The recent rise in prices in the cryptocurrency market has not stopped institutional investors from investing inbitcoin. The latest major transfer of funds from Coinbase to custody wallets, worth $ 630 million, confirms that organizations continue to accumulate coins.

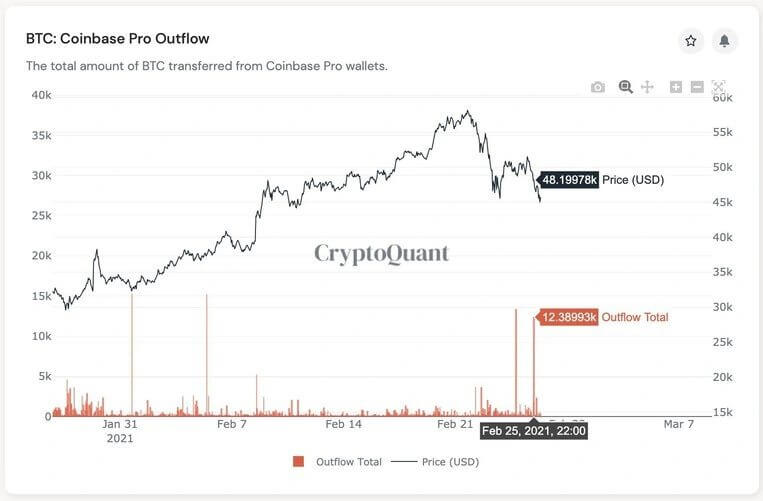

CryptoQuant CEO Ki Yong Joohas repeatedly emphasized the relationship between the price of bitcoin and organizations using the largest cryptocurrency exchange in the United States, Coinbase, to buy BTC in large quantities.

The examples given by the analyst firm did indeed reflect the increase in the value of BTC, with large investors transferring significant quantities of coins to storage addresses.

Last week, Joo predicted that after BTC fell below $ 45,000, the asset would quickly rise above $ 48,000, supported by "institutional-grade buying."

His prediction turned out to be accurate, since todaythe main cryptocurrency exceeded the $ 50,000 mark. In addition, the expert noted that institutional investors brought another significant batch from Coinbase to custody wallets.

CryptoQuant data shows that this time around 12,400 bitcoins were withdrawn, which is roughly $ 632 million at today's prices.

During last week's market crash, when BTClost about 25% of its value, there were reports that shortly before the fall, miners moved a significant part of the coins to exchanges and cashed out profits.

The community feared that institutional and retail investors would also join the sale, further driving down the price of the main cryptocurrency. However, this did not happen.

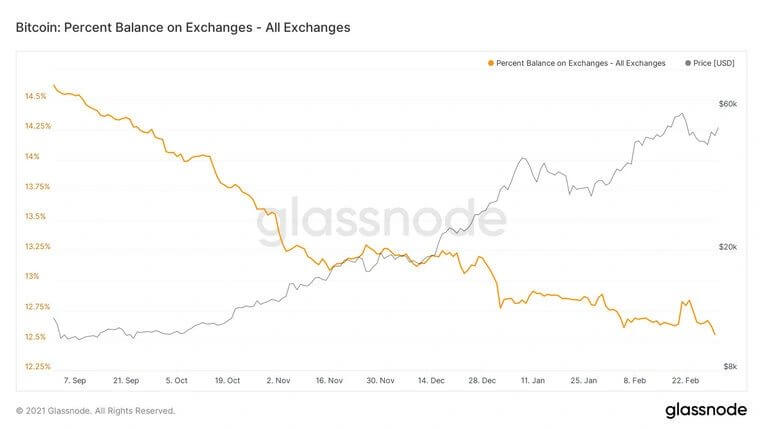

Data from another monitoring company Glassnodeshow that over the last week of February, bitcoin owners have really increased their transfers to crypto exchanges. However, the situation quickly changed and investors withdrew some of their coins from the trading floors.

Looking at the big picture, it is obvious thatinvestors are determined to reduce the amount of bitcoins stored on exchanges. In the past six months alone, the percentage of BTC on trading platforms has dropped from 14.5% to 12.5%, indicating a strengthening of the hodling strategy.

Where is it more profitable to buy bitcoin? TOP-5 exchanges

For a safe and convenient purchase of cryptocurrencies with a minimum commission, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support deposits and withdrawals of funds inrubles, hryvnias, dollars and euros.

The reliability of the site is primarily determinedtrading volume and number of users. By all key metrics, the largest cryptocurrency exchange in the world is Binance. Binance is also the most popular crypto exchange in Russia and the CIS, since it has the largest cash turnover and supports transfers in rubles from bank cardsVisa / MasterCardand payment systemsQIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

Rating of cryptocurrency exchanges:

| # | Exchange: | Website: | Rating: |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Bybit | https://bybit.com | 7.5 |

| 3 | OKEx | https://okex.com | 7.1 |

| 4 | Exmo | https://exmo.me | 6.9 |

| 5 | Huobi | https://huobi.com | 6.5 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

5

/

5

(

1

voice

)