Bitcoin looks very strong… but with very low holiday trading volumes.

All mentionedin previous posts hidden bearish divergenceshave been disproved, which means that the bullish is unfolding. However, earlier today the RSI on the 6- and 4-hour charts has already returned to the overbought zone, and on the daily timeframe - to 50, which is considered a significant level. RSI above 50 is a bullish signal, below 50 is considered more bearish.

Ultimately, the MACD on the daily timeframe worked as a great bottom formation signal.

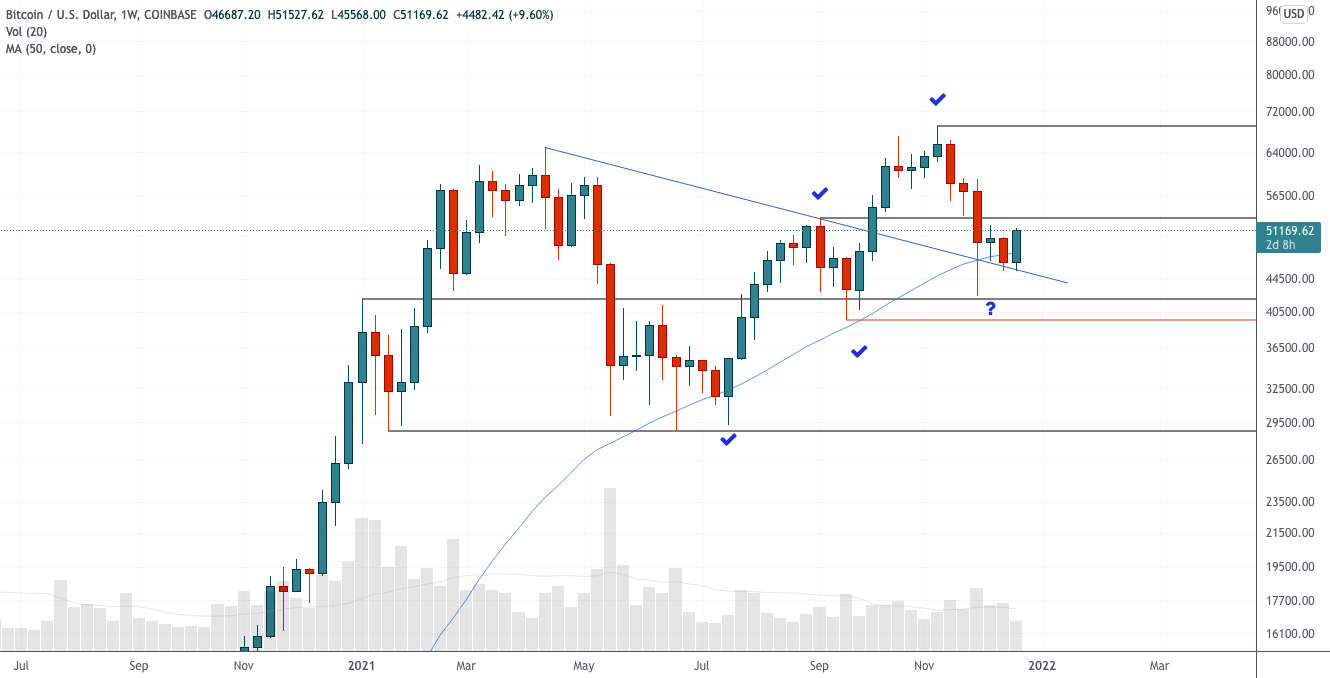

Weekly schedule

Chart executed in TradingView

The weekly chart looks great if the pricewill be able to keep these levels. As in July, the chart formed a temporary breakdown of the 50MA downside, followed by a bullish engulfing candlestick, confirming this level as support. The price chart continues to make larger lows and larger highs. If the current week closes with about the same “engulfing” (when the body of the previous candle is completely absorbed by the next), it will look like a bottom.

From the standpoint of candlestick chart analysis, these two weekly candles also form a "tweezers" formation (with equal lows of "wicks") - also a sign of short-term support and a bottom.

However, before the price has recovered above $53 thousand, in my opinion, it is too early to say that this is a real turn to growth.

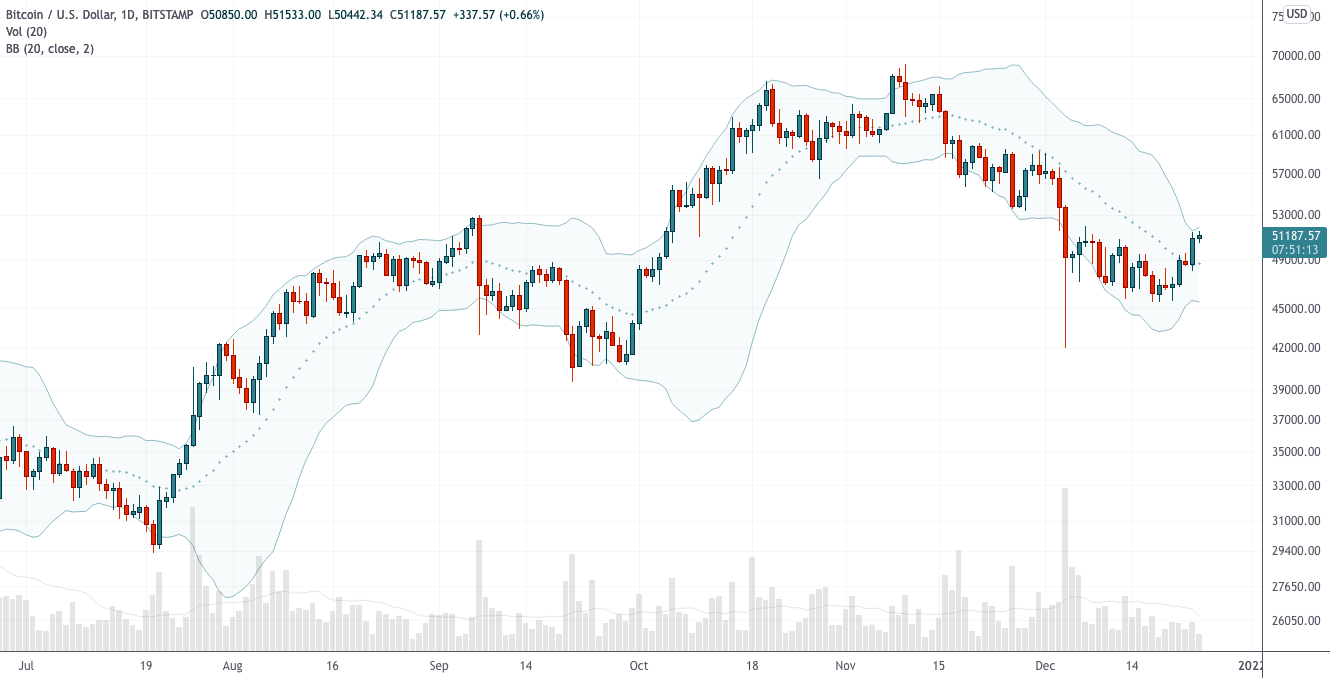

Daily chart

Chart executed in TradingView

Bollinger Bands look bullish again, priceis trading above the center line and testing the upper border as resistance. In addition, the indicator is narrowing, confirming that the downward volatility is at least paused.

Chart executed in TradingView

Great, but not enough trading volumes.Yesterday's candlestick broke through the downside black resistance and this was one of the reversal start signals that I am paying attention to. The important resistance above is still there, but it looks like a great start.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.