Cointelegraph's second annual study found that 62% of professional investors have either alreadyown digital assets (43%) or plan to acquire them in the future (19%).

In 2022, at least threenotable research among professional crypto investors: from Cointelegraph, Bitwise and Nickel Asset Management. On average, 45% of the organizations surveyed have investments in cryptocurrencies.

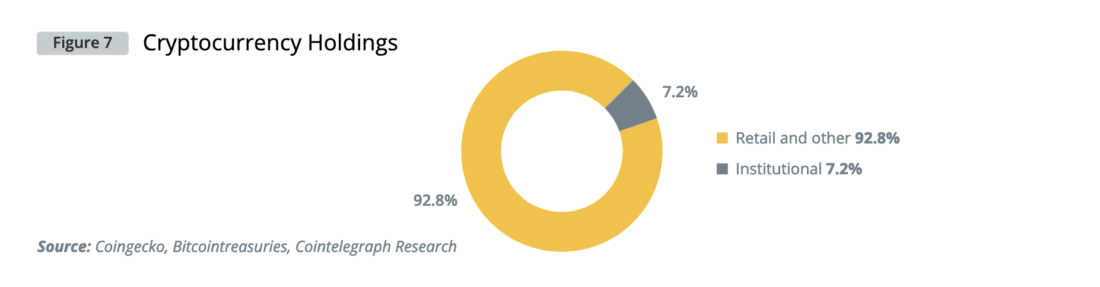

- In total, under the control of respondentsthere is $316 billion, 3.3% of which (about $10.43 billion) is invested in cryptocurrencies. Institutional investors, including public corporations and governments, hold more than 1.39 million BTC, representing 7.2% of Bitcoin's circulating supply as of October 2022.

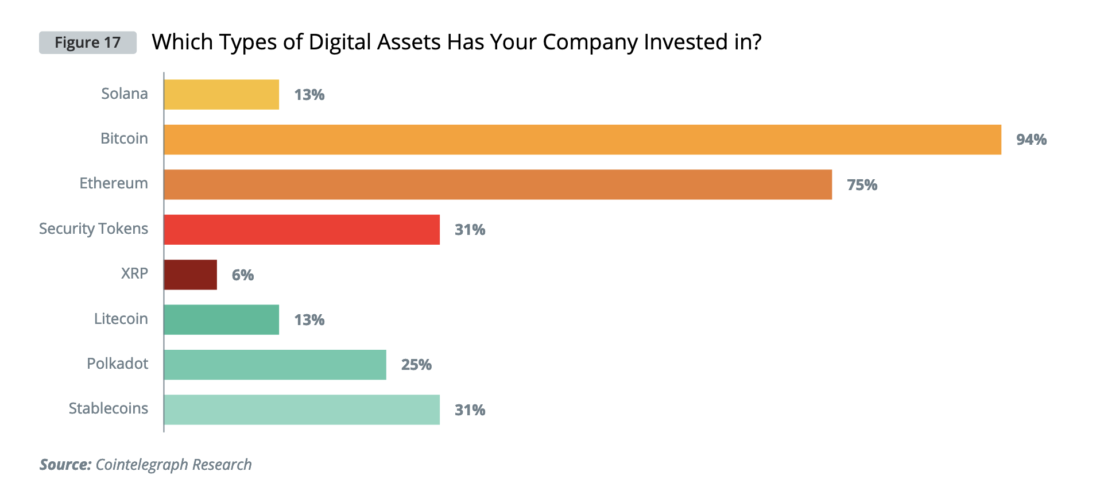

- Professional investors hold predominantlybitcoin (94%) and ether (75%). Institutional investors also show significant interest in tokenized assets (31%) and stablecoins (31%). They placed smaller shares of capital in Polkadot (DOT) (25%), Solana (SOL) (13%) and Litecoin (LTC) (13%). Some of the investors also mentioned their interest in shares of public blockchain companies.

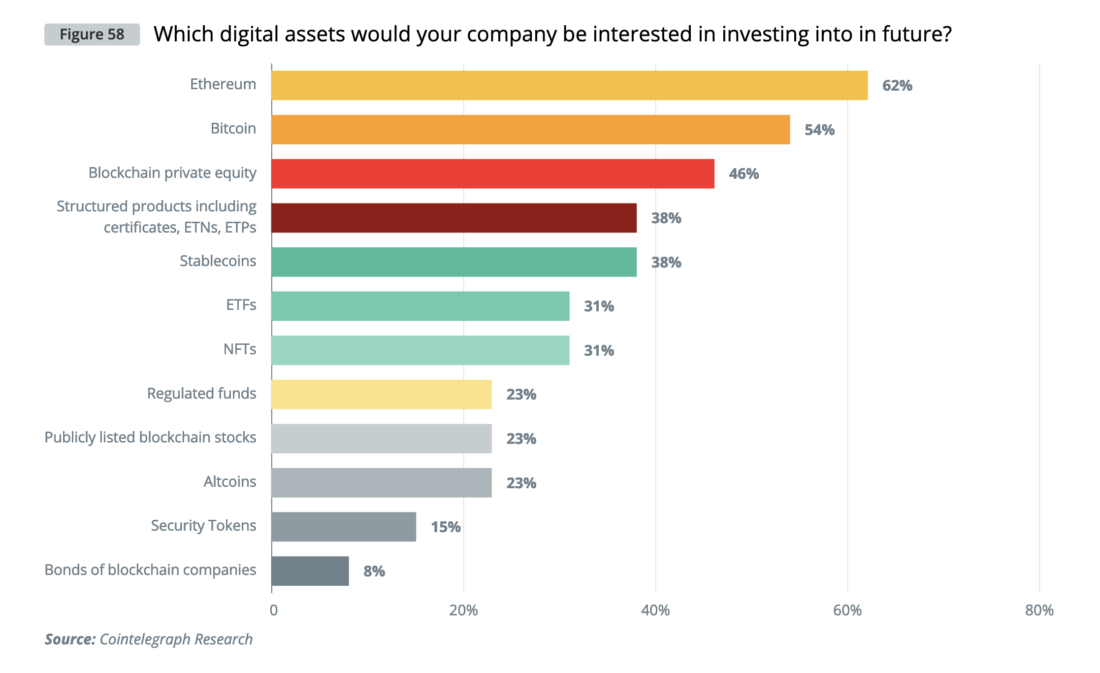

- Institutional investors with slightly moremore likely to buy ether than bitcoin in the next 12 months. 62% of the surveyed investors announced their intention to buy ether, for bitcoin this figure was 54%.

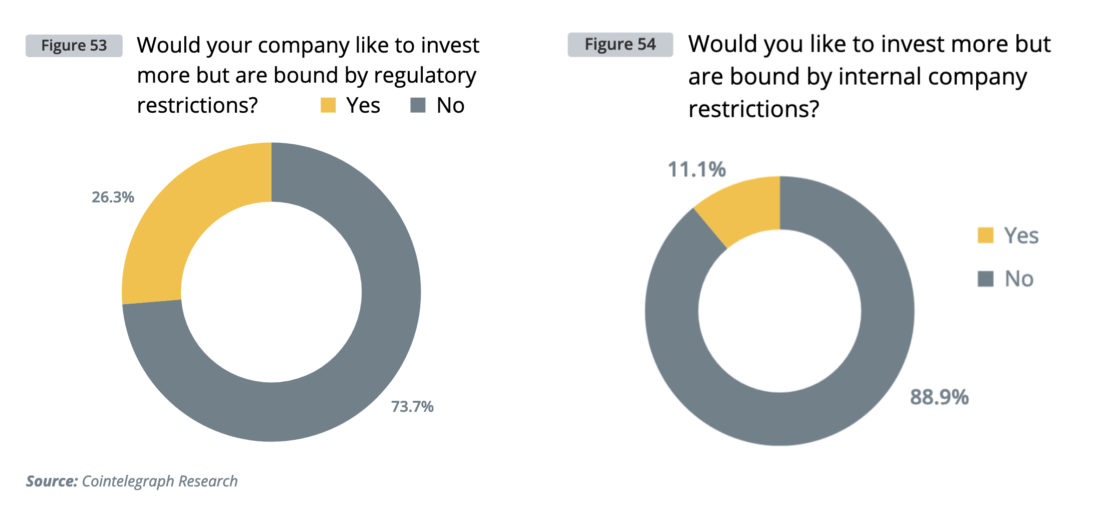

- Regulation stops one in four professional investors from acquiring bitcoin and continues to hinder further institutional adoption of cryptocurrencies.

Cryptocurrency financial markets and products:

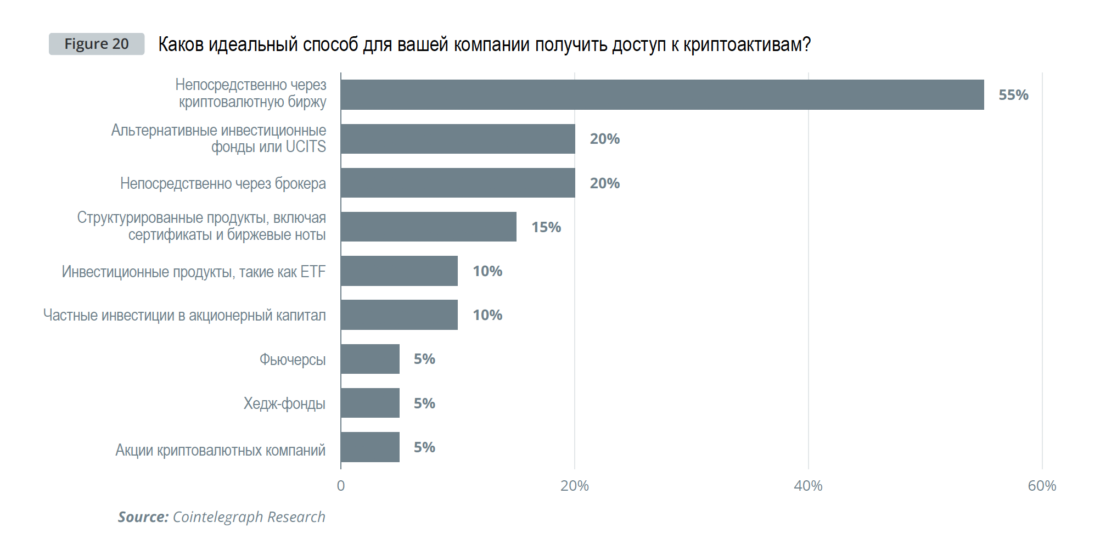

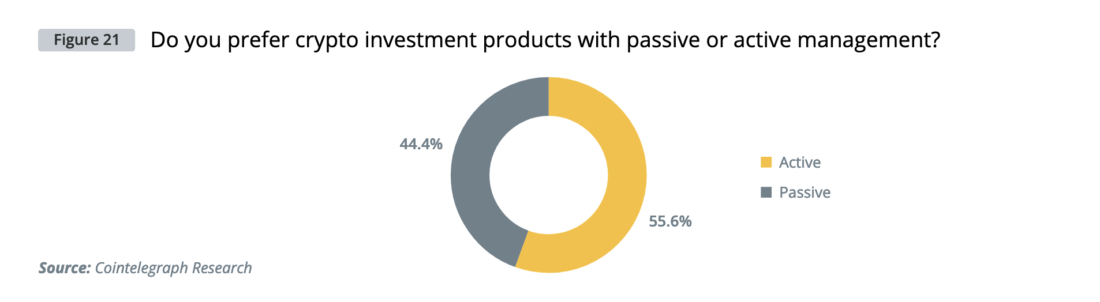

- According to the survey results, a small majorityinvestors (55%) prefer to hold cryptocurrencies directly. Interestingly, professional investors prefer investing in regulated funds to buying structured products or trading futures. Active strategies outperform passive ones by a small margin.

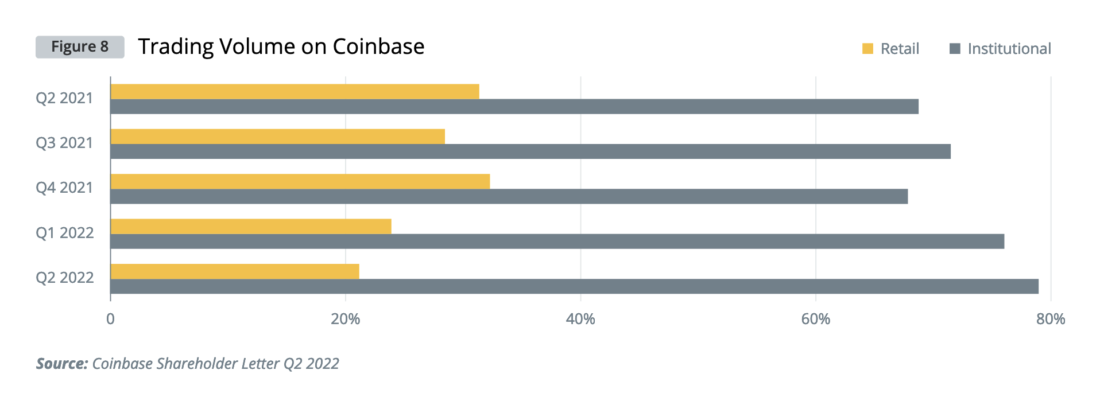

- Institutional investors account for 79% of Coinbase's daily trading volume.

- Perpetual futures markets are 5 to 10 times more liquid than spot markets.

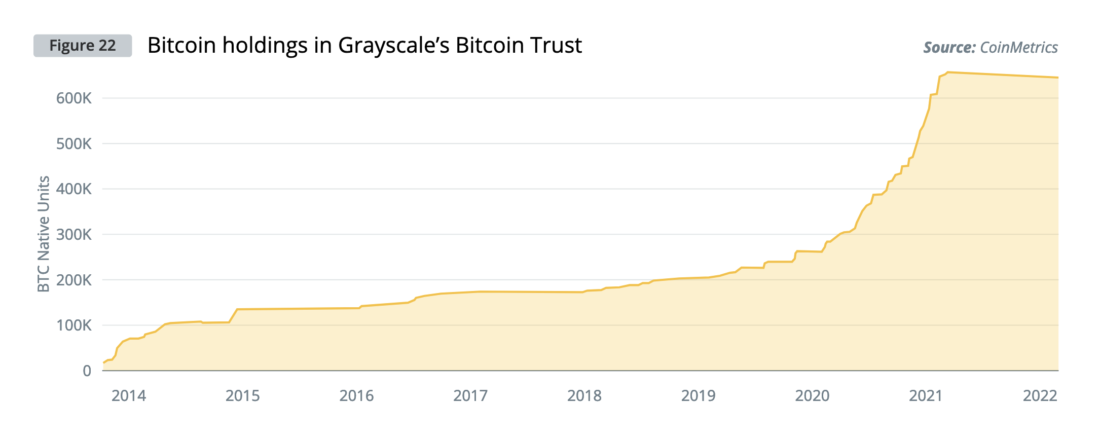

- The majority of institutional investments are still made through passive funds, among which the Grayscale Bitcoin Trust dominates with over 90%.

- There are over 800 digital asset funds in 80 countries around the world.

- ETH Options Open Interest ($5B)recently surpassed BTC options open interest ($4.8 billion), suggesting sophisticated traders are more interested in speculating on Ethereum.

Geographic Findings:

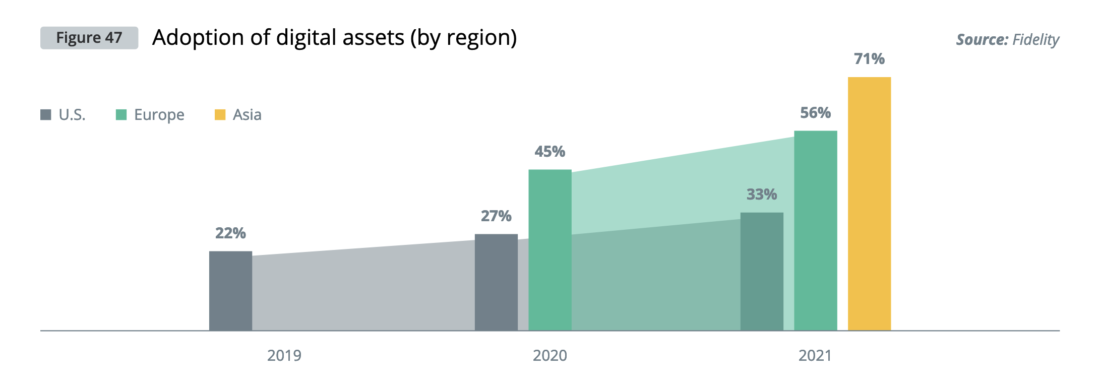

- Asia is a clear leader in the institutional adoption of digital assets; Europe and the US are somewhat behind with roughly equal levels of adoption.

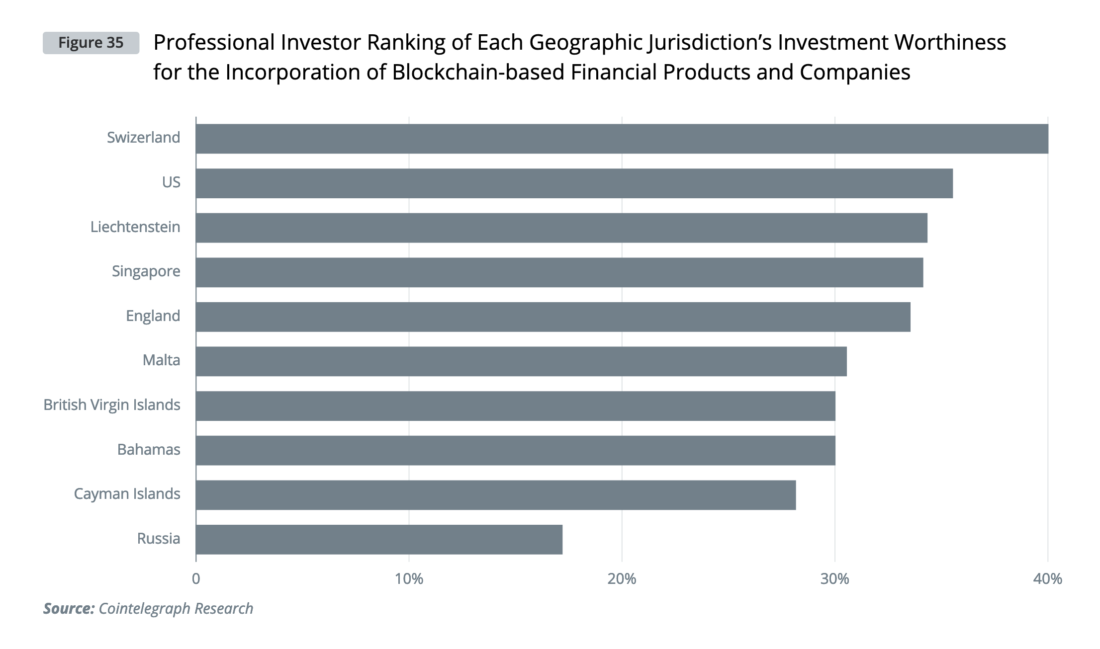

- Switzerland ranks first in terms of investment attractiveness in the field of digital assets, followed by the United States and Liechtenstein.

Navigation

- Survey of professional investors from Cointelegraph

- Methodology →

- According to the survey results, 45% of professional investors have investments in cryptocurrencies →

- Top 10 largest institutional investors in cryptocurrencies →

- Comparison of institutional and retail cryptocurrency holdings and trading volumes →

- Cryptocurrency Perception →

- When was the first wave of FOMO about cryptocurrencies among institutional investors? →

- Top Reasons for Buying Cryptocurrencies for Institutions →

- Top cryptocurrencies in the portfolios of professional investors →

- Crypto funds, corporate finance and derivatives

- Capital inflows into crypto funds →

- Mergers and acquisitions in the crypto market by traditional finance →

- How institutional investors buy and hold digital assets

- Crypto-friendly banks →

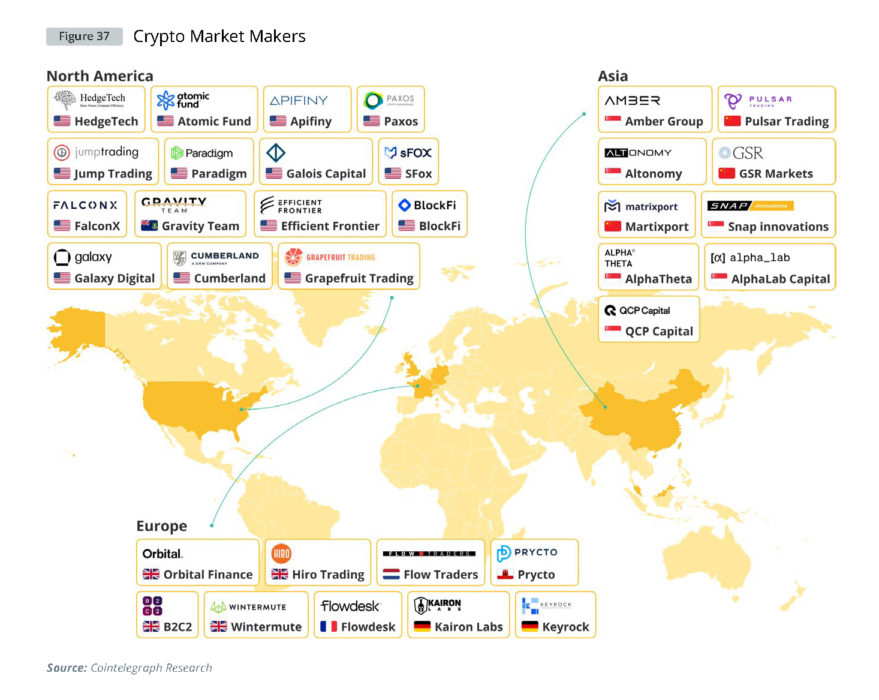

- Market makers →

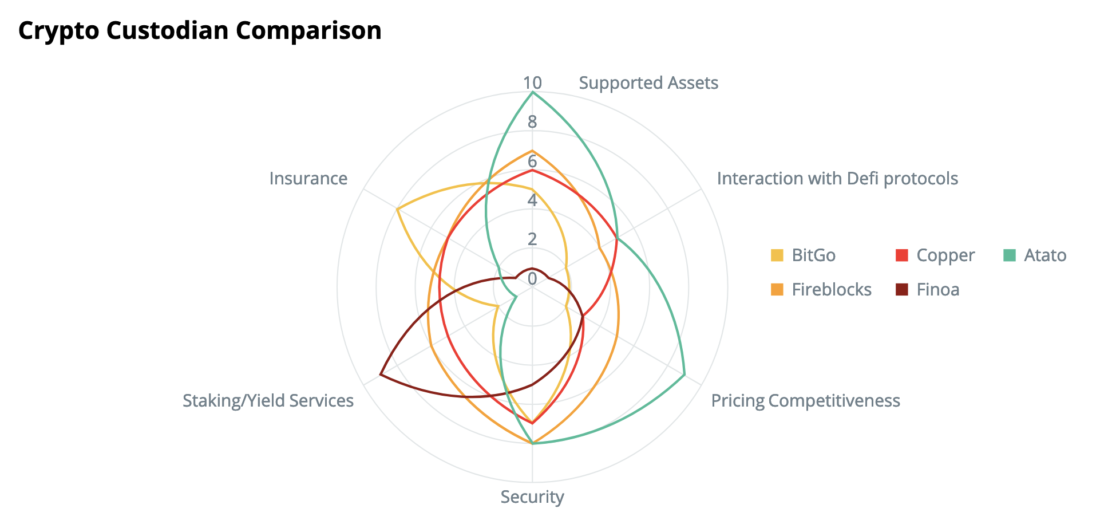

- Institutional Grade Cryptocurrency Custody Services →

- Demographics of Institutional Investors in Cryptocurrencies

- Geographic distribution of professional investors investing in cryptocurrencies →

- Barriers to institutional adoption of cryptocurrencies

- Prospects for institutional demand for cryptocurrencies

- Plans for buying cryptocurrencies in the future →

Professional Investor Survey by Cointelegraph

This report presents the results of the secondCointelegraph's annual survey of professional traditional finance investors. The survey provides comprehensive insights into the crypto investments of professional investors, including changes in their perception of digital assets and plans for future capital allocation.

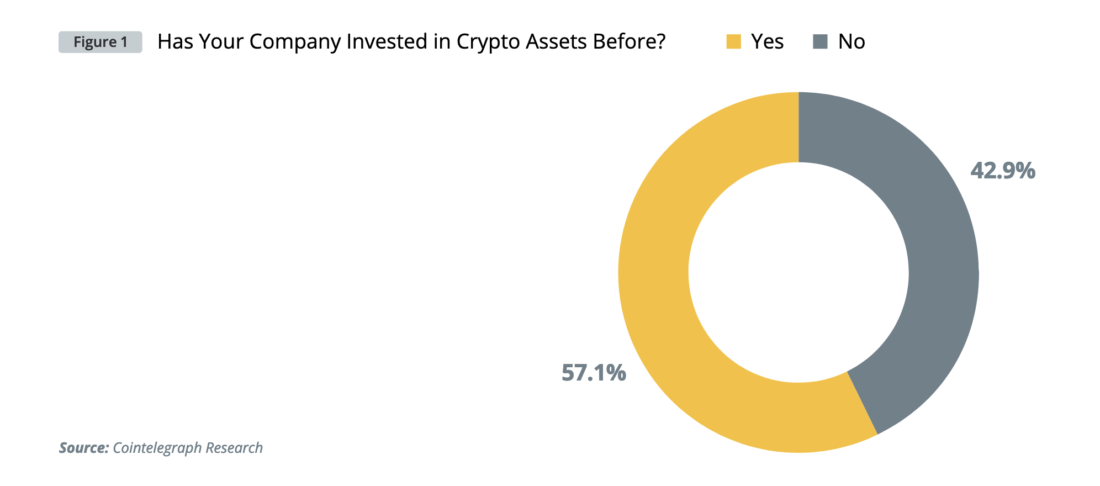

43% of professional investors already own cryptocurrencies, 19% plan to buy them in the future

The main conclusions confirm all those rumors aboutthat professional managers invest in cryptocurrencies. Over the past two years, the share of institutional investors who bought cryptocurrencies has increased by 22%. A new study shows that 43% of professional investors have already invested in cryptocurrencies (compared to 36% in 2020) and that 19% plan to acquire them in the future. Of the 48 respondents who reported that they currently do not own crypto assets, 16 said they plan to invest in crypto assets in the future. That is, the majority (62%) of professional investors who took part in this survey are interested in having digital assets in their portfolio.

Has your company invested in crypto assets before?

Methodology

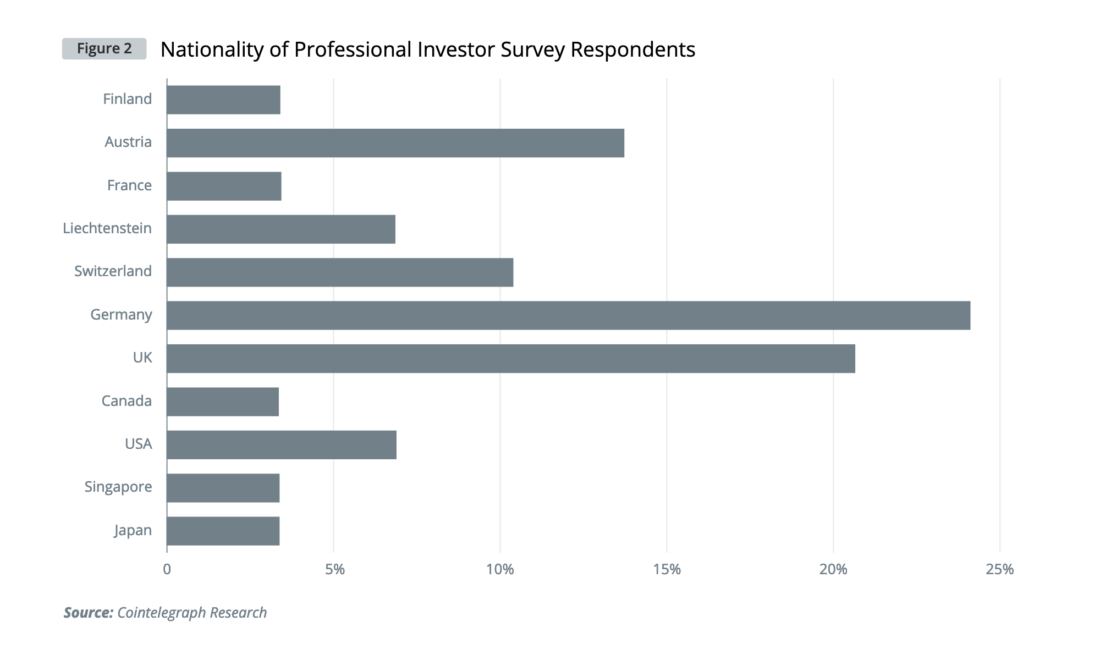

This survey received 84 responses fromprofessional investors from all over the world, mainly from the USA, Europe and Asia. The respondents included representatives of traditional banks, asset managers and pension funds. The report focuses on the distribution of capital on the buy side, not the sell side. Therefore, we did not send this survey to crypto funds that invest 100% of their capital in digital assets. The purpose of this report is to assess the demand for digital assets from traditional financial intermediaries.

The survey was sent by email 6004registered with the Financial Markets Authority professional investors in 11 countries: Japan, Singapore, USA, Canada, UK, Germany, Austria, Switzerland, Liechtenstein, France and Finland. Investors were given a two-week deadline to respond in July 2022.

$10.42 billion – the value of cryptocurrencies in the management of survey participants

The majority of respondents were from Germany andGreat Britain, followed by Austria and Switzerland. When the survey results were sorted by country, respondents from the UK found that they managed the most assets. In total, respondents have $316 billion under management, 3.3% of which, or about $10.42 billion, is invested in cryptocurrencies. Austrian respondents worked in companies with the largest number of employees. The majority (83%) of respondents worked in firms with fewer than 50 employees. Of the professionals who responded to the survey who were responsible for making decisions about the distribution of assets in their company, only one was a woman, compared to 81 men (although some respondents did not specify gender). The average age of respondents was 48.8 years.

Nationality of Professional Investor Survey Respondents

According to the survey, 45% of professional investors have investments in cryptocurrencies

According to CoinShares (pdf), the total volumeInstitutional ownership of cryptocurrencies through trusts and foundations was estimated at $62.5 billion at the end of 2021. This figure does not include direct ownership of BTC, totaling more than $10 billion as of March 31, 2022, as well as venture funding, which amounted to $25.1 billion.

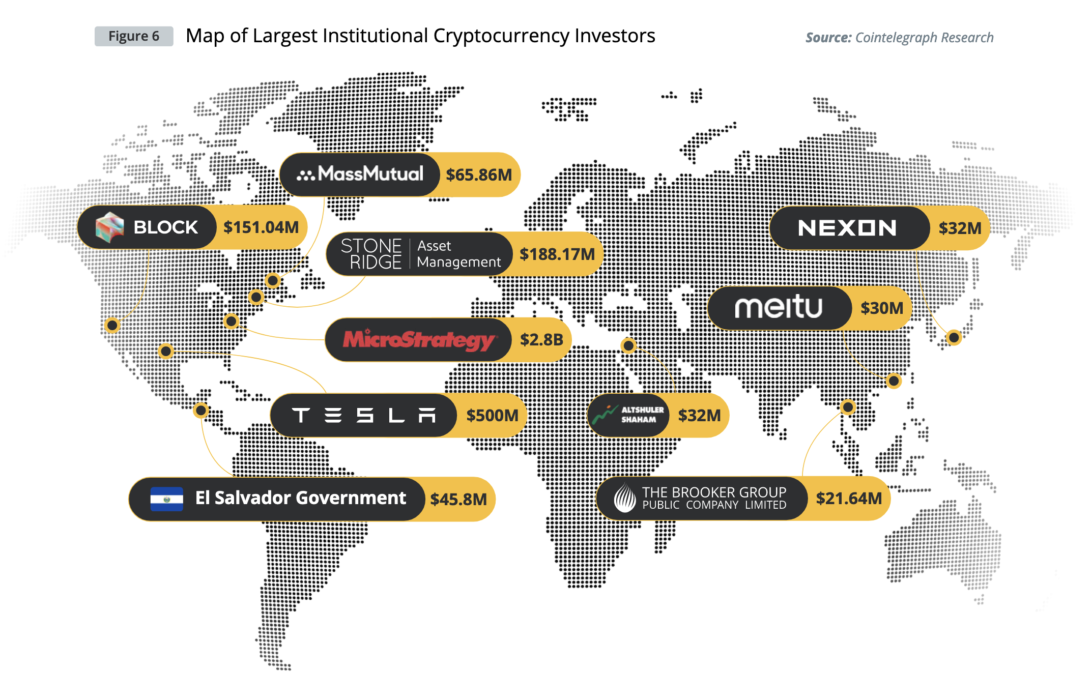

Of the 19.15 million BTC in circulation, 7.54% (1,444,201BTC) is estimated to be owned by institutional investors ranging from public companies like Tesla, private companies like MassMutual (an insurance company), exchange-traded funds (ETFs) like VanEck, to entire countries like El Salvador.

"I remain skeptical, but today many hundreds of thousands and millions of peoplein the world do not agree with this assessment… To the extent that we are trying to help institutions and investors with portfolio allocation, we should seriously consider being a market maker in the cryptocurrency markets… So it’s fair to assume that Citadel will start working with cryptocurrencies in the coming months.”

