AnalystWill Clementeanalyzes the current situation in the Bitcoin market, using on-chain metrics to separatesignal from noise.

</p>Dear readers, I hope you are doing well, andthe week was good. September is behind and has historically been bearish for bitcoin, and now we are heading into Q4. Let's dive into the interesting trends of the past week.

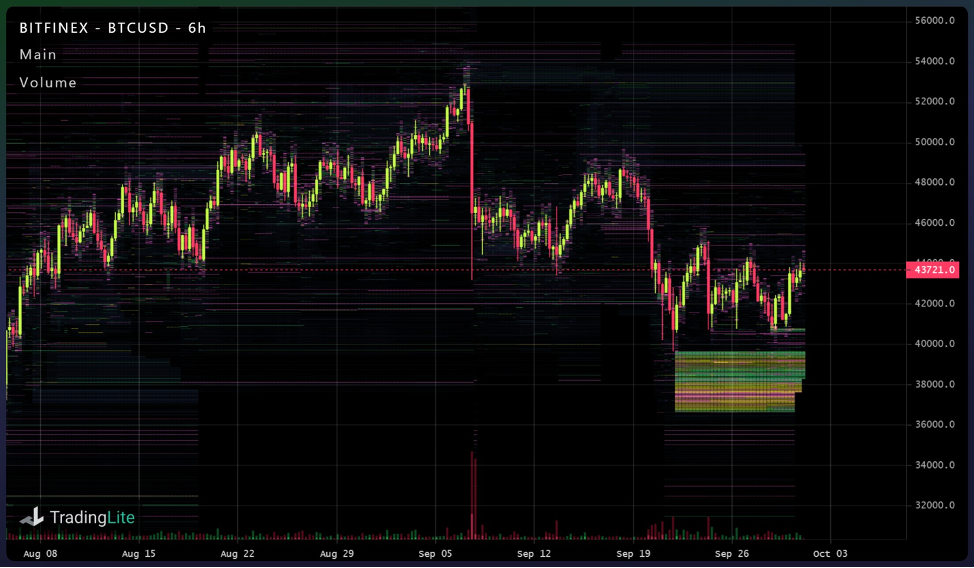

Let's start with the graph, which representsheat map of the order book on Bitfinex. There is a large number of bids in the $40K to $36K range, one of the largest buying walls seen since mid-2020. FYI, this also matches my on-chain model for the level, which is around $39K. This is important to keep in mind for several reasons. The bullish case for this case would be that some whale bulls have set a specific level. A bearish case, however, would have some nuances. Large bid or ask walls can be used to deceive other market participants into providing liquidity to the market participants who placed the wall.For example:the whales set up the buy wall, other market participants buy right above the (leading) wall, because who is going to sell into the giant bid wall? ... Right? Meanwhile, the whales are using this liquidity received above the bids to unload their positions. The same can be done and vice versa, with regard to selling walls, which in fact can be the psiops to create liquidity to enter long positions.

Not to mention, bids are psiops, as some of them did start filling up a few days ago. You just need to keep something in mind.

