I started investing in cryptocurrencies over a year ago. Following Warren Buffett's advice:"Neverinvest in what you don’t understand ”, – I began to read more and more aboutcryptocurrencies to gain an understanding of them before jumping into the cryptocurrency world. Today I still don’t fully understand cryptocurrencies, as this is a fairly large-scale area. But I learned enough to get back on my feet. When I started studying, a lot of the blogs and videos available online were either very superficial or too deep. They were either too specialized or too general. After spending almost a year studying, I am writing this article so that beginners, like myself, will find it useful and learn enough to start exploring on their own.

The article consists of a series of questions and answers. They are structured according to my learning path. Most newcomers are likely to go the same way, so I found this order quite reasonable.

</p>Before you start reading the article, stock upcoffee or beer. The article will be long. It took me more than two days to write it. I considered all the issues that I had to face. If you are familiar with something, you can skip the relevant questions and move on to the next ones. So, let's begin.

What is cryptocurrency?

Digital currency where code based oncryptography, controls the creation of currency units and verification of transactions for the transfer of funds. Cryptocurrency is not supported by the government or central bank of any country. Accounting is carried out on a distributed basis. Imagine this as a distributed registry where you cannot change the order of transactions.

You can call them folk money. Money created by the masses for the masses and controlled by the masses.

Such money has several advantages inComparison with fiat currency. For this reason, many banks and governments oppose the adoption of cryptocurrencies. Cryptocurrencies deprive centralized authorities of control, whether it be governments or central banks.

What is a fiat currency?

Currencies supported by governmentscalled fiat. Thus, most currencies that are familiar to us, such as USD (US dollar), GBP (British pound, or British pound), AUD (Australian dollar), CNY (Chinese yuan), JPY (Japanese yen), INR (Indian rupee) and etc., are all examples of fiat currencies. I did not have to meet the term “fiat” until I became interested in cryptocurrencies.

Fiat currencies have many drawbacks. They are centralized. Central authorities can make existing money invalid at the stroke of a pen. India recently conducted extensive demonetization. Currency can be printed arbitrarily, which leads to inflation. Inflation is the robbery of the poor and gullible without their knowledge. Commercial transactions require intermediaries such as Visa and MasterCard. For storing your own money, you have to pay banks a commission, while they earn on interest by lending your money. If you want to transfer money abroad, you need to get permission from the authorities and pay a huge commission to companies like Western Union. You pay a commission as a percentage, while ideally there should be a single transaction fee. Amount should not play a role.

Fiat lacks the characteristics of hard money. Cryptocurrencies make up for most of these shortcomings. In addition to all these advantages, they are also distributed, which in itself is a great advantage, since no third party needs to be trusted. And we have the opportunity to use this kind of money called cryptocurrencies thanks to blockchains.

What is blockchain?

Blockchain - the underlying technologycryptocurrencies. In fairness, it should be noted that cryptocurrencies are only one of the applications of the blockchain. Blockchain is an irreversible (forming a sequential chain), immutable and distributed transaction registry. Immutable registries are the foundation of many valuable transactions. We can talk about finances, accounting in governments and international diplomacy, and indeed about any important accounting.

What is Bitcoin?

Bitcoin - the first peer-to-peer electronic money. Bitcoin has solved the important problem of electronic money, known as "double spending." Although there are many resources where you can read about Bitcoin, you should definitely start with Bitcoin whiterpiper. Bitcoin is a pioneer among cryptocurrencies. Most other cryptocurrencies owe their appearance to Bitcoin, which has proved the possibility of building a secure decentralized mechanism for storing and transferring value via the Internet.

At this point, you only need to know that doublespending is the risk that a digital currency may be spent twice. If the same money can be spent twice, the currency loses its value and will not be safe. Bitcoin solved this problem and, as a result, created the prerequisites for a completely new world order.

Who invented Bitcoin or who is Satoshi Nakamoto?

The inventor of Bitcoin is Satoshi Nakamoto. But who is Satoshi Nakamoto? This is a long and very important mystery.

Many people think that Satoshi Nakamoto shouldto receive the Nobel Prize in Economics and the Turing Prize (an analogue of the Nobel Prize in the computer field) for the same invention: Bitcoin. This highlights the potential of blockchains and cryptocurrencies.

What is Altcoin?

All cryptocurrencies except Bitcoin are calledaltcoins or alternative cryptocurrencies. Bitcoin was the first cryptocurrency. There are many others, including Bitcoin clones (claiming the best features), cryptocurrencies based on smart contract systems, cryptocurrencies focused on specific areas, as well as various stupid cryptocurrencies. All these cryptocurrencies are called altcoins ("alternative coins").

What is shitcoin?

The derogatory name of cryptocurrencies, whichor another person or group is considered useless. Although many apply this term only to useless projects / cryptocurrencies, Bitcoin maximalists consider all altcoins to be shitcoins.

What is Bitcoin maximalism?

Bitcoin fans believe that Bitcoin isthe only true cryptocurrency, and everyone else is useless. Bitcoin maximalists argue that other currencies have no real use. They are convinced that all the money, time and resources must be spent on improving Bitcoin, since second-level solutions for the Bitcoin network can be used for any application. Therefore, all altcoins are useless.

This tweet perfectly illustrates the essence of Bitcoin maximalism:

What is Bitcoin Maximalism?

Altcoin: Hey @Bitcoin

Bitcoin: Hey Shitcoin— gokulnk (@gokulnk) May 21, 2018

Which altcoins are available?

Currently, more than 1900 altcoins are available. Most of these altcoins are scam (i.e. scam). But among the 300 leading altcoins, you can find many interesting projects. These pearls are potentially capable of changing the way of humanity. At this stage, they can be compared with Internet giants during their formation until 2000. Their true potential has not yet been realized. Perhaps we will find out what value they carry, only after a few decades.

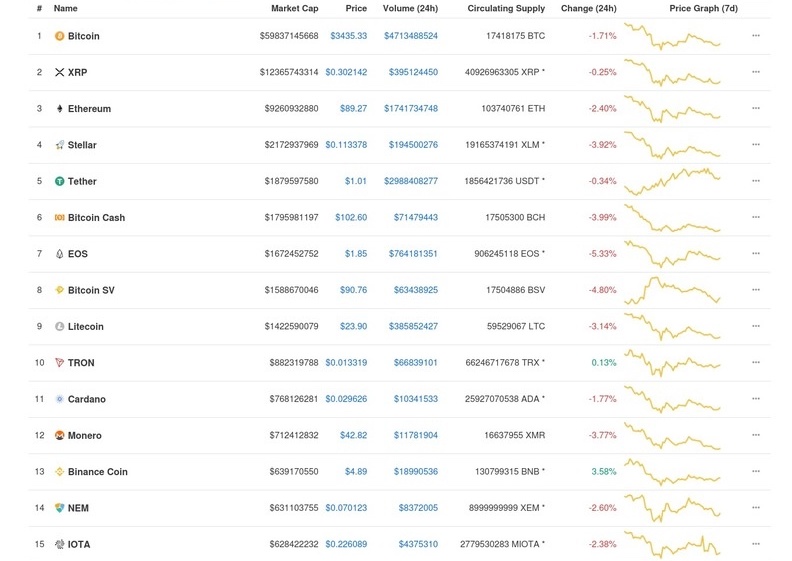

Here are the top 15 cryptocurrencies as of December 12th.

Top 15 cryptocurrencies at CoinMarketCap

If you want to know what tasks thesecryptocurrencies, then here I made a list. I am part of the team of this site, and it is still under development. We are working on a number of tools aimed at raising awareness about the world of cryptocurrencies. So do not pay attention to possible errors.

Where can I see a list of all cryptocurrencies?

All quoted cryptocurrencies can be viewedon CoinMarketCap. I used the word "listed" because this is not an exhaustive list of coins. These are only those coins that meet the requirements to be displayed on CoinMarketCap. There are many other projects that are not listed on exchanges, and some still exist only in private mode. Consequently, such projects are not presented on this site.

There are also alternative sources. On Cryptocompare, you can bookmark coins and keep track of your favorite cryptocurrencies. Coins.live is another similar site.

Is it a good time to invest in Bitcoin?

I bet on the growth of Bitcoin. In the long run, I believe Bitcoin has room to grow. I think the popularity of Bitcoin is just beginning, and I will use any recession to buy some more satoshi.

Many people I respect are optimisticon Bitcoin's prospects. Optimistic forecasts of many popular cryptocurrency personalities can be found in this post. Note that many of these forecasts are long-term and have nothing to do with short-term highs and lows.

Is it a good time to invest in altcoins?

Although I am optimistic aboutBitcoin, when investing in altcoins, I would advise caution. Most altcoins fell from historical highs recorded in December last year by more than 80%. Many people think that altcoins can lose even more. So invest cautiously and only in the best projects that you trust in the long run. But do not forget to set stop loss. Know when to quit the game.

What is a stock exchange?

The exchange is a site where you can exchange onecryptocurrency to another. Such sites are usually called crypto-crypto exchanges to emphasize that they do not support the ability to directly purchase cryptocurrency for fiat.

Is it possible to buy cryptocurrency for fiat?

Previously, you could only buy bitcoins for fiat, and to buy altcoins, you had to transfer the bitcoins to the exchange"Crypto-crypto". But now there are many sites where you can directly buy popular cryptocurrencies for fiat.

On which popular exchanges can I buy cryptocurrencies for fiat in the USA?

You can try Coinbase and Robinhood.Bittrex also plans to begin supporting fiat in a phased manner. The listing of altcoins on Coinbase is considered an important indicator, and there have been cases where rumors about the listing on Coinbase have caused cryptocurrencies to skyrocket in price.

The most popular place in the world for buying and selling bitcoins.

Can I buy cryptocurrency with a credit card?

On CEX.IO you can buy crypto with fiat. On Xcoins.io you can buy bitcoins using a credit card, PayPal or bank account. CEX.IO is the easiest way to buy Bitcoin and Ethereum. If it weren't for the high fees, I would recommend this service to many. From personal experience, I can recommend the Coinmama service, if you are not afraid of a rather strict KYC policy.

What are the popular international crypto-crypto exchanges?

Binance and Kucoin are very popular exchanges"Crypto-crypto". Both have grown a lot over the past year.At the peak of the hype, these two exchanges had to close registration due to excessive load. Both have many altcoins listed. If a cryptocurrency is in the top 100, then it is very likely that it is listed on one of these two exchanges.

- At Binance there is less trading commission and many good projects are quoted.

- Many new altcoins appear on Kucoin very quickly. The exchange also gives you free coins if you hold KNC.

Are these exchanges centralized?

Yes. Although the whole point of cryptocurrencies is decentralization, cryptocurrency trading mainly takes place on centralized exchanges. See what the irony is? But there is an alternative.

What is a decentralized exchange?

An alternative is, you guessed it, a decentralized exchange. On decentralized exchanges, cryptocurrencies are transferred from one user to another. This is a peer-to-peer exchange.

Let's say I want to sell 0.5 bitcoin for 25ethers. Users A and B want to buy 10 airs, and user C wants to buy 5 airs. If all four agreed to buy / sell at the indicated rate, a decentralized exchange will connect us all, and there will be transfers from wallet to wallet. So far, such cross-currency exchanges are not possible.

Are there working decentralized exchanges?

Nowadays there are decentralized exchanges whereYou can exchange currencies from the same category. For example, all ERC20 tokens are based on Ethereum and can therefore be traded against each other using a decentralized exchange such as the Kyber Network or IDEX. There are also other exchanges such as BitShares and Waves.

I thought 2019 will be the year of decentralized exchanges, but most of them suffer from low volumes and an insufficient number of quoted cryptocurrencies. So, I think, until they become popular, it is better to use centralized exchanges.

What happens if the exchange is hacked?

There are many precautionsallowing you to make sure that your accounts on the exchanges are not hacked. But if the exchange itself is hacked, you really can not do anything. Do not assume that exchanges will not be hacked. There are many cases of hacking exchanges and people losing funds.

