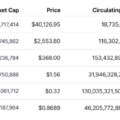

Another review from Cred and DonAlt, authors of the Technical Roundup newsletter. In today's review, the authors discuss heightBitcoin and Ethereum, as well as offering their own view of the NFT market.

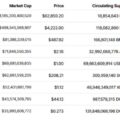

Bitcoin Breakout Accelerates, New Support Forms

Chart executed in TradingView

Chart executed in TradingView

The bitcoin / dollar pair continues to reach new onesmaximums. According to last week's review, there are technically (by definition) no resistance levels higher. Our best tools are futures data, round numbers, and exploring new ranges or technical structures. For example, if the market fluctuates in the range of $ 70 thousand, and this range is left, then it will be resistance.

We follow two broad technical topics in the bitcoin / dollar pair.

The first is a breakout of the weekly range.According to the weekly chart, the market exited the weekly range and reached a higher high. The picture is extremely bullish. It will become bearish (or at least significantly less bullish) if price is capped at the high of the range, thus forming an unsuccessful breakout. In this case, the target during the decline is first the midpoint of the range and then the minimum point of the range. Applying this structure to BTC / USD: a bull market is above $ 58K, a bear market is below $ 45K and $ 30K if the $ 58K level cannot be held.

The second is the nearest support at smallertimeframes. When the market starts to trend and goes into uncharted territory, the historical levels become less useful. As mentioned above, we must rely on new and later structures (usually seen on smaller time frames) to understand the market. BTC / USD, the nearest support in case of a rollback is the previous maximum located in the region of $ 63.6 thousand.

To summarize the above, BTC / USD looks likestrong above $ 58k. Break of weekly range on the way to new all-time high is bullish. The specified level is a boundary, depending on the price behavior, from which it is possible to form judgments regarding the further dynamics of the market.

If the market is as strong as it seems, these largebreakouts don't have to fail. The nearest support on a smaller timeframe is located at $ 63.6. With the market at record highs, we will be sharing new, shorter-term levels that we deem relevant as the market moves.

Just a few months ago, the market was onrally and looked like it could rise to $ 20K. Some participants increased their profits in the bull market and returned to square 1. For many others, things were much worse. We're going to remind you of how shitty it was right now, while times are good. Taking profit when quotes are going down is not a realistic option. Instead, make a plan, have some understanding of your tax risks, and keep some money free to take advantage of unique opportunities on occasion when cryptocurrencies are down.

