Is Bitcoin's energy consumption an environmental issue? How valid are the comparisons?Bitcoin energy consumption with countries andpayment systems? Does Bitcoin Mining Conflict with 100% Renewable Energy Initiatives? Is an environmentally conscious investment possible in Bitcoin mining? To these questions in yourreportCoindesk analysts answer. We present to you its translation.

Bitcoin price driven by retail demandexperienced explosive growth at the end of 2017, peaking at $ 20K in December and then rapidly falling to ~ $ 6K in February 2018. Professional investors then took notice, but little considered Bitcoin to be a viable capital multiplication tool compatible with proper risk control ... Three February later, Bitcoin's market cap surpassed $ 1 trillion and financial institutions are now taking cryptocurrency seriously. Bitcoin is no longer considered unsuitable for institutional investment.

Although the advantages of Bitcoin in terms ofWhile institutional investment may coincide with the benefits for retail investors, institutional capital still faces fundamentally different types of pressures. These are pressure from investors with certain expectations about the profitability of their investments, political pressure from regulators and reputational pressure from the public. A common cause for concern that unites all of these stakeholder groups is Bitcoin's undeniable relationship with energy consumption and its impact on the environment.

Despite some skepticism slowing downthe growth of investments in the so-called environmental, social and corporate governance (ESG, from Environmental, Social, and Corporate Governance), more and more institutions recognize their importance and introduce appropriate internal mandates. Blackrock and JP Morgan (PDF), for example, have released their commitments to ESG. There is a widespread interest among young investors that their money, among other things, benefits society and the environment, and this largely determines where they will channel funds as their capital grows.

As the price of bitcoin continues to rise,discussions about ESG in its context are becoming more visible. With increasing public attention to Bitcoin, criticism of its environmental impact will also grow, given that the rise in the price of BTC is associated with increased consumption of electricity, as well as well-documented links with Chinese miners using coal-fired electricity.

Decentralized nature and the principle of opennessBitcoin could potentially make it attractive from an ESG perspective. However, concerns about its environmental impact can become a barrier for institutional investors to be accountable to clients, boards of directors and internal company mandates. With this report, we want to contribute to solving these problems, and also show that Bitcoin does not pollute the environment as badly as its critics claim, and that it has the potential to significantly accelerate progress in energy development and the transition to renewable sources.

Power Consumption and Bitcoin Mining

As Bitcoin attracts moreof mainstream attention, respected investors, opinion leaders, media and cryptocurrency critics are increasingly sounding the alarm about Bitcoin's power consumption. And it's true: Bitcoin is an energy-intensive network. Miners - individuals, groups and businesses - use specialized hardware to mine Bitcoin. Miners process transactions by grouping them into blocks, and then compete to find the value of a random variable that meets the predefined protocol requirements. Finding this value allows you to add a block of transactions to the blockchain, and the process of finding it involves the consumption of a significant amount of electricity. Miners are rewarded for the computational work expended in successfully processing blocks, mainly through the issuance of new bitcoins. If the cost of the BTC they receive exceeds the cost of the consumed electricity, mining is profitable.

Bitcoin consumes large amountselectricity, but is it necessary? Bitcoin was created to transfer value between two parties without the need for a third trusted party to participate in the process, decentralizing trust in the payment network. To achieve trust, all network participants must reach a consensus on “who owns what,” with adequate security to maintain the integrity of the network. Bitcoin's energy-intensive consensus protocol is the tool through which the network achieves consensus and data integrity.

If such a consensus were easily achievable, then the network could be easily attacked. Mining is an extremely energy intensive process, which makes the cost of attacking the Bitcoin network prohibitive.

As Bitcoin Reaches Consensusregarding the state of the network due to energy-intensive computational "work", this algorithm is called proof-of-work. The power consumption of the proof-of-work blockchain is relatively transparent; there is only one step between the input of energy and the output of bitcoins. Thus, Bitcoin's energy footprint is completely reduced to energy consumption during the mining process. This makes criticizing Bitcoin's energy consumption easier compared to other industries that are energy-intensive to varying degrees.

Mostly in the early days of Bitcoinused relatively little electricity. In 2015, Bitcoin's share was only 0.02% of global energy consumption and reached 0.16% by 2018, according to the Cambridge Center for Alternative Finance (CCAF) estimates. Compared to worldwide, Bitcoin's power consumption was on a scale of error. With the subsequent simultaneous rise in the price of BTC and the Bitcoin network, news sources, supporters and critics of the cryptocurrency correctly determined that now Bitcoin began to consume significantly more energy - now its share has grown to ~ 0.58% of the world's total energy consumption. If Bitcoin were a country, then, as of April 18, 2021, it would rank 29th in terms of energy consumption between Ukraine and Argentina. When something starts to consume the same amount of electricity as governments consume, it undoubtedly attracts attention. It should be so.

As an argument we could considerBitcoin as a simple economy that imports energy and exports transfer, security and issuance of units of account capital. Taking this analogy further, Bitcoin Nation has a population of approximately 1 million people (miners), successfully transfers $3-4 trillion (in transactions) annually, securely digitally stores $1 trillion in capital (Bitcoin market cap), and issues $20 billion in new value (in block rewards) per year to facilitate transactions for 100 million unique users. Seen from this perspective, the prosperity of 1 million people would certainly not be so easily labeled as a waste of electricity.

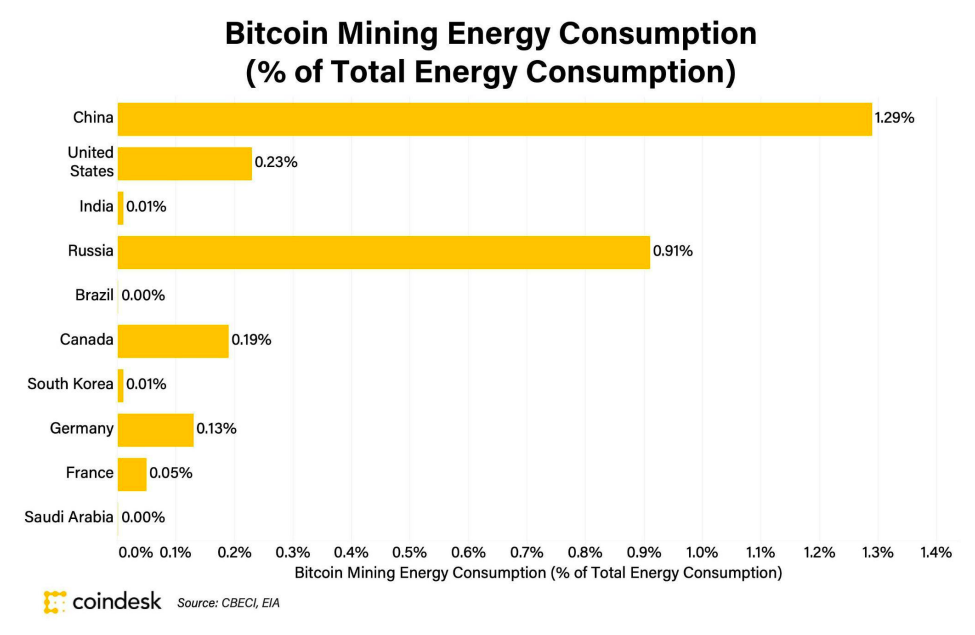

Of course, Bitcoin is not a country.Comparison of its energy consumption with the states gives practically nothing meaningfully, except perhaps a starting point in relation to the amount of energy used. If we consider only the countries from the top ten in terms of the amount of electricity consumed, in which there are mining enterprises, then the share of Bitcoin in them accounts for no more than 1.29% of the total energy consumption of the country. And if we compare with the United States, then, for example, game consoles (PDF) consume ~ 0.25%, and construction (~ 2.2%), industrial cooling (~ 2.7%), commercial ventilation (~ 2 , 9%) and commercial lighting (~ 3.0%) account for 2-3% of the total energy consumption for each item.

And while it may seem like an attemptmislead the reader, these statistics provide important context. The authors of the charts visualizing the energy consumption of Bitcoin as a single country overlook the fact that the energy consumption for Bitcoin mining is distributed among many countries as a subset of the total energy consumption of each of these countries. And this circumstance practically makes any comparison between the energy consumption of Bitcoin and different countries meaningless. Countries spend energy on many different things. Many of them really matter a lot. Many are much less important. But what states do not spend energy directly on is a global, open and trustless settlement network and digital capital preservation facility.

Fig. 1. Energy intensity of bitcoin mining in% of the total energy consumption of the country

Energy production and clean, green, renewable Bitcoin

While Bitcoin's power consumption is definitelyis in the spotlight, keep in mind that the goals of environmentally conscious investment practices and corporate policies are not simply about energy consumption. Attempts to control what people have the right to spend energy on would develop into a complex ideological battle, filled with subjectivity from all sides. So instead, environmentally conscious investments are aimed at increasing industrial use and production of "clean" renewable energy. The goal of ambitious environmental projects and political declarations - most notably the Paris Agreement - is to reduce or completely neutralize greenhouse gas emissions, namely carbon, given their harmful effects on the environment. The use of coal and fossil fuels for energy production has become a source of greenhouse gas emissions, as a result of which a trend has been set to switch to the production of renewable energy, since renewable sources of greenhouse gases do not emit greenhouse gases. The environmental commitments of some of the world's largest companies reflect this reality. Their goals are to ultimately become “carbon neutral” and therefore the green investment thesis around Bitcoin should also be based on relative carbon emissions.

