Article Reading Time:

2 minutes.

The founder of the Tron cryptocurrency project spoke about the risks that influenced the collapse of the Terra project and shared plans for the Tron USDD stablecoin.

In his publication, Justin Sun(Justin Sun) provided details about the decentralized stablecoin USDD, backed by TRX and the US dollar. Sun has quite ambitious plans for USDD - the businessman intends to make it a “new settlement currency.” To stimulate adoption and increase the supply of USDD, this stablecoin is more than backed by stable and volatile assets, says the founder of Tron. According to Sun, inorganic and unsustainable growth disrupts any ecosystem, while transparent overcollateralization is critical in preventing the stablecoin from being decoupled from the US dollar.

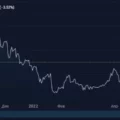

The head of Tron explained that in the collapseUST and LUNC courses were involved in the Anchor lending protocol. It attracted over $14 billion in UST deposits, which was a major reason for UST's explosive growth. However, it was precisely this unsustainable growth that brought the Terra project out of balance, which subsequently led to collapse. Additionally, the creation of the Luna Foundation Guard to diversify UST collateral and prevent it from being decoupled from the US dollar was an overdue decision. The reserve consisted of $3 billion worth of BTC, which was insufficient to support the nearly $19 billion UST supply.

Sun assured that USDD collateralwill be transparently displayed on the project's backup site. The Tron DAO Reserve fund has already allocated $550 million for this and plans to increase reserves as the supply of USDD grows. In addition, the fund will establish liquid USDD trading pairs with DeFi and CeFi tokens against USDD, which will be listed on centralized cryptocurrency exchanges and for which automated market makers (AMMs) will be used. In conclusion, Sun added that USDD currently operates on the Tron, BNB Chain and Ethereum blockchains, and this list will expand in the future.

According to data by Bloomberg,The algorithmic stablecoin market is growing much faster than conventional stablecoins because it is better “protected from the scrutiny” of regulators.