Many crypto enthusiasts cherish hopes that with the arrival of large investors, Bitcoin will begin rapid growth.pulling a wider market. For example, the head of Galaxy Digital, Mike Novograts, is convinced that very soon Bitcoin will overcome the $ 20,000 mark, and will help him in the development of regulated crypto exchanges aimed at professional market participants.

However, the massive adoption of cryptocurrencies and rapprochementa new industry with traditional financial structures - the process is not so fast. Discussions that “crowds are about to come” are crowds of institutionalists that have been going on for many years. Probably, many conservative market participants are still concerned about the volatility of cryptocurrencies, hacking exchanges, the vulnerabilities of decentralized applications, and still significant legal uncertainty.

In 2018-2019, there have been positiveshifts signaling a change of mood and, importantly, a change in the perception of new assets in the eyes of cautious traditional investors. The growing popularity of CME bitcoin futures, the development of custodial services and OTC platforms, multiple applications for ETF launch, the emergence of Bakkt, cryptocurrencies and the rise of the Grayscale Bitcoin Trust are clear signs of a growing market and institutional demand.

ForkLog understood the trends and identified barriers to institutionalization, and also studied the activity of whales in various sectors of the market.

“Bitcoin and everything else”

Despite the rapid development of altcoins anddecentralized applications, the cryptocurrency market for many is still associated mainly with bitcoin - the first and still the most capitalized cryptocurrency. Moreover, some BTC holders do not know about the existence of alternative coins, and if something has been heard about them, they do not want to delve into their features in detail.

Vision Hill CEO and founder Scott Armie notes that in the eyes of investors, the world of cryptocurrencies looks like bitcoin and “everything else”. The latter covers:

- innovations within the concept of Web3;

— decentralized finance (DeFi);

— decentralized autonomous organizations (DAO);

— smart contract platforms;

— security tokens (digital assets with the properties of securities);

— digital identification;

— data privacy;

— blockchain games;

— corporate solutions based on distributed registry technology (DLT), etc.

Number of whales that invested only inbitcoin, exceeds the amount invested in “everything else” or in a diversified portfolio with a predominance of digital gold. This is due to the fact that the first cryptocurrency is perceived by many as a kind of standard, a kind of cryptocurrency analogue of the S&P 500.

“The market share of bitcoin and its degreeinstitutionalization (futures, options, custodial services and a clearer legal status) made it more attractive for those seeking to enter the digital asset market, Armi shares his thoughts. “Bitcoin is probably currently positioned as a beta factor for the entire digital asset market.”

And yet, despite the status of “beta” and an impressive return on long-term investments in bitcoin, investors are still in no hurry to enter this market “for the whole cutlet”.

The thorny path to mass adoption

According to the head of Vision Hill, digital currencies and blockchain technology are extremely complex things, obscure for most people. Whales are no exception.

“Institutional investors are still exploring, gradually mastering. This process will take some time. ”- emphasized Armie.

According to him, some of those interested are sure that it is too early to invest large sums in the cryptocurrency market due to multiple risks, including regulatory ones.

Large players require maximum simplicity withinvesting - so that the instruments are as close as possible to traditional financial products and there is no need to immerse yourself in various technical details.

Discussing the factors that stimulate the influx of large players, Digital Currency Group partner Kari Larsen said the following:

“Exchanges shift the focus from retail traders toinstitutional players, providing such users with greater opportunities for interaction with the platform interface, including the more familiar API ”.

BCB cryptocurrency CEO Oliver vonLandsberg-Sadie is convinced that last year, "financial institutions that diversify old-school portfolios" and are armed with advanced technology have stimulated institutional growth.

The fact that the trend is gradually moving towards institutionalization, was confirmed by Boris Borer-Bilovitski, a representative of Copper Technologies, a company working with digital assets:

“Yes, of course, from very public players like American pension funds and university endowments to European foundations, family offices and other companies around the worldHe said in a conversation with Bitcoin Magazine. -There is also a growing number of US firms using high-frequency trading strategies in this area.”

According to him, until recently, one of the main obstacles to the institutional adoption of cryptocurrencies was the insufficient development of professional custodial solutions.

Institutionalization is an important step towardsglobal recognition of cryptocurrencies as an asset class. But while startups and traditional financial institutions continue to create infrastructure and products for professional market participants, regulation has been and remains a key challenge.

“Institutional investors, especially from the US, crave more legal clarity”, - said Scott Freeman, co-founder of JST Capital.