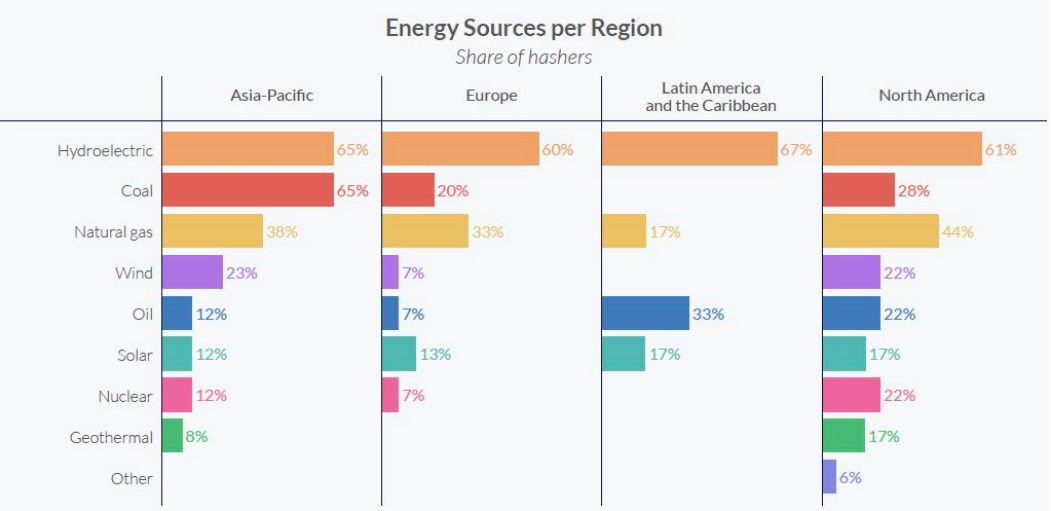

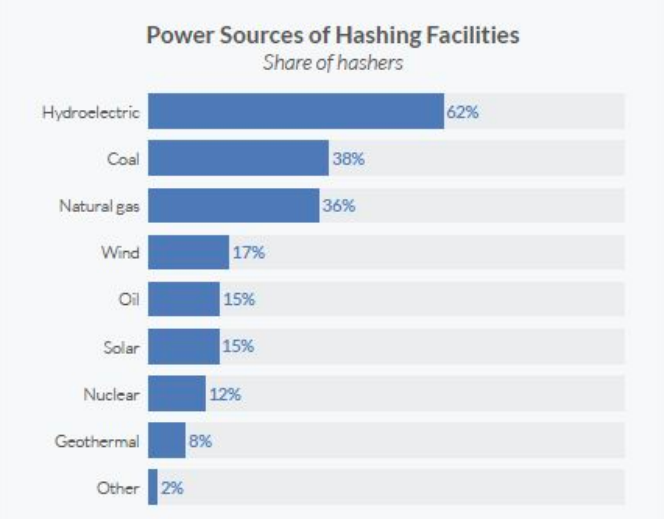

While bitcoin mining usesa significant amount of electricity, a good percentage of it comes from renewable sources. According to a 2020 study by CCAF, 39% of total energy for Bitcoin mining in 2019 came from renewable sources (up from 28% in 2018), with 76% of miners using renewable sources as part of their energy mix. This upward trend in use and the significant penetration of renewables should be encouraging. and electricity used by miners (according to their reports) are shown in the diagram below.

Rice. 2. and energy by region. : CCAF,3rd Global Crypto Asset Benchmarking Study

Despite this encouraging trend, there are a number of factors that investors need to consider.

The first is the type of renewable usedenergy. Hydroelectricity is by far the most common renewable energy source for Bitcoin miners. While hydropower is a renewable source that does not pollute water or air, it is sometimes described as the least desirable form of renewable energy given the damage that can be caused to local ecology by improper management and the potential release of methane from dammed reservoirs, a more potent greenhouse gas than carbon. It is important that dependence on any of the renewable energy sources does not become excessive. There is no perfect source of energy. Wind power is cost effective but prone to interruptions and wind turbines can wreak havoc on local wildlife. Solar power, while a huge source of potential energy, has been associated with possible pollution from photovoltaic cells that convert sunlight into electricity, interruptions, conversion inefficiencies, and the disadvantages of modern storage technologies.