The most notorious hacking happened with Mt.Gox. Many other exchanges were also hacked. In India, the popular Coinsecure exchange was hacked. Both mentioned exchanges agreed to pay compensation for the lost amount in dollars at the exchange rate at the time of the hack. But in many cases, people lost all the money invested and did not receive any compensation.

You can read more about precautions in the article “How to safely store cryptocurrency funds?”.

Is it possible to store my funds on my own, and not on exchanges?

The whole point of cryptocurrencies is decentralization. But the funny thing is that trading today mainly takes place on centralized exchanges. And so it will be until the distributed exchanges get better. Although there are interesting projects, such as Kyber Network and Switcheo, working to bring distributed exchanges to the masses, I believe that a distributed version of Binance could really turn the tide.

So most of my friends usecentralized exchanges for trading, after which they transfer funds to personal wallets, if for some time they do not trade cryptocurrency and plan to hold it a bit.

What is a wallet?

A cryptocurrency wallet stores public and private keys used to send and receive cryptocurrency funds. You can compare this with opening a bank account.

Who creates a wallet for me?

Cryptocurrencies use cryptography tosecure and verify transactions and control the creation of new units. Cryptography is the basis of cryptocurrencies, which is why they got this name. When they say that cryptocurrencies do not require trust, this means that you do not need to trust a centralized third party, such as a central bank or government, to ensure the security of your accounts and verify your transactions. The whole system is distributed. Each user can cryptographically verify any transaction.

What are public and private keys?

Public and private keys can be represented as a username and password, respectively.

The wallet consists of pairs of public and privatekeys. Public and private keys should be familiar to anyone who knows cryptography. If you are a programmer, then you probably used public and private keys to establish a secure connection. But what if you apply this concept to sending and receiving money? This is exactly what cryptocurrencies do. Before considering this in more detail, let us make a small digression.

Let's see how account creation, username and password work in Gmail.

Say you've never used Gmail beforeand now they wanted to start using it. First you need to create an account for yourself. Creating an account involves choosing a username and password. You can share your username with anyone so you can send mail. At the same time, your password gives you access to your account and special rights. With a password, you can initiate transactions between your account and other accounts (commonly referred to as sending mail).

Comparing Gmail and cryptocurrencies for a better understanding of keys

Now imagine for a moment that Gmail fromthe above example is a Bitcoin network. The first major difference is that Gmail is centralized, while the Bitcoin network is decentralized. If you want to create an account on Gmail, you open https://accounts.google.com/signup/v2/webcreateaccount and create it. Since Gmail is centralized, there is only one interface known to all. But the blockchain is decentralized. Therefore, if you want to create an account in the Bitcoin network, you need to broadcast a request for its creation to the Bitcoin network. If you are a programmer and know how to configure script execution, you can create an account in the Bitcoin blockchain yourself.

Because many people are not technical enoughsavvy, there are web interfaces for creating accounts on the Bitcoin blockchain. You can use sites like BitAddress and Walletgenerator to generate public and private keys. When creating accounts, they use one or another type of randomization, which ensures the preliminary generation of public and private keys. The public key (wallet address) is your username, and the private key is your password.

If you want to be transferred to your accountmoney, you give people your public key. The private key gives you access to your account and the funds available on it. If you want to transfer your bitcoins to someone, you will need your private key. Remember that all transactions in the Bitcoin blockchain are public and anyone can view them.

What happens if I lose my private keys?

If you lose your private keys, you’ll lose access toto your account. Once you lose access to your account, this also means that you will no longer have access to your funds. Although the blockchain registry confirms that there are so many bitcoins in your account, you can no longer use them because you lost your password.

So, while it's good to have off-exchange wallets, be sure to consider the risks associated with them.Freedom entails responsibility.You can't blame others for your fate.

In the case of Gmail, if we forget the password, we have a convenient link"Forgot your password?"helping reset the password. This is possible because Gmail is centralized, which means that Google has full control over the database and can change it at any time. The password can be reset if Google is sure that the account really belongs to you and the request to reset the password is genuine.