Nevertheless, Böhrer-Bilowicki is confident that some progress has been made last year:

“There is technology, but still not enoughunderstanding what custodial solutions for crypto assets should be. The regulatory landscape needs to be improved. Some remain discouraged by the lack of consensus between national and regional authorities. However, all this is rapidly changing for the better. ”

Investors believe in the future of cryptocurrencies

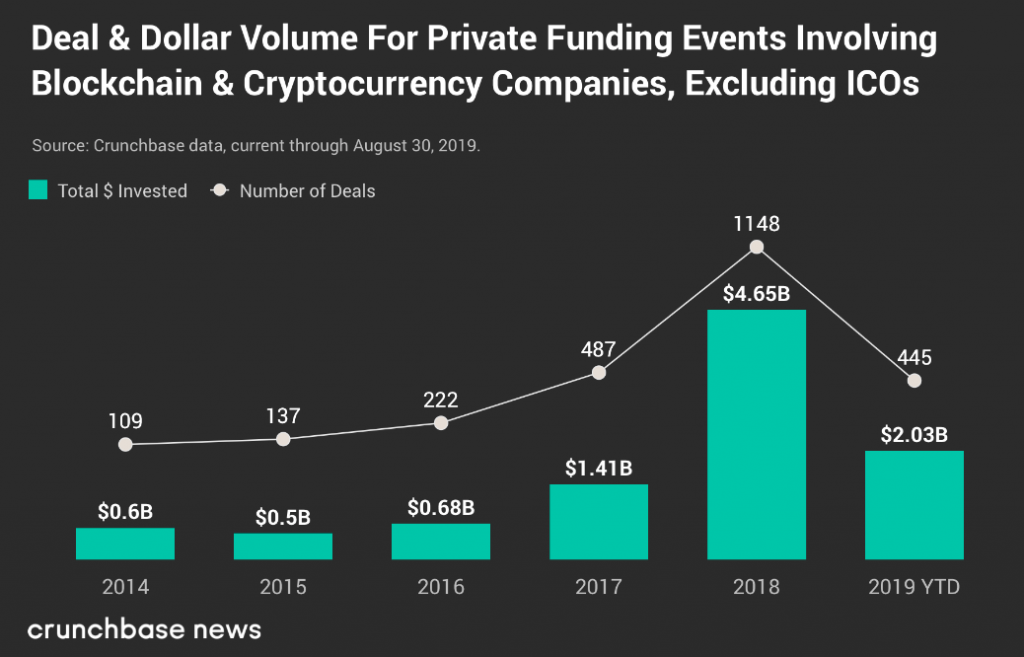

The fact that large market participants believe in the prospects of the bitcoin and blockchain industry is also confirmed by the figures: the volume of venture investments in the sector last year exceeded $ 2 billion.

Although this indicator is not the same as a year earlier, but it is more than in 2017:

Green columns of the diagram - annual volume of venture investments (in $ billion); points on the white line - the number of transactions. Data: Crunchbase.

Among the largest deals are:

- Robinhood - $ 323 million during the E-Series round. The company's capitalization thereafter reached $ 7.6 billion;

- Bithumb - $ 200 million during the Serie A round, despite losses in 2018 and a hack in June last year;

- Ripple - $ 200 million in the Series C round. Capitalization thereafter reached $ 10 billion;

- Kraken - raised $ 100 million, after which the company's capitalization grew to $ 3 billion.

Pantera Capital raised $ 160 in March 2019million for the activities of the Venture Fund III investment project. In April 2019, the launch of the Proof of Capital fund with offices in Hong Kong, Taipei and San Francisco was announced. Its size was $ 50 million, HTC was the main investor. Blockchain Capital venture firm, which intends to raise $ 250 million for its already fifth investment fund, does not stop there.

According to The Block, last year the issuersecurity tokens Securitize raised $ 15 million from the Japanese Sony and other well-known companies, and $ 40 million during the series B round with Visa participated in the custody service Anchorage. The aforementioned Blockchain Capital also invested in both companies.

Among other things, investmenttransactions concluded by Chainalysis ($ 30 million), Elliptic ($ 23 million), BlockFi ($ 18.3 million in 2019 and $ 30 million at the beginning of 2020), the Compound DeFi service ($ 25 million) and various venture companies.

Now consider the activity of large investors in the context of individual market segments and influential companies like Grayscale.