— Ken Griffin, CEO of Citadel | AUM +$50 billion

However, institutional interest is difficult to measuredirectly. It is not easy to quantify the investments of the largest traditional investors in cryptocurrencies, as many institutional investors do not disclose this information. In addition, many institutional investors have indirect exposure to cryptocurrencies and blockchain technologies through shares of public blockchain companies. Instead, surveys can be used to estimate the real volume of institutional investments in cryptocurrencies.

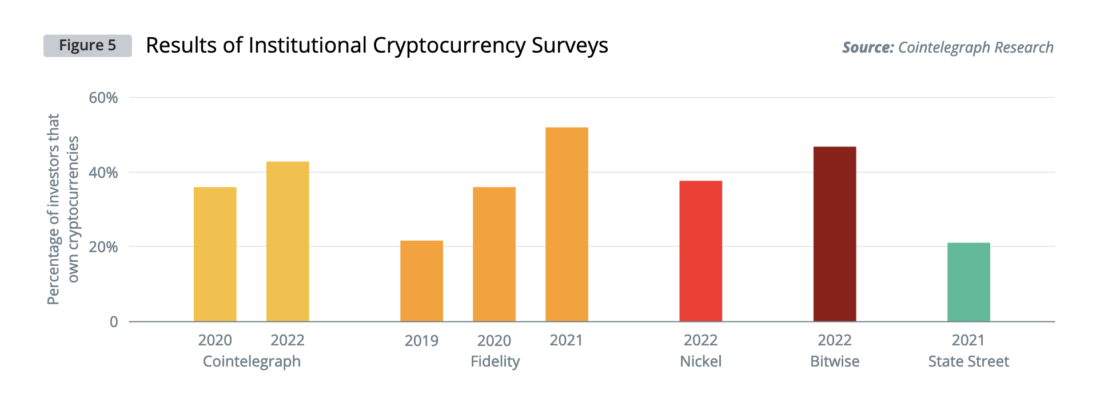

According to a study conducted by the companyFidelity (pdf), just over half (52%) of the surveyed organizations in Asia, Europe and the US have already invested in cryptocurrencies. Cointelegraph Research's results confirm the conclusions made by Fidelity based on a survey of its professional investor clients in 2021.

52% of Fidelity survey participants have already invested in cryptocurrencies

In addition to the Fidelity survey, no lessfour similar studies of the volume of professional investments in cryptocurrencies. The 2022 Nickel Digital Institutional Investor Survey (pdf) surveyed more than 100 investors with more than $110 billion in assets under management (AUM).

Comparison of the performance of a classic 60/40 portfolio and with the addition of bitcoin

Nickel Digital Asset Management specialistsnoted in their report «How Professional Investors Perceive Crypto in 2022 and Beyond» («How Professional Investors Perceive Cryptocurrencies in 2022 and Beyond») that a single-digit allocation to Bitcoin of 1-5% has a strong positive impact on portfolio returns. This can be seen in Figure 3, which shows that adding 5% Bitcoin to a portfolio of 55% stocks and 40% bonds doubles the portfolio's return. Similarly, the Cointelegraph study described in this report found that on average investors allocated 3.3% of their portfolio to cryptocurrencies.

Similar to our findings, Nickel reports:

- 91% of professional investors believe that the popularity of digital assets is growing.

- 19 of the companies surveyed invested in Bitcoin and held over $60 billion worth of BTC in total.

- 75% of digital assets are held in North America (USA and Canada).

- 78% of surveyed employees in key positions have a positive attitude towards digital assets.

- 47% say that improving custodial storage is one of the key factors in changing sentiment.

- 25% have more than doubled their investment in the last year.

- 38% believe that their funds will invest 5-10% of their capital in crypto assets.

- Exploiting market inefficiencies was #1 alpha for 69% of the investors surveyed.

- 79% cited security considerations as a deterrent.

- 67% expressed concerns about the volatility of cryptocurrencies.

- 56% pointed out that low market capitalization implies low liquidity.

- 46% spoke of concerns about regulation.

Dominance of security and liquidity concernsover regulatory issues and legal risks, was, in our opinion, the most unexpected conclusion from this report. This means that quality custodial services with a proven track record and an improved derivatives offering can be critical to attracting more institutional investors to the digital asset market.

Both take time, but we've already seenseveral promising proposals are under development and we are cautiously optimistic that significant improvements can occur in this area in the next 12 months.

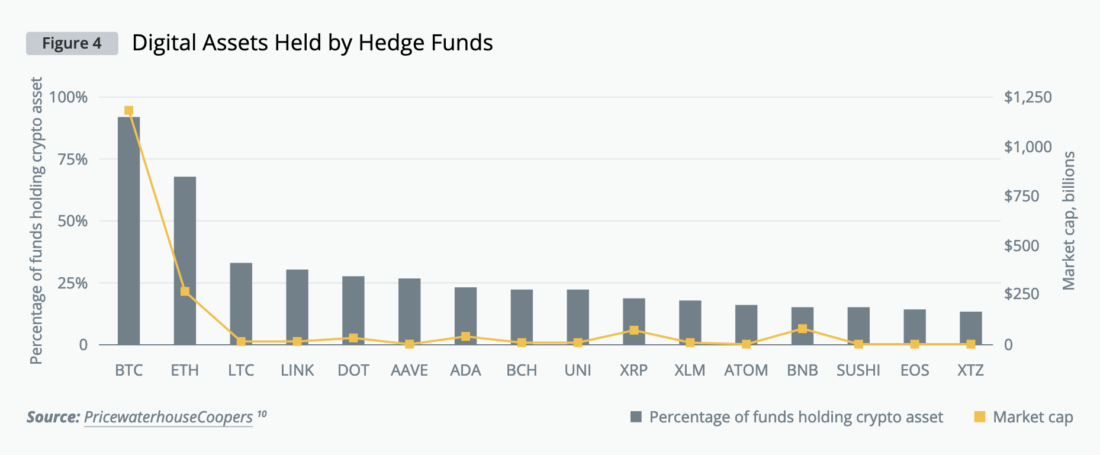

The second such report is the Annual Global CryptoHedge Fund Report 2021 (pdf) by PricewaterhouseCoopers. Since the focus of the PwC report is on investments in 2020-2021, returns do not reflect current market conditions and are not included here. However, we found a number of other interesting facts in it.

- In 2020, the use of institutionalby custodial services investors decreased from 81% to 76%, indicating that institutions are more involved in protocol management, which custodians do not usually support.

- Digital asset funds were mostly registered in the Cayman Islands (34%) and in the USA (33%).

- In contrast to a more recent Nickel Digital report, 82% of those surveyed cited regulatory issues as one of the biggest barriers to investment in the industry.

- 2020 has seen a clear decline in quantitative digital asset investment strategies in favor of discretionary long and short hedge funds.

- The bulk of the investment capital was made up of family offices and high net worth individuals, with an average of only 23 investors per fund.

- Investments were dominated by BTC and ETH, demonstrating the power law effect we have seen in other reports.

- 53% of funds allow active shorting of digital assets.

- 28% have active short positions.

- Only 56% of hedge funds use derivatives as part of their investment strategies.

- Decentralized exchanges were used, but far behind their centralized counterparts, with only 16% of participants using Uniswap and 8% using 1inch.

- The average size of investment teams was7.6 people, while experience with cryptocurrencies per team member was 2.8 years. It seems that veterans of the «ICO bubble» occupy senior positions in hedge funds.

- The lock-up period for capital in digital asset funds was one year across all funds surveyed, with about 30% of funds implying a hard lock.

The PwC report is a less recenta study of the rather former state of the investment landscape. Nickel Digital's research, in turn, reflects a landscape in which investor regulatory concerns have been partially resolved and investment strategies have matured. Investing in digital assets quickly professionalizes their operations and offerings.

The third report we want to talk about is the October 2021 State Street Digital Assets Survey. The report states that:

- 82% are allowed to place capital in digital assets.

- 21% actually own them, although the majority plans to increase their exposure in this direction.

- 56% expect cryptocurrencies to become commonplace in modern investment portfolios in the next three years.

- Small funds are the main factor in the growth of investments in digital assets. Sovereign wealth funds are generally prohibited from making such investments.

- As in the PwC report, funds prefer direct spot purchases without the use of leverage.

- Custodian solutions are a critical element for respondents, as cybersecurity concerns are a top hurdle.

- Decentralized finance (DeFi) and non-fungible tokens (NFTs) are seen as the main growth drivers for crypto adoption.

- 52% believe that blockchains will enable real-time settlement in financial markets in general.

Finally, the Bitwise/ETF Trends 2022 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets (pdf) provides some very encouraging figures:

- 94% of financial advisors received questions from clients about cryptocurrencies.

- 47% of advisors reported holding digital assets for themselves.

- The share of client accounts with digital assets increased from 9% to 16%.

- Shares of public crypto companies like Coinbase topped the list of investments (46%), BTC (45%) and ETH (41%) are not far behind.

- 60% cited regulatory issues as the main deterrent.

- 53% think cryptocurrencies are too volatile.

- 34% had difficulty applying valuation methodologies to digital assets.

- In addition to regulation, 46% said they would consider investing in digital assets when better custodial solutions emerge.

- 44% of respondents wanted to invest in a spot exchange-traded fund (ETF).

Comparing the results of four conducted in 2022year of surveys on professional investments in cryptocurrencies, it can be said that 45% of institutional investors have investments in digital assets. If there is anything in common between these reports, it is the notion that clear regulation and good custodial solutions will open up opportunities for broader investments in digital assets. These two factors are highly correlated with each other as custodial organizers have some legal responsibility and are most likely waiting for some more clarity themselves. Over the past year, we at Cointelegraph have seen legislators awaken to the promise and dangers of blockchain technology, and we hope they can provide the clarity and guidance to enable innovation while protecting the interests of investors and consumers.

Institutional Crypto Survey Results: Percentage of Investors Owning Crypto Assets

Top 10 largest institutional investors in cryptocurrencies

Target group for financial products based onThe blockchain includes pension funds, insurance companies, university endowments, high net worth individuals, family offices, wealth managers, banks and funds of funds from all over the world. In compiling our list of the top 10 institutional crypto investors in the world, we focused on traditional finance companies that have disclosed their crypto holdings.

The largest institutional investors in cryptocurrencies on the map

“It's a great speculation. I hold a little bit of Bitcoinmore than a percentage of their assets. Maybe almost two percent already.This seems like the right deal for today. With every day of Bitcoin's successful operation, trust in it will grow… I'm not a fan of hard money and I'm not crazy about the whole crypto thing. But at the end of the day, the best strategy to maximize profits is to bet on the fastest horse… And if I had to make a prediction, I would bet on Bitcoin.”

– Paul Tudor Jones, founder of Tudor Investment Corporation | AUM $24.9 billion

Comparison of institutional and retail cryptocurrency holdings and trading volumes

An important question in the context of cryptocurrency adoption isthe extent to which savings and trading volumes are dominated by retail or institutional investors. And as increased activity from institutional investors signals the adoption of cryptocurrencies by the mainstream, cryptocurrency observers are closely monitoring the development of this trend.

Institutional investors hold over 1.39 million BTC

Identify the owner of a specificcrypto wallet is a non-trivial task. Some large wallets may belong to private "whales", others - for example, to crypto exchanges and, therefore, contain funds from many investors, retail and institutional. In addition, one exchange can own several different wallets. Consequently, the distinction between retail and institutional savings will be imprecise at best.

According to estimates from popular resources such asbitcointreasuries.net, the total number of bitcoins on the balance sheets of public companies, private companies, governments and other funds is about 1.39 million BTC. The share of these coins in the total number of mined bitcoins is about 7.2%. Of course, this is a rough estimate as some wallets owned by institutional holders may have more Bitcoins. This means that these figures can be considered as the lower limit of institutional investment. And given that these numbers are specific to Bitcoin, the investment amount for the entire crypto asset sector may look different.

Investments in cryptocurrencies: retail and other 92.8%, institutional 7.2%

Institutional investors account for 78.8% of Coinbase trading volumes

Since most on-chain trading is quiteis opaque due to the very nature of crypto wallets, to understand the significance of institutional investors to the market, one has to turn to indirect indicators. For example, Coinbase publishes trading volumes for all assets on its platform, broken down by investor type. Based on trading volumes of $217 billion in the second quarter of 2022, we can see that the share of institutional investors in them increased from 68.6% in the second quarter of 2021 to 78.8% in the second quarter of 2022. That's an increase of 10.2 percentage points over the year. And although this is evidence of only one of the largest exchanges, it can well be considered as indicative of the sector as a whole.

Trading volumes on Coinbase

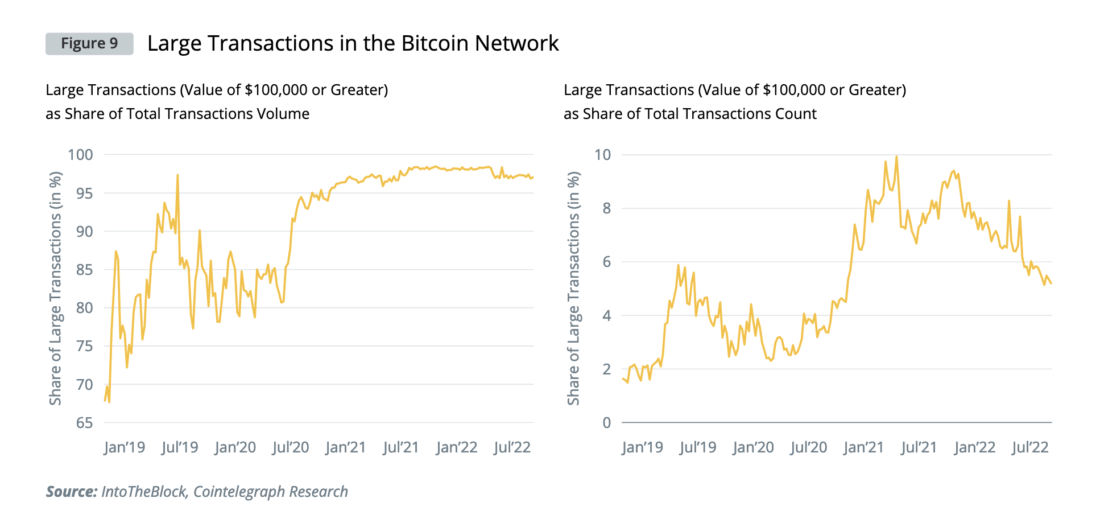

Other sources, such as IntoTheBlock, also refer to the share of large transactions, defined as transactions valued at $100,000 or more, as a measure of institutional activity.

From these figures, it can be seen that although the number of large transactions is less than 10% of the total, their value is up to 99% of the total transfer volume.

Large transactions (worth $100,000 or more) as a share of total transaction volume on the Bitcoin network

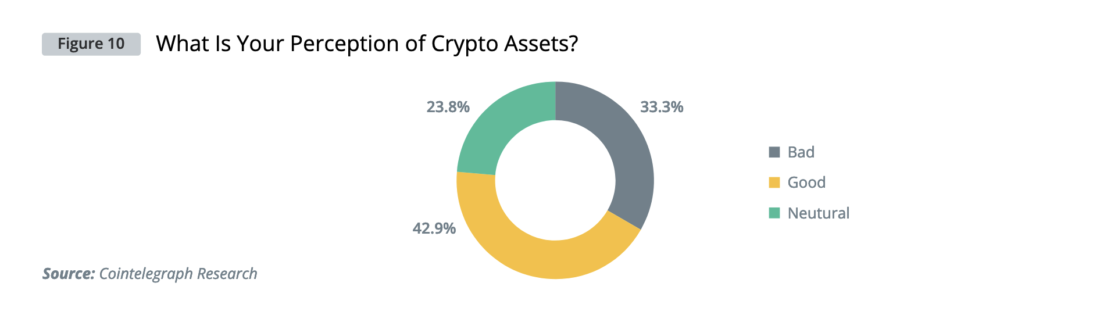

The perception of cryptocurrencies

When asked how they perceivecrypto assets, a surprisingly large percentage of respondents expressed a negative opinion. Unlike other asset classes, some professional investors seem to be clearly negative about cryptocurrencies.