Since Bitcoin is decentralized, it is not possible to reset the private key.

What is a hot wallet?

Hot Wallets Examples - Mobile anddesktop wallets. Hot wallets are used for everyday cryptocurrency transactions. A hot wallet, as a rule, has free access to the Internet. Only small amounts of cryptocurrencies are kept on hot wallets, as they are used for everyday transactions, and not for storage / security. A hot wallet is safer than exchange wallets.

What is a cold wallet?

Examples of cold wallets - paper andhardware wallets. Cold wallets are used for long-term storage of large amounts of money. They are not connected to the internet. Some cold wallets, such as hardware wallets, can connect to the Internet if necessary.

What is a paper wallet?

A paper wallet is a simple piece of paper, onwhich printed public and private keys. Although paper wallets are considered tamper-resistant, they are subject to wear and tear. If you lose a piece of paper or if the symbols on the paper are erased, you will lose access to your account and funds stored on it.

What is a hardware wallet?

A hardware wallet is a Bitcoin wallet,storing the user's private keys on a secure hardware device. Popular examples are Ledger Nano and Trezor. After talking with several friends who have been dealing with cryptocurrencies for years, I decided to purchase Ledger Nano. A hardware wallet is considered the most secure.

So which wallet should I use?

You can use any of these wallets depending on your needs.

This is the approach I take.

Break your funds into three categories.

- Long term.

- Medium-term (participation in ICOs and trading with low activity).

- Funds for active trading.

I store these categories of funds as follows.

- For most long-term remedies, usehardware wallet.

- For a small portion of long-term funds, usepaper wallet. This paper wallet is good to keep in a lockable drawer.

- Divide your medium-term funds and keep most of them indesktop walletand a small part - inmobile wallet.

- I distribute funds for active trading among variousexchanges, where I trade, in proportion to my level of confidence in a particular exchange. For example, I trust Binance the most, and then Kucoin. Consequently, baboutI keep most of my funds for active trading on these exchanges.

How to monitor your funds with so many exchanges and wallets?

I prefer to use to track mycryptocurrency investment common control panel. The portfolio tracker, which collects all your transactions from exchanges using the API and from wallets using the blockchain browser, can help with this. Although some people don't like to share their API keys with such portfolio trackers, it suits me and I share read-only API keys.

There are many free portfolio trackers out there, and the most popular is Blockfolio. While most are happy with Blockfolio, I'm hesitant to use it. I prefer to use either"Paid and closed", or"Free and open"applications.If the application is free and closed, this is an alarm for me.I would prefer a paid open app, but I haven't been able to find one yet.

What is the best portfolio tracker for tracking Bitcoin and cryptocurrencies?

I recently updated my account at Cointracking. It supports almost all popular exchanges. After setting up your API keys, the application can automatically import all your transactions from exchanges. Cointracking also has a report called “exchange balance” showing the current balance for all exchanges that you have synchronized.

Cryptocurrency Portfolio Tracker

I hear a lot about Delta right now. I read that using the Delta pro account, you can track 10 different portfolios, and this, I think, is a cool option. You can use one portfolio for HODLing, one for trading, etc. This is cool.

What is a HODL?

If you've read even a couple of articles about cryptocurrencies, I'm sure you've come across this term. No, that's not a typo in the word HOLD("Keep"). HODL stands forHold On For Dear Life (transl. - "Hold on with all your might"). Those who believe in a long-term bull trendBitcoin, recommend HODLit. They argue that this will yield more profit in the long run than trading. Although there are opposing views on this subject, this is a good strategy if you do not have much time to trade and monitor the market, provided that you have invested in good projects.

Don't forget aboutDYOR.

What is DYOR?

I'm sure you've come across this acronym at the beginning or end of articles about cryptocurrencies.DYOR stands forDo your own research (transl. by "Do Your Own Research")... It all started as good practice - askingof readers to do their own research, but now this has become a disclaimer to disclaim responsibility. Don't worry, will I add DYOR at the end of the article too?

What means"Invest only as much as you can afford to lose"?

