of the rate of return in response to changes in the price of bitcoin, especially when it comes to older hardware. While older ASICs have a much lower hash rate, they also consume less power, meaning that dollar-denominated revenues can quickly exceed operating costs during bull rallies.

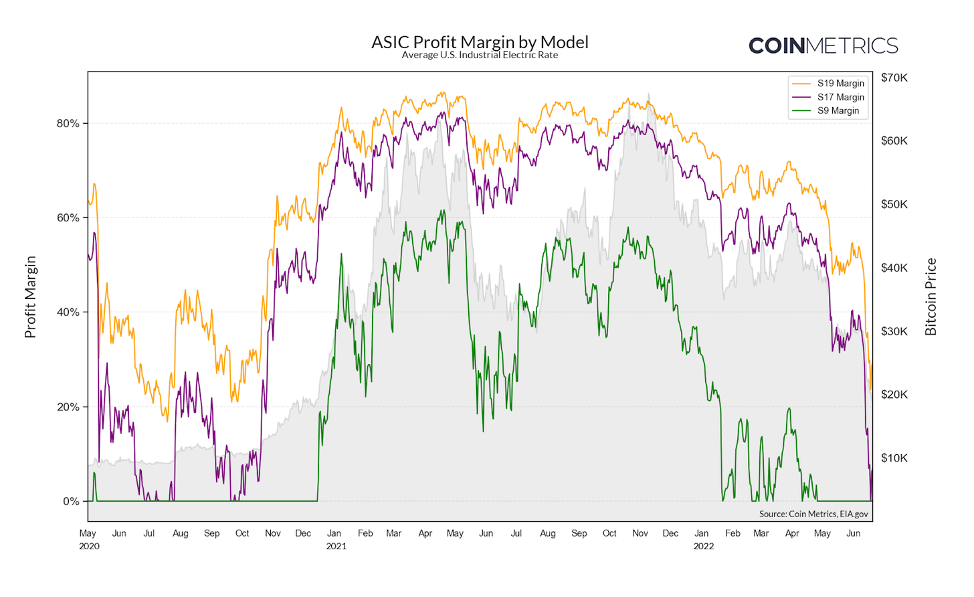

However, when the price of Bitcoin begins to decline(shown in gray below), profit margins could collapse just as quickly. At the end of a bull market, older equipment becomes much less competitive, not only because the BTC/USD rate falls, but also because new equipment begins to «displace» models such as S9 and S17.

ASIC profit margin by model. and: Coin Metrics Network Data Pro and EIA

While the Antminer S9 has been profitable for many years now, its golden age may be finally coming to an end.

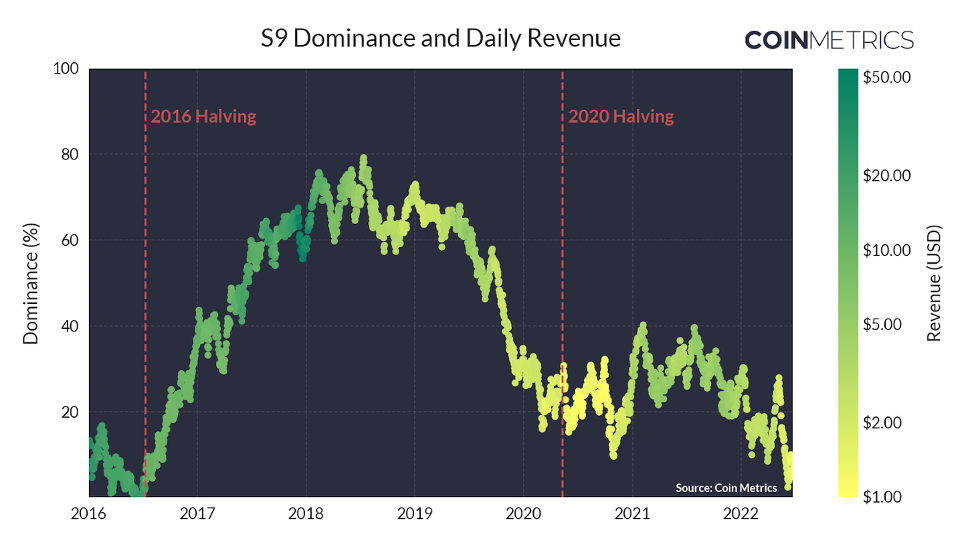

Thanks to methods for calculating one-time randomnumbers, we can identify and quantify the dominance of different ASIC models in relation to their contribution to the total bitcoin hashrate. At the peak of the 2017 bull run, the Antminer S9 held almost 80% of the hash rate, briefly bringing miners $50 a day.

