The global trend towards tighter regulation and de-anonymization of cryptocurrency transactions continues.Supranational organizations are introducing new rules that often contradict the very nature of cryptocurrencies and inevitably affect the regulatory environment in individual countries.

For example, the Financial Action Task Force on Money Laundering (Fat) obliged bitcoin exchanges and other supplierscryptocurrency services to comply with measures to combat money laundering and the financing of terrorism, by analogy with traditional financial companies. Member countries of this organization should, starting next June, ensure that local crypto exchanges exchange user data, including information about the sender, recipient and their digital wallets.

A significant impact on the industry is alsoFifth EU DirectiveAnti-Money Laundering Regulation (5AMLD EU), adopted on 9 July 2018.Its provisions overlap with the requirements of the FATF and suggest that:

- national financial investigation authorities should be able to obtain information that allows you to associate virtual currency addresses with the identity of the owner;

- national registries are required to disclose the beneficiaries of companies registered in EU member states;

- financial institutions are prohibited from opening and maintaining anonymous accounts and depository cells.

EU member states are required to introduce the amended rules into national laws no later than January 20, 2020.

The launch of the project also probably contributed to the intensification of restrictive actions by regulatorsLibraThe announcement of this global stablecoin was receivedgovernment agencies and banks came as a bolt from the blue: discussions about the risks to monetary policy and the stability of the global financial system immediately flared up at the highest levels.

In addition, in December, the Basel Committee onBanking Supervision published a document calling on regulators to develop a “prudent” approach to cryptocurrencies and stablecoins. The ministry is confident that the uncontrolled development of a new industry could entail risks of financial stability and harm the banking system.

Let us now consider the situation with the regulation of the blockchain and crypto industries in individual states, starting withpost-soviet countries.

Russia

Despite the president signed earlier this yearVladimir Putin's decree on specific dates for the adoption of cryptocurrency market regulation standards, the law “On Digital Financial Assets (CFA)” suspended. At least that is exactly what the Chairman of the State Duma Committee on the Financial Market Anatoly Aksakov put it.

Russian lawmakers have no way to decide whether to include “cryptocurrencies”, “token”, “mining” in the document or leave only the vague term “digital financial assets”.

Aksakov insists on legalizing operations,implemented only on controlled closed blockchains, but does not know how to “administer a ban” on the circulation of permissionless assets. He and the head of the Central Bank of the Russian Federation, Elvira Nabiullina, believe that private digital currencies threaten the financial system and are often used for criminal actions.

Some officials are quite sure thatcryptocurrencies have the characteristics of a “high-tech financial pyramid” and their future is very vague. There is a rather extravagant proposal - to introduce administrative responsibility for cryptocurrency mining.

Discussion of these and many other controversial issues forState officials' issues dragged on, and in November it became known that the law on digital assets would not be adopted until the end of 2019. Paradoxically, despite the uncertain status of cryptocurrencies, a mechanism for their confiscation is already being developed.

The Bank of Russia has a regulatory"Sandbox", which explores the possibility of issuing various stablecoins based on real assets. According to Nabiullina, although the central bank still plans to issue its own digital token, interest in new assets in the country has declined.

In general, “things are still there,” in the Russian Federation cryptocurrencies continue to remain in the gray zone.

Ukraine

Unlike most other post-Soviet countries, Ukraine has made significant progress in the context of regulating young industry.

In October, bills ontaxation of transactions with cryptocurrencies and anti-money laundering using digital assets, as well as amendments to the document “On public electronic registries” aimed at introducing blockchain.

The first bill amends the law “Onprevention and counteraction to the legalization (laundering) of proceeds from crime, the financing of terrorism and the proliferation of weapons of mass destruction. ” It involves the implementation of AML / CFT procedures in accordance with FATF requirements.

The second bill relates to taxationoperations with crypto assets. It separates the concepts of “token-asset” and “cryptoactive”. At the same time, income from operations with crypto assets is taxed 5% directly at the withdrawal of funds.

In December, Ukraine adopted amendments on virtualassets according to FATF standards and took an important step towards the legalization of cryptocurrencies in the country, defining market terminology. The law considers virtual assets as property and can be used for payment and investment purposes.

