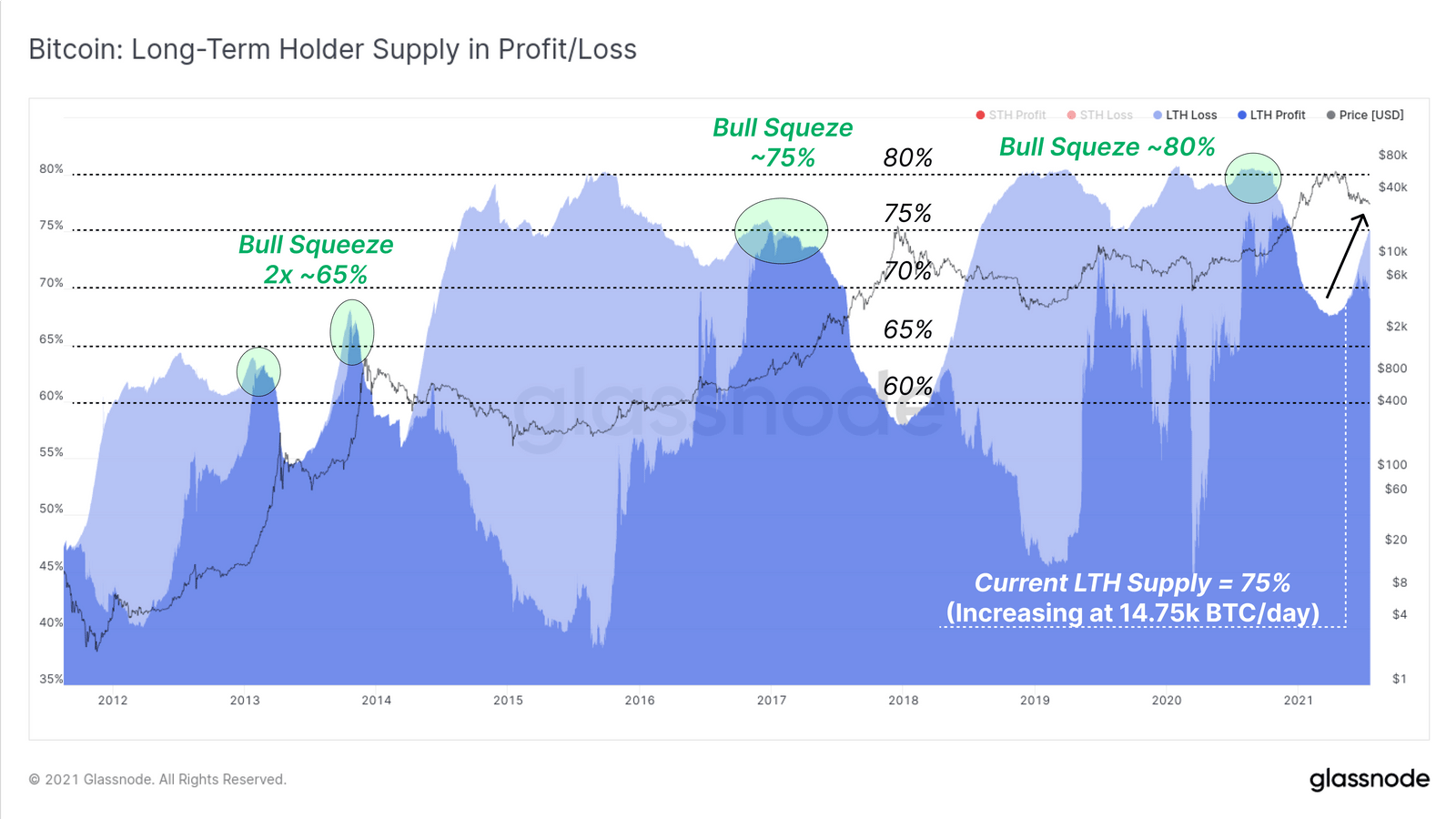

Hodling remains the preferred strategy for most investors despite rising volatility. TOThis is the conclusion reached by Glassnode analysts. In the latest report, experts claim that hodlers hold ~75% of the circulating supply of Bitcoin. However, only 6% of these 75% are at a loss.

According to experts, provoking the pastrallying out of bullish positions, as a rule, was accompanied by the fact that the hodlers held 65% of the turnover. For example, this was the case before the rally in 2013; in 2017, hodlers held 75%, and in 2020, even 80%.

Moreover, analysts believe that within twomonth, hodlers will hold up to 80% of the total number of coins in circulation. However, for this to happen, the coin maturation rate must be maintained (14.7 thousand BTC/day), which is difficult in the current bearish conditions, Glassnode notes.