Bitfinex order log heatmap with bids shown in green, yellow, pink

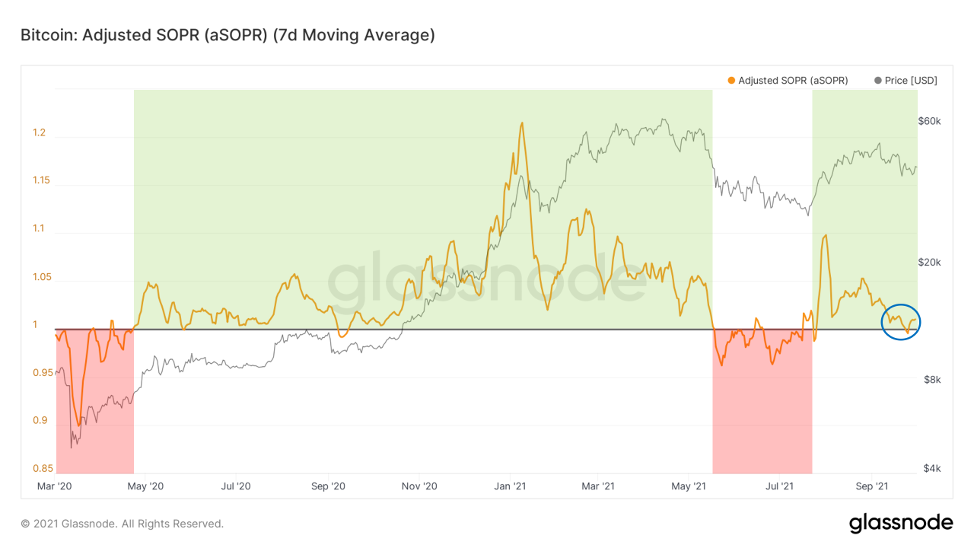

SOPR is the ratio of the profit that the coinsheld for each given trading period, using aSOPR adjusted for exits in less than an hour. This week I also added a 7-day moving average, in other words, making a weekly aSOPR. With this bounce off 1, you can now see how this happens.

Adjusted profitability ratio of spent outputs

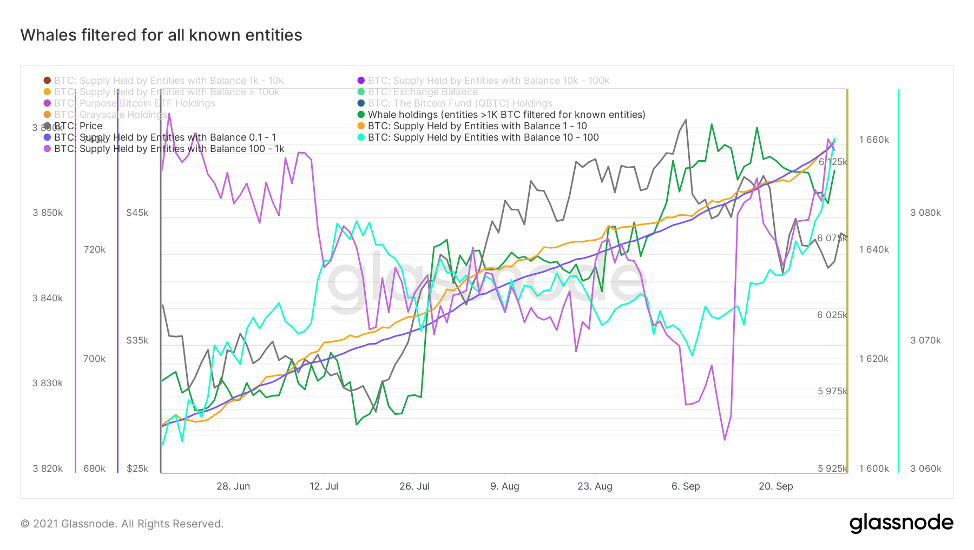

Next, consider the flows of our network subjects,comparing the behavior of different market participants, divided into cohorts depending on the size of their assets. Whales have been purchased since the end of July. Shrimp, crabs, fish and octopus are more difficult to acquire assets than ever. The only cohort that has shrunk is the 100-1 thousand cohort, which has also recently begun to increase its assets.

The volume of bitcoins held by whales (balance >1 thousand BTC). All clusters of addresses of known Glassnode exchanges, funds, over-the-counter brokers, etc. are filtered.

So where do these coins come from?And who has been doing sales for the past few weeks? The first answer is that the coins come from exchanges. The balance of exchanges is down 2,869 ($ 134 million) this week, down 62,251 BTC ($ 3.2 billion) for the month. At the same time, we have seen that BTC is constantly held by network actors with low-cost behavior, which means that they are statistically unlikely to sell BTC they accept.