Fig. 3. and energy for mining enterprises. : CCAF

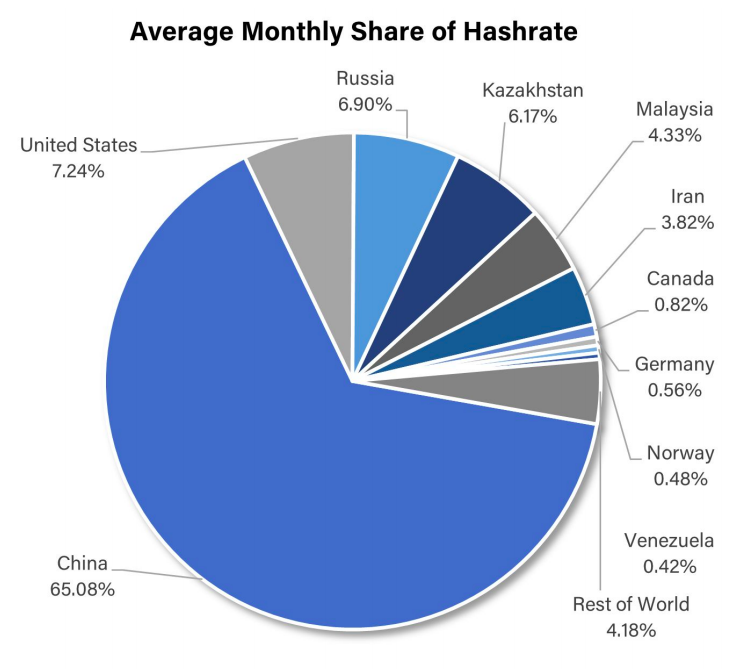

The second factor to consider isgeography. The CCAF estimates that 65% of Bitcoin's hashrate comes from China, which has historically been heavily biased towards coal.

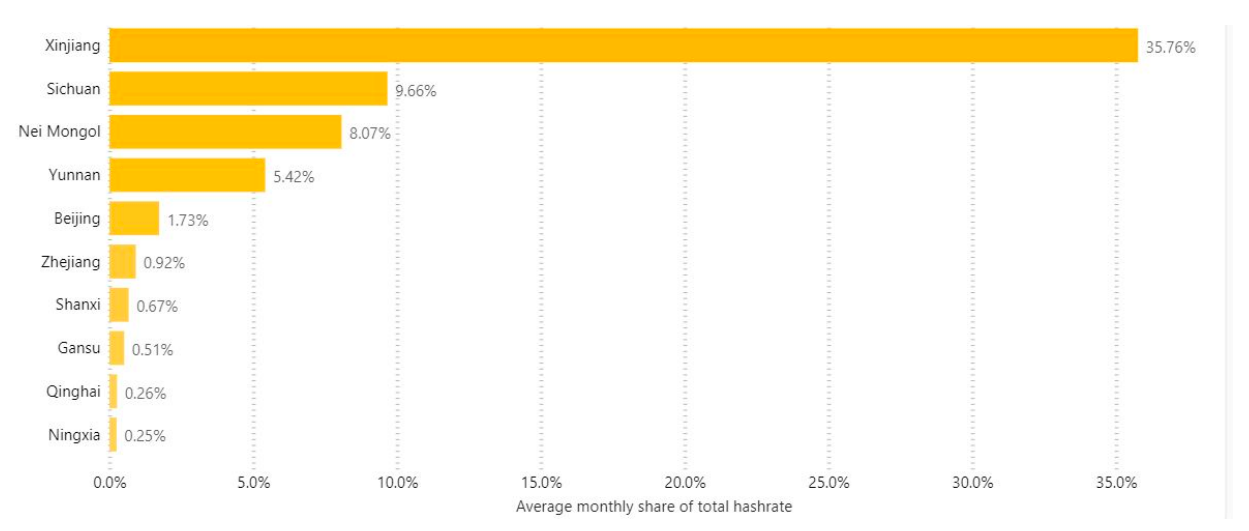

To understand the potential consequences of this,we need to take a closer look at the breakdown of Chinese miners by region (see Fig. 5). 15% of mining occurs in the provinces of Sichuan, Yunnan and Qinghai, where the bulk of the energy balance is made up of renewable sources (Sichuan >85%, Yunnan >90%, Qinghai >80%).

