A slight surge from new whales, continued re-accumulation, and more.

Hope the week is for yousuccessful. Another week in the range, although some interesting changes can be seen on-chain. So let's get straight to the overview.

Key points:

- The re-accumulation on the part of entities [network] with a small sales history continues and has accelerated significantly this week.

- Capital flows on exchange addresses again clearly signal accumulation: -17,794 BTC on exchange balance sheets.

- The hashrate seems to have found a bottom, at least locally.

- Grayscale's GBTC market premium is on the rise, but everyone is unlocking the shares when holders can sell them.

- Finally, a surge of positive whale activity.

- The influx of stablecoins into the market.

- New all-time highs in the number of users coming to the Bitcoin network.

- The level of on-chain activity of network users has dropped sharply.

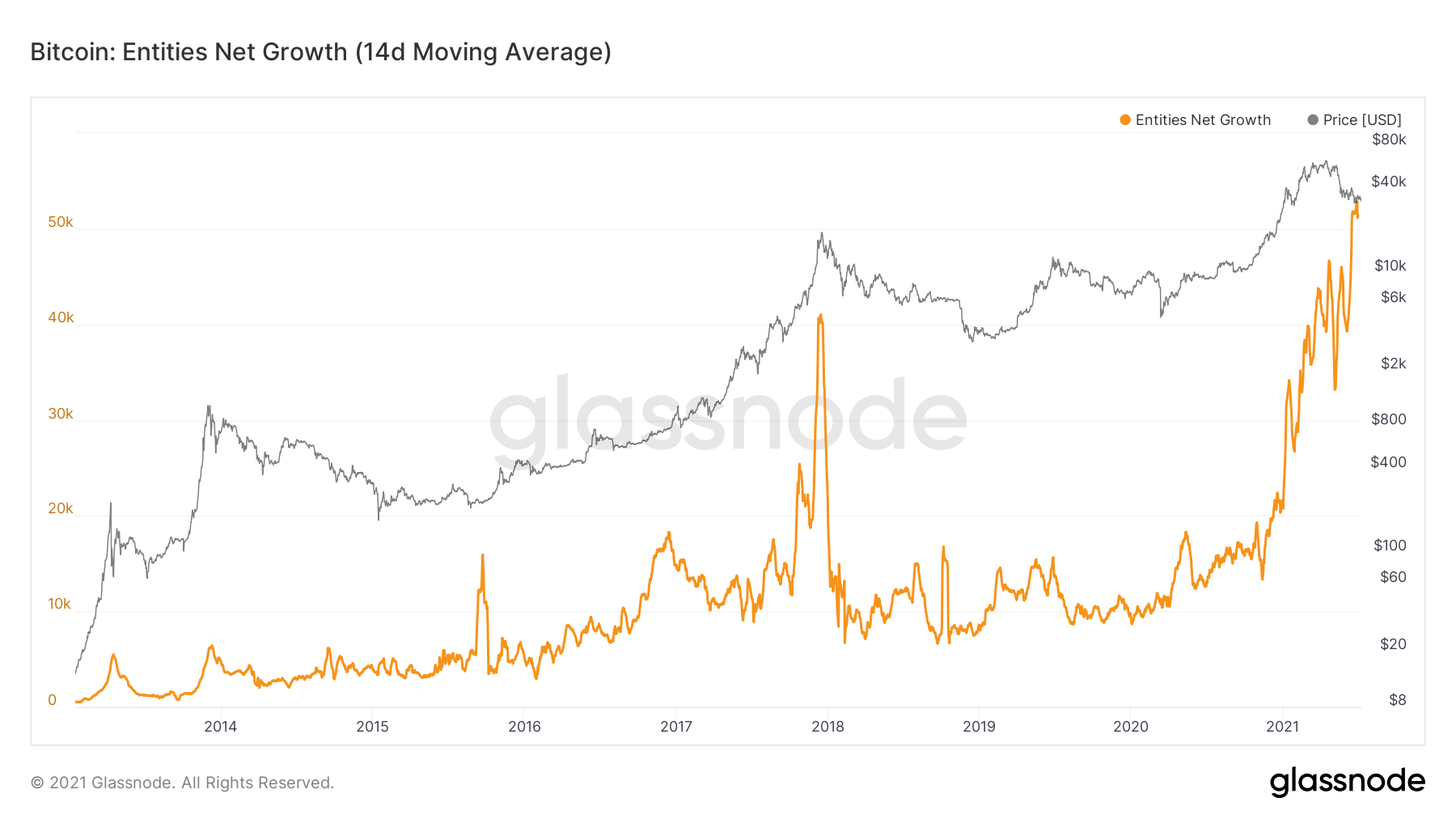

First, let's take a look at the net graphthe growth of users (“subjects” determined by the address clustering method) coming to the Bitcoin network. This figure reached record levels: more than 50,000 new network entities per day.

Net growth of new network entities (14d MA)

Now about the ongoing re-accumulation.This trend has only intensified this week. There are several important aspects here: the volume of supply replenished by the market, the size of the entities absorbing this supply, and the spending dynamics inherent in these absorbing entities. Let's go through all these points in the order of their mentioning.

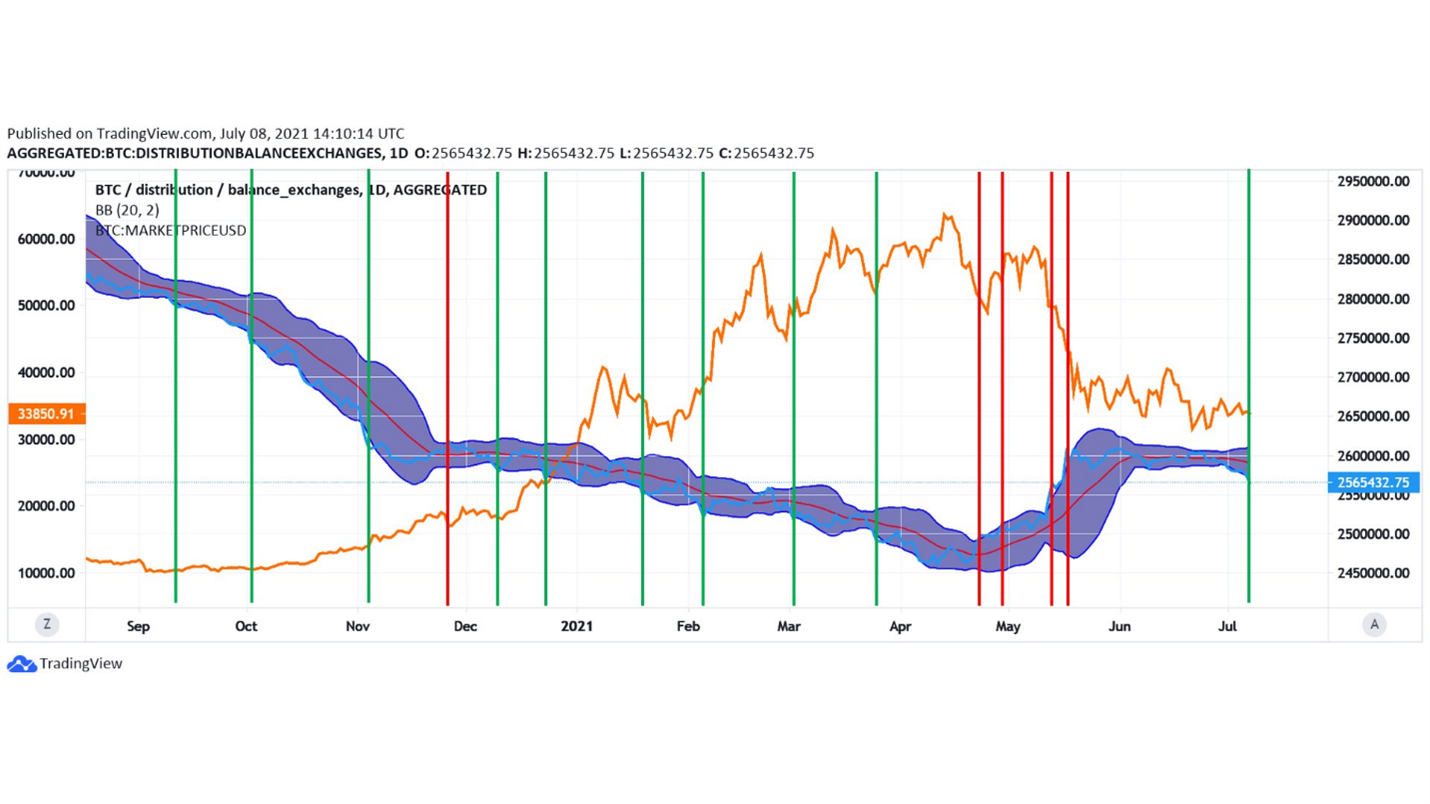

First, let's look at capital flows on exchange markets.addresses. Exchange balances dropped by 17,794 BTC this week. Instead of a simple graph of stock exchange balances, which you have already seen a hundred times, I will give a small variation of my own based on it. If you overlay Bollinger Bands on a chart of exchange balances, from time to time they signal that coins are either actively flocking to exchanges or are being aggressively withdrawn from them. And right now you can see the first “buy” signal in more than 3 months - another sign of a trend reversal towards accumulation.

Cumulative balance of exchange addresses

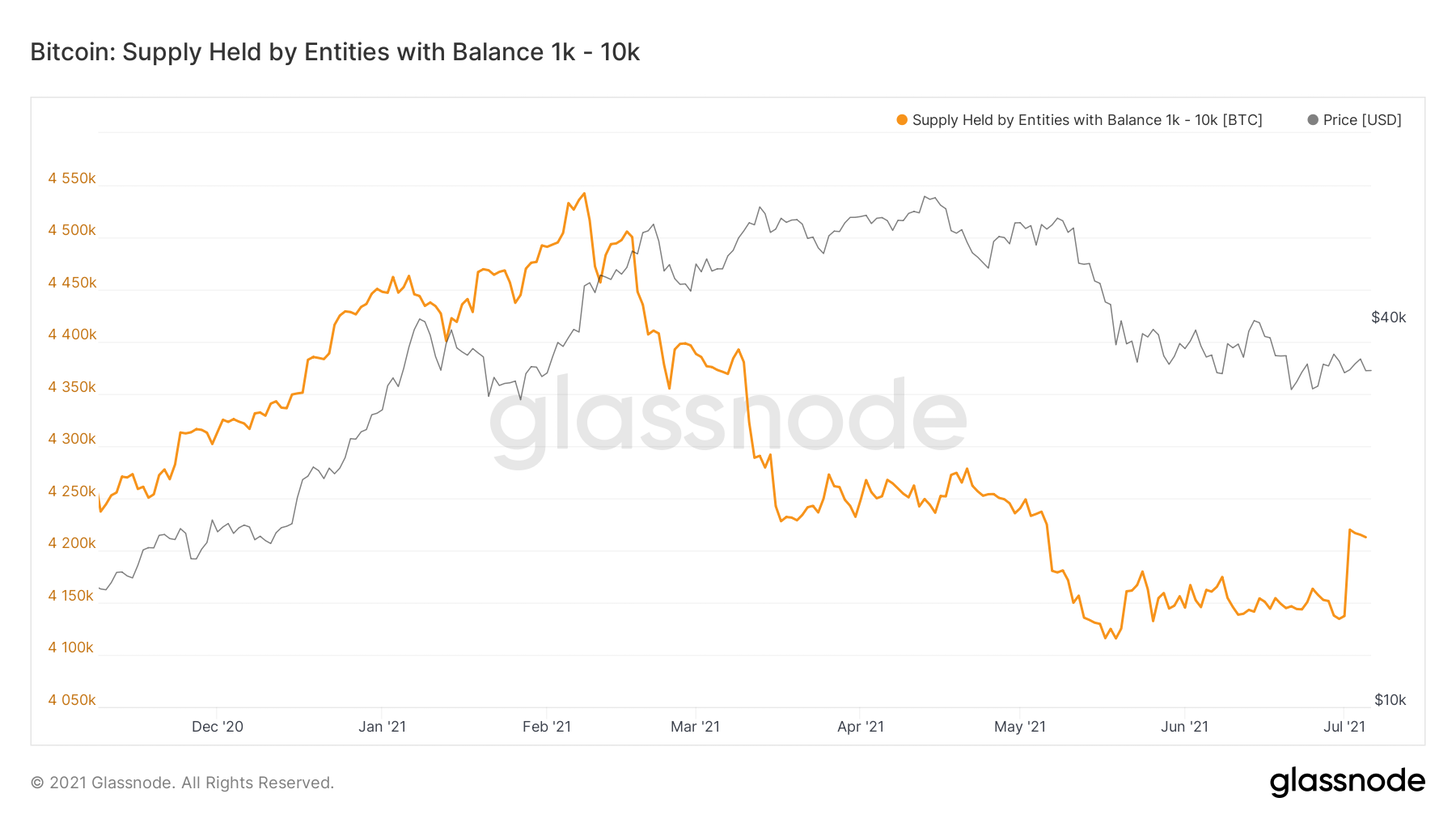

Next on the list is the size of the subjects,buying BTC at these levels. Retail has been actively buying for several weeks now, but now we have finally seen the surge in whale activity that we have been waiting for. This week, 17 new whales were recorded in the blockchain, the total size of their accumulations increased by 65,429 BTC.

Supply held by entities with a balance of 1 to 10 thousand BTC

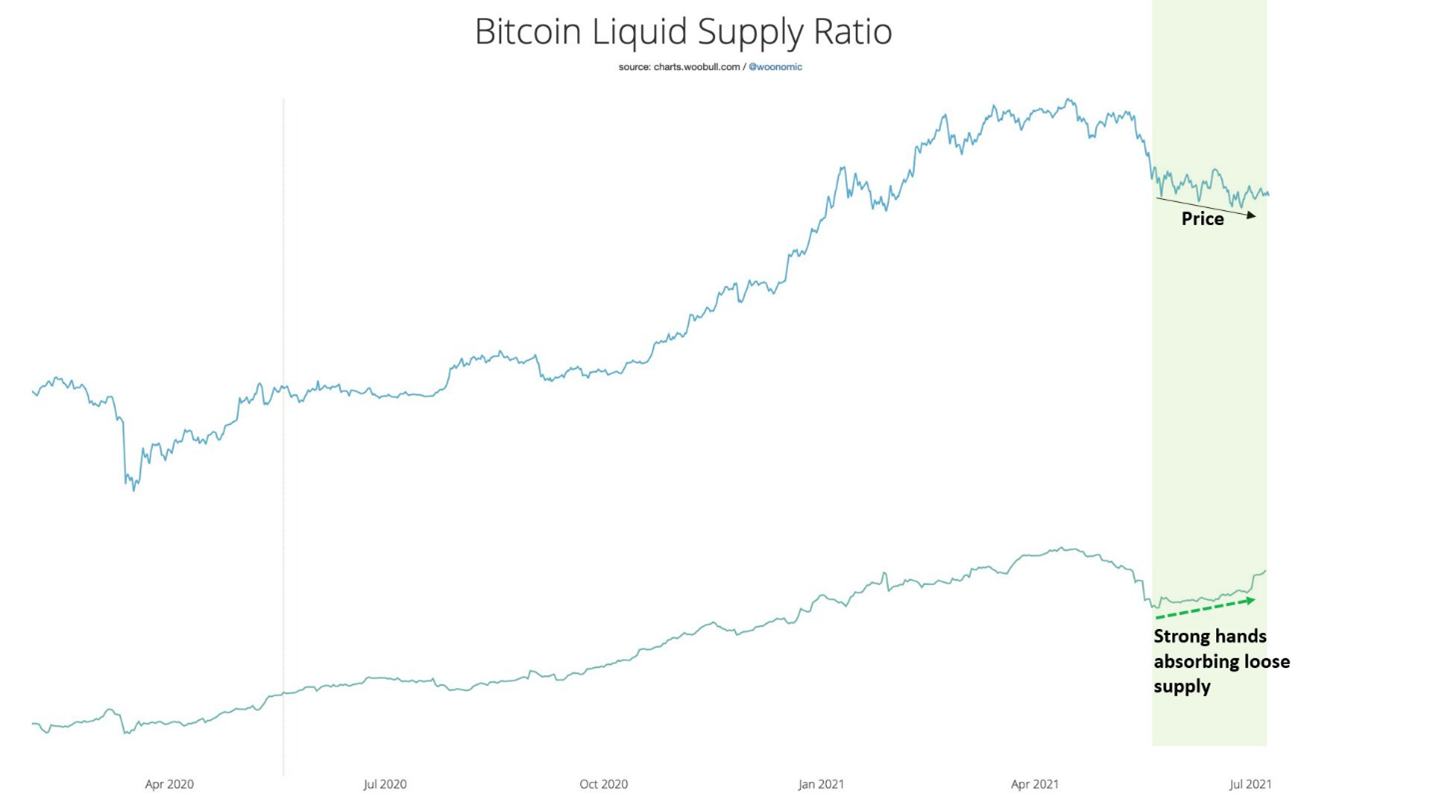

Finally, about the dynamics of spending inherent innetwork entities accumulating BTC at current levels. Subjects with very little sales history continue to absorb speculative traders' coins. The liquid supply ratio is growing, forming a divergence with the price chart. In my humble opinion, given the lack of surrender, the completion of re-accumulation is a matter of “when”, not “if”. When this process is complete, the market will experience a supply shock.

Bitcoin liquid supply ratio

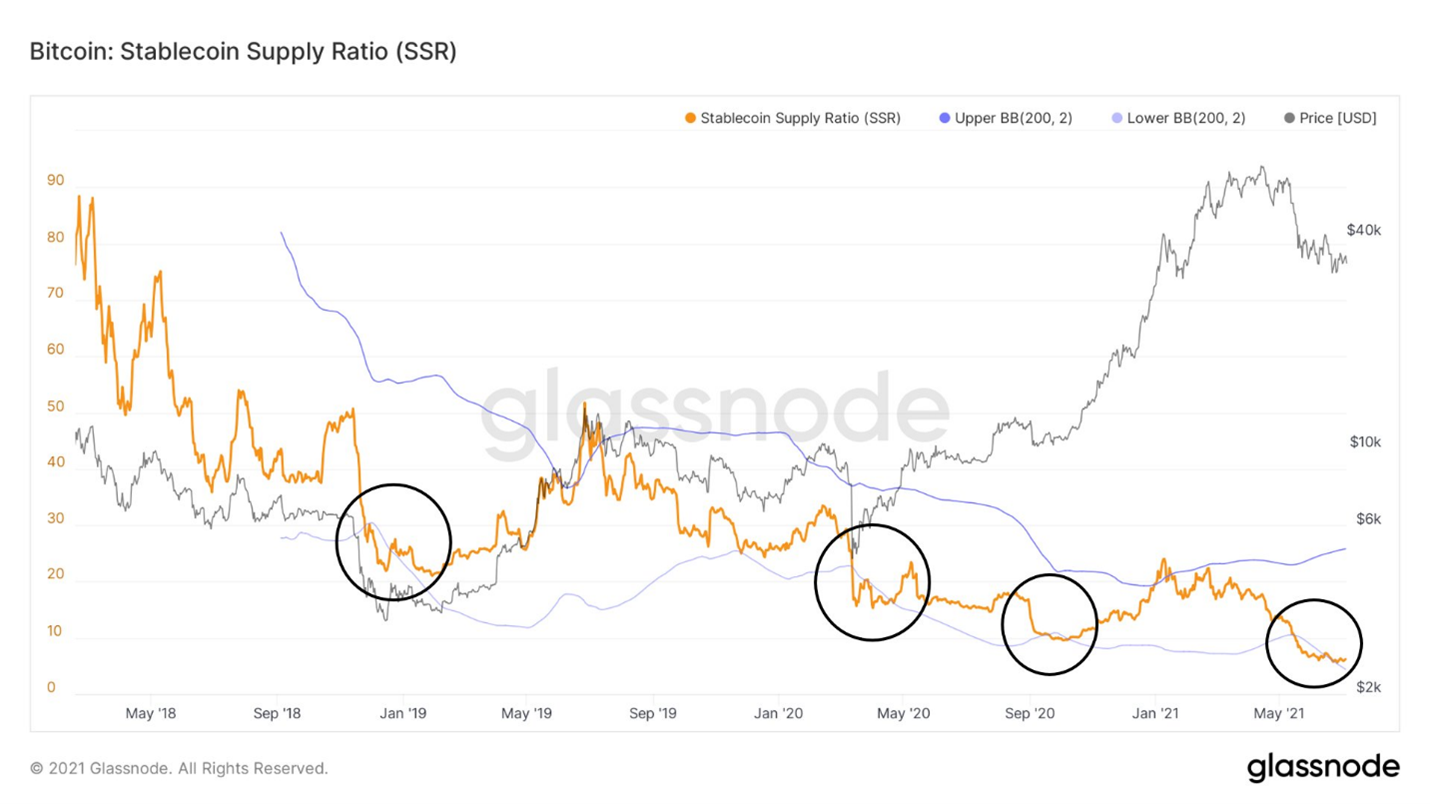

Moving on to the supply ratiostablecoins, an oscillator created by Willy Woo based on Bollinger Bands. The current recovery is reminiscent of the recovery from late 2018 and March and September 2020. Stablecoins are starting to return to the market.

Stablecoin Supply Ratio

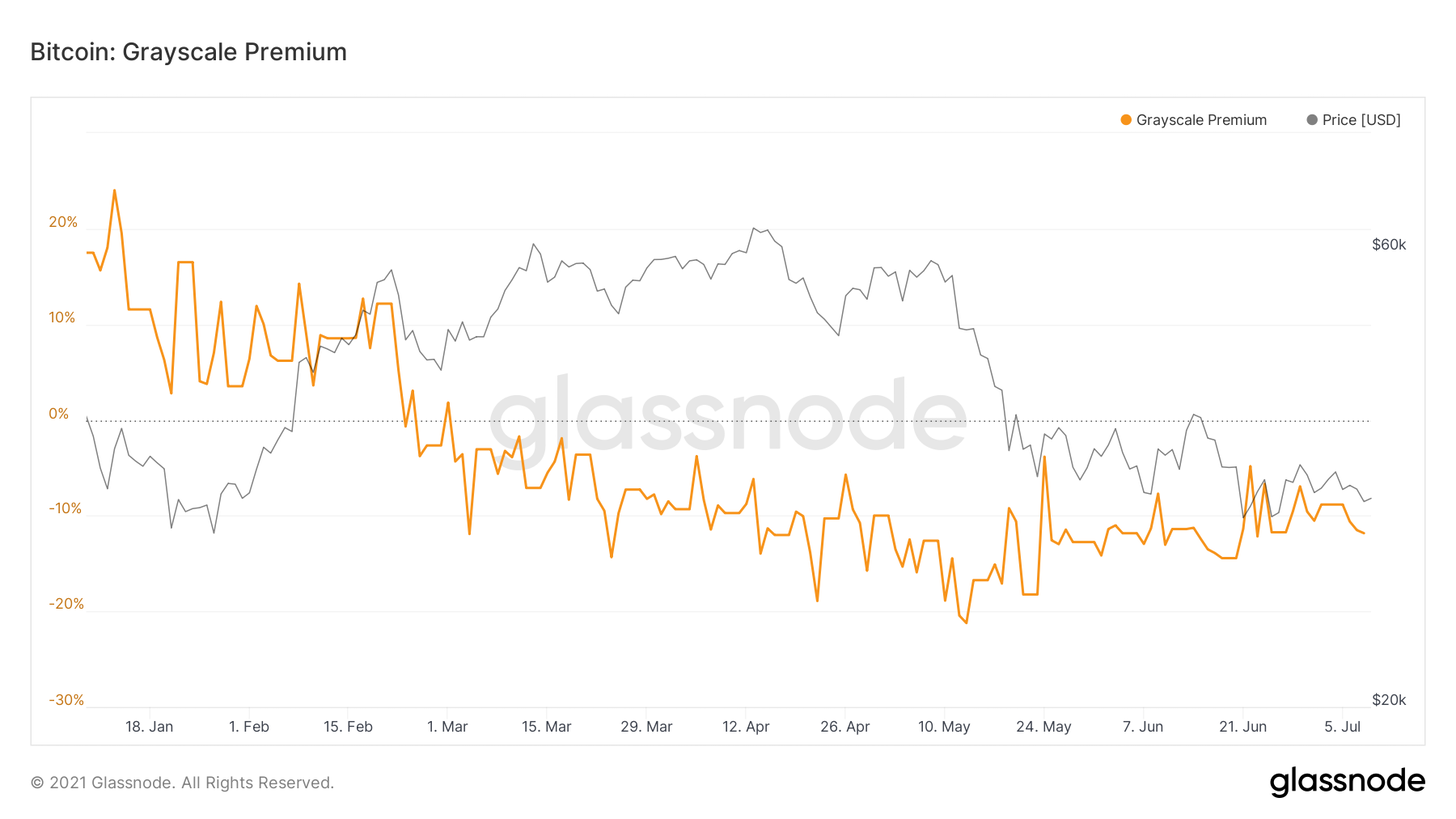

The Grayscale exchange rate award appears to be inan uptrend, and this is another sign of a return of capital to the market. It will be interesting to see how the upcoming share unlock affects the price premium. Probably someone else would give you a much better explanation, but in my understanding, there are two likely scenarios here: bullish and bearish. Bullish: Those who bought GBTC and short futures, selling after GBTC unlocked, will also close short positions. Bearish: If the premium is sold to the spot price level, institutional capital may flow to GBTC instead of spot BTC.

GBTC exchange rate award

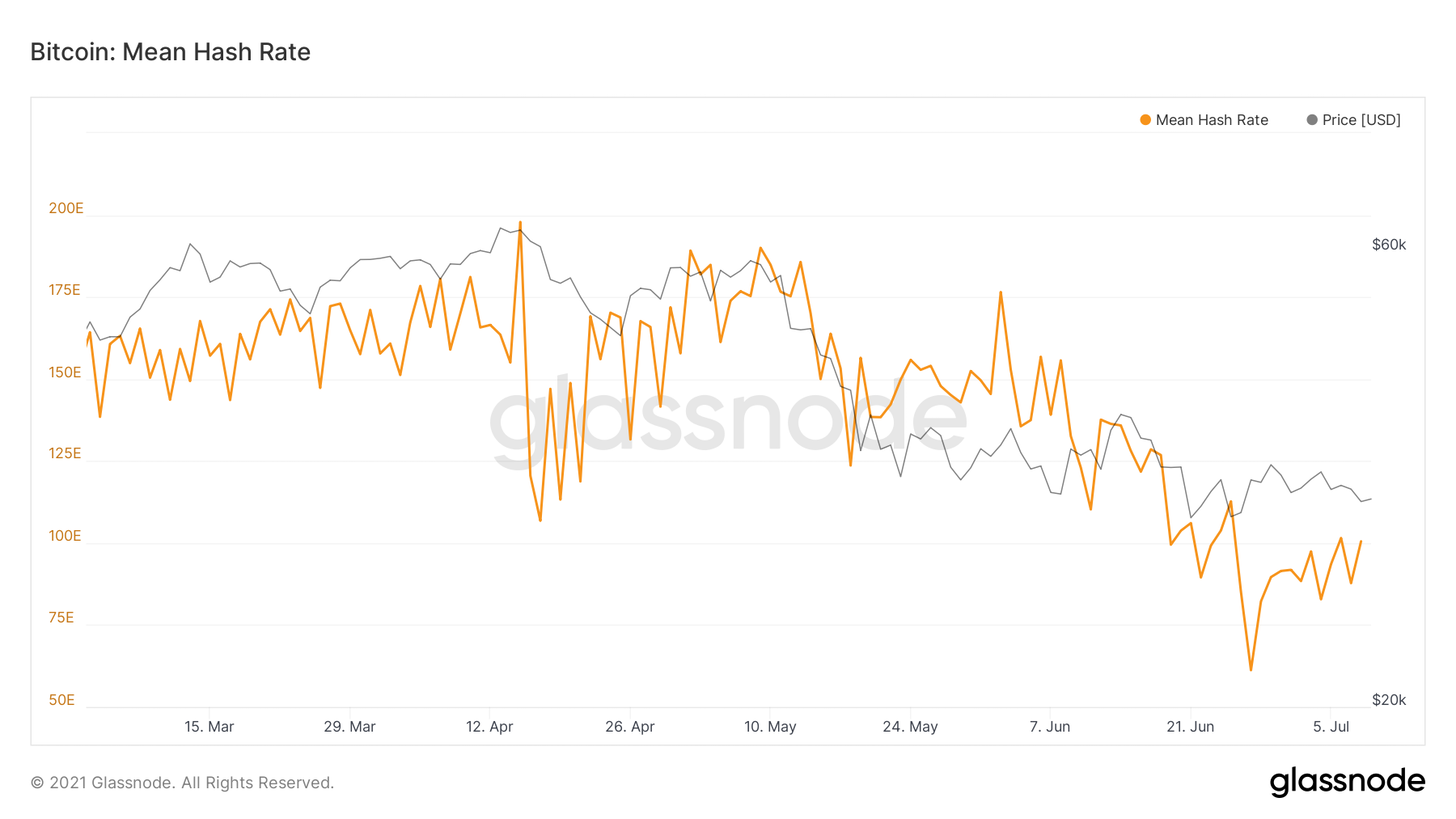

Hashrate seems to have finally found the bottom, at leastat least local, forming a small local upward trend this week. Full recovery is still a long way off, but it's good to see these first signs of a likely end to the decline. Miners also seem to have gone on a hoarding spree, adding 1,045 BTC to their total balance this week.

Average hash rate

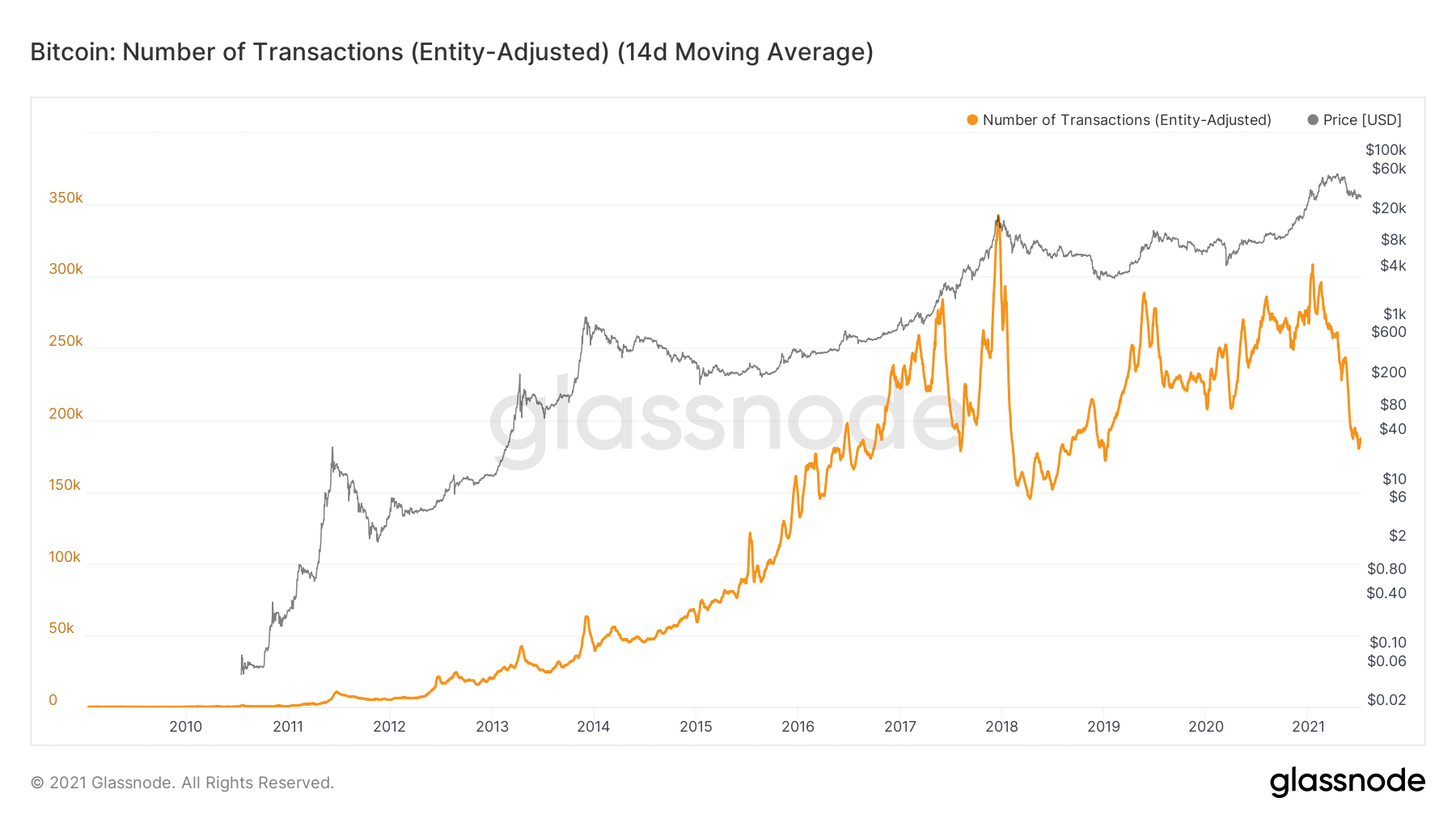

The activity level of netizens sharplydecreased, which can be seen in the number of bitcoin transactions. If I wanted to formulate a bearish scenario and challenge my own re-accumulation thesis, this is one of the charts I would use. Although part of this drawdown may be due to the fact that people used less Bitcoin due to the increased interval between blocks, this problem was eliminated by adjusting the difficulty.

Number of transactions adjusted by network entity (14d MA)

That's all for me. Have a great weekend everyone and good luck!

The article does not contain investment recommendations,all the opinions expressed express exclusively the personal opinions of the author and the respondents. Any activity related to investing and trading in the markets carries risks. Make your own decisions responsibly and independently.

</p>