As soon as the price of Bitcoin falls, prophecies begin to be heard that the mining industry is dying andminers are about to turn off their equipment en masse andwill begin to capitulate. This was the case last March, when the crypto market experienced one of the most powerful crashes in history, and more recently, when the price of Bitcoin dropped below $44,000.

However, after Bitcoin and Ether beatprice highs, no one turned off the mining equipment - on the contrary, it has risen in price several times, but even with inflated prices, it is still not enough for everyone. We figured out how much mining BTC, ETH and popular altcoins now brings and what to expect for players in this sector in 2021.

How did mining develop in 2020?

On May 11, 2020, a halving occurred on the network, duringwhich the reward for the found block was halved - from 12.5 BTC to 6.25 BTC. This event occurs every 210,000 blocks mined or repeats every 4 years. Thus, the creator of Bitcoin, Satoshi Nakamoto, laid down in the network protocol a mechanism for curbing inflation and controlling the emission of new coins.

Since the reward is decreasing, miners are tryingcompensate for losses: they upgrade equipment to more energy-efficient and powerful ones and do not sell mined coins in anticipation of an increase in their rate. For example, a year after the halvings of 2012 and 2016, Bitcoin grew in price several times and reached its then-records.

We are now also seeing impressive growththe cost of the first cryptocurrency and the altcoin market. Over the year, BTC grew by 300%, ETH - by 500%, most of the top coins also added a few X's. All this had a positive effect on the profitability of mining and the profit of miners who maintain the operability of these blockchain networks.

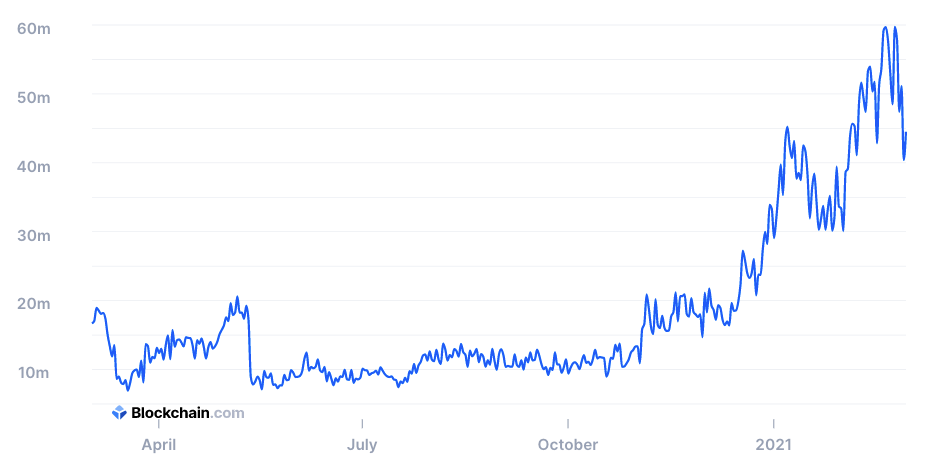

Bitcoin annual hashrate chart. The indicator grew by 34% and reached its record values of 150–160 TH / s. This suggests that new miners are joining the Bitcoin network.

Due to the COVID-19 scare last Marchyear, the crypto market collapsed, and the value of Bitcoin lost about 55% in a matter of days. However, it took only a few months to recover, thanks to which the miners almost never worked in the red. And the slow growth of the crypto market in the spring and summer of 2020 brought profit even to small miners with old equipment.

It is noteworthy that miners from Russia alsoThe depreciation of the ruble helped - coins are sold mainly for dollars. In the fall, the prices of cryptocurrencies began to rise rapidly, and with it the profitability of mining.