Legal innovations criticized somerepresentatives of the local crypto community. For example, the founder of the REMME startup, Alexander Momot, expressed the opinion that in the current form, the legislation will impede the development of the blockchain sphere and lead to the transfer of human capital to more friendly jurisdictions.

“If these bills are adopted in this form, then, according to our estimates, Ukraine will lose about 10 billion hryvnias in the next three years”- emphasized Momot.

Belarus

In this country, quite loyal tocrypto industry conditions. According to the Decree on the Development of the Digital Economy, residents of Belarus can buy and sell cryptocurrencies, as well as issue their own digital assets.

In addition, individuals are entitled to exercisemining, acquiring, exchanging and alienating tokens for Belarusian rubles, foreign currency, electronic money, as well as giving and bequeathing them. Until 2023, profits from token transactions are not taxed.

Crypto platform operators must identifycustomers, comply with AML / CFT rules and provide cash reports. The authorized capital of such companies should exceed 2 million Belarusian rubles, for ICO operators this amount is 500 thousand.

Earlier this year, at the base of High ParkTechnologies launched the licensed Currency.com exchange, on which, in addition to cryptocurrencies, trading instruments based on traditional financial assets are presented.

In April, President Alexander LukashenkoHe proposed the construction of a large data center for cryptocurrency mining near the Belarusian Nuclear Power Plant. He also stressed that the state intends to provide comprehensive support to the digital economy.

Uzbekistan

Citizens of the country can only conclude transactions for the sale of crypto assets. The use of the latter as a means of payment in the country is prohibited.

In general, the conditions for the development of localcrypto industries are extremely unfavorable. For example, a license for crypto platforms can only be obtained by legal entities from other countries. They require significant authorized capital, server deployment in Uzbekistan, and many other uncomfortable things.

Kazakhstan

The authorities are considering a bill defining the legal status of mining and the features of its taxation.

According to the document, cryptocurrency mining is considered as entrepreneurial activity only if computing resources for mining are provided.

Tax liabilities for operations with cryptocurrencies arise at the time of their sale for fiat assets.

North America

USA

In the United States, cryptocurrency related activities undercontrol of several departments at once. The Securities and Exchange Commission (SEC) regulates digital currencies with the properties of securities, and the Commission for derivatives trading (CFTC) regulates exchange commodities and crypto derivatives.

Federal Deposit Insurance Commission(FDIC) controls the participation of banks in the field of crypto assets. The U.S. Department of the Treasury's Office of Financial Crimes (FinCEN) also plays an important role, which, for example, intends to control stablecoins.

CFTC is different from the above organizationsless tough approach. In particular, the head of the agency Heath Tarbert believes that digital currencies do not carry systemic risks for the financial system, if it is not about any global stablecoin.

SEC chief Jay Clayton considers approachits departments to regulate cryptocurrencies “balanced”, protecting investors and promoting innovation. The main resources for working with digital assets are concentrated in FinHub, which collaborates with other regulatory authorities.

In December, the SEC approved a fund based onBitcoin futures and TokenSoft's activities as a transfer agent for the tokenization industry. On the other hand, the agency to this day refuses various companies to launch cryptocurrency ETFs. In addition, the Commission continues to suppress the activities of startups that previously conducted an unregistered ICO.

In December, Congressman Paul Gosar proposed a bill providing for the separation of functions for regulating digital currencies between the above departments.

Also, the regulatory environment varies in different states. For example, rather strict rules in the state of New York, where cryptocurrency companies must have BitLicense.

This fall, the United States Internal Revenue Service (IRS) for the first time in five years updated its tax calculation guide for crypto investors.

Despite the difficult working conditions, the USA is still the leader in the number of cryptocurrency hedge funds and other blockchain-related companies.

Canada

Bank of Canada ensures that the new classof assets did not create systemic risks of financial stability for the country's economy, and the Financial Institutions Department observes that the volumes of crypto assets of the respective organizations are within the acceptable risk level.