Banks and pension funds

In Germany, more than 40 banks are interested in obtaining a license for cryptocurrency depository services.

One of the first to do this was the Berlin SolarisBank AG. Earlier, the financial institution registered a subsidiary of Solaris Digital Assets to provide cryptocurrency custody services.

“As soon as it becomes easier to buy and store bitcoin and other cryptocurrencies, we expect significant growth”“- said the representative of SolarisBank, Michael Offermann, emphasizing that digital assets are fundamentally changing the market.

In February 2019, pension funds from the countyFairfax, Virginia, invested $ 40 million in crypto and blockchain space through Morgan Creek venture capital firm. In the fall of the same year, these funds invested another $ 55 million.

Most of the funds of Morgan Creek Digital are directed to blockchain-related infrastructure companies, and about 15% of the company invests in crypto assets.

According to the chief investment directorof the Andy Spellar police fund, in an environment of low interest rates and low returns on traditional investments, the attractiveness of venture capital investments is significantly increasing.

“So far, we are seeing uncorrelated dynamics with respect to other asset classes”- he added.

Thus, even such conservativeInstitutions, like banks and pension funds, are attracted by new investment opportunities to diversify their investment portfolios. The most advanced financial institutions strive not only to reduce the correlation of investments with the traditional market, but also to increase their profitability. According to Binance Research, the inclusion of bitcoin in the investment portfolio allows you to achieve these goals at an acceptable level of risk.

Extremely Successful Grayscale

As of February 19, the total assets (AUM) managed by Grayscale is $ 3.3 billion.

</p>To the largest of the company's funds - GrayscaleBitcoin Trust - it’s worth $ 2.95 billion. It is easy to calculate that with a bitcoin price of $ 9600 (as of February 20), the company manages more than 300,000 BTC (1.64% of the total BTC market supply). The company achieved such indicators in less than four years of existence.

Bitcoin Fund - The Most Popular ProductGrayscale, its share in AUM is 89.39%. Given that only accredited investors can directly buy shares of funds, this is another confirmation that the vast majority of whales choose bitcoin.

Brokers through whom you can invest in GBTC

According to the latest report, the structure of Grayscale's customer base is as follows:

- 71% of the company's customers are institutional;

- 19% - qualified individual investors;

- 7% - pension funds;

- 3% are family offices.

According to The Block researchers, holders~ 1.65% of GBTC shares are institutional investors with AUM more than $ 100 million. In particular, the ARK Web exchange fund of the investment firm ARK Invest consists of these securities for 2%.

