The failure of the United States government to agree on incentives to offset the negative impact of the coronavirus,Indicates that the dollar is "funny money", profitably allocating bitcoin (BTC). This statement was made by Cameron Winklevocks.

In a tweet, the co-founder of Birzhi Gemini capactically assessed the lack of warming up in the provision of additional financial assistance in Washington.

«The US dollar has turned into so funnymoney that politicians are now “expanding trillions of dollars” in economic stimulus talks. Remember when a billion was a big number? If this isn't a wake-up call and support for Bitcoin, then I don't know what is.

The US dollar has become such funny money thatpoliticians are now «trillions of dollars apart» in stimulus negotiations. Remember when a billion was a big number? If this isn’t a wakeup call and an endorsement of #Bitcoin, I don’t know what is.https://t.co/PIcKp8rfOw

- Cameron Winklevoss (@winklevoss) August 6, 2020

On Friday, the adjustments between the movies and the publishers appeared "on the brink of a crunch", as the desired sums of incentives from both sides were numbered to

Now, the cameraman's brother, Tayler Winklevocks, brought up the news about the fact that the investment bank Goldman Sachs, traditionally not inclined to the drawing, rectified

«Now Goldman Sachs is involved in Bitcoin. What a wonderful report they published called “Don’t Buy Bitcoin” in May.

Independently from the agreement on stimulation, achieved by the government

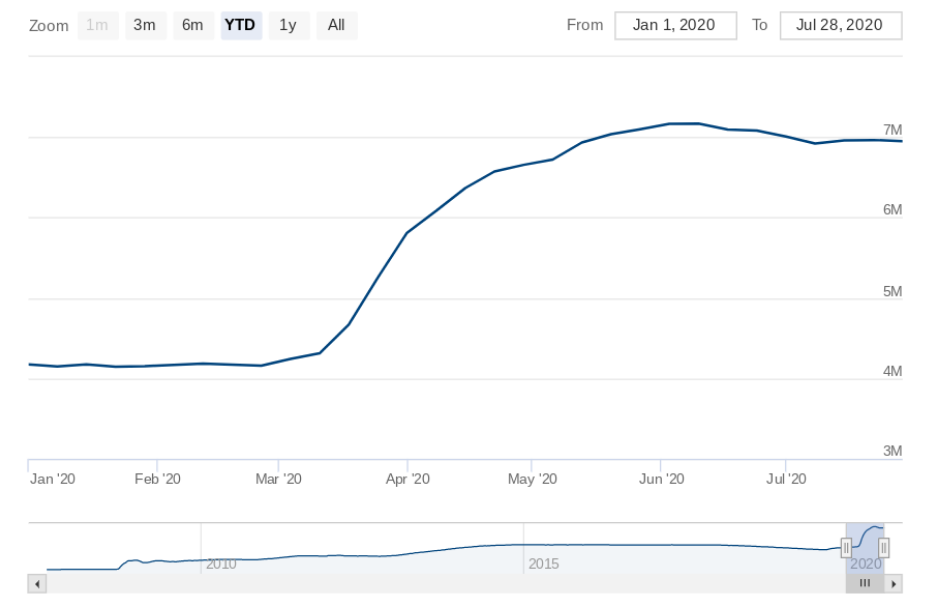

On August 7, the balance of the FPC was $ 6.94 trillion, while the gross national debt of the United States was $ 26.6 trillion, or $ 214,000 for the tax payer.

Now, outside the USA, the money-printing scale has become very alarming, for example, in the beginning of this week, the Turkish lira dropped to the bottom of the top

In other countries, the cumulative balance of the central banks of the G4 countries has grown just so that the growth of gold to the historical maximum in the US does not seem to be reasonable.

</p>«In fact, only one asset compensatedbalance growth G4. These are not bonds, not commodities, not loans, not precious metals, not miners. Only one asset was significantly better on almost any time horizon. Yes, Yes. This is Bitcoin, BTC,” said Paul Pal, founder and CEO of Global Macro Investor and Real Vision Group.