The Canadian Consumer Protection Agency and regional regulators, such as the Ontario Securities Commission of Ontario, Alberta and British Columbia, indirectly regulate the industry.

In the summer of this year, the government obliged cryptocurrency firms and partner banks of these companies to register with the Financial Analysis and Reporting Center of Canada (FinTRAC).

Bitcoin exchanges are classified as suppliersservices in the field of money transfers and are required to comply with the KYC / AML rules regarding both local and foreign platforms. Trading floors should identify the senders and inform the regulator of the details of transfers amounting to more than 10 thousand Canadian dollars.

Bank of Canada is considering issuingown digital currency, although recently the head of the regulator Stephen Poloz called the crypto industry a risky area that does not have advantages over traditional finances.

European countries

The European Parliament has not yet adopted a regulatorydocuments directly regulating cryptocurrencies. However, the latter are widely distributed in many EU countries, each of which has its own specifics of legislation. For example, some states may or may not levy a capital gains tax on operations with crypto assets, the rates of which may vary significantly.

Germany

Federal Office of Financial SupervisionGermany (BaFin) defines cryptocurrencies as “units of account” that can be used for payment purposes. In order to use digital assets for commercial purposes, individuals and companies need to obtain regulatory approval.

In addition to BaFin, the local crypto industry is regulated byGermany's central bank - Deutsche Bundesbank. He controls the activities of regulated services, including those related to tokens in financial institutions.

Until recently, relatedcryptocurrency activity was not so easy. Some representatives of the crypto industry even expressed the opinion that local regulators deliberately hinder its development, trying to maintain legal uncertainty.

However, at the end of November, a bill was passed,allowing financial institutions to buy and sell bitcoin and other cryptocurrencies. Starting January 1, 2020, German financial institutions can offer customers online banking services, including operations with stocks, bonds and cryptocurrencies, with the appropriate license. Banks get the opportunity to store bitcoin and other crypto assets.

Another sign of a warming relationship between German regulators and the crypto industry is the appeal of Finance Minister Olaf Scholz to issue the euro.

Malta

The authorities of this small island statequite thoroughly approached the development of a legal framework for a new industry. Cryptocurrencies in Malta, although they are not legal tender, are nonetheless recognized as "an intermediary in the exchange, unit of account, or means of preserving value."

Investment activity in this country is quitehigh. So, in July, Apple co-founder Steve Wozniak invested in the Malta blockchain company EFFORCE. In September, the Binance cryptocurrency exchange and the Malta Stock Exchange (MSX) signed a memorandum in accordance with which a platform for security tokens will be launched. MSX has entered into a similar agreement with OKEx.

Malta also has internationala division of the American Bittrex exchange, the office of the largest Indian crypto platform Zebpay, Tokenomica from Waves, the ZB.com platform and other companies and their representative offices.

Estonia

Estonia has a convenient e-residency system andsimple business conditions. The legislation is generally friendly to blockchain and cryptocurrencies, and the developed digital infrastructure contributes to the effective regulation and creation of a favorable investment climate.

Cryptocurrencies are regarded as property,income from exchange transactions with them is taxed on capital gains. Also in this jurisdiction, the position of the regulator regarding the cases of recognition of ICO tokens by securities is quite clearly defined.

At the end of 2018, the Ministry of Financetightened industry regulation to prevent money laundering. In 2020, the local regulator will begin to verify information about the participants of cryptocurrency enterprises. The latter must be registered and located in Estonia. If the company is located abroad, in order to obtain a permit for activity, it needs to open a branch in this country.

State fees for obtaining permissionfor activities to provide virtual currency services will be increased from 345 euros to 3300 euros, and an application for a permit to conduct activities will be processed from 30 to 90 days.

Great Britain

The authorities of this country quite thoroughly approached the issue of industry regulation.

So, in December 2018, the Ministry of Taxesand the UK Customs Board (HMRC) has published a detailed guide for cryptocurrency owners explaining their approach to such assets. The document refers to previous reports by the British government, in which digital assets are considered more as property than forms of money.

Cryptocurrency companies are registered inFinancial Regulation and Supervision Authority (FCA), some receive a so-called E-Money license. Profits from cryptocurrency transactions are taxed on capital gains.