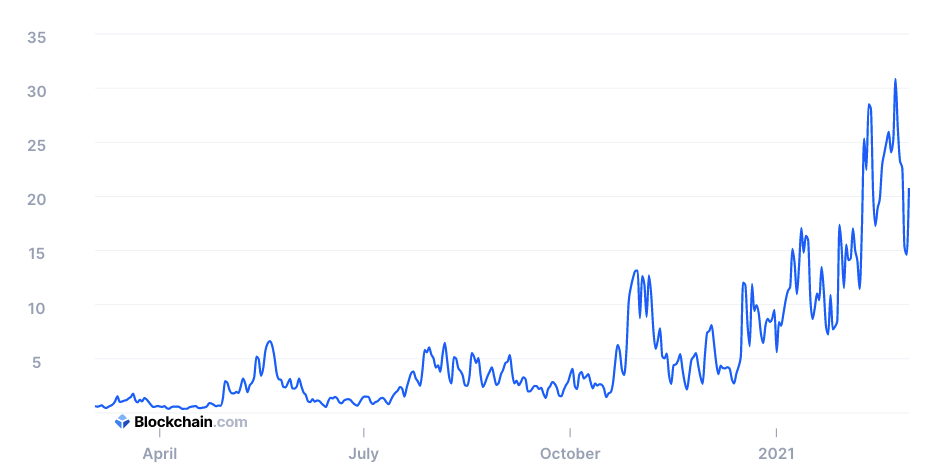

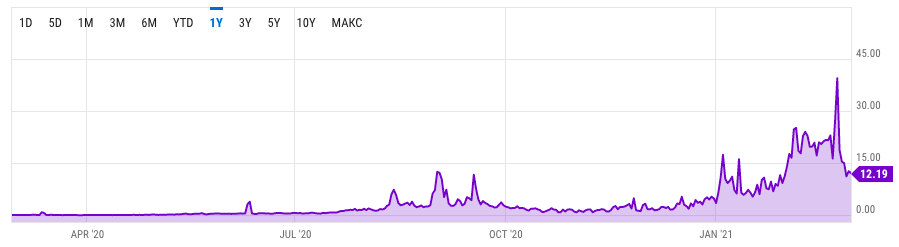

Bitcoin mining profitability chart for the year.

At the same time, the reduction in rewards in Bitcoin fromwas more than compensated by the gradual increase in commissions in this network: from $0.3–$1.3 in March and April to $15–$30 in February. Moreover, if in the spring of last year the payback period for most miners in the Bitcoin network was 1.5–2 years, then by autumn this figure had already dropped to 6 months.

In total, Bitcoin miners earned about $5 billion last year, and over $2.4 billion in the first two months of 2021.

“In fact, in 2018, the activities of miningpools became unprofitable, and many turned off their equipment. In 2019–2021, the industry is gradually recovering, including through the release of more energy efficient equipment. Nevertheless, the main risks affecting the payback are the lack of legal regulation, high transaction costs, and strong volatility of currencies. ",” noted Oksana Belyanskaya, CEO of Rocket PR.

Bitcoin transaction fee change chart.