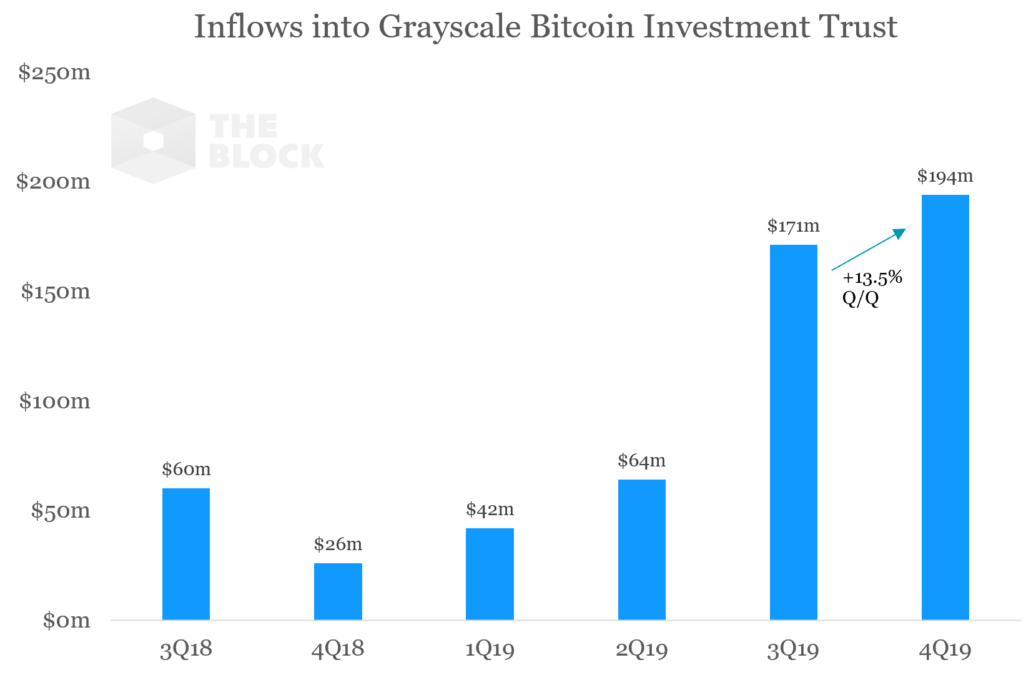

“Therefore, the influx of funds into GBTC is a good indicator of institutional investment in bitcoin.”, — The Block researcher Larry Chermak shares his thoughts. —In total, in 2017, the inflow amounted to $ 64 million, in 2018 - $ 220 million, and in 2019 - $ 438 million. ”

GBTC revenue has been growing rapidly for five consecutive quarters

Grayscale Bitcoin Trust is one of the few forretail investors investing in bitcoin in the context of 401 (k) and IRA pension plans. Also note that GBTC stocks are extremely popular in the US OTC (OTC) market.

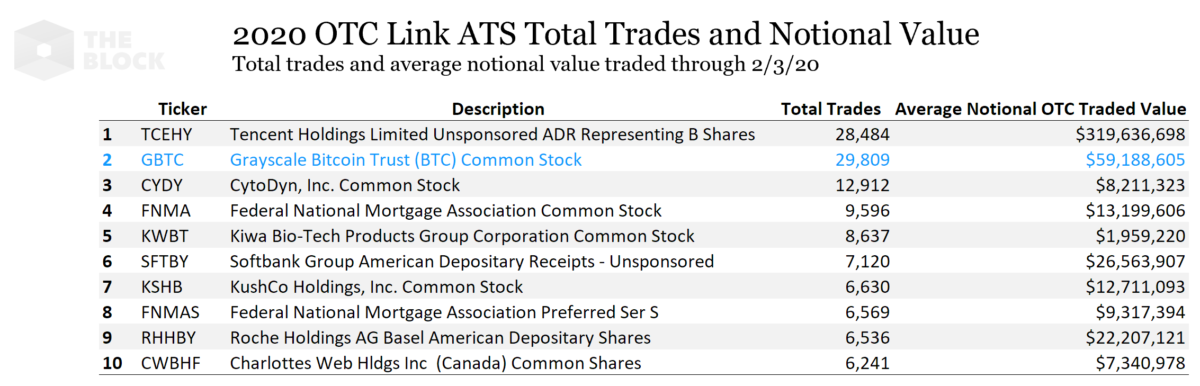

On the OTC Link ATS platform, GBTC shares are the second most popular financial products after Tencent B Shares.