How do you feel about crypto assets? 33.3% negative, 23.8% neutral, 42.9% positive

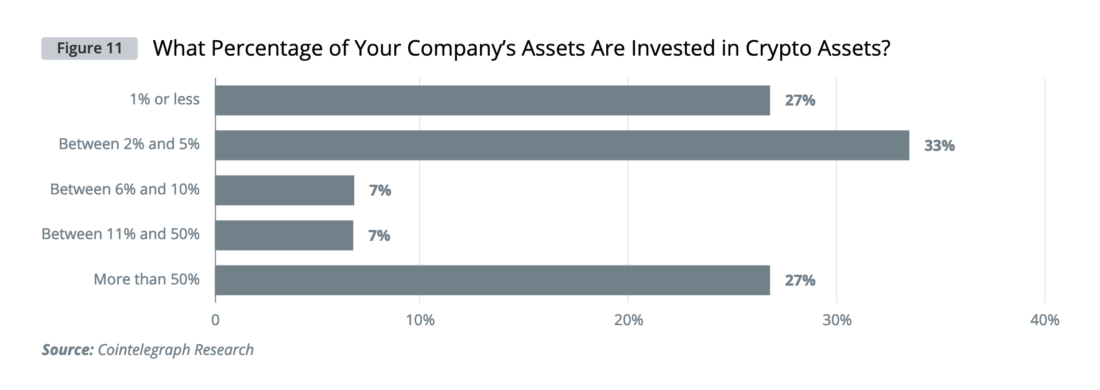

Among institutional investors holdingdigital assets, 60% of respondents invested 5% or less of their portfolio value in them. It is noteworthy that more than a quarter of those surveyed placed only 1% or less of the amount of AUM (assets under management) in crypto assets.

3% of the portfolio - the average volume of placements in cryptocurrencies among respondents from among professional investors

What percentage of your company's assets is invested in crypto assets?

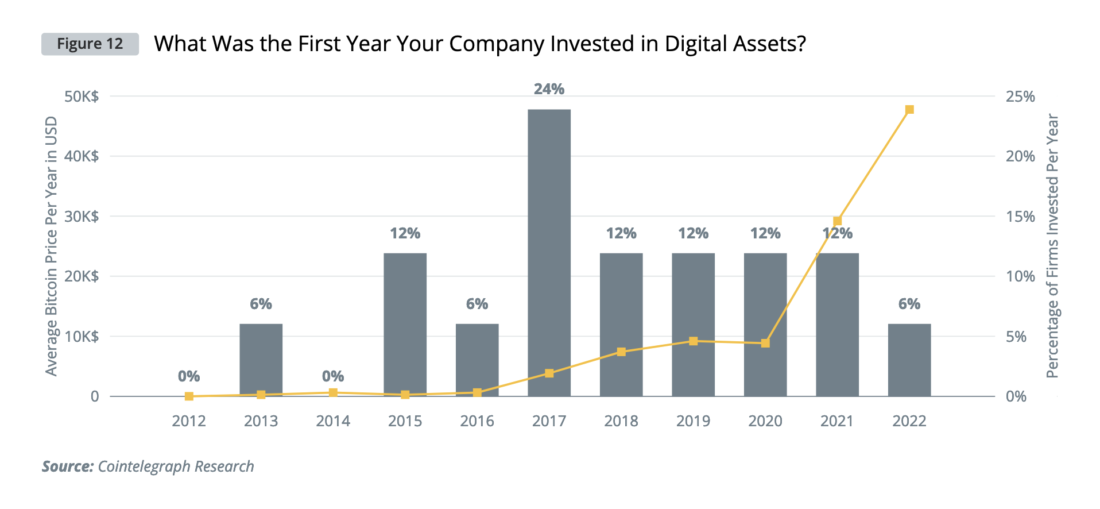

When was the first wave of FOMO about cryptocurrencies among institutional investors?

Almost a quarter of investors invested indigital assets during the 2017 bull market. Only 6% of those surveyed invested in crypto assets in 2022, following the peak on April 14, 2021, when the price of BTC was almost $64 thousand per coin and Bitcoin's market capitalization reached $1.18 trillion.

In what year did your company first invest in digital assets?

Top Reasons for Buying Cryptocurrencies for Institutions

Thomas Zeltner, CEO Zeltner & Co:

Why did you decide to invest some of your family assets in cryptocurrencies?

First, staking in Bitcoin 2-3%standard portfolio 60/40 significantly increases its Sharpe ratio. Secondly, cryptocurrencies are a unique opportunity for diversification. And finally, it makes sense for every family to invest part of their assets in the technologies of the future.

How do you allocate capital in cryptocurrencies?

We were not satisfied with the presented on the marketsolutions because we were looking for proactive solutions managed by people we trust and at a fair price. So we created our own actively managed certificate and hired Demelza Hayes, an excellent crypto portfolio manager who we trust and also has a fantastic track record. In addition, we needed a bankable product to ensure the process was scalable across all of our client portfolios.

What percentage of a portfolio should professional investors place in cryptocurrencies?

It depends on your personal risk profile and prospectsmarket. Our colleagues typically allocate less than 1% or even 0% to crypto assets, while we recommend investing between 3% and 7% depending on a variety of factors. We now view the prospects for the cryptocurrency market as neutral, but increasingly bullish. Therefore, we place 5% of the capital in it.

Kim Wirth, CIO Zeltner & Co:

How do you manage your crypto portfolio?

Our performance is the result of a combination of ownershipcryptocurrencies, staking rewards, and profiting from market-neutral derivatives strategies. We take a core-and-satellites approach, where we invest in large coins such as Bitcoin or Ethereum as the core and various smaller altcoins as satellites. Additionally, we employ an active rebalancing strategy designed to take advantage of cryptocurrency volatility while reducing risk and maximizing long-term growth.

What coins do you invest in?

We are currently diversifying investmentsbetween the three categories. Layer-1, layer-2 coins and exchange coins. We also use derivatives for certain strategies such as hedging.

How do you manage the risks of investing in cryptocurrencies from a portfolio perspective?

Let's start with the fact that our crypto product itself canbecome neutral to the market or even go into a net short if we are bearish. In addition, we optimize tactical weights for cryptocurrencies to manage overall portfolio volatility. Beyond that, portfolio rebalancing, when used correctly, is still one of the most powerful tools.

How is your research work on cryptocurrencies structured?

We use a bottom-up approach, withwith the help of which we form a pool of coins and projects that are reliable and promising from our point of view. We then track these coins using quantitative signals to decide when to buy and when to sell. In addition to this pool and signals, we form a macroeconomic picture of the world, based on which we determine the general mood regarding the cryptocurrency market as a whole. This is where we decide what percentage of capital we will invest in a predetermined pool of coins and how much in market neutral futures and options strategies.

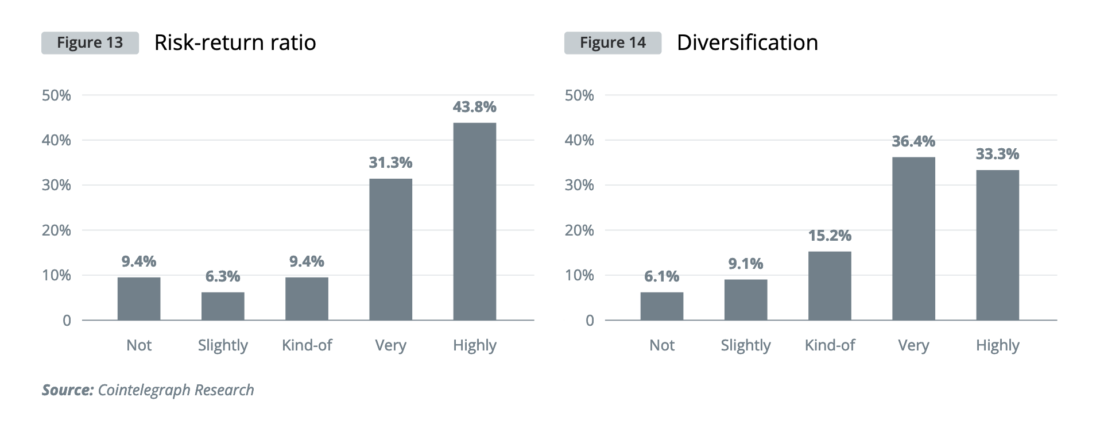

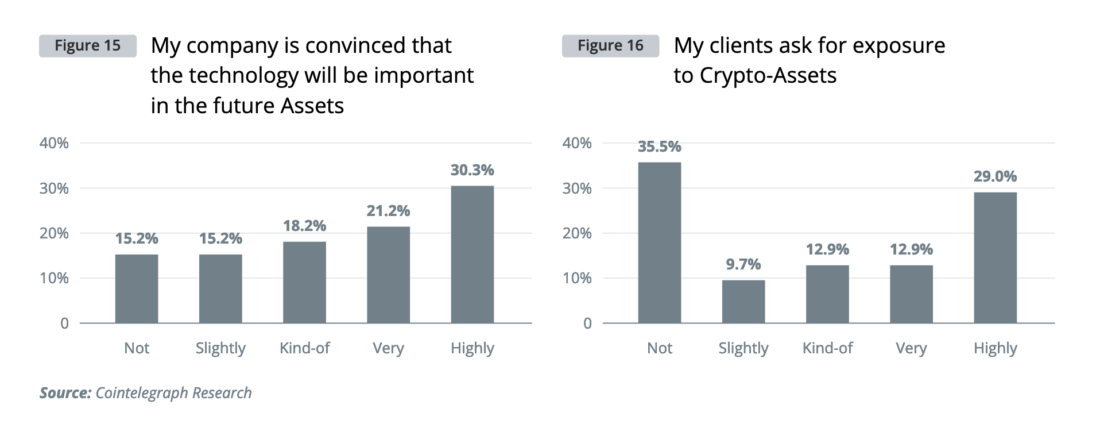

According to the survey results, the most importantThe key to investing in digital assets is the risk/return ratio: 44% of respondents rated this characteristic as «very important». The majority of votes on the factors «diversification» and «my company is convinced that this technology will play a significant role in the future» are in the middle and slightly to the right on the importance spectrum, indicating rather moderate importance of these factors for the investors surveyed. It is noteworthy that the demand for digital assets from clients, according to the survey results, does not have much influence on the decision of managers to invest in these assets.

Rice. 15: My company is convinced that this technology will play a significant role in the future

Rice. 16: Clients ask about investing in crypto assets

Top cryptocurrencies in the portfolios of professional investors

What types of digital assets has your company invested in?

Bitcoin and Ethereum

There is nothing surprising in the fact thatprofessional investors hold mainly bitcoin (94%) and ether (75%). In addition to the two main digital assets, institutional investors are also interested in tokenized assets (31%) and stablecoins (31%). They placed smaller shares of capital in Polkadot (DOT) (25%), Solana (SOL) (13%) and Litecoin (LTC) (13%). Some of the investors also mentioned their interest in shares of public blockchain companies.

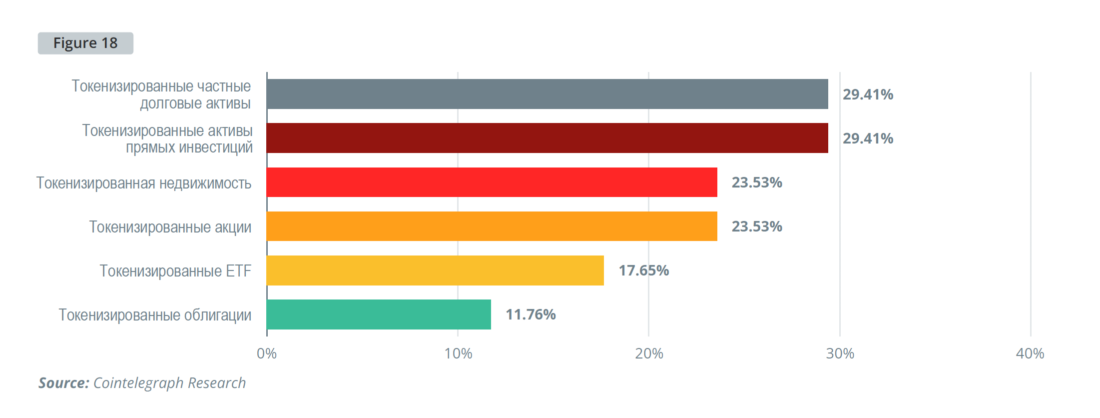

Tokenized Assets

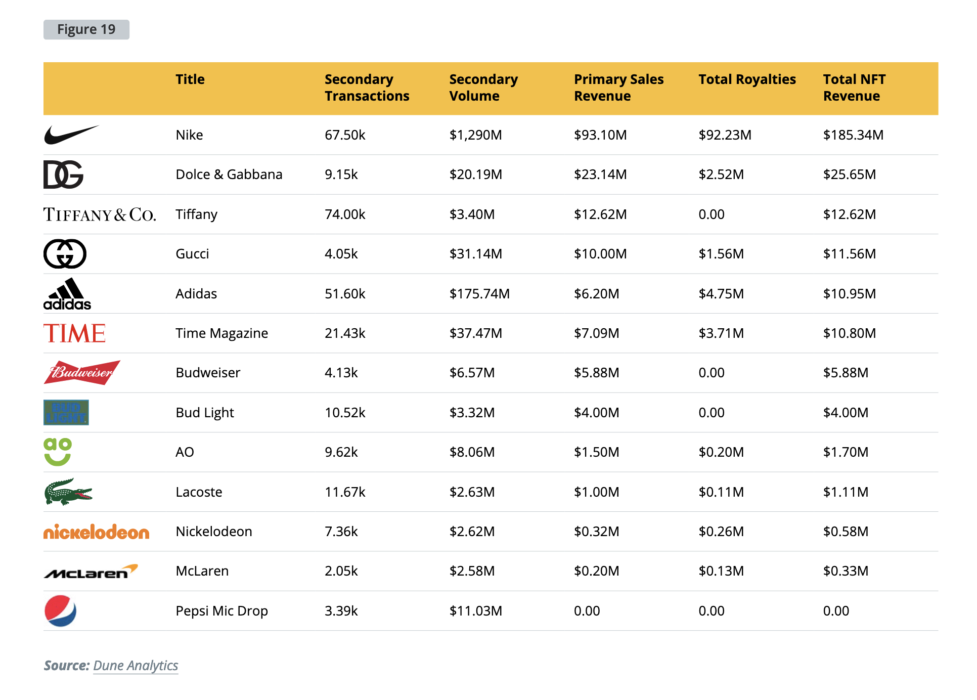

One NFT sold for $69 million

When Visa bought CryptoPunk's NFT in August 2021, the purchase created a lot of buzz. The company said (pdf) that it views NFTs as a “promising means of attracting audiences.”

Leading auction houses Sotheby's andChristie's held eight-figure NFT auctions at the height of the blockchain-based digital art market frenzy in the summer of 2021. Sotheby's digital auction lineup included NFTs from Pak, LarvaLabs and Xcopy, while Christie's sold «Everydays: The First 5000 Days» from Beeple for $69 million and curated the digital art series «Encrypted».

But not all institutional investorsare positive about NFTs. When ConstitutionDAO, an ad hoc group of private investors, attempted to purchase an original copy of the US Constitution, it was outbid by hedge fund titan Kenneth Griffin. ConstitutionDAO has raised $47 million from private investors with an average contribution of just $217. However, the transparency of the initiative suggested that other bidders knew exactly how high the group could offer.

We believe that the future demand for NFTs from institutional investors can be divided into two categories:

- Acquisition of «blue chips» from the NFT world, similar to Visa's purchase of CryptoPunk.

- NFTs as certificates of ownership of other underlying assets.

The second option was started by Uniswap, wherethe user receives an NFT representing their liquid position. Since some liquidity providers can be extremely profitable, these «utilitarian NFTs» may represent ownership of an income-generating asset.

In general, interest in and perception of NFTsinstitutional investors remains positive. However, without a solid regulatory framework and likely deeper liquidity and more sophisticated instruments, they will not invest heavily in NFTs.

Metaverses Raise $120 Billion

According to a June report (pdf) by McKinsey onAccording to a survey of 3,400 consumers and business executives, corporations, venture capitalists and private equity investors are already investing $120 billion in metaverses in 2022, more than double the $57 billion invested in all of 2021. This is largely due to Microsoft's intention to acquire Activision for $69 billion. The study also found that 95% of business executives expect metaverses to have a positive impact on their industry within five to ten years, and 61% expect it to moderately change practices in their industry.

McKinsey estimates that metaverses will have a $5 trillion market impact by 2030:

- $2-2.6 trillion for e-commerce;

- $180-270 billion for the academic virtual learning market;

- $144-206 billion in advertising market;

- $108-125 billion for gaming market.

The main reason why NFTs and metaverses are important toinstitutional investors - this is marketing «from the consumer» (consumer-led marketing), a growing and powerful method of attracting customers. Brands and projects that use consumer-driven marketing and a personalized approach to marketing will experience better user engagement and higher conversions. Since these assets are on the blockchain, investors can earn real ROI by understanding which NFTs and metaverses will go viral.

Crypto funds, corporate finance and derivatives

This section is about the ways in whichprofessional investors are investing in distributed ledger technology. The four main ways include direct ownership of cryptocurrencies, buying crypto funds, mergers and acquisitions, and derivatives.

There are numerous regulated investmentproducts that allow investors to access digital assets, including buy-only products based on a single asset or index, derivatives, self-managed trading bank accounts, and many others. According to the survey results, a small majority of investors (55%) prefer to hold cryptocurrencies directly. Interestingly, professional investors prefer investing in regulated alternative funds to buying structured products or trading futures. Active strategies outperform passive ones by a small margin.