Lack of mining equipment

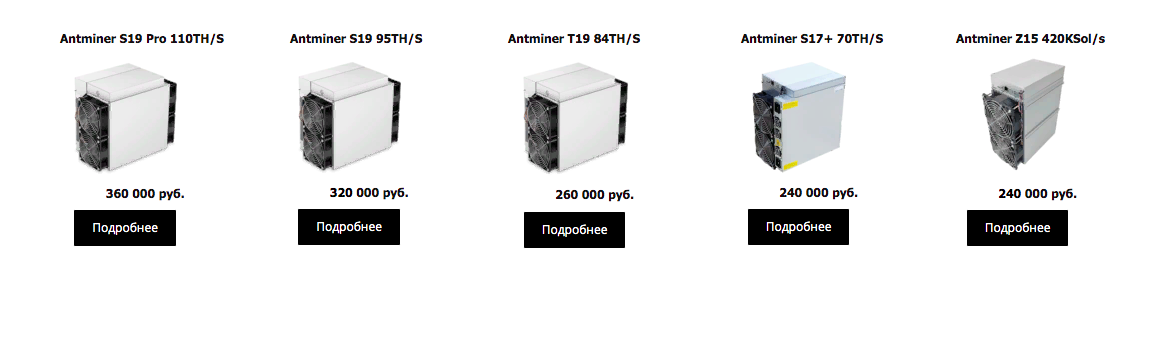

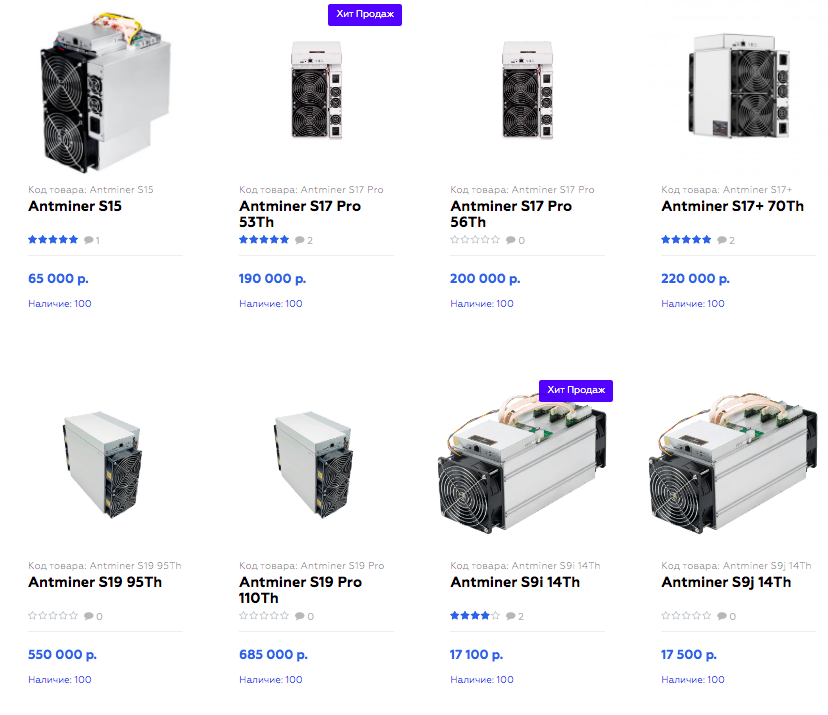

Since last fall, even outdated ASICsdevices like Antminer S9 and Antminer L3+ began to work profitably and bring in several thousand rubles a month. As a result, their price rose from 3,000 rubles to 15,000 rubles (and even up to 35,000 rubles). Prices for top-end devices (for example, Antminer S19) have increased several times. As a result, there is a shortage of equipment on the market.

Thus, in the field of mining there is nowa separate problem is the shortage of equipment and the lack of inexpensive miners. Indeed, in light of rising profitability and shorter payback periods, many devices began to be in high demand and were sold out last year, even at prices several times higher than market prices.

The cost of the same devices at different sites can reach hundreds of thousands of rubles. Here are examples of prices for miners of the popular Antminer series from one of the suppliers.

Danatar Atajanov, brand manager of the Oxly platform, said that many miners began to connect old devices, especially since it became very problematic to acquire new ones.

"Chinese manufacturers of miningequipment at the beginning of the year reported on the closure of sales by the end of the summer of 2021. There is information circulating around the market that sales are contracted until the end of 2021. In conditions of a deficit, prices for iron increased by 2–3 times. Today, due to the shortage, the market is so hot that the price of devices located in China may be higher than the market price of availability in Moscow. For example, the cost of the Asic S19 Pro 95Th reaches 800,000 rubles, and the payback at the current rate will be about 12 months, including electricity ", - said Atajanov.

Sergey Arestov, co-founder of the operatorindustrial mining BitCluster, said that customers who bought equipment before December 2020, that is, until the prices of miners jumped to the skies, have already recouped their investment, now receiving a net profit.