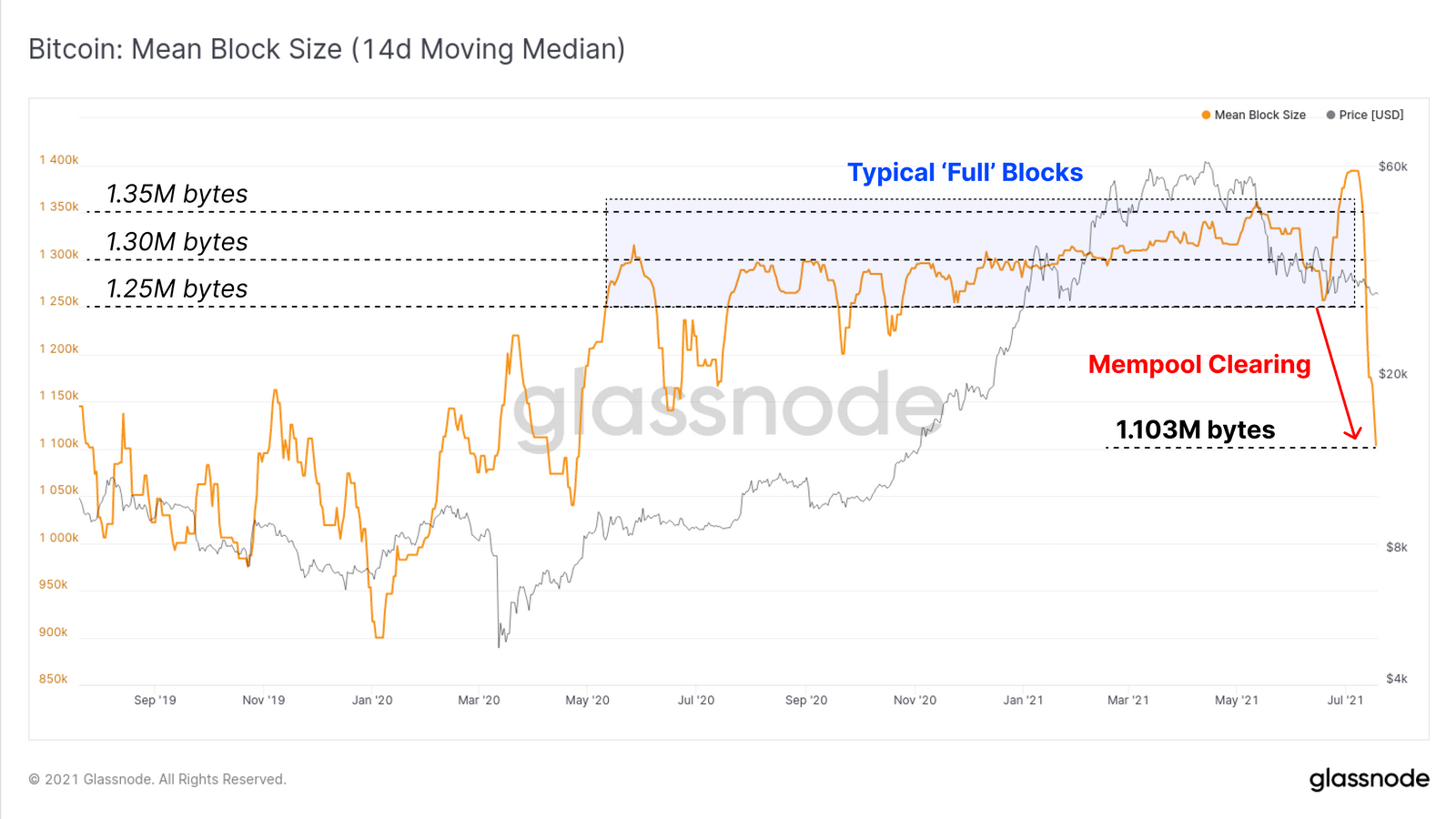

Thus, experts emphasize that on-chain activityremains extremely low due to the clearing of the bitcoin mempool, as well as due to the drop in transaction volumes. For example, as the mempool emptied, the average block size decreased by 15-20% to 1.103 MB. The last time this block size was in May 2020. This suggests that blocks mined by miners are not being filled with transactions, and network utilization remains low.

The fact that the Bitcoin community is stuck in negativityAnalysts from the Santiment resource also reported earlier. According to them, negative social sentiment on Bitcoin is gaining momentum as the volatility of the cryptocurrency falls. However, even negativity can play into the hands of the market. For example, experts recall that high social volumes and extremely optimistic sentiments, as a rule, were not catalysts for sustainable price growth.

Where is it more profitable to buy bitcoin? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Bybit | https://bybit.com | 7.5 |

| 3 | OKEx | https://okex.com | 7.1 |

| 4 | Exmo | https://exmo.me | 6.9 |

| 5 | Huobi | https://huobi.com | 6.5 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication