Last year, JPMorgan noted in a note to investors the high likelihood of Bitcoin being replaced.gold as insurance against inflation.For at least one of the developing countries, this forecast came true: in two weeks the Turkish lira lost over 30% of its value, and inflation again reached 20%.

In response to rising inflation, central banks typicallyraise the key rate to reduce the rate of turnover of funds and the number of loans. Loans are becoming expensive, preference is given to deposits, the “temperature” in the economy is dropping and prices are dropping. This path is not without its drawbacks, but it avoids hyperinflation, which is detrimental to any economy.

Turkish President has his own visionfinancial policy, which runs counter to classical economic theory. Since 2019, Erdogan has changed the head of the Central Bank three times, as he wanted to keep the key rate at low levels. Coupled with large waste of the state apparatus, a military campaign in Syria and a growing national debt, this led to an increase in inflation to 19.9% in October. At the same time, the Central Bank in mid-October reduced the interest rate from 18% to 16%.

Inflation in Turkey,%

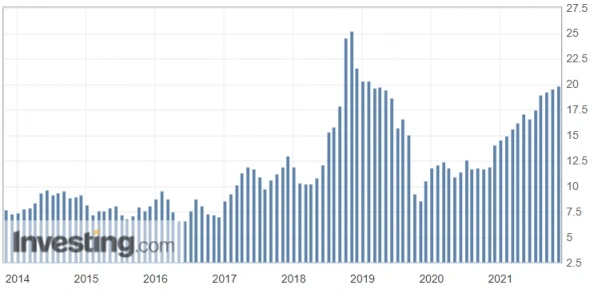

Since 2020, the Turkish lira against the dollarThe United States has fallen in price by more than half. In search of insurance against devaluation, the Turks began to massively buy Bitcoin, and the number of registrations on cryptocurrency exchanges from this region tripled by the end of 2020. In March 2021, the volume of cryptocurrency trading in the country reached $ 27 billion, which is 30 times more than the same period last year. Then Erdogan declared a fight against cryptocurrencies and in April banned their use as a means of payment. Some of the Turkish crypto exchanges closed, but this did not stop the public's interest in Bitcoin.

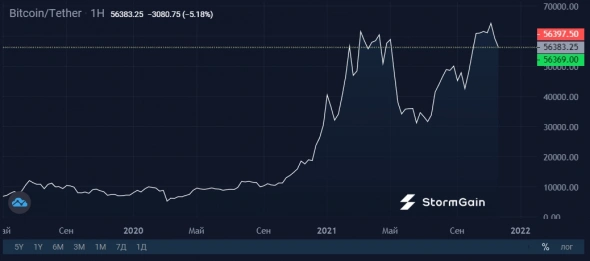

Image Source: Cryptocurrency ExchangeStormGain

According to the local crypto platform BtcTurk, onlyover the past day, the turnover for the BTC / TRY pair has exceeded $ 55 million and continues to grow. According to the head of MicroStrategy Michael Saylor, Bitcoin is the last hope for Turkey, and the country should follow the example of El Salvador.

Image source: twitter.com/saylor

Bitcoin has a fundamental difference fromnational currencies - a deflationary mechanism. When individual states and rulers can print more money to fund political ambitions, the rate at which new Bitcoins appear has been steadily declining from year to year. In addition, every four years, the miners' reward for the mined block is reduced, and the total number of coins is limited to 21 million.Since January 2020, the money supply (M2) of the Turkish lira has increased by 56%, and the amount of Bitcoin - by only 4.1%. Unsurprisingly, the BTC / TRY pair is hitting new highs.

What do you think, can cryptocurrency be considered as insurance against inflation? Let us know in the comments!

Analytical group StormGain

(platform for trading, exchanging and storing cryptocurrency)