As well asDYORI would call this the first rule of investing in cryptocurrencies.During the bull run in November-December 2017.Seeing such profits from their friends, many others invested more than they could afford to lose.They bought at all-time highs with loans taken from banks and acquaintances.Since January, markets have been falling, and many coins have lost more than 90% of their value.So, please take this advice seriously before investing in cryptocurrencies.It was a typical caseFomo.

What is FOMO?

FOMO stands forFear of missing out (transl. by "Fear of Missing Out")Many people start investing in cryptocurrencies because of FOMO.There will be many opportunities to come across good projects and invest in them.Invest fromfear of loss of profitand withoutconducting own research– two bad decisions. Don't do that. Do not hurry. Figure it out. The best investment is the time you spend understanding the markets. This will also help you avoid becoming a victim.Fud.

What is a FUD?

FUD stands forFear, Uncertainty and Doubt (trans. — “fear, uncertainty and doubt”). Unconfirmed news and rumors causedcryptocurrencies do more harm than any governments or central agencies could do. There have been times when articles a year ago called FUD due to misconception, which subsequently led to a drop in prices. A professional trader should be free from FOMO and FUD.

How to trade cryptocurrencies?

You can trade cryptocurrencies in the same way as securities. As in any trading, the goal isBUY CHEAP and SELL EXPENSIVELY, taking only those risks that you can afford. Although it sounds simple, in fact it is not. Believe me.

You can trade both Bitcoin and altcoins.First stepin trading – convert fiat into cryptocurrencies. This process may vary depending on your country.Second step– create accounts on popular exchanges and transfer cryptocurrency to these accounts. If you've done this, you're done. JustBUY CHEAP and SELL EXPENSIVELYorSELL EXPENSIVELY AND BUY CHEAP.

But, before you start trading, be sure to understand all the risks of cryptocurrency trading.

What are the risks of cryptocurrency trading?

I will list only a few risks, but do not forget DYOR to find out about all the associated risks.

- Cryptocurrencies may be declared illegal inyour country, and it can become very difficult to convert your cryptocurrencies back to fiat. China restricts cryptocurrency trading. India recently asked banks to stop supporting any business dealing with cryptocurrencies.

- Your banks may block your cryptocurrency trading accounts.

- The cryptocurrency you trade can be for oneday to lose most of its value. BitConnect in one day lost more than 90% of its market value. The fact that Bitconnect was in the top 10 cryptocurrencies only exacerbates everything, since the cryptocurrency community could not do anything to stop this scam.

- Exchanges can be hacked and you can lose your money.

- If you do not adhere to best practices, your wallet may also be hacked and you will lose all your money.

- You may not be able to sell your cryptocurrencies, as there will be no demand. This is also called a lack of liquidity.

- And many other risks?

I’m saying all this not to scare you away. But it is very important to know all the associated risks before you start trading.

What analysis can I do before trading cryptocurrencies?

Typically, two types of analysis are performed: technical analysis (TA) and fundamental analysis (FA). Most of my friends day traders are good at TA, and most HODLers are good at FA. The best investors I know combine both types. It is up to you to decide whether you will use TA, FA, or both, but devote enough time to this.

What is fundamental analysis?

Fundamental analysis is learningfundamental indicators of the project in which you invest. It includes researching information about the project, company, team, their previous achievements, about the area in which the project works, the task that he is trying to solve, the development plan and whether it has been adhered to so far, etc.

What is technical analysis?

Technical analysis is the art of reading charts. It is based on the principle that price behavior tends to repeat itself due to patterned collective investor behavior.In simple terms, this means that market cycles are repeated all the time.

Although I'm not sure if using technicalanalysis to predict prices, I am convinced that it helps to make informed decisions. For long-term investments, a FA is required. Likewise, TA is required for short-term trading. If you are engaged in day trading or short-term trading without a TA, this actually means that you are guided by intuition. This is bad. So learn technical analysis, even if you do not fully believe in it.