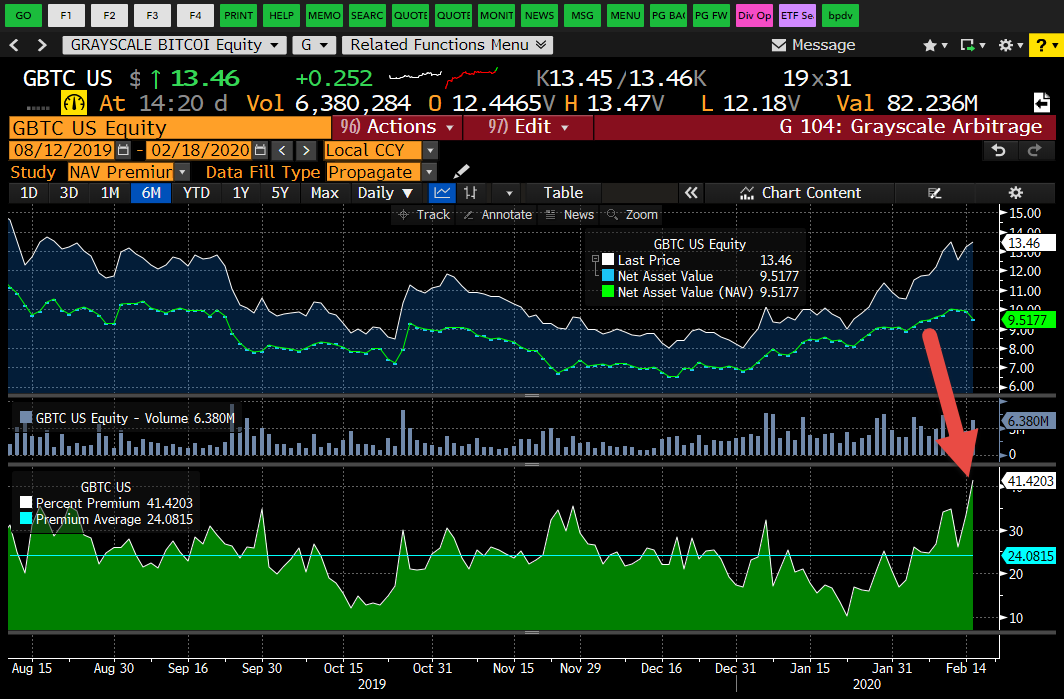

The Block notes that GBTC shares are trading well above their underlying asset (Net Asset Value, NAV).

By mid-February, the difference between the market value of GBTC shares and the underlying NAV fund was 41% (an increase of 6% compared to the previous month). Data: Bloomberg.

Thus, investors pay more for GBTC shares than if they bought Bitcoin directly.Therefore, large players are much closer andmore understandable are traditional financial assets. Based on this, it can be assumed that the integration of the traditional market with the cryptocurrency will contribute to the demand for bitcoin, which is the basis of stocks of funds and other securities.

Regulated Bitcoin Futures on Bakkt and CME

Activity on Bakkt continues to grow. Open interest on the platform in January reached a historic high of $ 12 million. The average trading volume in the same month amounted to $ 26.45 million (+ 22% compared to December 2019).

