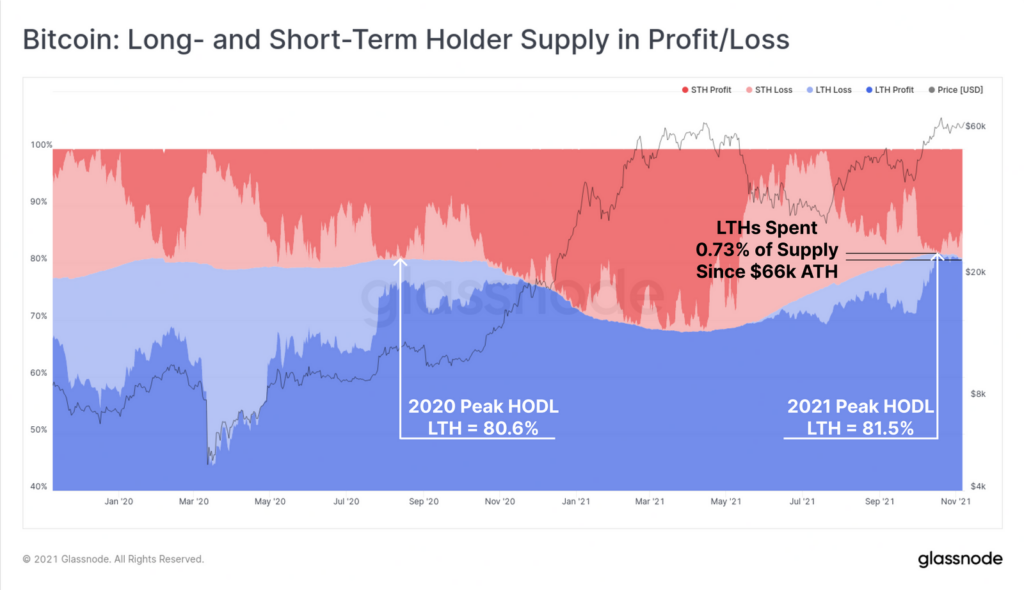

Long-term Bitcoin investors began moving coins after Bitcoin crossed the $66,000 threshold. About itGlassnode analysts reported on their blog.At its peak, investors were holding about 81.5% of the total supply of bitcoins. The numbers have adjusted since then, however, as investors spent 0.73% BTC of total coins in circulation.

However, analysts noted that though"Old coins" are in motion, the market seems to be absorbing them without any problems. Glassnode argues that the ability to "asymptomatically" absorb large volumes of coins is natural in bull markets.

Eventually, however, market participants begin toreact to the movement of coins, which soon results in a correction. It was similar, for example, in August 2020. Then the price of bitcoin broke the $ 12,000 mark, which forced investors to take profits. The result was that already in early September, the price of the cryptocurrency fell back to ~ $ 10,200.

However, current expenses, according to experts,is closer in its dynamics to deliberate profit-taking than panic selling due to the anticipation of an absolute maximum in the price of bitcoin. According to the “worst-case scenario” of price development from an anonymous analyst under the pseudonym PlanB, bitcoin may approach the $ 100,000 mark by the end of November. $ 135,000.

</p></p>