Note: This chart was created a couple of days ago, so the price here is not fully updated.

Supply Shock Ratio for highly liquid (red line), illiquid (blue) and stock (purple) supply

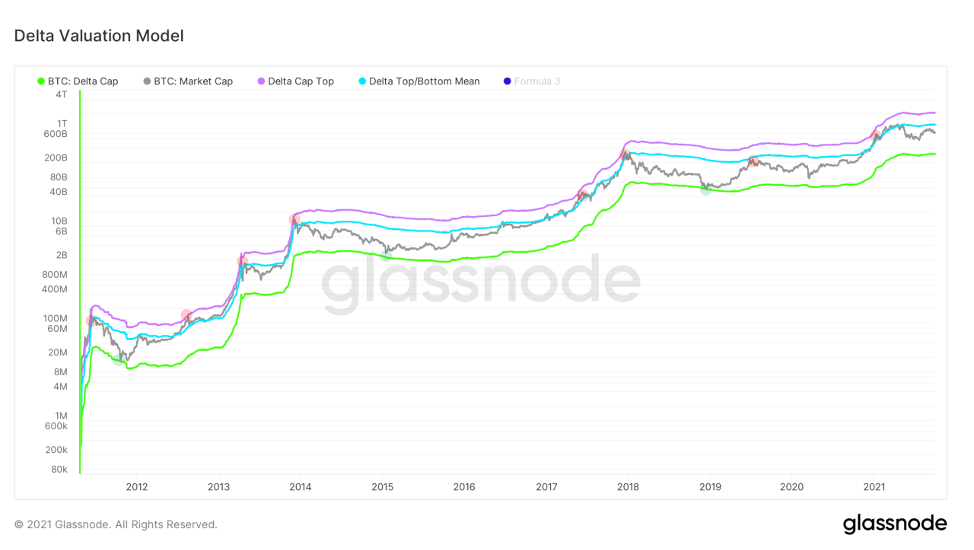

I try to add my own to these letters.own creations to give unique information. You saw my illiquid supply shock ratio, which is now used by other analysts like Willie Wu, my illiquid supply level model, and now something else. And that's something - it's a Delta Valuation Model. Delta cap (conceptualized by David Puell) takes into account the difference between average cap (moving average over the entire BTC period) and realized cap (the average price that investors paid for their coins, essentially on-chain VWAP). This is pretty good for the macro lows, but when the high is updated many times, it is captured just as well. Taking the average value between the minimum and maximum capitalizations, you will get the average blue line. This was an important level for Bitcoin price interaction, serving as resistance to the 2019 mini bull market.

Delta valuation model (purple line - high delta capitalization, green line - delta capitalization, blue line - delta high / low value, gray line - bitcoin price)