However, a significant part of the hash rate ismining in Xinjiang and Inner Mongolia, historically dominated by cheaper and more abundant coal-fired electricity. In recent years, with all the human rights controversy (even with regard to renewable energy), Xinjiang has made significant strides in renewable energy production. In Inner Mongolia, Bitcoin mining has been stopped. When mining enterprises move to other regions, miners will either move to regions with excess hydropower capacity (given the excess growth of hydropower in China), or to areas where coal-fired power is mainly used (risking again being subject to a local ban).

Rice. 4. Average monthly hashrate share (:https://cbeci.org/mining_map)

Rice. 5. Average share (%) of regions in the total hashrate of China. :https://cbeci.org/mining_map... Note: Location data can be corrupted using VPN.

On the path to energy independence Chinarealized the need to increase hydropower capacity, since its coal reserves were insufficient to produce the required amount of energy. The construction of hydroelectric dams is also an effective means of providing electricity to poor, off-grid rural areas. China has increased its hydroelectricity production at an impressive rate, to the point where it now worries about excess power in some locations. In fact, China's provinces are reported to be running behind significant amounts of potential hydroelectric power, especially during the rainy season. About 30 TWh remains unused in Yunnan and Sichuan—the hydropower generation capacity there is more than double the capacity of the local power grid. This creates the conditions for Bitcoin miners to come in and consume this wasted electricity.

China, as part of its five-year plan for2016-2020 pledged to become a global leader in renewable energy development and plans to limit the use of coal to less than 58% of total energy consumption. In comparison, the United States' dependence on coal electricity accounts for ~ 19% of the country's total energy consumption. It remains to be seen whether China will succeed in meeting this target, but it is the world's largest investor in renewable energy (PDF) and has consistently provided the majority of annual renewable energy growth since 2019. In the last five-year plan for 2021–2025. China has cemented this commitment by aiming to reduce carbon intensity by 18%, and President Xi Jinping has pledged to achieve carbon neutrality by 2060.

Although China's dominance of Bitcoin mininghas been steadily declining since Q4 2019, it still accounts for two-thirds of the total hash rate, so other countries will need significant investment in mining hardware to gain market share.

Such investments became known recentlytime, with the emergence of new mining enterprises in North America or announcements of planned mining expansion with a focus on this region. In practice, Bitcoin miners usually join mining pools to smooth out fluctuations in profitability. Pools allow multiple miners to contribute to finding a block, and the reward is distributed among them according to their share of the total computing power. North American miners have historically used Chinese pools, but with the advent of new mining pools in North America, this situation is changing.

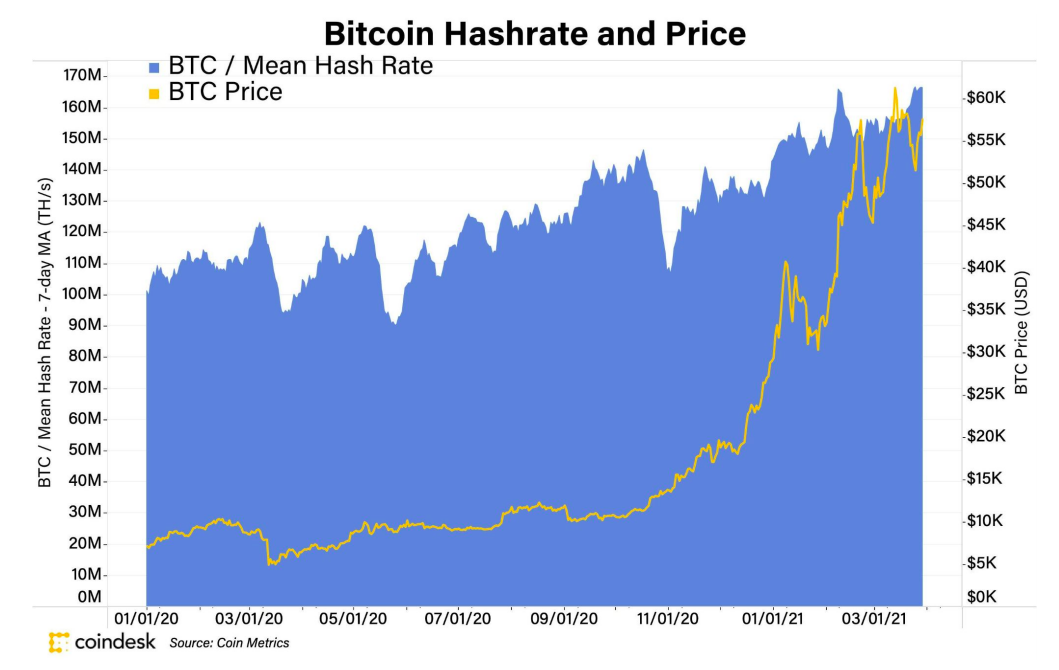

Fig. 6. Bitcoin hashrate and price

North America has also historically depended onnon-renewable energy sources, with 62% of the share of fossil fuels in the total production. In this regard, North America has been committed to cleaner energy since 2010, and in 2016, the United States, Canada and Mexico announced an action plan for the North American Climate, Clean Energy and Environment Partnership, pledging to achieve 50% clean energy production. energy by 2025.

