Bitcoin miners are accumulating coins for the first time since December 2020, thus reducing downward pressure onmarket, according to data from the blockchain.

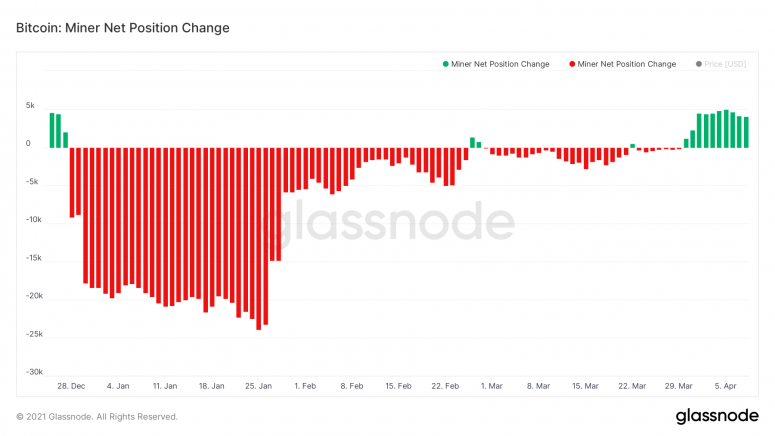

Position index developed by Glassnodeminers MPI (Miner Position Index), reflecting changes in the balances of their wallets for 30 days, recently returned to positive values. Over the past two weeks, the number of bitcoins in miners' wallets has increased by 4,435 to 1.806 million BTC.

“Miners switched to accumulation of liquid assets,because they have enough cash reserves to support their activities, which they received during the rise of bitcoin from $ 20,000 to $ 40,000, or most of them are holding in anticipation of the rise in the rate "Flex Young, CEO of Hong Kong-based Babel Finance, told CoinDesk.

Miners receive income in cryptocurrency, but withservice providers pay in traditional currency, so they are forced to liquidate part of the mined coins. The volume of liquidation depends on their current operating conditions and expectations in the context of Bitcoin price behavior.

Resuming the accumulation of mined coinshas been observed since March 31, while for four months before that, miners were reducing their positions and fixing profits. The largest volumes of cryptocurrency - from 17,000 to 24,000 BTC per day - were sold by them in January.

Glassnode states that although the share of salesminers in the total trading volume in the cryptocurrency market is small, their behavior reflects the expectations of its largest players. At the same time, "whales" also stopped selling, and their number has been steadily above 2,000 since March 31st. Before that, the value dropped from 2,230 to 2,004 in two months.

It should be borne in mind that this model of behaviorThere is also a downside - large players can avoid selling when they know that the market is unable to absorb additional supply without significant depreciation.

As a result of the transition of miners to the accumulation strategy, on the morning of April 10, the bitcoin price continued to grow and again surpassed the $ 60,000 mark.

</p>Where is it more profitable to buy bitcoin? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Bybit | https://bybit.com | 7.5 |

| 3 | OKEx | https://okex.com | 7.1 |

| 4 | Exmo | https://exmo.me | 6.9 |

| 5 | Huobi | https://huobi.com | 6.5 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication