Article Reading Time:

2 minutes.

A lawyer has suggested that Ripple's former CTO be included in the regulator's lawsuit over the sale of XRP if Ripple actually violated securities laws.

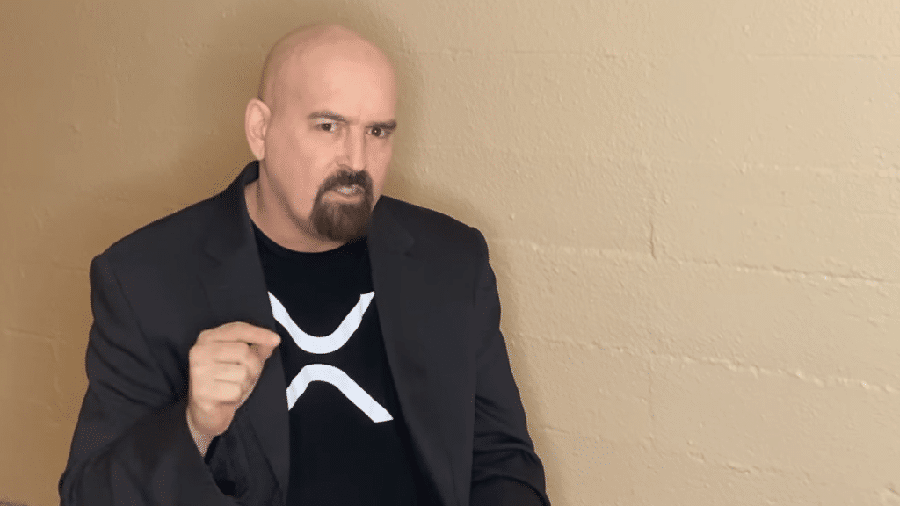

Former Ripple Labs co-founder Jed McCaleb(Jed McCaleb) just recently completed the sale of crypto assets in XRP. Attorney John E Deaton, who represents more than 68,000 XRP holders, said that if the US Securities and Exchange Commission (SEC) accuses Ripple of conducting an illegal ICO in 2013, then the agency should prosecute trial and McCaleb.

Deaton explained that the amount earnedMcCaleb from the sale of XRP, much more than the $1.3 billion raised by Ripple executives Chris Larsen and Brad Garlinghouse.

“SEC Says XRP Is Considered Valuablepaper, so anyone who sells it is violating Section 5 of the US Securities Act. If it were truly illegal, the SEC would not allow the defendants to continue breaking the law as they sell XRP to cover company expenses, including legal fees. In this case, a written warning would be sent to McCaleb to stop selling XRP,” Deaton tweeted.

Let us remind you that the former technical directorRipple received 9.5 billion XRP as a gift for its contribution to the development of the project. After McCaleb left Ripple, the SEC filed a lawsuit against the company in late 2020. However, even after the start of the lawsuit with the regulator, McCaleb calmly sold XRP to investors. Thus, in January 2021, he sold 28.6 million XRP for the amount of $8.78 million. Deaton noted that the meaning of his statements was not to attract the attention of the SEC to the former head of Ripple. He only wanted to highlight the inconsistency of the SEC's claims.

Recently Garlinghouse once againcriticized the department for its reluctance to clarify the operating rules for cryptocurrency companies. He believes that only the US Congress can influence the SEC's approach to regulating crypto assets.