Do you prefer passive or active managed investment products?

Dr. Alexander Thoma, Head of Digital Assets at PostFinance:

What is your position on digital assets?

Digital assets are one of our strategicdirections because we believe in the fundamental technology behind them and see the potential for many future use cases. Cryptocurrencies, which we classify as digital assets, are currently the only digital asset with the highest market readiness. In our eyes, the growing institutionalization in recent years has contributed to the growth and maturation of this market in such a way that cryptocurrencies have become the fifth asset class and it is clear that they are not going anywhere. On the other hand, we note a growing demand from our clients for services and products related to digital assets and, in particular, cryptocurrencies. Our clients want to manage their cryptocurrencies where they do their other financial business: with us as their main home bank. We believe that a significant part of the exchange services is driven by necessity, as most traditional banks still do not offer services related to crypto assets. And we want to change that. Therefore, our task is to create a safe and easy way for our customers to access this market.

Do you currently offer blockchain or crypto-related products or services, or do you plan to provide them in the future?

We do not currently offer direct investments in cryptocurrencies. Nevertheless, we develop products and services in the field of digital assets.

Capital inflow to crypto funds

On-chain data alone cannot tellwhether the address belongs to an organization or an individual. Services such as Glassnode and Nansen use data analysis to find more sophisticated heuristics and cluster addresses by common network entities, but they also do not have aggregated data on institutional demand separately.

Most institutional demandfocuses on the major cryptocurrencies as they offer the most liquidity in the spot and derivatives markets. While separating retail and institutional interest based on transaction data alone is not easy, we have identified three valuable metrics to help us do this: fund inflows, annual regulatory disclosures, and M&A deals. Let's take a closer look at this.

Bitcoin and Ethereum take the lion's shareinstitutional interest. The high liquidity of the spot market, futures and options combined with offerings such as the Grayscale Bitcoin Trust make these cryptocurrencies especially attractive.

Security is one of the main issues thatinstitutional investors want to solve, and trusts offer a very convenient and cost-effective solution. The inflow of funds into funds is one way to assess the interest of institutional investors in digital currencies.

BTC on Grayscale Bitcoin Trust balances

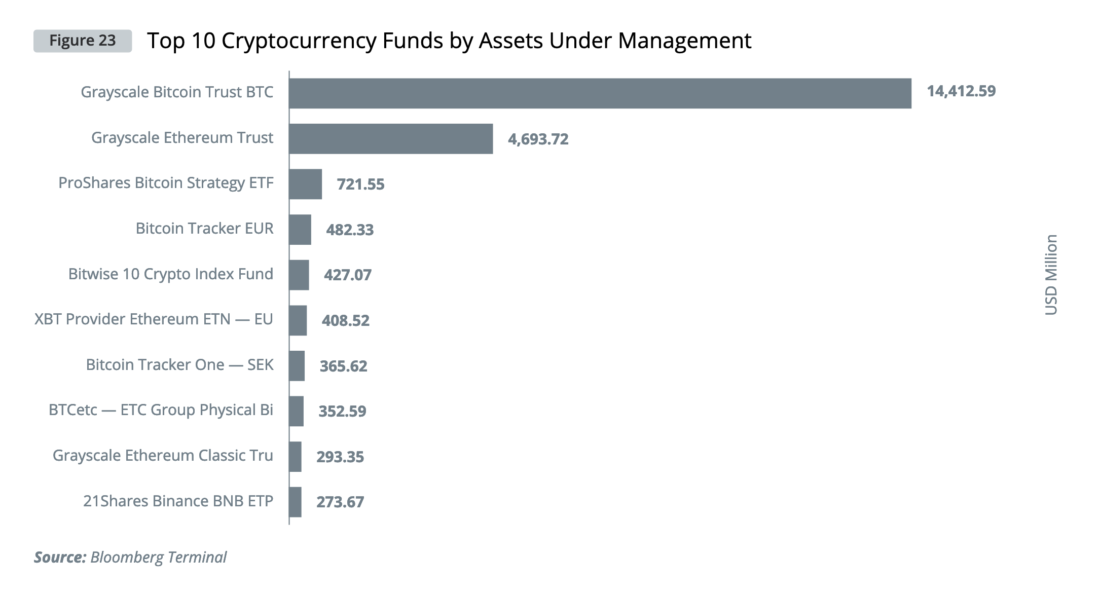

Grayscale alone holds more than 640,000BTC is worth over $10 billion at the time of writing. The noticeable plateau in GBTC balances may be due in part to increased competition from Bitcoin futures ETFs such as ProShares’ Bitcoin Strategy ETF (BITO) ($721 million AUM) and Bitwise's 10 Crypto Index Fund ($427 million AUM), as well as a general slowdown in the growth of institutional investment in Bitcoin in the 2022 bear market.

Top 10 Cryptocurrency Funds by Assets Under Management

Annual capital inflows into cryptocurrency trusts in2021 was $9.3 billion, up 36% from $6.3 billion in 2020, but a sharp slowdown from the 806% increase in inflows in 2019-2020. The market is becoming more mature and investors should not expect similar gains in the near future. We have repeatedly seen that the most explosive growth potential lies in the early stages of digital asset development. In 2013, Bitcoin's capitalization was just $1.5 billion, which means it has grown more than 800-fold at its 2021 high. It's hard to believe that Bitcoin is capable of reaching a capitalization of over $700 trillion. However, exceeding gold's market cap ($10 trillion) looks within reach under some reasonable assumptions.

“I can imagine that cryptocurrencies will play a big role in the new renaissance because people will simply not trust central banks.”

–Stanley Druckenmiller, CEO Duquesne Family Office | AUM $12 billion

Year-to-date digital asset fund performance

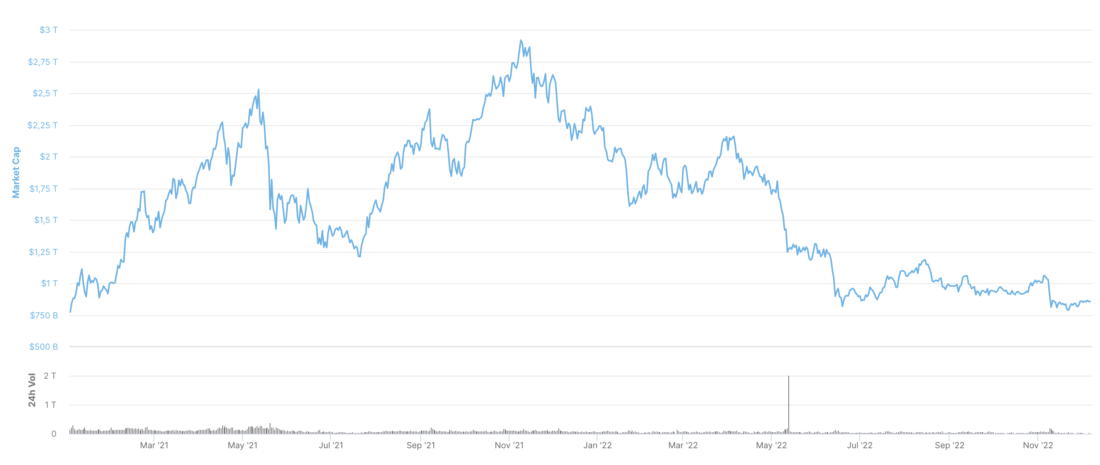

In the last 12 months there has been a massivedestruction of the value of digital assets. The total market capitalization of the crypto market fell from $2.72 trillion on November 11, 2021 to $795 billion on June 18, 2022, erasing 71%, or $1.92 trillion, of the total dollar value.

Total market capitalization of the cryptocurrency market (Source: CoinMarketCap)

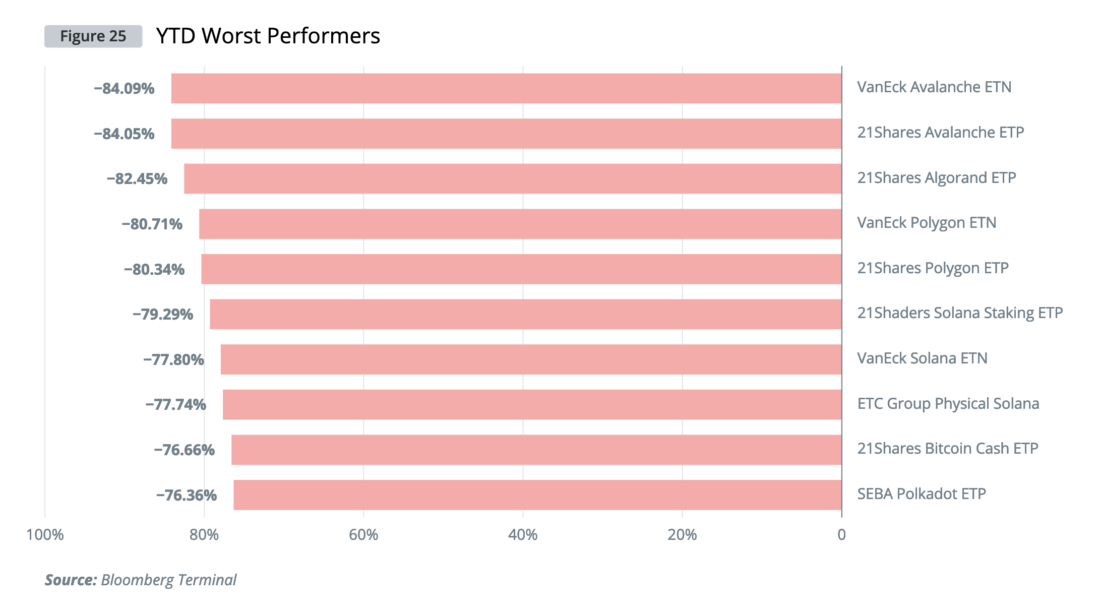

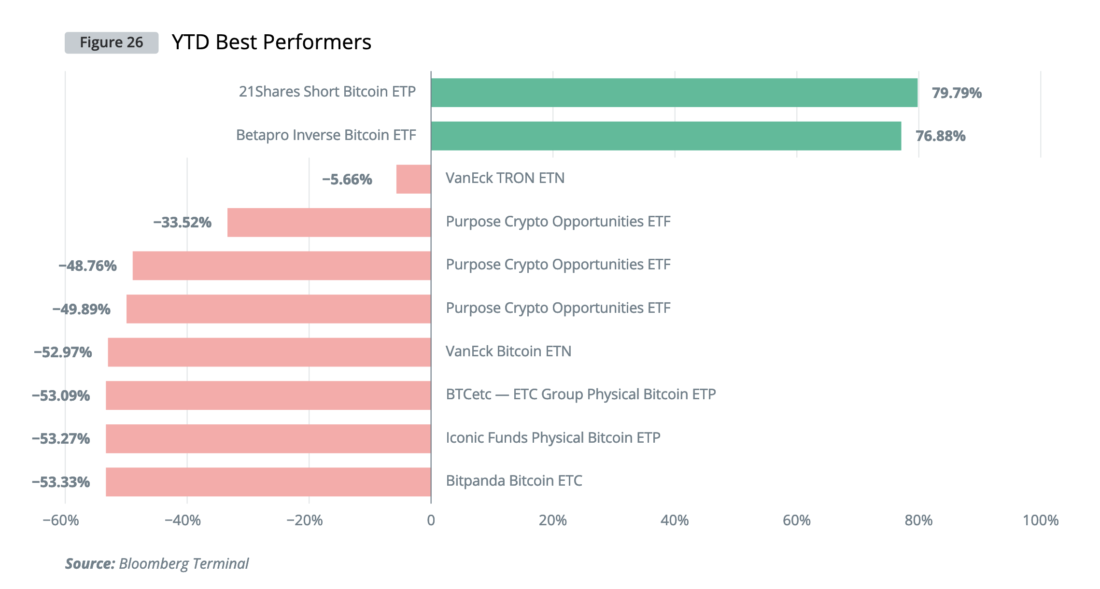

Digital asset fund performance in fullreflect this dynamic, which is to be expected. Ecosystem funds like VanEck Avalanche ETN or 21 Shares Solana Staking ETP fell along with the underlying cryptocurrencies, while short selling strategies like Betapro’s Inverse Bitcoin ETF saw gains.

More diversified crypto funds with activecontrol showed much better results. Purpose's Crypto Opportunities ETF outperformed the best-performing passive crypto ETF, losing «total» 33.5% compared to VanEck's Bitcoin ETN, which lost almost 53% of its value.

The largest fund by volume is still the Grayscale Bitcoin Trust Fund, with $14 billion in assets under management.

Funds with the best performance since the beginning of the year

Disclosure of financial information about the ownership of cryptocurrencies

Another way to gauge institutional interestinvestors - according to data filed in Form 13F. Institutional investment managers that manage investments of $100 million or more must report quarterly on Form 13F to the U.S. Securities and Exchange Commission. Only a portion of the fund's investment needs to be reported, and any positions in spot BTC do not need to be reported. However, crypto asset-related investment vehicles such as trusts are often disclosed on Form 13F.

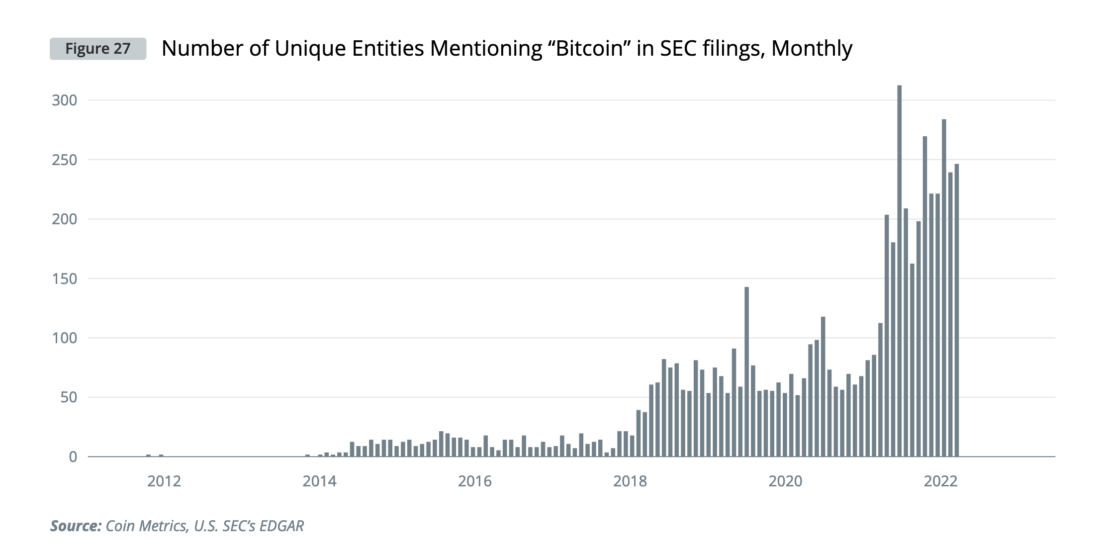

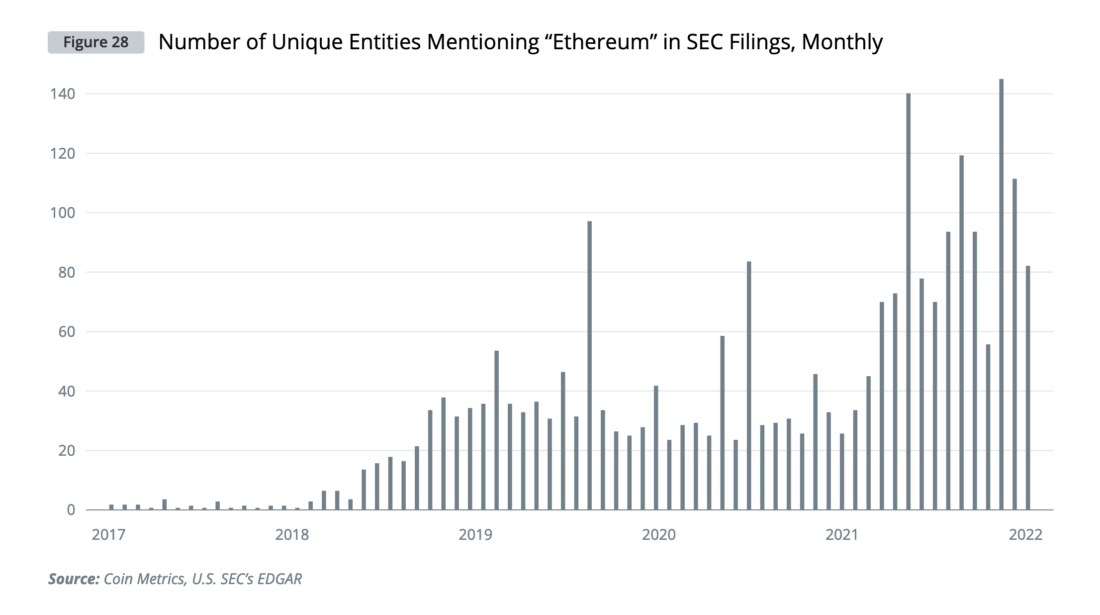

Coin Metrics analyzed the SEC databaseEDGAR did a full-text search for “bitcoin” and “ethereum,” then removed duplicates when one entity reported the same assets on subsequent declarations. These cleaned up numbers clearly showed a threefold increase in Bitcoin-related declarations since 2020 and a fourfold increase for Ethereum.