In the United States, the election of President JoeBiden has aligned the country's climate targets with President Obama's goal of achieving zero greenhouse gas emissions by 2050. Biden also brought the United States back to the Paris Agreement following President Trump's rather unpopular decision to withdraw from it in 2019. The ambitious political commitment of the US presidential administration on climate augurs well for efforts to develop sustainable renewable energy around the world, given the size of the United States, both economically and in terms of energy consumption. In terms of sustainable development of renewable energy and environmental protection, participants in the mining industry often make commitments to use clean energy.

For example, Argo Blockchain and DMG BlockchainSolutions launched a pure energy mining pool. Gryphon Digital Mining recently raised $ 14 million to open renewable energy Bitcoin mining ventures in the United States.

Broader initiatives includeCrypto Climate Accord, founded by three non-profit organizations (Energy Web, Rocky Mountain Institute, and the Regulatory Innovation Alliance) with more than 25 supporters from business and non-governmental organizations, including some bitcoin miners.

Crypto Climate Accord is an initiative of a privatesector aimed at decarbonizing the cryptocurrency industry. Its goal is to transfer all mining to fully renewable energy sources. The agreement itself does not have the force of law, but its participants plan to interact with key politicians to stimulate decarbonization of mining, and have charted a path for other market participants to join the agreement.

The goals of the agreement are, of course, very high, butthe fact of its adoption clearly indicates that the industry is aware of its impact on the environment. Given the partnerships with the bitcoin miners themselves, it is clear that no one overlooks that mining should continue to move towards more sustainable energy production practices.

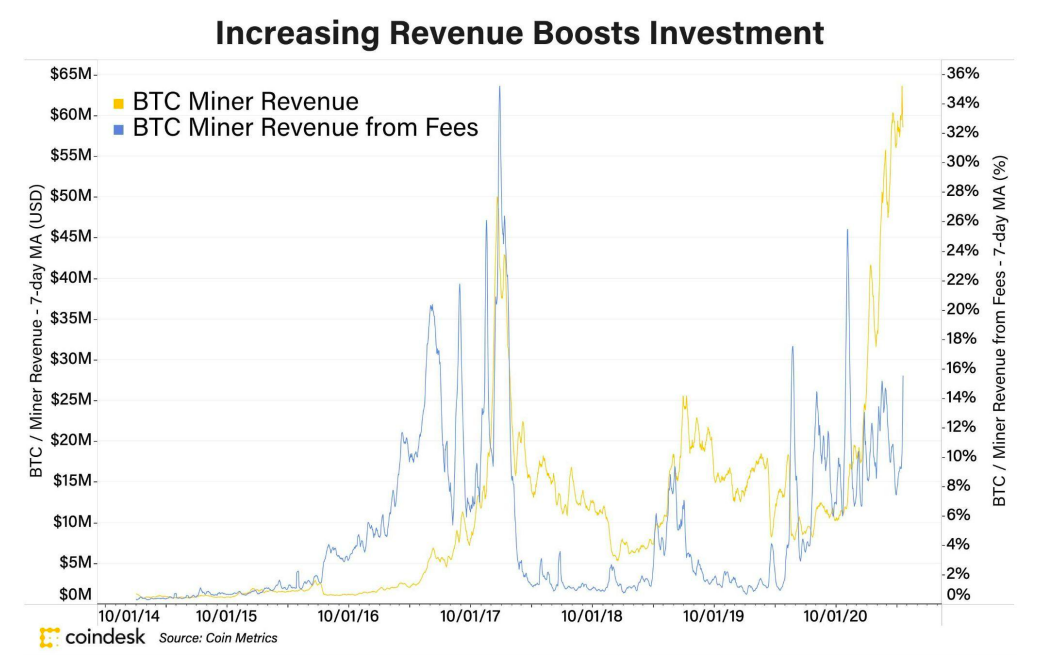

In terms of investment, in March 2021mining revenues hit an all-time high thanks to rising transaction fees and BTC prices. Increasing profitability can have several consequences. The first is an increase in external investment in the industry, which in turn should drive improvements in all aspects of Bitcoin mining. Secondly, increasing the profitability of mining means that miners have additional cash reserves that can be used to increase production space or expand opportunities for using clean energy.