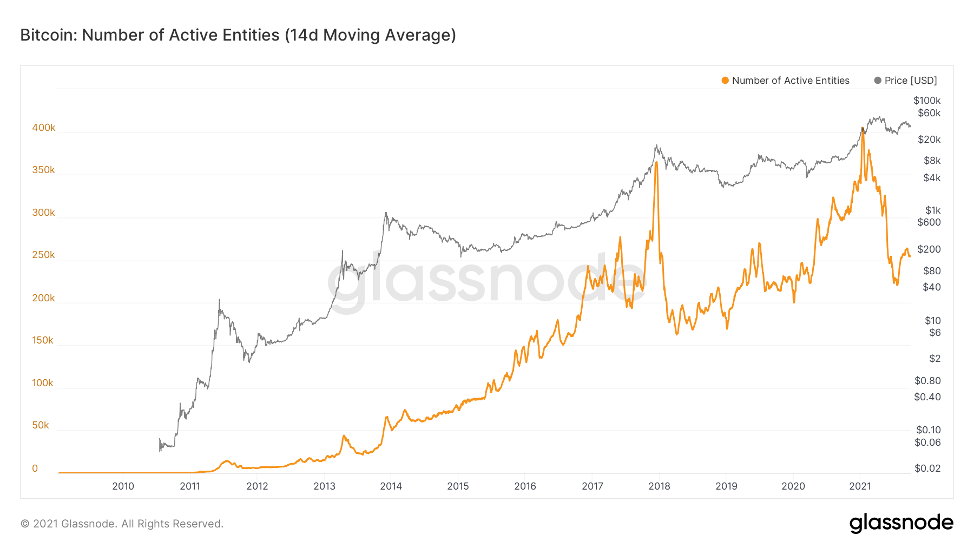

The main potential bearish case withon-chain perspective is related to transactional activity on the network. Things like the number of transactions, mempool, total volume and active network actors are all at a minimum. This can be viewed as bearish because there is low demand for network usage. However, to counter this argument, one could say that speculative market participants are gone (which is also reflected by Google search trends), bundling done by exchanges, or transactions starting to migrate to the Lightning network.

Number of active network entities (14-day moving average)

Lightning Network Bandwidth and Mediumthe channel size becomes parabolic as the number of channels and the number of nodes continue to grow. We are very optimistic about the lightning network as it is imperative for Bitcoin to inevitably move to a medium of exchange.

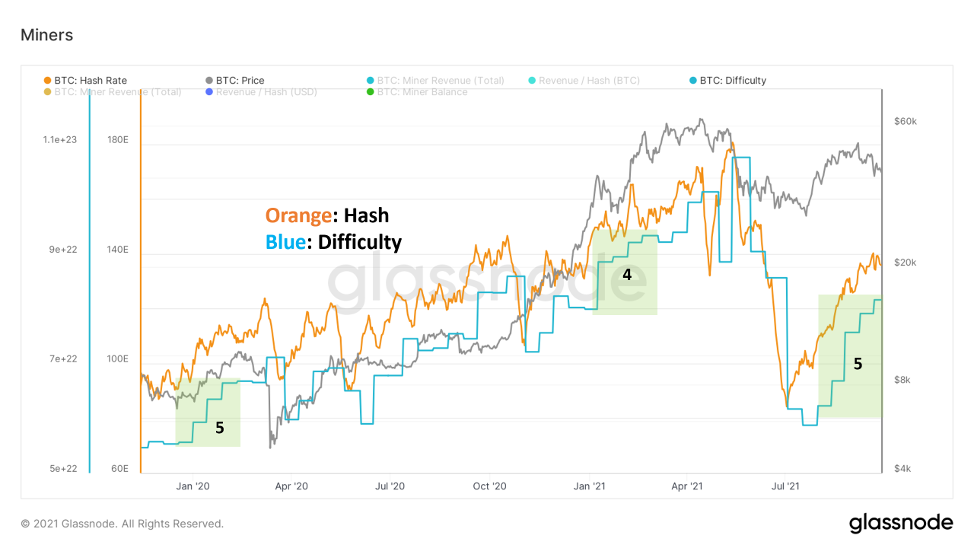

Finally, let's take a look at what's going on withminers. Orange is the hashrate, blue is the difficulty. Difficulty adjustment was one of Satoshi's greatest accomplishments, as it allows the release to be controlled in accordance with the amount of energy that secures the network. When the hash goes back to the network, we see positive adjustments to the difficulty, when the hash goes out of the network, we see negative adjustments to the difficulty. BTC recently had 5 positive difficulty adjustments in a row, for the first time since February 2020. This shows how quickly the hash rate continues to return to the network after the migration of Chinese miners.

Miners

That's all for today. Great weekend to everyone.

BitNews disclaims responsibility forany investment recommendations that may be contained in this article. All opinions expressed express exclusively the personal opinions of the author and respondents. Any actions related to investment and trading in crypto markets involve the risk of losing invested funds. Based on the data provided, you make investment decisions carefully, responsibly and at your own risk.

�

</p>