Number of unique organizations mentioning «bitcoin» in SEC returns, monthly

Number of unique organizations mentioning «ethereum» in SEC returns, monthly

Mergers and acquisitions in the crypto market by traditional finance

In addition to direct purchase of digital assets,Institutional investors can access this market by investing in blockchain companies through traditional routes: seed investment, venture capital investment, direct growth equity investment, or mergers and acquisitions. The advantage of such investments in blockchain companies is that the legal, accounting and tax implications are well understood compared to the gray area associated with the direct purchase of cryptocurrencies.

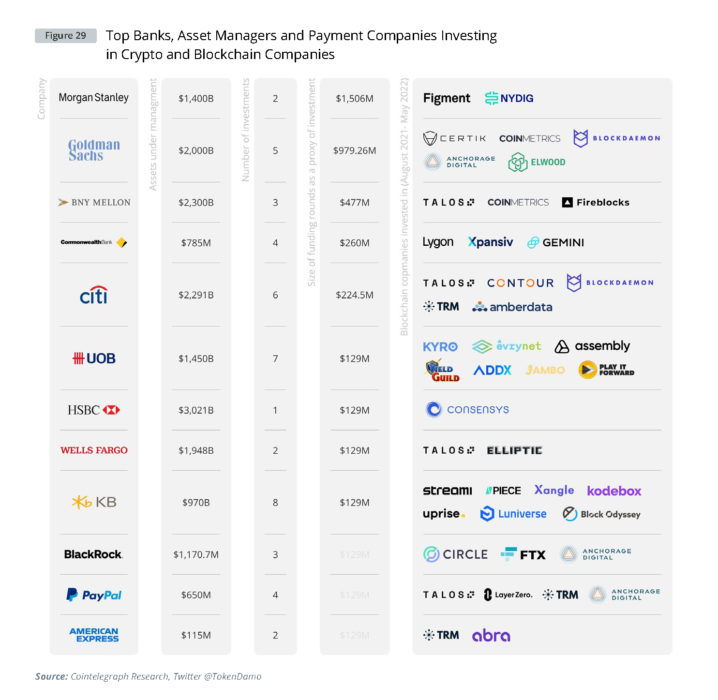

Major banks, asset managers and payment companies investing in crypto and blockchain companies

We see that many large banks have investedeither blockchain infrastructure companies like Fireblocks or cryptocurrency exchanges like Gemini or analytics companies like Amberdata. The trend is clear in what types of companies are investing in compliance, custodial storage and infrastructure.

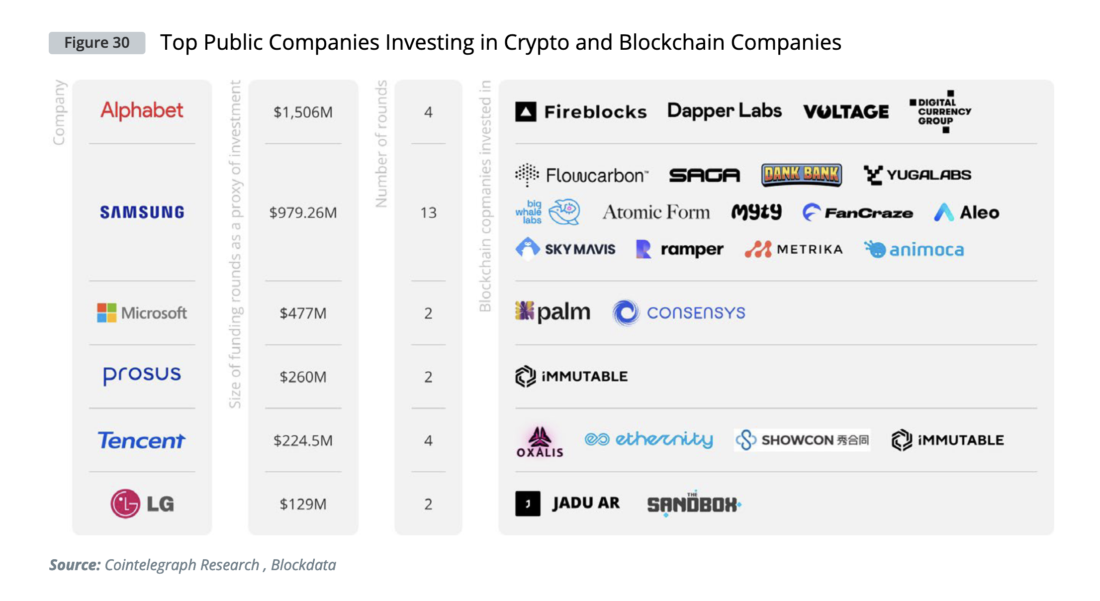

Top public companies investing in crypto and blockchain companies

Beyond banks, global tech giantsalso invest in blockchain and cryptocurrency companies. Among the most active investors are big names such as Samsung, PayPal and Google's parent company, Alphabet.

In addition to blockchain development companies such assuch as Layer Zero, Immutable and Talos, digital asset custody solution providers such as Fireblocks or Anchorage, as well as GameFi powerhouses such as The Sandbox and Dank Bank have been popular.

How Institutional Investors Buy and Hold Digital Assets

What happens when a professional investordecides to buy cryptocurrencies directly? What services and intermediaries will be involved in this transaction? In this section, we will talk about the infrastructure stack that institutional investors need to buy digital assets. An overview of the major banks, custodians and market makers facilitating institutional trading in digital assets around the world is provided on the ecosystem maps.

Crypto-friendly banks

Ranking of geographic jurisdictions by suitability for the implementation of blockchain-based financial products and companies from the point of view of professional investors

Banks working with cryptocurrencies and blockchains

Silvia Ybarra, Head of Customer Solutions at BBVA Switzerland:

What digital assets does BBVA offer to its clients?

In 2021, BBVA, through its subsidiary inSwitzerland has included two of the most important cryptoasset market protocols, Bitcoin and Ethereum, in its value proposition. The soundness of the Swiss banking system combined with the regulatory framework for distributed ledger technology allows us to be 100% consistent players in this new industry.

Is it only for Europeans?

Thanks to the open architecture of our service,our clients are mainly located in the regions where BBVA operates. We have found a strong appetite for cryptocurrencies among banking clients in Latin America and Europe who want to diversify their investments, from private clients to institutional investors.

Do you have clients directly requesting access to cryptocurrencies or digital assets? What are the sentiments towards them among your customers?

Our service is only for customers,who want to diversify their investments with this type of asset, and who want to personally manage their portfolios. The main advantage is that they can integrate their digital portfolio management with a traditional, moreover, in a bank with an international presence, regulated and with more than 150 years of history.

In addition, we found that the profileinvestors interested in this type of assets do not fit into any specific framework by age, geography or wealth level; rather, we are increasingly meeting a more diverse profile of customers who are very interested in developing technologies and new trends.

Does BBVA have BTC and ETH based products? What other financial products are planned for the coming year?

For BBVA, choosing the right direction is more importantspeed. We started with the two most important protocols in the market, which complement each other, and of course we will gradually include new services, adapting to technological advances and with absolute responsibility towards the interests of our customers.

Market Makers

Market makers of the crypto market

Michael Lee, Head of Digital Asset Trading at Flow Traders:

Why did Flow Traders enter the cryptocurrency market?

In 2017, we saw a growing demand forbitcoin and ether trackers. As a global liquidity provider specializing in exchange-traded products (ETP), it was a natural step for us to provide liquidity in products that track cryptocurrencies.

Soon we began to provide servicesmarket maker in the cryptocurrency spot, futures and ETP markets. We used our technology stack and trading experience to start trading this new asset class. With the development of the market, we started trading options, began to actively work with decentralized financial protocols, and created an over-the-counter business.

What is the role of a market maker in crypto markets?

Market makers have always played a very important role in the financial markets. They reduce spreads between quotations, reduce volatility and promote fair pricing of quoted products.

This is especially true for the cryptocurrency markets, wherethe opportunity to invest in a project at a fair price can play an important role in the success of the project. Especially for projects where a well-diversified and decentralized distribution of tokens is key, a good market maker will go a long way.

When we started providing the servicemarket making in the cryptocurrency markets, it became clear that this is not the only way we can add value to them. We support venture capital and ecosystem growth with our traditional finance expertise and capital, and this year we launched our own venture capital fund, Flow Traders Capital.

How do you see the state of institutional adoption of cryptocurrencies?

For the institutional adoption of cryptocurrencies, the two most important factors are the market infrastructure and the state of regulation.

In recent years, there have been many improvements ininfrastructure - in relation to, for example, exchanges where you can trade cryptocurrencies and solutions for custodial storage of cryptocurrencies. As for regulation, it is not yet fully formed, but the introduction of rules such as the MiCA [licensing regime] will contribute to the continued acceptance of cryptocurrencies by institutional capital.

An example of a regulated product that contributed toinstitutional acceptance, — ETP for cryptocurrencies. These are financial products that are traded on exchanges and track the price of cryptocurrencies. At the same time, these products are subject to regulation and allow institutional managers to access the relevant markets without having to decide which exchange they are going to buy cryptocurrencies on and which depository solution they will use for them.

Cryptocurrency custodial services of institutional level

Institutional cryptocustodians

John Gu, CEO of AlphaLab Capital Group:

While for cryptocurrency puristsWhile self-custody remains the ideal («not your keys = not your coins»), larger organizations such as hedge funds and Web3-native entities such as decentralized autonomous organizations (DAOs) have to face the reality increasing regulation (from governments), risk (from hackers) and responsibility (to their customers).

Like everything related to cryptocurrencies,The custodian industry is a growing area with a fairly wide range of heterogeneous solutions. In addition to the sheer number of options available, the expected secrecy of the industry makes it hard to find the details unless you're good at asking very specific questions and familiar with the range of offerings available.

Six key criteria

We have narrowed down the important factors for a potential user of digital asset custody solutions.

DeFi Compatible

The vast world of DeFi, with its decentralizedcredit, trading platforms, native tokens and stablecoins, is constantly evolving. The ability to connect and seamlessly trade within and between these protocols is vital for clients for whom DeFi is an important part of their strategy.

Staking and «yield farming» services

Earning additional profit by staking(using a validator node) or DeFi farming («yield farming» on DeFi protocols) is becoming an increasingly important part of investing in crypto assets. It also requires time and effort that could be spent on other things, and the custodian's ability to take on the necessary steps is a distinct advantage for the professional investor.

Supported Assets

History (especially recent) has shown that«safe» coins do not exist, so the investment portfolio needs to be diversified, not only between tokens, but also between blockchains. Ideally, a custodian should be able to support any asset you bring to them, but in reality the ability to add new coins may be limited if older technologies are used.

Competitive pricing

Traditional Pricing Structureinvolves charging fees based on the value of the assets (held) and the number of transactions. New custodial service providers are increasingly implementing innovative pricing models, including offering flat-fee subscription options with varying levels of service, which can represent significant savings compared to paying based on asset value and/or activity level. Thus, the pricing structure (basis points or $) often matters more than the price level (25 bps vs. 35 bps).

Security

The most basic and most important of the servicescustodian is to ensure the safety of assets. There are many methods custodians use to keep your keys secure (MPC, HSM) and various ways they can demonstrate the effectiveness of these systems (eg audits). Systems demonstrate their security over time when they manage to scale without successful hacking or major code failure. But in the end, a history of no major hacks or glitches in the codebase is the best evidence of a system's security.

Insurance

Since no security systemis invulnerable and people make mistakes, insurance is the last line of defense and should theoretically provide users with maximum peace of mind. The reality of crypto asset custodial insurance is often patchy, so even if a custodian claims to have insurance, it is important to pay attention to the level and terms of coverage of the insurance plan, ideally with the help of an expert trained to read the “fine print.”

Cryptocurrency Landscape

There is no cryptocustodian thatwould have received high marks in all respects: everyone has their strengths and weaknesses. The right choice of a custody service provider largely depends on the needs of the client.

Old-timers of the market

Example: BitGo.This group includes qualified custodians whose clients include highly regulated organizations such as Fidelity or Calpers. Their offering reflects the conservative trading needs of their client base and while their services can be relatively expensive, they are the perfect choice if risk minimization is your primary goal.

new guard

Examples: Fireblocks, Copper.«Second wave» Crypto custodians have achieved a dominant position in the market adjacent to the "old-timers" and are differentiating themselves by offering a wider range of services. Therefore, they are no longer primarily focused on minimizing risk. They attract clients - such as mid-market hedge funds - with more complex trading requirements, for which the trade-off between regulatory certainty and advanced functionality makes sense.

Challengers / Outsiders / Wilds

Example: Atato.This group of crypto custodians often originate from non-Western markets. They compete with the “new guard”, seeking to offer a similar or improved range of services. They may represent an attractive choice for smaller funds or start-ups with complex needs, higher price sensitivity and a willingness to take a chance on a new market entrant.

Specialized Services

Example: Finoa.For investors who require in-depth expertise in a particular area – such as staking services – it may make sense to use a specialized custodial service instead of or in addition to one of the generalists. In the future, we can expect specialist services to increase their performance in other axes, or generalists to increase their offerings to meet the needs of those who are interested in specialized solutions. For now, the multi-custodial fund approach may be the best option.

Conclusion

All of the above reflects the current statemarket, not the final or ideal. However, we do not believe that the “winner takes all” effect is the case. will dominate the custody services market, leaving one or two dominant players as the primary or only viable choice. The crypto investor market is heterogeneous and requires the involvement of a range of players to fulfill different use cases. So it's important to know what you need and (at least for now) conduct thorough due diligence.

Comparison of cryptocurrency custodians

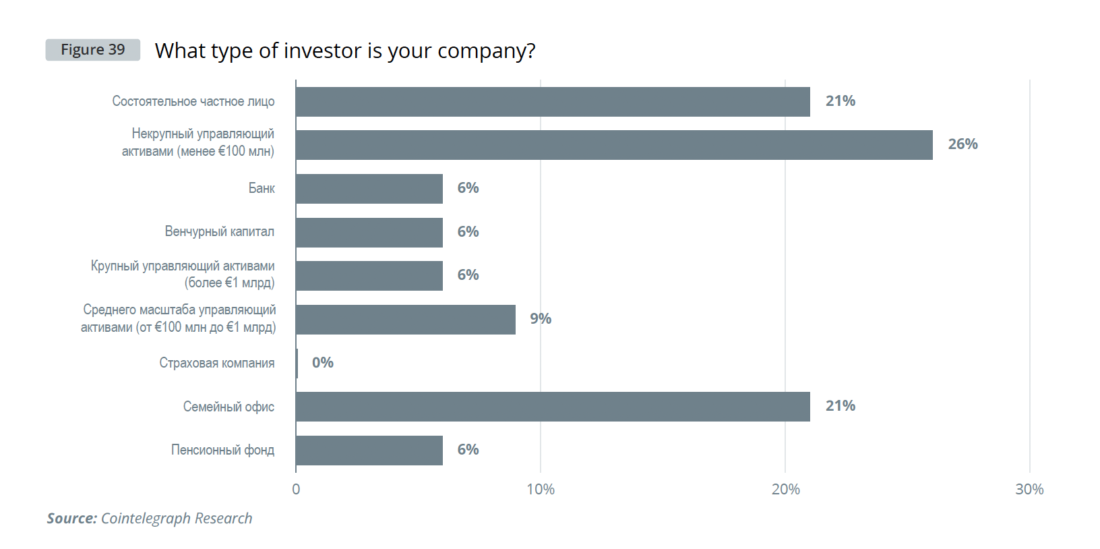

Demographics of Institutional Investors in Cryptocurrencies

What type of investor is your company?

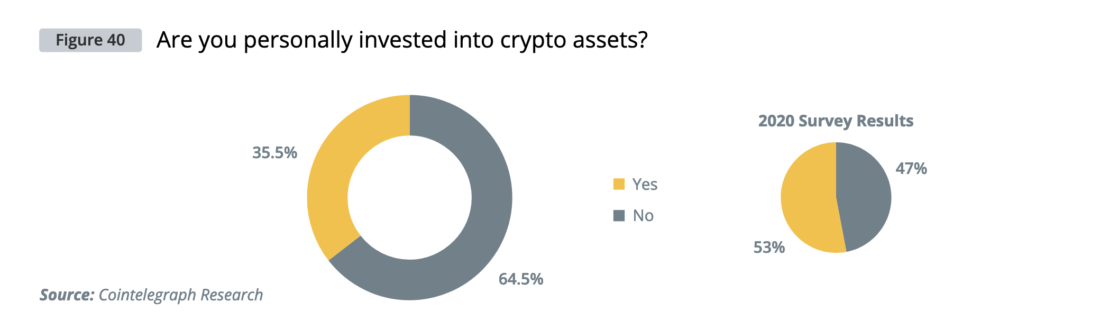

Do you personally invest in crypto assets?