In July of this year, the regulator publishedThe final version of the guide to cryptocurrency assets, which are divided into security-, utility- and exchange tokens. Some stablecoins may be classified as electronic money.

It is expected that in accordance with the Fifth DirectiveAfter January 10, 2020, the EU, companies working in the field of payments, storage and exchange of cryptocurrencies will have to undergo two complex registration procedures, in particular, to comply with the new anti-money laundering rules.

Due to the tightening of regulatory requirements, the British company Block Matrix, which is the developer of Bottle Pay, a Bitcoin payment service, stopped working.

France

Cryptocurrency exchanges, custodial services and asset managers must be registered and certified by the French Financial Markets Authority (AMF).

In April, France allowed life insurance companies to invest in digital assets through specialized funds without any restrictions on the amount of investment.

The tax from traders is calculated when converting cryptocurrencies to fiat. According to the Minister of Finance Bruno Le Mer, when buying goods and services for digital assets, VAT will be charged.

Cryptocurrencies are actively used in retail,Bitcoins can even be bought at tobacco shops. France, on the other hand, may prohibit the circulation and trading of anonymous assets such as Dash, Monero and Zcash.

Authorities have a positive attitude towards technologyblockchain. For example, the French gendarmerie used Tezos technology to control spending, and in the first quarter of 2020, the French central bank is going to test its own digital currency.

On the other hand, the Ministry of Finance intends to initiate the blocking of Libra development in the EU.

In December, the AMF first approved an ICO.

Luxembourg

In this tiny country, the legislation is quite friendly - it is not without reason that the largest and oldest Bitstamp crypto exchange in Europe is registered here.

The government considers tokens and cryptocurrencies as intangible assets, transactions with which are not subject to income tax until they are converted into fiat, and are also exempt from VAT.

At the beginning of this year, a bill was passed in Luxembourg that created the legal basis for security tokens.

Netherlands

The country's authorities are taking active steps to combat anonymous cryptocurrencies, and also intend to oblige exchanges and wallet providers to undergo the licensing procedure.

According to the state, platforms that exchange fiat for cryptocurrencies should follow the same rules as other financial services.

From January 10 of next year, activitiescryptocurrency companies will be regulated by the Netherlands Bank. Local digital asset platforms and wallet providers are required to register with the regulator.

The country has also developed a bill ontougher penalties for fraud using “new payment methods”. The document provides for an increase in the prison term for unlawful acts using banking applications and digital currencies to six years.

Portugal

Cryptocurrency trading and payments using digital assets in Portugal are not subject to value added tax.

Back in November 2017, the head of the central bankIn Portugal, Helder Rosalino stressed that the financial regulator does not consider bitcoin as a currency, since it is not a means of saving and cannot be used for lending.

Lithuania

On the whole, Lithuania does not lag behind most European states in the pace of adoption of new norms that tighten the regulation of young industry.

In the summer, the government approved amendments tothe law on the prevention of money laundering and terrorism, which provide for the mandatory registration of cryptocurrency operators. Companies were obliged to carry out an identity verification procedure if the transaction amount exceeds a thousand euros, and also to report financial transactions worth more than € 15 thousand to the Financial Crime Investigation Service.

Tokensale organizers must identify the identities of investors if the transaction amount exceeds three thousand euros.

Finland

In this country, on May 1, the law oncryptocurrency service providers. The responsibility for registering and controlling digital asset firms is assigned to the Financial Supervisory Authority (Fin-FSA).

Cryptocurrency companies must separate customers' money from their own funds, comply with AML rules, and also conduct activities only in Finland.

Due to new rules, popular p2p platformLocalBitcoins has introduced measures to strengthen capital controls. In June, the company removed the option of trading cryptocurrency for cash in person, then introduced user verification. These measures led to a decrease in transaction volumes by more than 30%.

Asia

China

In addition to the People’s Bank of China (NBK), associated withDigital assets are indirectly regulated by the Chinese Cyberspace Administration, the Ministry of Industry and Information Technology, the Ministry of Public Security, the Securities Market Regulatory Commission and other departments.