“In the summer, the buried S9s were soldalmost by weight [approx. ed. — when the crypto market falls, old mining equipment is sometimes sold for the weight of the metal and components from which it is made]. However, now even they bring money. We have clients who were waiting for a bargain price for these devices and bought them in the thousands.”, said Arestov.

In December, after a sharp jump in the bitcoin rate,According to Sergei Arestov, the demand for the purchase and installation of equipment for the extraction of cryptocurrencies has grown tenfold. The expert expects a similar increase in demand in 2021-2022:

“In 2 months, the high season will begin in Chinawater, and a huge number of devices will start plugging into the outlet [ed. - The flood season is considered a particularly profitable period for Chinese miners, as they can buy electricity at lower prices from hydroelectric dams]. Then the difficulty of mining in the Bitcoin network will increase significantly, and, as a result, the profitability of mining will fall. The cost of electricity will again be the main indicator of efficiency, and a flow of miners from all over the world will flock to Russia for a favorable tariff.", said Arestov.

At the same time, a huge amount of miningequipment is purchased by American companies and funds. For example, Marathon Patent Group alone bought 70,000 Antminer S19 miners from Bitmain. Just to accommodate all this equipment, a power of 250 MW is needed.

“All companies providing hosting services are striving to increase their capacity. We plan to commission at least 60 MW in 2021.”,” Sergei Arestov shared his plans.

Evgeniy Chertok, head of the company’s IT departmentReksoft (a software developer) said that almost all video cards for computers have either increased in price several times or completely disappeared from sale, for example, the GeForce RTX 30.

A number of factors led to the equipment shortage:

- Low production volumeThe development of modern video cards was influenced by the fact that the supply of equipment from abroad has decreased on the market.

- Lack of import substitution... So far, Russia does not have its own production facilities in this area.

- Lowering the threshold for entering cryptocurrency mining.The rise in the value of many cryptocurrencies has made their mining profitable again and has made it possible to start mining at home on powerful computer video cards in everyday conditions.

- Not declining demandon video cards among gamers of modern video games.

Evgeny Chertok suggests that the deficitvideo cards in Russia will last as long as cryptocurrency mining is profitable. In other words, as long as the cost of a package of mined cryptocurrencies is higher than the cost of electricity and depreciation of iron, we will observe a shortage of equipment on the market.

Profitability of Bitcoin mining in Russia

We found out from BitCluster at what indicatorsminers in Russia will be profitable. At the current level of hashrate and the complexity of mining in the Bitcoin network, Bitcoin mining in Russia is profitable with a coin price of over $6,000 and the cost of electricity up to 3 ₽/kWh.

Thus, if the military-technical vehicle costs less than $6,000, it will have to be mined at a loss. But if the bullish trend continues, miners won't have to worry about profits for a long time.

True, the break-even point greatly depends on the power of a particular device. For a clear example, let’s compare the performance of 2 miners of opposite power:

- Antminer S19 pro110 th / sat a tariff of 3.2₽/kWh: break-even point -$ 5 800;

- Antminer S913 th / sat a tariff of 3.2₽/kWh: break-even point -$ 19,700.

In any case, miners have a solid margin of safety.