S9 dominance and daily income. : Coin Metrics Network Data Pro

In subsequent years, the profitability of S9 significantly improved.decreased, but it retained a significant position at the level of about 20-30% of the network hashrate. However, as bitcoin price fluctuations have continued to drive down mining margins over the past few months, it looks like S9 may be relinquishing its role as the dominant player in the mining ecosystem. However, like any ASIC, there is no clear line beyond which the S9 will become obsolete. An experienced miner with reasonably low electricity costs can still make a small profit.

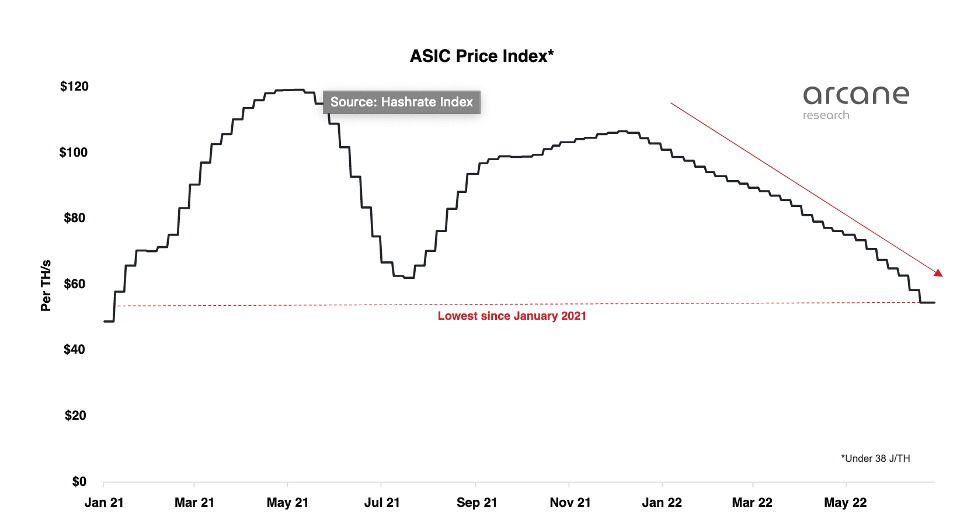

ASIC prices haven't been lower since January 2021

Prices for BTC mining machines have fallen in recent months and will most likely continue to fall.

ASIC price index. :HashrateIndex

At its peak in April 2021, the mostenergy-efficient ASICs were sold at $120 per Thesh/sec. Prices plummeted in the summer of 2021 as China’s BTC mining ban brought a flood of Chinese ASICs into the market, but rebounded in November as Bitcoin hit an all-time high.

ASIC prices have been steadily falling since November as mining has become less profitable. Prices are now at their January 2021 levels and are halving from their November peak.

A sharp drop in ASIC prices could lead toproblems for mining companies that have taken on debt obligations secured by ASICs. As the value of ASICs falls, the cost of credit increases, forcing these companies to post more collateral.

ASICs are now priced the same as they were in January2021, but at that time mining was twice as profitable as it is now. Therefore, theoretically, car prices should be half of today's levels to account for this difference in profitability.

Another reason why ASIC prices,are likely to continue to fall is the mass payments of public miners for the remaining machines, as those who cannot pay for these upcoming deliveries will have to throw them on the market.

BitNews disclaim responsibility forany investment advice that this article may contain. All the opinions expressed express exclusively the personal opinions of the author and respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

Based on source #1 and source #2