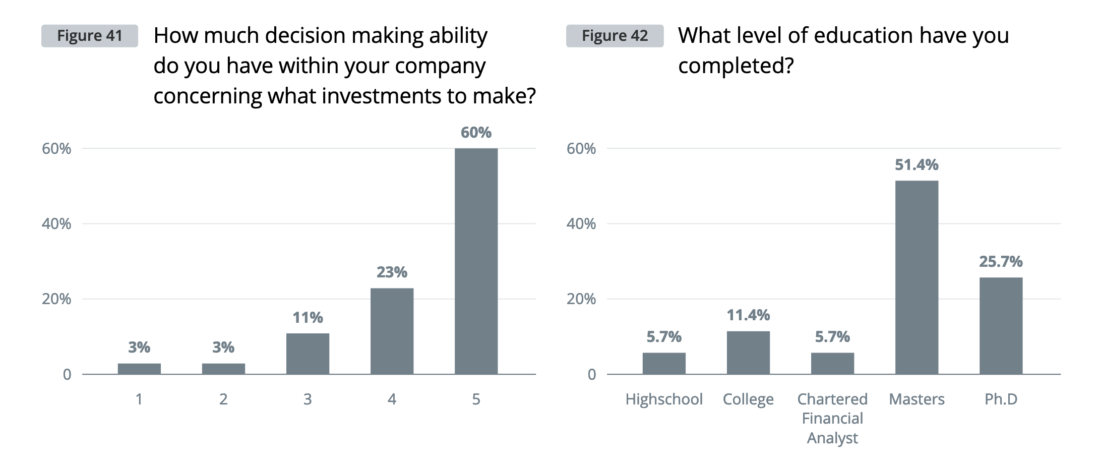

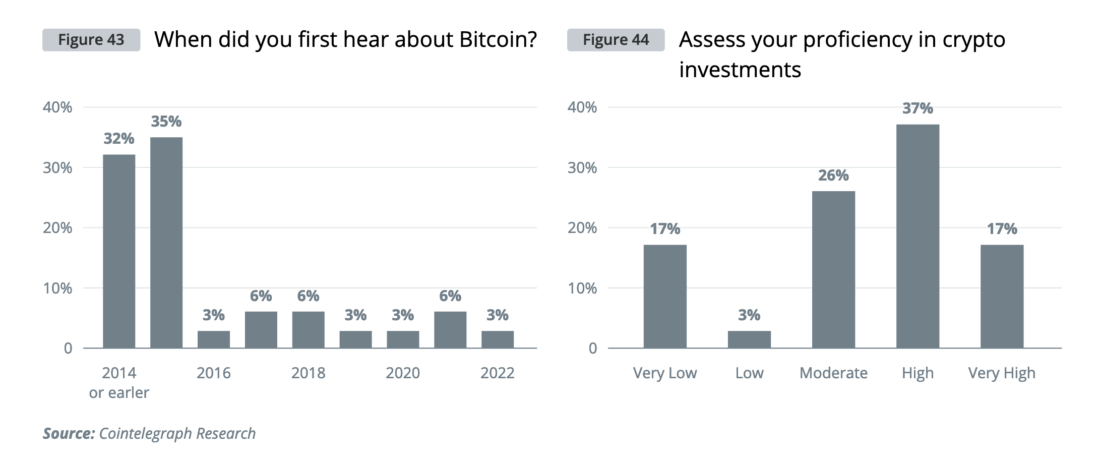

Nearly 2/3 of professional investors saythat they keep crypto assets in their personal portfolios. This represents an impressive 18% growth since the last Cointelegraph survey two years ago. Several case study respondents stated that they themselves have privately invested in bitcoin and other digital assets, while their companies have not yet made direct investments. However, the majority of respondents had a high level of decision-making ability in their firm. A possible explanation for this is that asset allocators invest with higher risk aversion when investing on behalf of others than when managing their own wealth.

The majority of respondents had a master's degree or higher in the formal scale of education.

Rice. 41: How broad are your options for making investment decisions in your company?

Rice. 42: What is the level of your completed education?

Rice. 43: When did you first hear about Bitcoin?

Rice. 44: Assess Your Crypto Investment Knowledge

"What will happen isthat one of these fearless pensionersfunds, one of the market leaders, will say: «You know what? We have a depository, Goldman Sachs is involved, Bloomberg has an index that I can track my performance against, and we are going to buy». And suddenly, suddenly, some second guy also buys. The same FOMO we saw from retail players will play out among institutional investors as well.”

— Mike Novogratz, CEO Galaxy Investment Partners | AUM $1.9 billion

“I believe this is my third crypto winter.There have been a lot of ups and downs, but I see this as an opportunity… I was raised to be a contrarian, non-conformist thinker, and I developed the knee-jerk reaction that if you're really confident in the fundamental long-term plan, then when everyone else comes out,it's time to double upbet."

— Abigail Johnson, CEO Fidelity | AUM $4.5 billion

Institutional demand for digital assets manifests itself in the following forms:

- direct cryptocurrency purchases: for example, MicroStrategy, which bought more than 129,000 BTC, or Tesla, which owns more than $2 billion in BTC;

- buying securities of cryptocurrency trusts, like the Grayscale Bitcoin Trust;

- the use of derivatives, like futures and options, to trade on changes in the prices of digital assets;

- buying/selling NFTs like CryptoPunks.

Most acclaimed institutional holderBitcoin is perhaps the US company MicroStrategy, whose CEO Michael Saylor purchased 129,218 BTC with an average price of $45,714. The Latin American country of El Salvador is another major institutional buyer of Bitcoin. President Nayib Bukele made Bitcoin legal tender in September 2021, and since then the cryptocurrency has made great strides in terms of adoption. The move to introduce the highly volatile asset as legal tender that business owners must accept has drawn a lot of criticism. Some even accuse Bukele of starving the poor in order to gain recognition on Twitter. Let's see how his bet plays out further, after this price drop.

Geographic distribution of professional investors investing in cryptocurrencies

The crypto industry has been around for almost 14 years and,like many other industries, it started with speculative use cases aimed at retail users, which went hand in hand with high volatility. Institutional adoption is a direct result of the introduction of more mature institutional grade products to the market, which in turn leads to positive feedback with growing institutional interest and products meeting the highest standards in terms of compliance and scalability. Until 2017, the liquidity of the crypto markets was limited to a handful of exchanges with multi-million dollar trading volumes across all assets, but in recent years the situation has changed dramatically. More liquid deposit/withdrawal platforms between fiat and cryptocurrencies have been vital to the success of cryptocurrencies in institutional use cases.

According to Fidelity research, the levelInstitutional adoption of digital assets in Asia is higher (71%) than in Europe and the US. Fidelity found that 56% of European and 33% of US institutions currently have investments in digital assets, up from 45% and 27% in the previous similar report.

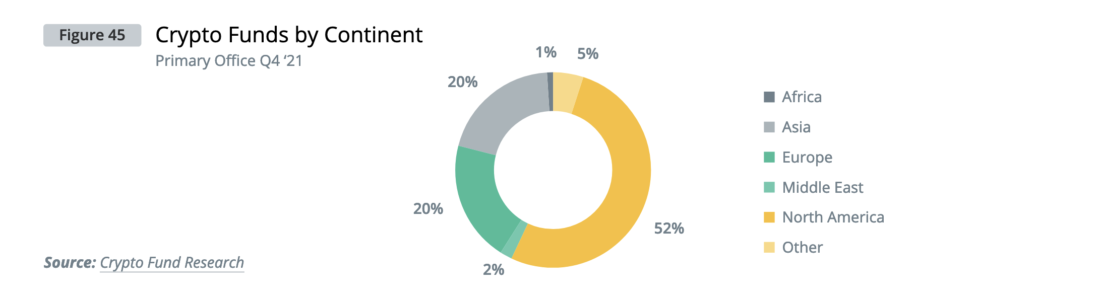

According to Crypto Fund Research, at the end of IVquarter of 2021, there were more than 860 crypto funds in the world with head offices in more than 80 countries. The pace of new fund launches began to pick up in the first quarter of 2021, and this trend continued throughout the rest of 2021 as new funds outpaced fund closures for six consecutive quarters. Just over half of all crypto funds are based in North America, most of them in the US. About 20% of funds are concentrated in Europe and Asia.

Cryptocurrency funds by continent

USA

Since institutional demand for moreAs actively managed cryptocurrency investments gain momentum, the asset management industry has begun to meet this demand. The first signs of institutional interest were in gaining initial exposure to Bitcoin and Ethereum, either directly or through passive products. Now the appetite of professional investors is moving beyond this initial access towards differentiated strategies and attempts to gain more exposure to this growing asset class. Pension funds and endowments are still among the slowest investors to adopt cryptocurrencies, according to a January 2022 survey of institutional investors by Fidelity. Large pension plans such as the Houston Firefighters' Relief and Retirement Fund, for example, have announced allocations to cryptocurrencies, but the share of total assets under management is still very small in most cases. The aforementioned Houston-based fund's Bitcoin investments accounted for just 0.5% of its $5.2 billion portfolio.

Hedge funds, registered investmentAdvisors and some companies are increasing their bet on cryptocurrencies as the market becomes more mainstream. Institutional trading volume on Coinbase totaled $1.14 trillion in 2021, up from just $120 billion a year earlier and more than double the $535 billion of retail investors. An October 2021 State Street survey of 300 institutional investors found that more than 80% of them are now able to invest in cryptocurrencies. Large funds with $500 billion or more in assets under management have shown the most interest, and nearly two-thirds of them have dedicated staff dedicated to the cryptocurrency market. While most crypto funds are headquartered in the US, less than 20% are technically registered there (like a Delaware company, for example). For a variety of tax, legal and regulatory reasons, the predominant offshore domiciles for crypto funds are the Cayman Islands and the British Virgin Islands. Together, 49% of crypto funds are registered in these offshore zones.

"I believe in the future of blockchain technology. This is a revolution, and it is already happening, gaining the trust of more and more users. Bitcoin is like gold, while gold is a recognized alternative to fiat money.”

— Ray Dalio, ex-CEO Bridgewater Associates | $140 million

The growth of institutional investment has changedbehavior of cryptocurrency markets. Now, digital asset markets have begun to follow the state of traditional markets: the correlation between them is higher and more stable than ever. Major banks such as Morgan Stanley, Citi and Goldman Sachs are starting to offer a wide range of digital assets to their clients. For now, traditional financial institutions prefer trading futures and options over perpetual offerings, which are typically viewed as short-term exposure products due to the unpredictability of their funding. At the same time, Wall Street, after years of resistance, is increasing its cryptocurrency offerings in the fields of money management, trading and even investment banking. The Chicago Mercantile Exchange offers options and futures trading on some well-known digital assets, and Goldman Sachs held the first over-the-counter Bitcoin options trades in March. Meanwhile, BlackRock joined stablecoin issuer Circle's $400 million funding round in September, and many asset managers are planning to launch cryptocurrency funds to meet demand from younger, tech-savvy investors. In April 2022, Fidelity Investments announced plans to include Bitcoin as an available option for retirement accounts.

Europe, Middle East and Africa

In terms of cryptocurrency adoption, Europeans are not lagging behind.Assets in European exchange traded products (ETPs) and mutual funds with cryptocurrency exposure have topped €10.5 billion, according to Morningstar, highlighting the potential appeal of these products for asset managers. XBT, a division of CoinShares, is the largest provider of such products in Europe, with assets of €5.4 billion spread across eight products registered in Sweden and Jersey. It is followed by Swiss group 21Shares, which manages €2.1 billion in cryptocurrency financial products. Ruffer Investment Management, a UK-based fund manager, made a $745 million bet on Bitcoin in December 2020. Ruffer's placement brought in $27.3 billion in assets, which , the fund claims, will work as a hedge. It effectively protects 6,500 customers from the risks associated with a volatile digital economy.

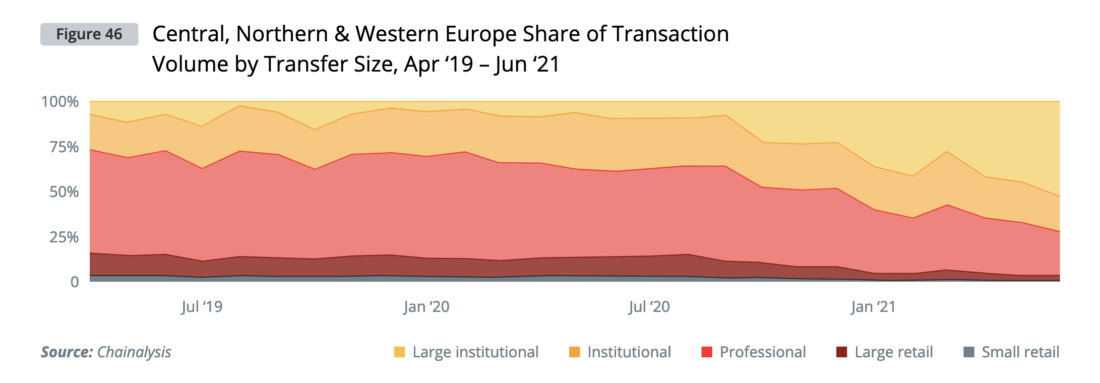

DeFi, a general term for the networkdecentralized non-custodial financial protocols focused on lending, yield farming, crypto derivatives and other similar financial products have reportedly given a huge boost to the cryptocurrency industry in England, France, Germany and other European countries. According to Chainalysis, European institutional investors are embracing DeFi: transaction volume in Central, Northern and Western Europe has grown significantly across almost all cryptocurrencies and service types, but especially in DeFi protocols. An influx of institutional investment, as reflected by transaction size, accounted for most of this growth, although retail activity also increased.

Shares of transactions of various sizes in the total volume of cryptocurrency transfers in Central, Northern and Western Europe from April 2019 to June 2021

Venture capital hits record high in 2021level of investment, with investment in Europe increasing. European venture investors have poured a record $2.2 billion into cryptocurrency and DeFi startups in 2021, up significantly from $473 million in 2018. They support digital asset markets such as NFTs, payment infrastructure, and DeFi startups. French football-themed NFT trading platform Sorare has become a «unicorn» in 2021 after raising a $680 million funding round. Other notable cryptocurrency venture firms include:

- Blossom Capital, a venture capital firm that already participated in MoonPay's recent $432 million Series A funding to back European startups.

- Berlin-based venture capital firm Cherry Ventureslaunched its first fund focused on crypto startups with $34 million ready to invest, and has already participated in rounds for Lido, Morpho and Radicle.

- At the end of 2021, Greenfield One attracted oneof the largest crypto funds ever to exist in Europe - $160 million to invest in crypto startups. The firm has already invested in crypto companies such as Celo, Dapper Labs, Colony, 1inch, Near Protocol and others.

- In December 2021, Kraken Ventures launched a new $65 million fund with key employees to guide European investment in crypto startups.

- Brussels-based Tioga Capital announced closureits first fund with $70 million to invest in crypto startups. The new firm aims to fund blockchain and digital asset projects at seed stage and Series A.

- LeadBlock Partners announced its plan to close its first $100 million fund for B2B blockchain startups. Their portfolio includes industry leaders such as Bitpanda.

In addition to crypto-focused venture capital funds, there are several European technology firms that also invest in crypto companies. Among them:

- Vito Ventures,

- Seed+Speed,

- earlybird VC,

- High-Tech Gründerfonds,

- Mosaic Ventures,

- HV Holtzbrinck Ventures,

- Point Nine Capital,

- Lunar Ventures,

- XAnge.

As for the prospects, Europe, forwith the exception of Switzerland, it is moving more cautiously in this direction. Brussels has begun to create a legal framework in the form of a package of comprehensive measures, Markets in Crypto-assets Regulation (MiCA), which should come into force in 2023. MiCA includes a pilot mode, which is a «sandbox» for tokenized shares, which should encourage the private sector to not only limit itself to trading and investing in coins, but also develop tokenized shares.

In Europe, regulation of asset management canlimit the ability of enterprises collectively investing in transferable securities funds, which make up the lion's share of mutual funds traded within the European Union, to invest in cryptocurrencies, but the market for exchange-traded products pegged to cryptocurrencies is experiencing rapid growth.