Technical analysis is a broad field, and I have yet toI am only superficially familiar with him. There are many indicators, patterns and theories. For now I only use support/resistance levels and trend lines. I have yet to become familiar with channel lines and continuation and reversal patterns. I recommend starting your study here or here.

How about commissions on exchanges?

When trading on exchanges, there are two types of fees that you should be aware of:trade commissionAndwithdrawal fee.

Different exchanges have different trading fees.Robinhood and Cobinhood have zero trading fees. Binance gives a 50% discount on trading fees if you pay in BNB. Likewise, Kucoin gives a special discount if you have KNC in your account.

We cannot consider commissions here in detail.on all exchanges. You should familiarize yourself with them. However, if you want to know how much you spent on commissions, Cointracking has a convenient report.

When it comes to withdrawal fees, I noticed that Kucoin usually has lower fees than Binance. While Binance has a high withdrawal fee, Kucoin does not requireKycif you withdraw less than 2 BTC per day.

What is KYC?

KYC stands forKnow your customer(trans. —“Know your customer”) Many exchanges, especially in countries where governments are not friendly to cryptocurrencies, require the passage of the KYC procedure. This means that you need to provide details about your identity and place of residence in order to open an account on the exchange or to trade / withdraw more than a certain amount. A number of popular participants in the crypto community oppose KYC, since cryptocurrencies should be completely free from governments.

Is it worth trading only Bitcoin, or is it worth trading altcoins too?

Bitcoin has the highest liquidity. If you do not want to risk trading with low liquidity, then you are better off trading bitcoin. In addition, since Bitcoin has existed since 2010, it has the most historical data.

Altcoins have relatively low liquidity. Altcoins are extremely volatile, and many good altcoins can generate very good returns. Given this, many are actively trading in altcoins.

What is the relationship between the price of bitcoin and altcoins?

The relationship between bitcoin and altcoins can be summarized in the following four sentences:

- When the price of bitcoin is stable or slowly rising, altcoin prices rise rapidly.

- When the price of bitcoin rises rapidly, altcoin prices fall rapidly.

- When the price of bitcoin drops, altcoin prices quickly fall.

- When the price of bitcoin drops rapidly, altcoins fail.

This interesting connection between bitcoin and altcoins can be explained by the following observations.

- Bitcoin is still the flagship of cryptocurrencies. He is a leading cryptocurrency.

- Bitcoin and altcoins compete for a share in the capitalization of the cryptocurrency market. Therefore, when there is no influx of new funds, money moves either from Bitcoin to altcoins, or in the opposite direction.

- When the prospects are positive and there is no influx of new funds, money moves from Bitcoin to altcoins.

- When the prospects are negative, but there is no outflow of money, money moves from altcoins to Bitcoin.

- When the prospects are negative and meansare withdrawn from cryptocurrencies, and Bitcoin and altcoins suffer. In this scenario, altcoins suffer more. It is in such cases that altcoins lose 90-95% of their price.

What are satoshi?

Satoshi– currently the smallest unitbitcoin, which can be recorded on the blockchain. It is equal to one hundred millionth of a bitcoin (0.00000001 BTC). It was named after the creator of Bitcoin, Satoshi Nakamoto.

Is it worth striving to increase Satoshi or Fiat?

If you think that Bitcoin is waiting for the brightfuture, and adhere to optimistic views on its long-term prospects, then looking for Satoshi growth is the best approach. If you are a trader and you are only worried about how to make more money, then you may be best suited to search for fiat growth. I look at both. As a rule, I periodically calculate my profit in fiat. If my total portfolio does not fall below a certain amount in fiat, I usually track my portfolio in satoshi, because I believe in the long-term prospects of Bitcoin.

Where is margin trading possible with bitcoin?

Margin trading is akin to buying on an exchange incredit. Different exchanges offer different leverage. A leverage of 10x means that for every dollar you have, you can buy bitcoins worth $ 10. Although it increases your profits tenfold, it can also ruin you. Since exchanges lend you money, they liquidate your position (forcibly sell your bitcoins) when the price drops below a certain level. Do not engage in margin trading if you do not understand the risks associated with it.