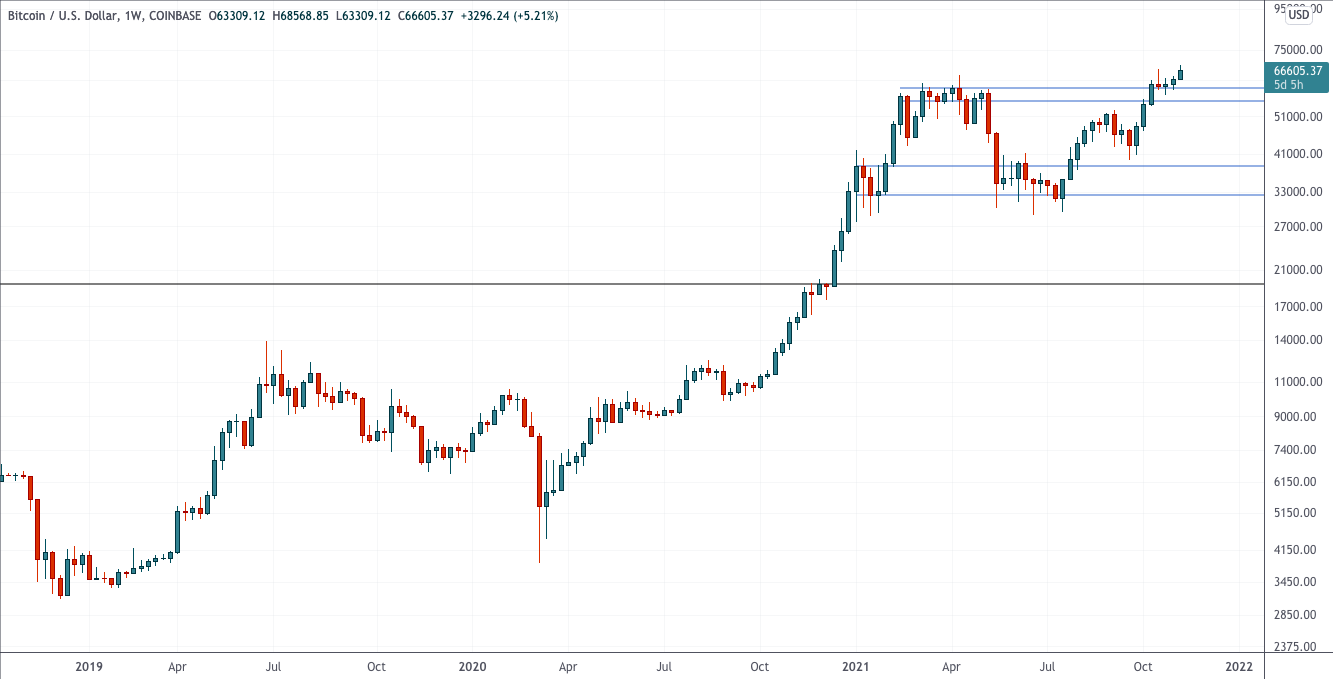

Ethereum classic uptrend

Chart executed in TradingView

Chart executed in TradingView

Ethereum / dollar continues to reach newmaximums. Ethereum / Bitcoin is still within range on older timeframes. Like BTC / USD, ETH / USD has no resistance levels above current values. The same instruments are applied (data on futures, round numbers and new structures that form over time) with an additional instrument: ETH / BTC.

Even if ETH / USD has no technical levels fordetermining the context, ETH / BTC can be used to understand the situation or determine the time of entry. Hopefully this graph will be interesting in the not too distant future. ETH / USD has some pretty clear technical specifications.

The bull market is based on the breakout of the highweekly range of $ 3.9K and is relevant until this breakout stops. If it doesn't, especially now, given how far the market has moved from the breakout point, it will be one ugly chart. The layout is positive in the absence of a downward movement under the $ 3.9 thousand mark.

On the daily timeframe, a clearan uptrend with distinct higher highs and higher lows. Cred always gets PTSD from this type of staircase (in the past, the entire staircase was captured by a single red candle), but there isn't much evidence for that. Instead, it is wiser to assume that the uptrend will continue until proven otherwise.

The first sign of weakness will be a daily breakout.in the structure of the market, ie closing below the support at $ 4.5 thousand. At this point, buying out a deeper fall and / or restoration of support would be a more attractive setting.

To summarize the above:A weekly range break above $ 3.9K is in full swing and the market looks strong. The daily market structure is bullish. Older timeframes are bullish until proven otherwise. A loss of the $ 4.5K level would be a short-term bearish shift. Loss of $ 3.9K - Global Bearish Shift.

What's up with NFT?

When Bitcoin and Ethereum go up, a class emergesspeculators (most of us, to be honest) for whom this is not enough. We are looking for assets with a lower market cap in order to benefit more from the bull market.

For most of the last year, such an asset wasDeFi. Following the blue-chip trend and taking advantage of the discounts provided by Bitcoin and Ethereum pullbacks was a great strategy until they were gone.

This is a recent rally in major directionsaccompanied by tremendous growth in NFTs. Twitter turned into an art gallery and it was all punks, monkeys, mints, and not a single bitcoin / dollar chart. In the last couple of months, NFT has been in a downturn. Volumes are falling, mints are difficult to sell (and if they are sold, then in secondary markets and often at a loss), blue-chip levels are declining, and the list goes on.

However, we still believe that behind thissector is worth watching. It may well become an accompaniment to the altseason, if the market continues to grow. NFTs are interesting for a number of reasons. We like them as a road to the cryptosphere, since they do not require any financial knowledge.

They are also a great product for exchanges,as can be sold to US users without the usual regulatory issues. Their cultural insight into the length of the bull market they've been in is truly impressive. This sector is attractive to us as traders because of the liquidity dynamics coupled with the highly distorted risk-reward opportunities that exist in this space.

We all know the cryptosphere is highly reflective.(during growth it continues to go up, and if it starts to decline, then it continues to an extreme degree). NFTs take this to the absolute, which means that in an uptrend, prices are "thin" at almost every level, and sell orders are infinite in a downtrend, as many projects have already figured out at this point in time.

Detection of new price levels andMultipliers, when applied in appropriate conditions, create an experience similar to trading extremely liquid shitcoins with a low market capitalization. This is the type of market in which you end up writing off most of your bets, but if you guess right in some cases, you can increase your portfolio by hundreds of percent.

We have already seen a bubble in the NFT market, and ratherin total, we'll see him again. NFTs are fun, different from the markets we are used to, and represent the most asymmetric risk-reward schemes in the cryptosphere. Most of the artist copies of Fiverr (with all due respect), which are 10K projects for creating profile images, are rubbish and will not cost anything. But if you catch something that isn't already there, it will likely pay off the rest of your ugly pixels.

There are also likely use cases, ohwhich we haven't even thought of yet. If the majority accept the premium altseason conditions, most likely in the form of consolidation well above all-time highs, we expect the risk to decrease from Bitcoin and Ethereum → first level / trending altcoins → NFT.

In the NFT world, a pure gaming experience is relevant.We are still figuring out what to do with this sector. Profile pictures? Games? Metaverse? Who knows? A lot of buzzwords and venture capital investments are being played out. However, we both set aside money (which we expect will eventually turn to 0) to take part in this relatively new sector of the cryptosphere.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

�

</p>