China is steadily moving forward in the implementation of blockchain technology in the work of the central bank,however, it is not the only country in the Asian region seeking to explore the prospects of digital assets.

The Central Bank of Japan is also actively exploring the legality and benefits of issuing state-controlled cryptocurrencies, according to a recent report from the Bank of Japan Financial Research Institute.

Legal basis for CBDC release

Bank of Japan Study (BOJ) LegislationThe country aims to study the legalization of the issuance of digital currency by the central bank (CBDC). The revitalization of BOJ cryptocurrency research is driven by China's ambitions in the coming months to introduce its own digital currency, DECP.

Bank of Japan Institute for Financial Studiesestablished the CBDC Implementation Legal Study Group in November 2018. His goal was to identify and study the main legal issues related to the launch of digital currency in Japan.

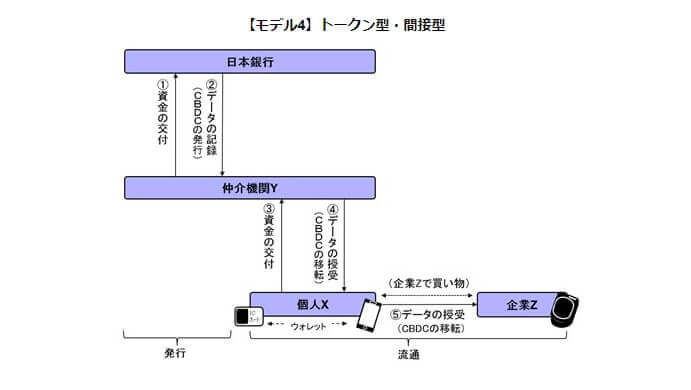

It is assumed that the CBDC of Japan will consist of two types of accounts - these are deposits that are held in regular banks with the support of the Bank of Japan and are available to individuals and companies.

Cryptocurrency CBDC presented in the report as"Electronic money" and its data will be transferred between digital wallets similar to fiat currencies. The central bank will use intermediaries to distribute CBDC tokens, and not provide them directly to users due to concerns about the destruction of the hierarchical structure of the financial system.

The BOJ report also notes that will be introducedrestrictions on the retail use of CBDC to prevent money laundering or terrorist financing. Transaction size limits are the most effective way to solve these problems. As with conventional banks, before any digital cryptocurrency becomes publicly available, it will be necessary to introduce KYC rules.

</p> 5

/

5

(

1

vote

)