The situation in recent days can be described as complete stagnation, a seasonal lull at the endOctober/early November this year especiallynoticeable. We note the very low volatility of market instruments and the absence of any news events; this only suppresses activity, which is reflected in the charts.

By and large, market dynamics are now dictated byin the short-term range, speculators do what they love: they exploit trading ranges of 20-30 points, this is enough for them.

What caused this market lethargic sleep?We'll try to figure out what's going onwhat development options might exist. As a rule, such a situation transforms into something interesting, trading impulses appear somewhere that can lead to serious market fluctuations.

Now the situation was as follows:Monetary policy, which also influences the market, is in stagnation mode, you can call it that. The Federal Reserve lowered the rate last week, as expected, it did not bring any surprises, the market was ready for it. Paul's conference also did not provide any new surprises, the dollar is predictably under pressure, being close to its local lows. In fact, the dollar does not attempt upward rollbacks, which indicates the complete indifference of players to the current trading situation. If we look at the chart, fluctuations of 20-30 points are all we can observe.

Traditional assets in this regard are not too different from crypto, crypto is also in consolidation mode and the range of fluctuations here is quite narrow.

Let's look at what driving factors are or are not currently influencing market dynamics.

At this stage, interest in risk is characterized byas fundamental, it remains the main driver. We see that interest in risk remains high, but there is no further growth, investors remain in moderate optimism, market assets, which are traditionally associated with risk, are at their local maximums, asset safe have some pressure, no major fluctuations occur.

Brexit process faded into the background, postponementuntil January 2020. Accordingly, what will happen in the next 2-3 months is still difficult to predict, but we see that, as a rule, any postponement is accompanied by the usual bureaucratic procedures, which reduce all interest in the process to zero, the same thing happens here.

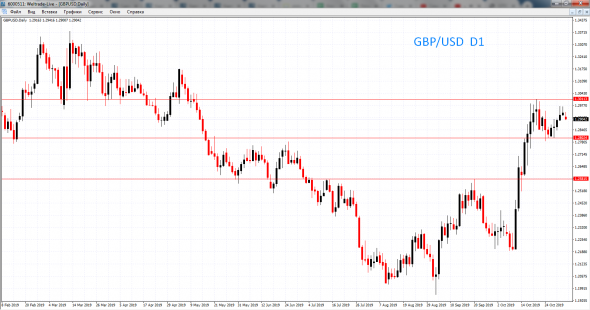

GBP/USD

The dynamics of GBP/USD are dictated solely bythe Brexit process and we see that volatility has decreased, activity has fallen and the pair is trading in a very narrow range, today it is 29-29.5. Nothing interesting is happening; last week there was an attempt to grow towards 1.30, but the mark was not reached. Thus, the global barrier of 1.30 remains inviolable, and this critical resistance will remain so for a long time.

There is no decline below, the recent surge inside 1.28 has already been forgotten. Now the pair practically does not fall below 1.29, which actually indicates an approximate balance of power in the market between bears and bulls. This situation should continue in the near future. The trading range will narrow, traditionally forming a “triangle” or “wedge” on the chart, followed by a fairly significant breakthrough in one direction, which actually confirms the formation of a “triangle” or “wedge” pattern.

No other processes will affect the pound in the near future, so everything here depends on the news headlines related to the Brexit negotiation process.

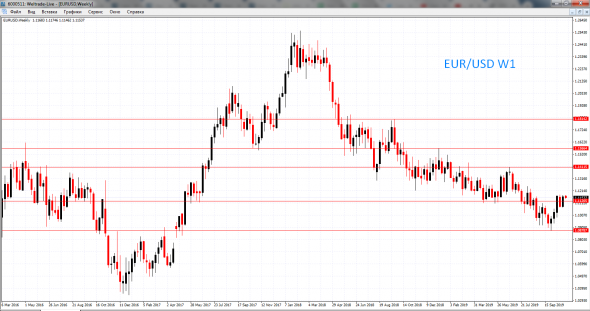

EUR / USD

Let's turn to the EUR/USD pair, it is noted hereThe pair is moving upward quite confidently, but until the 1.1180 mark is broken, most likely it is a matter of time. The pair will move higher and higher over time, the process will not be fast, the good liquidity of the pair does not contribute to sharp fluctuations.

The decline is not noted here, it is thought that higher1.12 couple still will be able to pass this week, it is unlikely that progress will be significant. It seems to me 1.1250 - this is the maximum that can be expected in the current situation, and from below reliable support is in the region of 1.11.

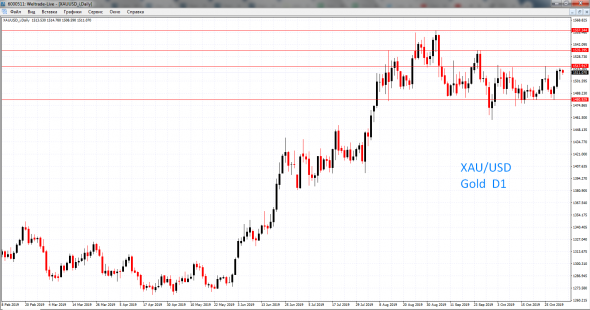

XAU / USD

Now we turn our attention to gold, hereA fairly serious trading interval has been formed: the bottom is $1480 and the top is $1520. This is 40 dollars and will constitute the global medium-term interval, the mark of 1500 + - 20 dollars, this is actually what you need to focus on.