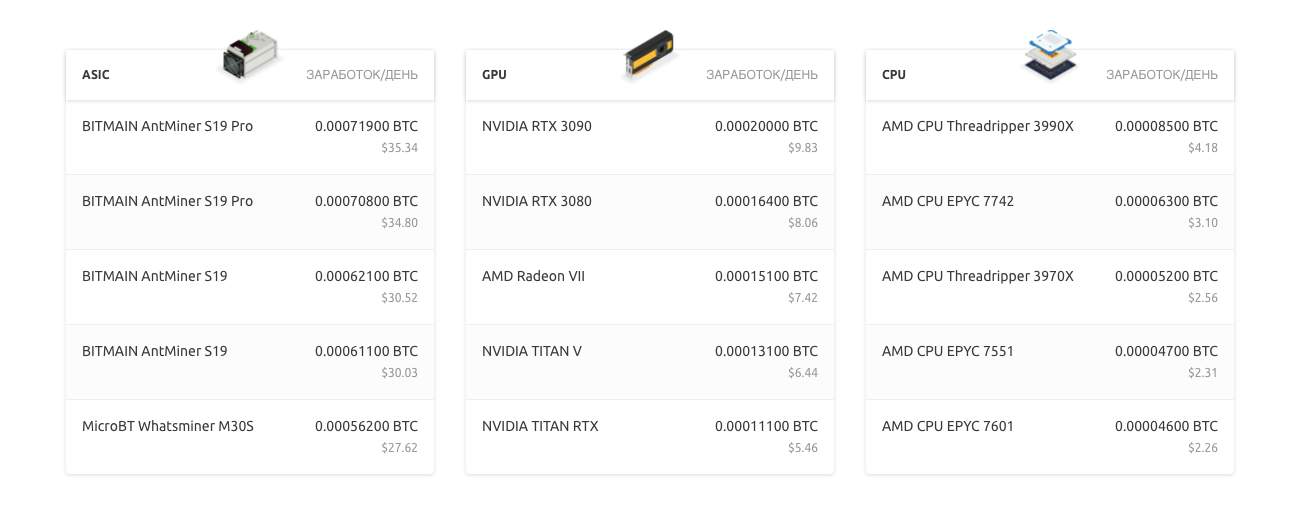

Here is the profitability of mining several top-end devices at a BTC rate of $ 8,764, taking into account electricity costs of 3.2 rubles / kWh:

- Antminer S19 pro110th/s—61835 ₽per month;

- Whatsminer M30S+++112th / s–63 109 ₽per month;

- Antminer S913.5 th / s—5 000 ₽per month.

With such a profitability of mining, the payback period of the devices is from six months.

Prospects for mining on the Ethereum network

Let's consider the second cryptocurrency by capitalization, which can still be mined - the transition of Ethereum 2.0 to the Proof-of-Stake consensus algorithm began at the end of last year and will take several years.

Over the past year, ether has risen in price 7 times (at its peak- almost 9 times), while commissions on the Ethereum network increased 90 times (at the peak - 300 times). Thus, in February, the commission for an Ether transaction averaged from $15 to $20. Transaction fees account for up to 40% of the profits of Ethereum network miners. Therefore, mining this coin is still profitable.

In 2019, ETH miners earned $0.7 billion, in 2020 - already $2.12 billion, and in the first two months of 2021 - over $2 billion. The rise in ether prices led to a sharp increase in the cost of video cards and, again, to their shortage.

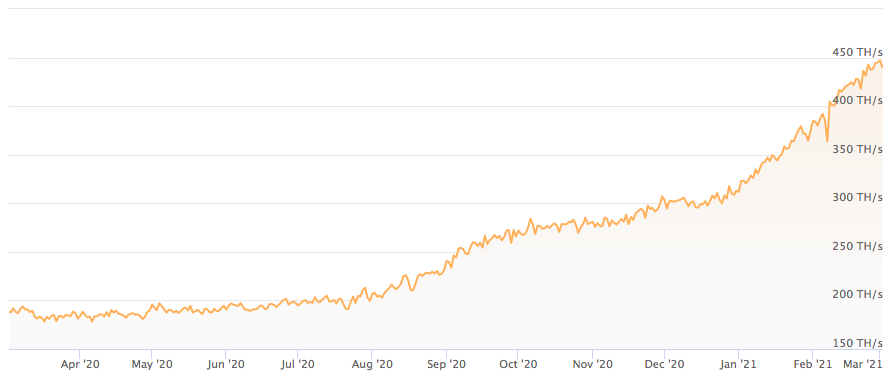

Per year The hashrate of the Ethereum network, that is, an indicator of the required power of mining equipment, increased from 187 TH/s to 440 TH/s. This means that new miners are connecting to the Ethereum network.