Asian-Pacific area

Asia has certainly been a pioneer in terms ofinstitutional adoption of digital assets, but the rest of the world is starting to catch up. According to Fidelity's 2021 Institutional Adoption of Digital Assets study, Asia has the highest number of investors investing in digital assets.

Digital asset adoption (by region)

Until recently, if an investment firmwas not originally launched as a specialized crypto fund, it was difficult for it to enter the market in a significant way due to problems related to security, storage, liquidity, settlement, regulation, anti-money laundering, etc. Over the past few years, these problems have largely been resolved, and now we see how the largest institutional investors are entering the digital asset markets on a significant scale - in Asia and around the world. Recognizing the high yield potential of cryptocurrencies, traditional asset managers are exploring how to maximize the value of this asset class, and players such as Fidelity Investments are investing heavily in the Hong Kong-based cryptocurrency services operator. Heightened interest from institutional investors has also led digital asset management platforms to innovate and offer more sophisticated products designed for a wider range of users with different risk appetites. In 2021, BCMG Genesis Bitcoin Fund-I, or BGBF-I, was officially launched in Malaysia, claiming to be the first insured institutional crypto product available in the Southeast Asia region.

"I did not hearnot a single good argument why you shouldn’t invest 1% of your liquid net worth in Bitcoin.”

— Bill Miller, CEO Miller Value Partners | +$1.9 billion

Fighting for the title of the main cryptohub of Asiaseveral jurisdictions including Singapore and Hong Kong. Singapore has become one of the world's leading, if not the main, crypto hubs for several reasons: the regulator's progressive stance on digital assets, a favorable business climate, and a strong fintech ecosystem and talent base.

In addition to Singapore, Thailand is experiencing an activeparticipation of both crypto-startups and traditional financial institutions. Thailand's fourth largest bank, Kasikornbank, has begun experimenting with DeFi and has also recently introduced its own NFT marketplace. The country's oldest lender, Siam Commercial Bank, has also entered the game by acquiring a majority stake in Bitkub, Thailand's largest digital asset exchange.

But in one area Asia lags behind the West:it does not have its own exchange products that track cryptocurrencies. With the launch of several Bitcoin ETFs in the US and Canada and the listing of other exchange-traded products in Europe, the Asia-Pacific market seems ripe for crypto funds. Asset managers in the region are actively investigating opportunities and understand the attitude of regulators towards these products. In different countries of Asia, these views differ significantly. Singapore has begun issuing regulatory consent to service providers related to virtual and tokenized assets under the Payment Services Act and tokenized assets under the Securities and Futures Act. China has gone in the opposite direction by outlawing all cryptocurrency transactions in the country, including services provided by offshore exchanges. Despite such inconsistencies, Asia as a whole is the dominant force in the cryptocurrency markets.

| Exchange Traded Funds (ETFs) | Exchange-traded products (ETP) and exchange-traded notes (ETN) | |

| Purpose | Exchange products that allow access to the crypto asset market | Exchange products that allow access to the crypto asset market |

| Trade | Secondary trading on the stock exchange | Secondary trading on the stock exchange |

| Regulatory status | Are subject to regulation of funds - for example, according to the 40th law, UCITS, etc. | Funds not subject to regulation - for example, a listed debt instrument |

| Custodian and/or control duties | Follow the regulation of funds - for example, control functions | No regulatory requirements |

| Access for retail players in North America | Yes, in USA and Canada | Not yet |

| Access for retail players in Europe | Not yet | Yes |

| Retail Player Access in Asia Pacific | Not yet | Not yet |

The Chainalysis report showed that 40%Bitcoin's on-chain activity, carried out on the top 50 largest exchanges, is in the Asia-Pacific region. To date, investors in the region seeking access to the cryptoasset markets, such as hedge funds and family wealth managers, are turning to private funds, usually registered in offshore jurisdictions, or using alternative fund structures. Those asset managers who plan to launch ETFs may consider initial participation in the crypto market through alternative funds as a means not only to test market demand, but also to persuade regulators to launch conventional crypto-based ETF structures in their markets. According to the latest Asia-Pacific edition of The Global Family Office Report 2021 by Campden Wealth in conjunction with the Raffles Family Office, only 19% of family wealth managers in Asia-Pacific invest in cryptocurrencies, which is notably lower than in North America (31%) and Europe (28%). Cryptocurrencies accounted for just 2% of portfolio investment in the region. However, the huge returns of digital assets in 2021 have caught the attention of professional money managers in the Asia-Pacific region. According to the report, more than a third of the region's family wealth managers plan to increase their investments in cryptocurrencies.

Barriers to institutional adoption of cryptocurrencies

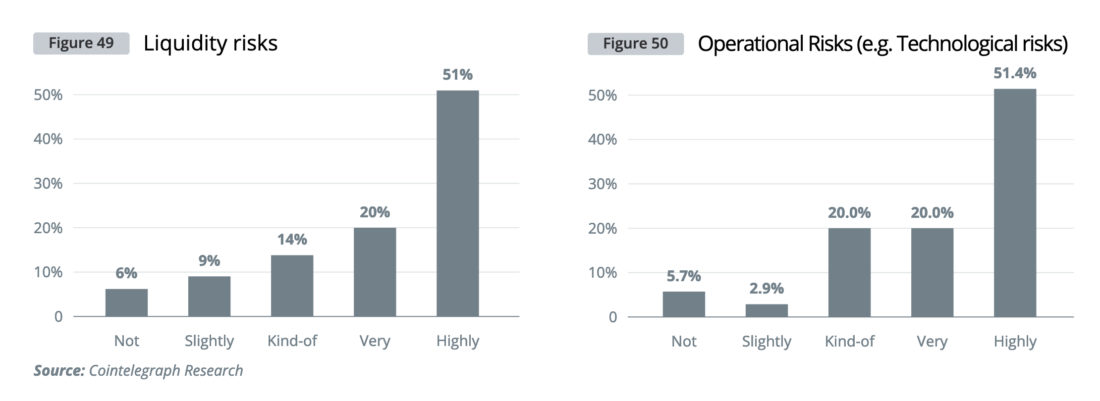

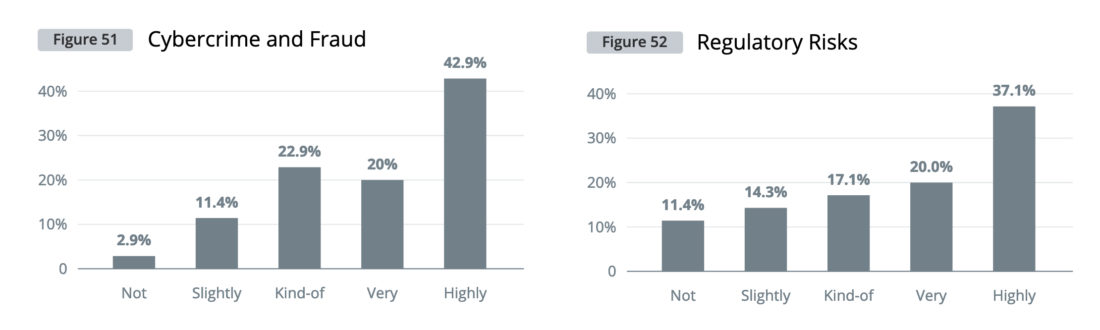

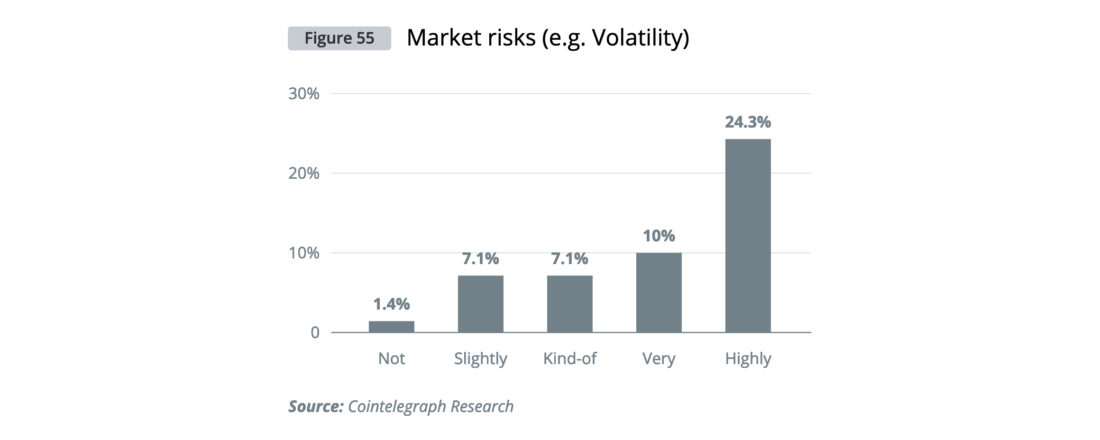

Asset managers were asked to evaluateperceived risks when investing in crypto assets by degree of importance; possible risks were as follows: liquidity risks, operational (technological), cybercrime and fraud, regulatory and market risks (volatility). All the risks mentioned are «important» spectrum of graphs. However, the most significant risk for respondents was liquidity risk.

This is very different from a survey.professional investors, conducted by Cointelegraph in 2020. In 2020, the most important perceived risk was regulatory. Almost 80% of the sample placed it in the «important area» graphic arts. The second and third most important perceived risks were identified as market risk and liquidity, with ~71% and ~70% respectively. Operational and cybercrime risks have been placed in the «important area» the same number of respondents (~68%).

Rice. 49: Liquidity risks

Rice. 50: Operational risks (e.g. technological)

Institutional buyers show morehigh sophistication compared to retail counterparts. High liquidity and the ability to hedge the risks of price fluctuations are among the main requirements for institutions to place any significant capital.

Rice. 51: Risks of Cybercrime and Fraud

Rice. 52: Regulatory risks

Another obstacle for institutionalinvestors is the uncertainty of the regulatory framework and the unclear tax consequences of keeping cryptocurrencies on the balance sheet. As much as crypto advocates deplore regulatory pressure, it must be admitted that no pension fund, professional manager, savings or loan institution would invest heavily in digital assets without clear regulation. From this perspective, the industry should engage in dialogue with legislators around the world and demonstrate fresh ideas and innovative approaches. Thus, the thinking of regulators can be more informed, and the decisions made more accurate and meaningful.

Rice. 53: Your company would like to invest more in cryptocurrencies, but is bound by regulatory restrictions?

Rice. 54: Would you like to invest more in cryptocurrencies, but are bound by internal company restrictions?

Market risks (for example, volatility)

A 2020 Cointelegraph survey found thatprice volatility is a major barrier to institutional adoption of cryptocurrencies, followed by a lack of understanding on what fundamentals to value them and fears of market manipulation; however, investors expressed less concern about the complexity of the market infrastructure and barriers to institutional participation than before.

Prospects for Institutional Demand for Cryptocurrencies

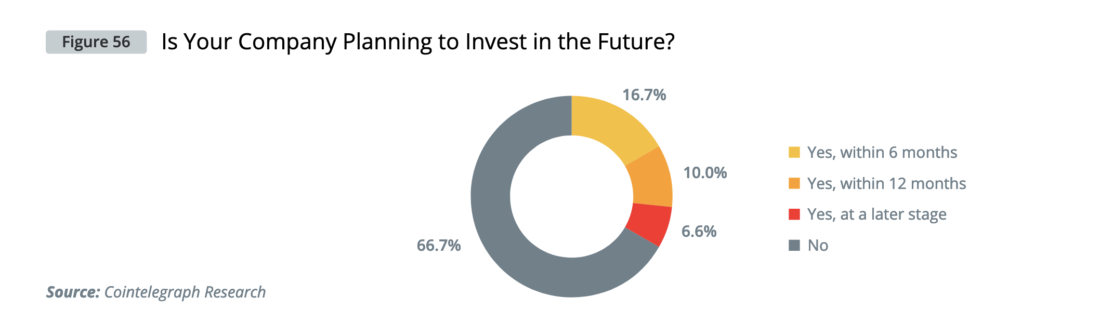

Plans for buying cryptocurrencies in the future

Does your company plan to invest in cryptocurrencies in the future?

Of the 84 professional investors who passeda Cointelegraph survey in 2022, 48 reported not owning cryptocurrencies to date. Of those 48, two-thirds said they had no plans to ever invest in cryptocurrencies. On the other hand, a third of them said they plan to buy cryptocurrencies in the future. This is in stark contrast to the results of the Fidelity study (pdf), according to which 70% of institutional investors expect to buy digital assets in the future.

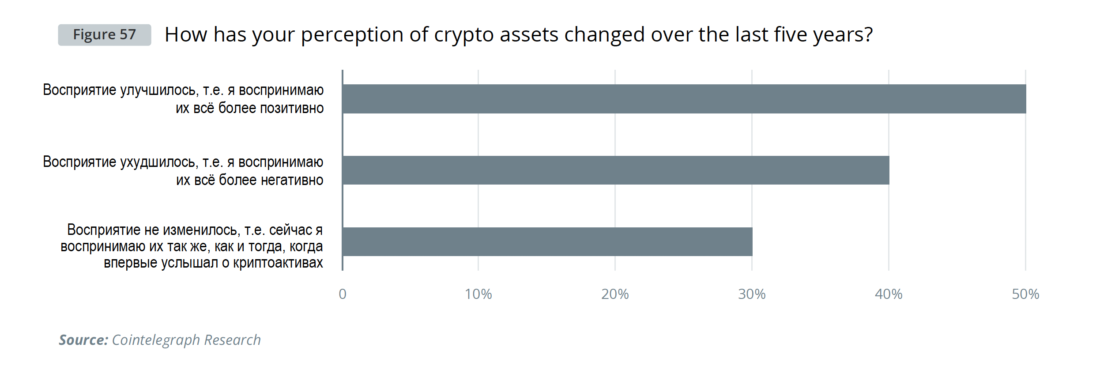

How has your perception of cryptoassets changed over the past five years?

What digital assets would your company be interested in investing in in the future?

Several negative attitude towards cryptocurrenciesof respondents commented on why they do not own cryptocurrencies as follows: “Cryptocurrencies are pure speculation in which, unlike Dutch tulips and other bubbles, there is not even an underlying asset”, “It is just rubbish with no real risk management. Fraud and swindle" and "I'd rather invest in lottery tickets than cryptocurrencies."

“Women control about 80% of retailexpenses, and retailers just haven't realized yet that they can save 2%, and often they operate on very low margins, so this could double their profits. Theycan save 2% by simply accepting bitcoininstead of a bank credit card. And this could change everything."

— Tim Draper, Founder of Draper Ventures and Draper Associates | +$250 million

Institutional demand is largely driven bythe presence of professional trading tools, but it also stimulates their development - the classic “chicken and egg” dynamic. Markets are becoming more mature, but the pace of their development is not comparable to the speed of innovation in digital assets and, in particular, in DeFi.

In the last six years in the cryptocurrencyinvestment was dominated by the thesis of a thick protocol. In a nutshell, it states that most of the value of digital assets is extracted at the protocol level, and only a small part at the application level.

This will probably change soon asblock space in blockchains increasingly resembles a commodity asset. Many blockchains already have more or less the same set of functions, and compatibility with the Ethereum virtual machine plus improvements in bridge technology cross-blockchain means that applications can move from one blockchain to another or be deployed to multiple platforms simultaneously.

Bridge technologies such as LayerZero, Quant and THORchain, to a certain extent, add another option for institutional demand. But ultimately, blockchain is a means of storing and transmitting information. We can see from the history of telephone networks how this is likely to happen. While significant value is initially captured at the protocol and infrastructure layers, these companies are not worth a fraction of the applications built on top of the telecom infrastructure. Depending on the exact definition, it can be said that 6 of the 10 most valuable companies in the world are built on the basis of telecommunications infrastructure.

The same may well be repeated withblockchain technology, since the cost of blockchain, which has no other use than sending and receiving tokens, is very limited. This is why we expect institutional investors to invest in tokens rather than native blockchains in the near future.

One of the main obstacles forinstitutional demand for crypto assets that we see everywhere is regulatory issues. Banking is one of the most heavily regulated industries in the world, which is why bankers don't like the idea of investing large sums in assets with unclear legal consequences.

As a result of recent sanctions against Tornado CashDozens of Ethereum addresses have been listed by the US Office of Foreign Assets Control, illustrating quite well the validity of the legal concern. Transactions with these addresses can result in up to 30 years in prison, and significant funds have been frozen in protocol vaults, even if they belong to users.

Another major issue is liquidity andmarket infection. The collapse of Terra, for example, was fueled in part by the bandwidth limitations of the Ethereum blockchain and the lack of deep liquidity even in the largest stablecoin pools.

We expect institutional demand to startgrow much faster when and if regulators clarify the legal and tax implications of investing in digital assets. And this adoption will also solve most of the liquidity problems. Institutional demand will contribute to institutional supply and vice versa. Whether transactions will take place on the blockchains themselves or in rollups with access restrictions, or even closed pools, will be interesting to see.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>