In case of a break above $ 1520:it is very likely that it is time to resume growthsomewhere in the direction of $1540-1550, most likely this will be due to either a sharp increase in interest in a safe-haven asset or a serious wave of dollar decline, or a combination of these two factors.

If gold falls below $ 1480:it will be possible to assume that the upward trend, if not reversed, then at least took a pause.

The current state of gold is consolidation inaround the $1500 mark, give or take 20 dollars. In the near future, the trading interval is even narrower: $1500 below is a psychological barrier and $1515-1520 above. But as we have seen, a rise above $1,515 is met with new selling, so further growth looks unlikely in such a calm market.

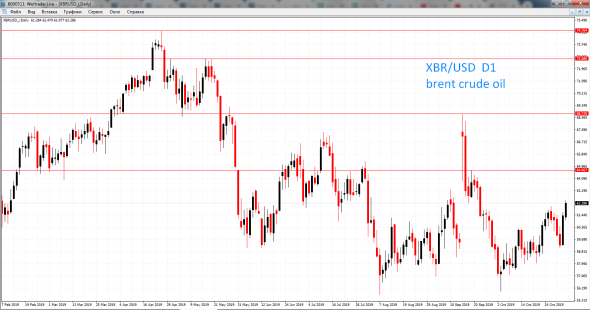

Brent

Special attention is paid to the dynamics of oil, inIn particular, Brent today rose above $ 62. I have already said that any upward bounces should be used for long-term and medium-term short positions. In this case, the growth did not even reach $ 62.5 and again Brent oil is dropping, speculators have done their usual business. They find entry points for sale and most likely oil will drift to around $ 61-62 in the direction of $ 60, possibly even $ 59. I would like to note that last week the $ 59 mark stood, there was a rebound from it. A typical range is unlikely to be violated.

Bitcoin

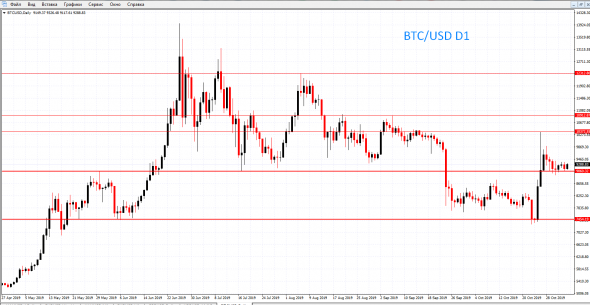

To conclude our review, we traditionallylet's turn to the crypto market, in particular to bitcoin. Here, after good fluctuations in recent weeks, there has been a lull, the fluctuations are quite narrow, if we are talking about Bitcoin then the corridor is 9000-9500 dollars. This range covers all fluctuations, sharp ups and downs of activity are associated with large deals, liquidity is not very high here, naturally large deals can lead to a movement of $ 100-200, but after that the price returns to its original state.

For example, today we see that the rangefluctuations are no longer 500 dollars, but just under 200 dollars, this indicates that a consolidation process is taking shape here, the technical side looks like growth will continue here sooner or later.

As already noted, support is in the $8900-9000 band and Bitcoin is still above these levelsthe probability of growth is large enough, with a breakthrough above $9500, growth may resume towards $10000-10500 and so on.If Bitcoin drops lower than $ 8900-9000and stays below these levels, which means the bullswill again announce its capitulation and Bitcoin will begin its movement even lower to the $8,500 mark and maybe even $8,000. For now, the lows that we noted at $7300-7400 should not be expected. The technical picture is now more set for growth rather than a sharp decline.

This is how the situation looks, let me remind you that for the currentThere are practically no statistics this week. Everything will develop approximately according to its seasonal schedule, the market will be relatively calm, perhaps adjustments will be made by news headlines, which are, in fact, a “Black Swan”, that is, unexpected events that can change the market situation. We are talking about unplanned events, but in the case of calendar events, there is nothing to fear for now, and the market calm will continue.

As a rule, we mark November as the lastactive month of the year, since after Thanksgiving in the United States, which this year is celebrated on November 28, after this day the markets enter the phase of preparation for the Christmas and New Year holidays, market activity becomes less and less intense every day.

So we see now that activityis at a low level, if this continues throughout November, then I do not exclude the possibility that such a lull may go into December. We are completely dependent on unexpected factors in the face of the “black swans”, which include news headlines, these may be: unpleasant or pleasant surprises in the brexit negotiation process; or another aggravation of the United States and China trade war; or some third force that we don’t know and for which the market is least prepared. This third force can lead to a serious hesitation, but when and where it appears to say we can not.

Vasily Barsukov (Chief Dealer WELTRADE)