Margin trading is possible onBitmex and Bitfinex. Although margin trading is also possible on Poloniex, I personally do not like this exchange. I've done some research on margin trading, but haven't done it yet.

How to shorten Bitcoin?

Short sale(sale without cover or shorts)bitcoin trading is selling bitcoins you don't have so you can buy them later. So it can be beneficial if youSELL EXPENSIVELY AND BUY CHEAP. If you are sure that the price of bitcoin will decrease, then make short sales of bitcoin.

Short selling Bitcoin is also possible on Bitmex and Bitfinex.

What is Ethereum?

Ethereum is programmable money. This is a smart contract platform. Ethereum has interested many. Money and programming are two powerful concepts. If combined, the consequences and possibilities are endless. Ethereum was the first in the cryptocurrency world to do this.

What are smart contracts?

Smart contracts (in the context of Ethereum) arecontracts that are programmed and executed on the Ethereum blockchain. They are compiled in the programming language Solidity. Smart contracts allow you to automate decision making and money transfers. They exclude human participation from these scenarios and automate the entire process.

What is an ERC20 token?

ERC20 tokens are new cryptocurrency tokens,created on the Ethereum blockchain using smart contracts. For example, Power Ledger is an ERC20 token. You can read the details of the Power Ledger smart contract here, and see the code itself here.

What is an ICO?

ICO stands forInitial Coin Offering (trans. — “initial coin offering”). This is like an initial public offeringInitial Public Offering or IPO Securities. Funds from interested parties are accepted in the ICO, after which they are allocated ERC20 tokens according to the amount invested by them.

How to participate in the ICO?

Ethereum-based ICOs are still the most popular. However, there are other platforms, such as NEO, Stellar, etc., that help conduct ICOs and create your own token. In most ICOs, funds are not directly accepted from exchanges. To participate in the ICO, as a rule, you need to transfer funds from your wallet so that ICO tokens can be received on the same wallet.

You can create an Ethereum-based ICO to participateEthereum account with Myetherwallet. You can transfer Ethereum tokens from the exchange to the address of your Ethereum wallet. After that, open the ICO site in which you participate, and follow the instructions. As a rule, you need to transfer the air from your wallet to the target ICO wallet. Read the instructions carefully to understand what gas is and how much GWEI you need to set for your transaction.

What is airdrop?

ICOs are prohibited in a number of countries, including the United States.Therefore, most projects today use the Airdrop approach. We had a detailed article on this topic. If you have an Ethereum wallet, Ethereum-based projects can drop tokens to your address. That is, they simply transfer tokens to your account. Yes, you get free money. You ask, what does this give them? This is a way for them to spread information about the project, which in turn will increase the value of the tokens.Isn't it cool?

Ethereum is just one of the blockchains knownusing airdrop. Other projects like NEO, Stellar, and EOS also allow for ICOs and Airdrop. Create a wallet in each of them. Who knows, maybe you will get money for free, which later will be valuable.

Should I invest in or trade in cryptocurrencies?

Only you yourself can answer this question. But I personally think that everyone should at least a small part of their investment funds invest in cryptocurrencies. In the future there will be many blockchains and cryptocurrencies. It is better to get to know them before they become widely popular. And if at the same time you can make good money - this is wonderful.

Finally

Over the past year, I have also encountered manyother issues. But these questions are very specific. Therefore, I will keep them for other articles. I believe that the issues discussed in this article allow you to get a general idea and take the first steps in the world of cryptocurrencies.

This is an interesting world. It has many projects that solve very interesting problems. There are many programmers in it who break down the barriers of technology and expand the possibilities of human interaction. When humanity is able to freely interact, coordinate its goals, increase efficiency and expand opportunities, no task will be too big and no individual contribution will be too small. We really live in a special time. Cash rewards are just a nice side effect. Even when I was losing money on cryptocurrencies, I was not too upset because I felt that I was making a contribution to the growth of what would turn out to be revolutionary in the coming years.

If you've read this far, it'sreally wonderful. Thank you for taking the time to read this article. I hope this article answered at least some of your questions and you are now one step closer to investing in cryptocurrencies.

</p>