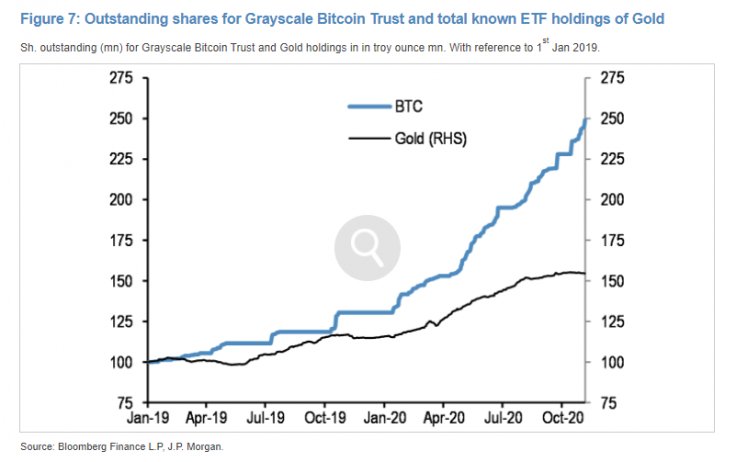

Grayscale Investments' Bitcoin Trust outperforms gold-based exchange traded funds (ETFs), not leastturn thanks to the participation of institutionalinvestors. This opinion was expressed in a new report by analysts from the largest American bank in terms of assets under management, JPMorgan, excerpts from which are provided by CoinDesk.

“This contract supports the idea thatsome investors who have previously invested in gold ETFs, such as family wealth management firms, may consider Bitcoin as an alternative to gold. ", They write.

In other words, the rise of the GBTC trust suggests that the demand for Bitcoin comes not only from the millennial generation, but also from large institutional investors, the authors of the report explain.

“As we noted in the previous report from 23October, the potential for long-term growth for bitcoin is significant if it competes more intensively with gold as an “alternative” currency. The market capitalization of bitcoin from current levels should rise 10 times to match private sector investment in gold through ETFs or bullion and coins "They add.

That said, JPMorgan included a warning to investors in its report:

"The sharp price spike this week seems to have brought Bitcoin close to overbought levels."

Rate this publication