From the point of view of politicians, those who define them,will also be able to act accordingly to make the energy balance cleaner. For example, a Bitcoin mining facility in Missoula, Montana was closed by a magistrate court order because the miners were unable to satisfy a request to use 100% renewable energy. Implementing strong and comprehensive policies in collaboration with industry players will inevitably lead to cleaner Bitcoin mining.

Fig. 7. Increased profitability stimulates investment

Bitcoin mining mobility and Bitcoin as a battery

Another important characteristic of mining is that in order to organize a successful mining enterprise, miners only need access to electricity and the Internet. Bitcoin mining is mobile.

For example, a miner can mine bitcoins ina remote area with access to relatively cheap renewable energy that cannot be transported for use elsewhere. In this case, the miner uses an isolated and poorly demanded energy source. This could have an economic impact on communities located near such sources, which, through mining, are able to monetize their proximity to cheap energy sources.

With this in mind, industry professionals sometimes use a cognitive model that refers to Bitcoin as a battery.

At first glance, such a statement mayappear false and misleading. Bitcoin is incapable of physically storing energy. However, miners can take unused energy and convert it to Bitcoin.

Bitcoin retains value.That is, in this case, Bitcoin acts as a battery in relation to capital, converting energy into capital and storing it. Bitcoin does not make energy available for transmission, it provides the ability to transfer its value equivalent.

The concept of "Bitcoin as a battery" can be developed a little further. To set the stage, we need to acknowledge two things.

First, Bitcoin mining is a business withfree entrance. Any innovation in mining that can make a miner more efficient than others will be short-lived. The profitability of a Bitcoin miner depends on the whims of adjusting the difficulty and price volatility of the asset. Thus, the best way to remain consistently profitable is to control what you can control.

In this case, these factors includeenergy costs and operating costs. As a result, the profitability of Bitcoin mining is relatively limited. As the price of BTC rises, the number of miners willing to enter this market increases. As the number of miners increases, more energy is consumed and the Bitcoin protocol is being adjusted, making mining more energy intensive. If the price of BTC does not rise enough to compensate for this, then some of the previously profitable miners will be forced to stop working due to rising costs. When the market moves in the opposite direction, the opposite happens.

Secondly, Bitcoin mining is ongoing.Due to technological limitations and a lack of accurate understanding of energy demand, energy companies are forced to estimate how much energy they need to generate for their customers. Therefore, there are periods when more energy is produced than necessary and supply exceeds demand. To compensate for this, companies change the price of electricity at different times. Since bitcoin miners have limited profitability, they are good candidates for using surplus energy.

That is, bitcoin miners can act as their ownkind of load balancers, using relatively cheap surplus energy to mine Bitcoin when supply and demand imbalance occurs, and through that subsidizing electricity for any further use. Then again, if you take the "Bitcoin as batteries" metaphor literally, it will again be a bad battery. Bitcoin does not store units of energy for later use of the same units of energy. Rather, it saves the cost of a unit of energy for later use.

Thus, developing this analogy, Bitcoin can be called a “load balancing value battery” (PDF).

In the United States, in particular, there isan urgent need for investments in the transmission and distribution network. As regulated utilities, energy companies are usually limited in both the means of generating income and the price they can charge consumers for energy. If energy companies create a new revenue stream for themselves through Bitcoin mining, then they will have more free capital to invest in network and infrastructure development. Along with the development and proliferation of Bitcoin mining, so too is the demand for surplus energy and affordable investment in power grids.

Greenidae Generation company in Dresden, stateNew York City is an example of a powerhouse that has taken advantage of this by using Bitcoin mining as an additional revenue stream. In 2017, Greenidge switched from coal power to natural gas. It launched 7,000 mining machines in 2019 and used its power generation capabilities to mine Bitcoin from its surplus. At that time, 1 BTC was worth about $5 thousand. By today, the company is positioned more like a Bitcoin miner with its own power plant and even merged with a public company in March 2021.

Another advantage in terms ofThe mobility of bitcoin mining is the ability to mine natural gas - mainly methane - released in oil fields. Part of the oil production process produces natural gas emissions that must be removed in some way. Transporting such natural gas somewhere for use is usually not economically feasible. As a result, historically, this gas was burned or, even more harmful to the environment, released directly into the atmosphere.

One of the priorities of ESG policies islimiting natural gas emissions from oil fields. When natural gas is burned, the methane it contains is broken down into carbon. Unfortunately, flaring can be ineffective at breaking down methane, and as we said earlier, methane is more polluting than carbon.