This country has long been considered the world center of the bitcoin industry. However, in 2017, the PRC authorities banned ICOs and cryptocurrency exchanges.

In November, the Shanghai branch of the NBK announcedthe intention to eradicate the remnants of the crypto industry in the country, recalling that all tokensales are tantamount to illegal placement of securities or illegal fundraising. Local law enforcement agencies continue to identify and suppress the activities of cryptocurrency trading floors, and the regulator is required to tighten control over fiat channels to counter foreign platforms.

Soon, the authorities of the large Chinese city of Shenzhen announced similar intentions, and in Guangzhou they reported on the complete closure of digital currency exchange platforms.

According to Dovi Wang of Primitive Ventures, in Chinaare promoting a program to report those involved in cryptocurrency trading and Pump & Dump. In addition, local authorities urge Chinese residents to be careful when investing in blockchain startups, as they may be promoting cryptocurrency projects under their guise.

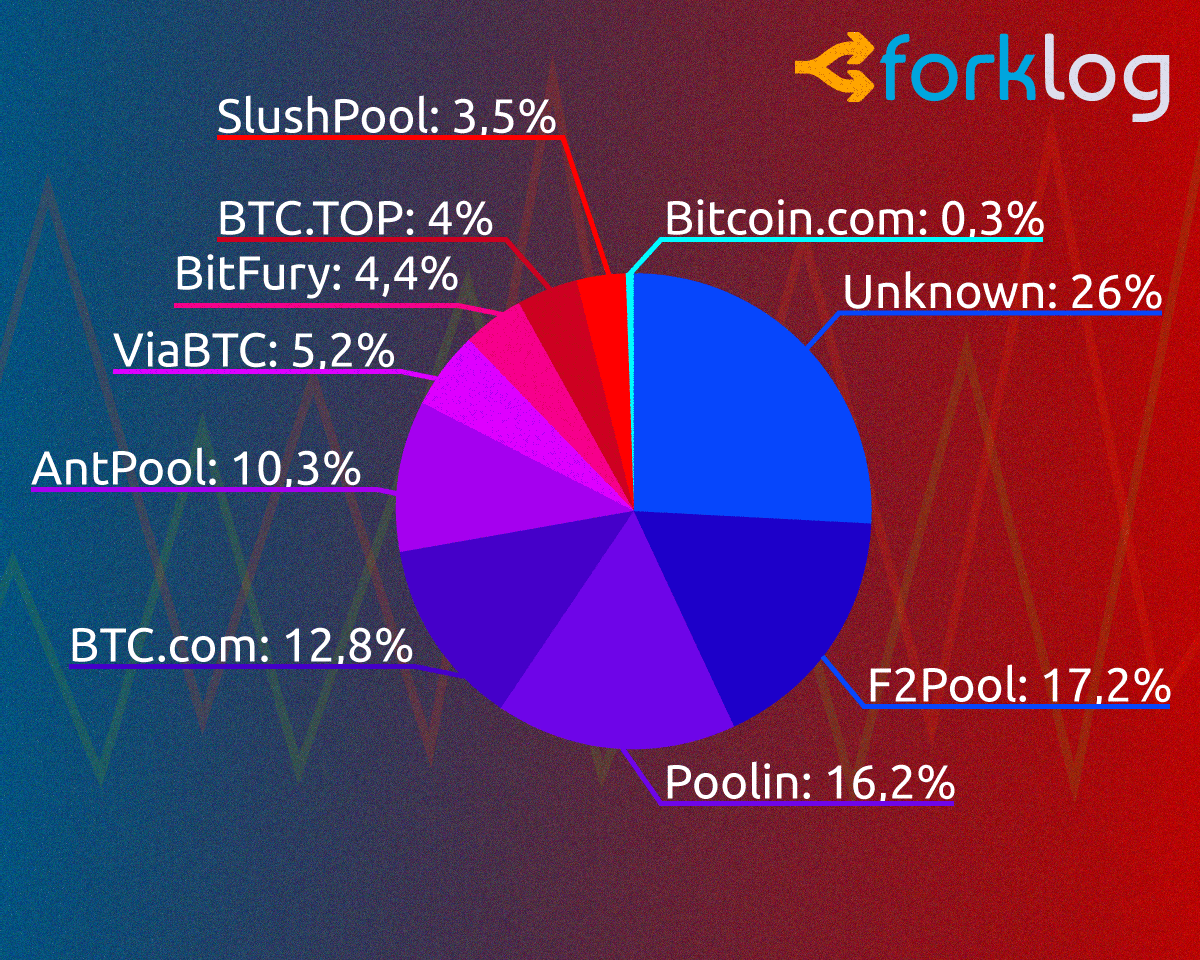

However, mining in the country is still flourishing, this activity is not included in the list of “undesirable industries”. The share of Chinese miners in the bitcoin hash exceeds 60%.

The largest mining pools. Data: blockchain.com as of 12/25/2019

Singapore

This is one of the most friendly tocryptocurrencies of Asian countries. Despite the fact that digital assets in Singapore are not considered legal tender, the country's tax office treats them as goods subject to value added tax (more precisely, the Goods and Services Tax (GST), the local equivalent of VAT).

This summer, Singapore tax offeredcancel GST on fiat money cryptocurrency exchanges and identified key characteristics of digital tokens, which are not stablecoins.

The regulatory framework developed by the Central Bank (MAS) involves comprehensive regulation of large payment firms and several types of licenses.

MAS may soon allow cryptocurrency derivatives to be listed on regulated exchanges.

Recently, it is known that the local regulator is suspicious of private transactions and privacy-oriented wallets.

Hong Kong

A little over a year ago, the Hong Kong Securities and Futures Commission (SFC) introduced the rules for cryptocurrency funds and announced its intention to control trading platforms.

The rules state that fund managers, where more than 10%cryptocurrency assets must obtain a license from the SFC. The capital of the funds should exceed 3 million Hong Kong dollars ($ 384,000) and such companies should have an independent director dealing with due diligence, as well as a third-party custodian. In this case, the assets of the fund and its manager should be kept separately.