Data: The Block

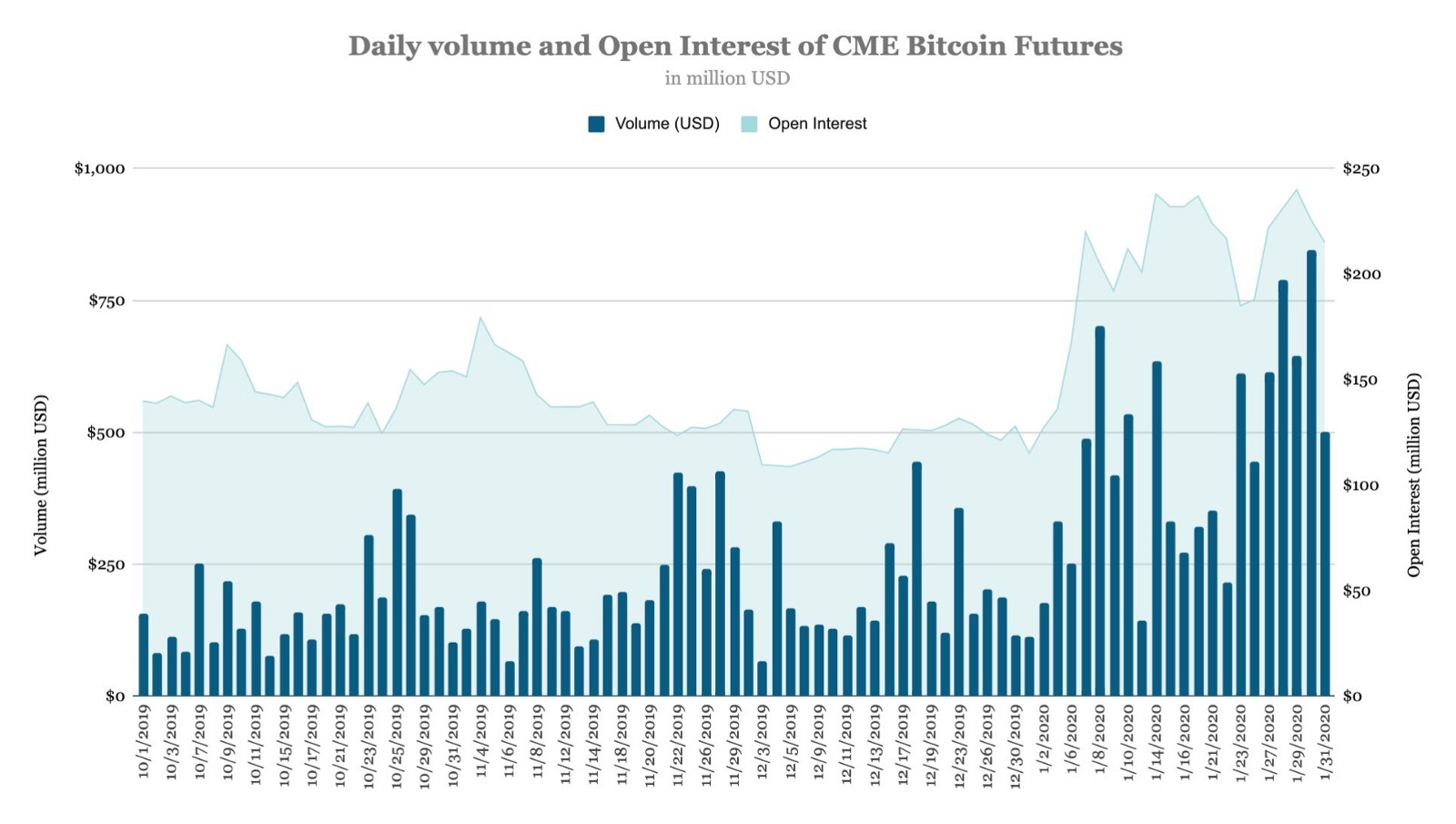

However, Bakkt's revs are still relativelysmall compared to the Chicago Mercantile Exchange (CME), where the volume of trading in bitcoin futures is 17 times higher. The average daily turnover on CME in January increased by 144% compared to December - from $ 187.71 million to $ 458 million.

January 2020 was the second most successful month since the launch of CME futures:

</p>In 2019, the volume of trading in Bitcoin contracts on CME increased by 69% compared to the previous period.

Also, according to Arcane Research, futures quotes are significantly higher compared to the spot price.

The contango and growing demand for regulated bitcoin futures indicate an improvement in market sentiment and confidence of large investors in the prospects for the first cryptocurrency.

Fidelity

$ 7 trillion Asset Manager FidelityAt the end of last year, Investments received a license from the New York State Department of Financial Services (NYDFS) for its unit to operate as a custodial service and platform for operations with bitcoin.

“The custodial and trading services we provide are important building blocks for the further massive adoption of digital assets among institutional investors”“Said Fidelity Digital Assets COO Michael O’Reilly.

It is known that Fidelity plans to become a custodian for the fund based on bitcoin options and is working on Ethereum support.

Fidelity recently acquired a $ 14 million stake in Hong Kong-based BC Group, the operator of OSL's Digital Asset Institutional Digital Platform.

“This is another indication that largeinstitutional investors are in the realm of digital assets. This is a confirmation of what the BC Group and OSL believe in - mass adoption is inevitable. Leading financial companies invest in institutions with institutional infrastructure that meets all regulatory requirements and standards. ”- said BC Group CFO Steve Zhang.

OSL is a cryptocurrency exchange focused on large players, which also provides brokerage, custody and SaaS services.

Many financial companies interested in cryptocurrencies create and invest in platforms focused on the needs of their own kind. Significant emphasis is placed on the custodial component.

Indeed, the focus is on bitcoin; Popular altcoins like Ethereum are still being studied by institutional groups.

Future forecasts

Vision Hill analysts predict that 2020 will be one of the brightest in the history of the crypto industry. However, they emphasize that the forecast does not apply to the market value of digital assets:

“If everything in the industry depended solely on fundamental progress, then the bull market would rage over the past two years.”

Experts expect this year to continue growing industry. Asset prices, they say, are a derivative of the degree of market development.

Investments in the cryptocurrency sphere frommajor players are growing, but still make up a small part of the huge institutional portfolio. Cryptocurrencies are still considered a new class of assets, many players still see them as too high a risk.

Nevertheless, the industry continues to grow and develop, uncertainty is gradually dissipating, and the framework for assessing all prospects is becoming clearer.

“We hope that this will lead to larger and more informed investment decisions”, - Vision Hill representatives expressed optimism.

According to a survey conducted by Fidelity, 47% of institutional respondents with “exceptionally good opinions” about cryptocurrencies:

"Institutional investors find digital assets attractive; many would like to invest in them over the next five years."

Well-known cryptocurrency analyst and trader Ton Weiss, in a conversation with Crypto News, said the following:

“I am sure that the number of family offices seeking to acquire bitcoin for the long term is growing.”

Weiss also emphasized that in the future, institutional groups will prefer mainly the first cryptocurrency.

Thus, if the whales continue to beTo associate the cryptocurrency market with Bitcoin alone, then in the future its market share will continue to increase. With tightly limited supply, declining due to halving inflation and constant or growing demand, the price of bitcoin will rise. This is an objective and, therefore, independent of the will of people economic law of demand.

Alexander Kondratyuk