There are several reasons for this increase in interest among miners:

- Bull market and the rise in the value of ETH.

- Network congestion due to the growing popularity of Ethereum-based DeFi projects.

- The growth of commissions in the network.

- Interest in the ongoing update of Ethereum to state 2.0, after which staking will replace mining.

Don't be afraid that Ethereum mining will die in 2021costs. The complete implementation of the update to Ethereum 2.0 will take up to two years, and if something goes wrong, this process can be significantly delayed. During this time, you can manage to recoup your investment in mining equipment.

After the transition to PoS, miners of the Ethereum networkwill have to choose: to engage in staking or switch to mining other coins. Most likely, most of the current ETH miners will switch to other projects, because otherwise they will have to get rid of expensive equipment. But new players - those who have not invested in equipment - will switch to staking.

It is still difficult to predict which coins will be used.former ether miners will be transferred. Perhaps most of them will pay attention to Ethereum Classic (ETC). The coin works on the same algorithm as ether, and the project team is not going to transfer it to PoS. However, do not try to guess - we will not guess anyway.

What altcoins to mine in 2021?

Sergei Arestov believes that in the futureFor several years, mining bitcoins will be more profitable than mining any other coins. The exchange rate of altcoins is too volatile - prices can rise and fall quickly, making it difficult to formulate a long-term strategy or predict when exactly the equipment will pay off.

Therefore, we must keep in mind that mining altcoinsis a lottery. But if you are ready to play it, Sergey Arestov recommends mining only the first 20 coins by capitalization, for example, the same Ethereum Classic, Monero, Litecoin, Zcash, DASH, Bitcoin Gold, and Dogecoin. By the way, Litecoin mining will also be profitable on old equipment like Antminer L3 from Bitmain, released back in 2017.

Top coins by capitalization are assets from time-tested projects that will not suddenly disappear, they have liquidity, and their rate is more stable than small coins.

Mine "nonames"risky- today they seem like new bitcoin, but tomorrow they will be worth nothing and will not allow you to recoup your investment.

Old equipment is still profitable

At the same time, the bullish trend of the crypto market and pricerecords still make it possible to mine Bitcoin even on devices of previous generations, especially when it comes to industrial mining. For example, on miners such as Antminer S9, Bitfury B8 and Bitmain S9.

But within a year, these devices will likely no longer be profitable. Therefore, for those who want to continue making money from mining, it’s high time to think about upgrading their equipment.

“Now mining is profitable on almost all devicesand at almost any cost of electricity. But as new generation devices enter the market and as the complexity of the network increases, mining profitability will decrease, and we advise you to pay attention to devices with a power of 80 Th/s and higher and with an electricity consumption of no more than 2.5 kW.”, recommends Sergey Arestov.

If the bullish trend continues, the corrections will not be too strong, and the complexity of the network will not fly into space, then this configuration will most likely last until the next halving.

Danatar Atajanov noted that due to the inevitableAs network complexity grows, modern, productive devices will generate significantly more revenue. In this situation, it will be difficult for private miners to compete with modern data centers equipped with the latest generation equipment and receiving electricity on special terms. Because of this, the demand for cloud mining has increased.

“We have felt an increase in demand for ourselves.Making money on cloud mining in the current situation is much easier: bypassing the costs of equipment, its configuration and support, you get access to modern equipment in optimal conditions for mining. All our computing power has been sold out, and new applicants have to be put on the waiting list ", said Atadzhanov.

Mining is still in a gray zone in Russia

However, it is worth noting that in Russia the mining industry is still not regulated, and this carries certain risks.

From January 1 this year in Russia there is a Law “On Digital Financialassets” (CFA Law). We have already examined in detail its main provisions, the regulation of digital assets in the Russian Federation and their legal status. Let’s just note the main thing: cryptocurrencies are recognized as property, they can be traded, but you cannot pay for goods and services in the country.

