For a long time, bitcoin was positioned as an asset,which does not correlate with the traditional ones, but the current recession clearly demonstrates that institutional investors do not consider it a safe haven in which global market shocks can be waited.

On Monday, the Dow Jones index lost 7%, andoil showed the largest price drop in the last 30 years, the bitcoin rate also decreased by 20%. However when traditional markets just began to fall amid the coronavirus epidemic, and cryptocurrency was growing, many expected an influxinstitutional investors. Unfortunately, this never happened.

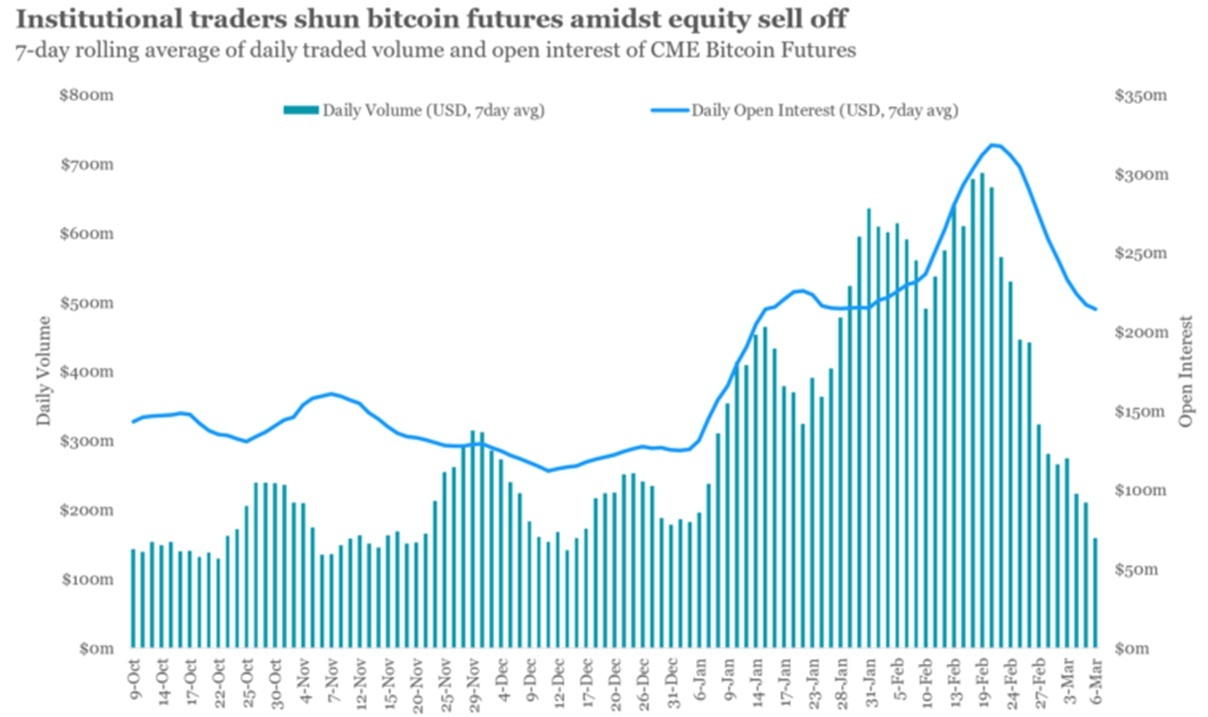

About the interest of large players in the MTC canjudge by the futures market, the most convenient instrument for them, associated with digital currency. For example, after the volume of CME bitcoin futures reached its maximum on February 19, the lowest rate in 2020 was recorded on March 6. At the same time, over the past two weeks, open interest in the instrument has decreased by 25%.

This clearly shows that institutionalinvestors do not consider digital currency to be digital gold, preferring more stable assets, and the market itself is clearly correlated with traditional markets.

</p>