Companies such as Crusoe Energy Systems, EZBlockchain, Great American Mining, and Upstream Data are leveraging the oversaturated natural gas market, the mobility of Bitcoin mining and the drive to minimize pollution by installing modular generator sets in oil fields and efficiently converting natural gas that would otherwise be burned into electricity for mining. just thrown into the atmosphere. This strategy increases the profitability of energy producers and reduces the negative impact on the environment.

Finally, a side effect of it allenergy consumption, which we have not yet mentioned in this report, is the amount of heat generated by mining enterprises. The emergence of Bitcoin mining enterprises in Iceland, Russia and other countries with cold climates is largely due to the desire to reduce the cost of cooling mining equipment. It is now technically possible - and perhaps quite practical - to reduce heating costs in cold climates by using the heat generated by Bitcoin mining. There is even information about the use of the generated heat by miners to heat greenhouses and chicken coops. Examples of these innovations can be used to try to predict future symbiotic options for Bitcoin mining.

A modular generator that converts natural gas into energy for mining. Photo: Upstream Data Inc.

Payment Systems and Bitcoin - Considering a Potential Alternative

At the beginning of the article, we explained why comparing Bitcoin to countries is not particularly useful.

Comparisons are similarly incorrect.Bitcoin with centralized payment systems. The argument of those making it is that payment systems like Visa use far less energy than Bitcoin while processing many more transactions. Visa uses a tiny fraction (~0.25 TWh [PDF]) of Bitcoin's energy consumption (~125 TWh), processes an average of 150 million transactions daily, and is capable of processing over 24K transactions per second, according to compared to ~300-400k Bitcoin transactions. As with the cross-country comparison, the comparison between Bitcoin and payment systems is incomplete due to two important factors: Visa's actual power consumption and Bitcoin's ability to scale in terms of the number of transactions it processes.

First, the Visa payment infrastructuresupported by far more resources than the company's technology stack itself. How much energy Visa uses to conduct transactions is difficult to determine precisely because it handles transactions in different countries' national currencies. Visa depends, among other things, on the success of many separate systems. Visa's "token" is not native to its network. Apart from the arguments about using the US dollar as a foreign policy weapon circulating on social media, the point is, of course, that at the heart of the Visa system lies much more than just the company's technology stack. Taking into account the relevant institutions and entire industries, the true energy consumption of Visa should include at least a fraction of the energy intensity of the issuance of national currencies and banking systems. What makes Bitcoin different is that the Bitcoin payment network transfers its own native tokens for settlement of transactions, the finality of which is ensured by the same rules and protocol. Bitcoin is more than just a payment network. Bitcoin is also the currency itself that is transferred in transactions.

Second, one transaction on the Bitcoin blockchain is not equal to one payment. As Nick Carter wrote in an article,

“Bitcoin offers fast and reliablefinalization of the calculation. This means that transaction participants can have confidence in the finality of the transfer of funds within a short period of time. This allows Bitcoin to scale to enormous proportions: billion-dollar transactions are quite common and are settled without incident… Thus, Bitcoin is best thought of as a highly secure, base-level settlement network similar to Fedwire.”

The Finality of Bitcoin's Settlement Mechanismis the first, “baseline” layer upon which a thriving decentralized financial ecosystem can be built. A detailed discussion of sidechains, layer-2 protocols, and off-chain transactions is beyond the scope of this report, but it is important to understand that behind a single Bitcoin transaction there can be hundreds, thousands, or even millions of related transactions. Simply counting transactions in a block of the main blockchain cannot provide a complete picture. Bitcoin is a simple money transfer system where $10 billion can be transferred as easily as $100 billion, and the mechanics and system remain the same regardless of the size of the transaction.

Conclusion

In this report, we have outlined the main environmentalConsiderations for investing in Bitcoin. The discussion on the decarbonization of Bitcoin needs to continue. At first glance, Bitcoin looks like a potential stumbling block to a cleaner, more renewable energy transition simply because of its energy intensity. However, the suggestion that Bitcoin is clearly bad or good for the environment seems misplaced.

Our main task was toemphasize that investing in Bitcoin and ESG are not direct opposites. An investment in Bitcoin, under a certain approach, can be considered an investment in an ESG, given its potential impact on consumption and energy production patterns. Bitcoin already uses a large number of renewable energy sources and most miners have access to them. As political and environmental pressures mount, miners may move towards using even more renewable energy sources. Plus, as innovative methods of powering Bitcoin mining become popular, energy companies will be able to profit from monetizing excess energy that would otherwise be wasted. Bitcoin is helping to improve several aspects of clean energy capabilities. In this regard, Bitcoin gives ESG proponents reason to be optimistic.

�

</p>