There is no definition of mining in the CFA Law, onlyit is said that regulation of the circulation of cryptocurrencies will be considered in a separate bill. There is no mention of mining in bill No. 1065710-7 “On amendments to parts one and two of the Tax Code of the Russian Federation,” which provides for the declaration of income from cryptocurrencies (for details on how to pay taxes for cryptocurrencies, read our article).

All this puts mining in a strange position inin a legal sense - cryptocurrencies are allowed, taxes must be paid for them, but they cannot be used as payment. Can mining be considered payment for work or services? And if miners declare their coins, won’t they be charged with illegal entrepreneurship? There are no answers to these questions yet, but the general logic of legislators leaves little hope that the sector will receive support.

As long as there is no regulation of miningreflected in the law, this activity is formally in a gray zone. As a result, miners are forced to mostly work “in the gray” - the budget does not receive the taxes that it could well receive.

Danatar Atajanov believes that the state wants to limit the turnover of cryptocurrencies so much as to make it impossible for the normal development of mining and crypto business in general. In such conditions, the mining business is forced towill look for legal development options, such as the export of hash rates - the sale of computing power to loyal jurisdictions with the receipt of fiat money instead of cryptocurrencies.

Lack of sector regulationnegatively affects not only private miners, but also industrial mining. Russia has excellent conditions for this activity - inexpensive electricity and a cold climate. Therefore, the world’s largest mining farms and data centers are being built in the country, for example, the Bitriver farm in Siberia or the data center from Rosenergoatom near Tver.

If legislators were more loyal to the sector, this couldto attract foreign miners to Russia. According to estimates by the Russian Association of Cryptocurrency and Blockchain (RACIB), this would bring several billion dollars annually to the country’s budget.

Mining is waiting for a good year

The bull market is a huge boon for the mining sector of the crypto industry.

Until recently, equipment paid for itself ina year and a half, now - in a few months, and even outdated devices bring profit. Sergey Arestov expects the price of Bitcoin to rise to $80,000 this year - at such prices, miners have nothing to fear. If the trend continues, the sector will experience strong development, new jobs and investors will appear.

However, before purchasing miners forlast money, remember that after any rally there is always a decline. Despite the bull market, mining cannot be seen as an easy and quick way to make money. This is a full-fledged business with all the associated risks.

If a new “crypto winter” sets in, mining may even bring losses and you will have to either work for future prospects or turn off the equipment. Such situations also need to be calculated.

Cloud mining: TOP-5 services

Cloud mining is a model of earningcryptocurrencies by renting equipment (hash rate), mining is carried out at the expense of equipment management by the contractor, who solves all issues related to the technical and software components.

Cloud mining setup does not requirea productive computer or knowledge in the field of blockchain and cryptocurrencies in general. Setting up in this case consists in going through the standard registration procedure on the service website, choosing a tariff plan and paying for the contract. Then the user specifies the address (personal wallet) where the mined cryptocurrency will be withdrawn.

Rating of TOP-5 cloud mining services (with current estimates for 2021):

| Service | Rating | Detailed overview |

| IQ Mining (Editor's Choice!) | 9.5 | Read the review |

| ECOS | 7.2 | Read the review |

| YoBit VMining | 6.5 | Read the review |

| BitDeer | 6.4 | Read the review |

| HashFlare | 6.3 | Read the review |

The criteria by which the score is given in our rating:

- Profitability and profitability– we calculate the payback period, clarify the reality of mining.

- Prices and commissions– we take into account the validity of tariff plans and compare them with competitors.

- Deposit / withdrawal, discounts, reliability– we analyze reviews, test the correctness of accruals and withdrawals.

- Convenience of the platform and site– we evaluate the functionality, errors and failures when working with the service.

- Features of the company– unique services and useful services, period of work on the market.

- final grade– the average number of points for all indicators determines the place in the ranking.

5

/

5

(

1

voice

)