The SFC prohibits an ICO if a campaign initiator token is issued less than 12 months before the start of the token sale.

According to updated rules, licensethe regulator will be able to get sites where at least one security token is being traded. SFC requires licensed platforms to offer services exclusively to professional investors and adhere to strict criteria for listing digital assets.

Japan

In this country, perhaps the most progressive legislation for cryptocurrencies, which in April 2017 was recognized as a legal means of payment.

However, after hacking the Coincheck exchange for $ 533 millionindustry regulation has gradually tightened. In particular, the local Agency for Financial Services has introduced mandatory licensing of trading platforms, tightening the requirements for cybersecurity and compliance with AML / CFT.

In the summer of 2019, legislativechanges aimed at protecting consumers and increasing regulatory certainty, implying tighter control over derivative products, as well as preventing the risks of hacking exchanges. The latter was also limited by the maximum leverage (up to 4x).

In addition, cryptocurrencies have come to be officially called “crypto assets” rather than “virtual currencies”. The standards will enter into force in April 2020.

South Korea

Another generally cryptocurrency-friendly country, albeit with a clear tendency to tighten industry regulation.

South Korea does not view digital assets aslegal means of payment, and exchanges are tightly controlled by government agencies, including the local Financial Services Commission (FSC). In addition, the Ministry of Economy of the country can conduct comprehensive checks of bitcoin exchanges. Since September 2017, ICOs and margin trading have been banned in the country.

Since the summer of 2019, local cryptocurrency exchanges are requiredreimburse users for losses in the event of hacks and various malfunctions in the operation of their systems. In addition, FSC began to directly control trading platforms and license them in accordance with the recommendations of the FATF.

India

The regulatory environment in this country is one of the mostunfriendly to the crypto industry. Although digital currency trading platforms are generally legal, the activities of such companies are extremely difficult due to legal uncertainty.

Despite the lack of legal cryptocurrenciesstatus, authorities are confident that operations with bitcoin should be taxed on capital gains. In 2018, the Reserve Bank of India banned commercial banks from conducting operations related to digital assets.

According to local media reports, a bill has already been developed in India on a complete ban on cryptocurrency transactions, the discussion of which was regularly postponed by the Supreme Court.

Other jurisdictions

Switzerland

One of the most friendly to bitcoin andblockchain of countries. In Switzerland, cryptocurrency transactions are legal, and business rules are not burdensome for companies. This approach stimulates innovation and encourages investment.

The country's tax office is consideringcryptocurrencies as assets, transactions with which are taxed on property. Holders of digital assets must file annual returns. Local cryptocurrency exchanges are licensed by the local Financial Markets Supervision Service (FINMA).

In the canton of Zug is the holy of holiescryptocurrency world - Cryptodolina, which became the birthplace of the Ethereum Foundation, Libra Networks and dozens of blockchain startups. Zug has become the first city where Bitcoins pay a fine for parking in the wrong place, and you can exchange cryptocurrency for fiat even at some banks.

In 2019, he began work in this small countrySEBA crypto-bank, custodial service from Swissquote, and new cryptocurrency-based ETPs are regularly launched on the largest Swiss stock exchange SIX Swiss Exchange.

Swiss authorities are considering issuing digital currency central bank (CBDC).

Australia

In this jurisdiction is quite progressiveregulatory environment - the circulation of digital assets and the activities of cryptocurrency exchanges are legal. In 2017, the Australian government defined Bitcoin and other cryptocurrencies as capital gains taxes.

In 2018, the local Securities and Exchange Commissioninvestment has somewhat tightened regulation of exchanges and ICO. Trading floors must be licensed, identify customers, and take anti-money laundering measures.

Australia Revenue Agency (ATO) controlscryptocurrency operations of citizens and makes sure that they do not hide their income in offshore. The country's police are successfully stopping illegal operations with cryptocurrency by closing exchanges related to drug trafficking.

Gibraltar

This tiny state is famous for a well-thought-out, clearly defined and cryptocurrency-friendly regulatory framework.

The activity of exchanges is legal, companies pay 10%income tax. Bitcoin transactions are not subject to capital gains tax. Blockchain-based firms are required to obtain an appropriate license from the Financial Services Commission.

Bitcoin Platform Offices Located in GibraltarCovesting and Huobi, Coinfloor's oldest UK exchange, and the eToro social investment platform division. The Gibraltar Blockchain Exchange has a cryptocurrency trading platform.

Latin American countries

Different countries in this region have their own regulatory characteristics. INBolivia, for example, Bitcoin and digital asset exchanges are banned, and inEcuadorOnly the government-issued SDE token is allowed to circulate.

In other countries, cryptocurrencies are widely used as a means of payment and are readily accepted by many retail outlets, while being taxed on capital gains or income taxes.

In general, the trend in the region is towards tightening. INMexico, for example, bitcoin exchanges and working with themfinancial institutions should receive permission from the central bank by providing a business plan describing the operations, planned commissions and mechanisms for identifying users.

AuthoritiesParaguayobliged cryptocurrency companies to disclose information about their activities. It is expected that legislative regulation of the market will be adopted in the first half of 2020.

From summer 2019Brazilianand global crypto exchanges operating in this country must transfer data on user transactions to the authorities, and inChileA tax has been introduced on income from transactions with Bitcoin. In going through hard timesArgentinabanned from buying cryptocurrency using credit cards, and suffering from hyperinflationVenezuelaleft the Bittrex cryptocurrency exchange.

findings

Despite the desire of various organizations to bring the regulation of the cryptocurrency sector to a single standard, most countries follow their own approaches.

However, as before, the market is going throughtransformation and the trend as a whole follows the path of further “tightening the screws”. Regulators warmly welcome strict compliance with KYC / AML and often do not accept anonymous transactions. In many countries, cryptocurrency companies are not much different from other firms and banks.

It’s hard to say clearly whetherthe development of industry, its widespread regulation. With confidence, only one thing can be stated - the restrictions that apply in many countries often contradict the very spirit and nature of cryptocurrencies, created just in response to the inefficiency of state institutions and as a step towards a more free market.

Alexander Kondratyuk