After hitting all-time highs earlier this month, Bitcoin and other major crypto assets failed tohold on to these levels and return to the rangeprevious consolidation. This can be explained by several potential factors, including both a change in macroeconomic prospects and the state of the crypto market itself.

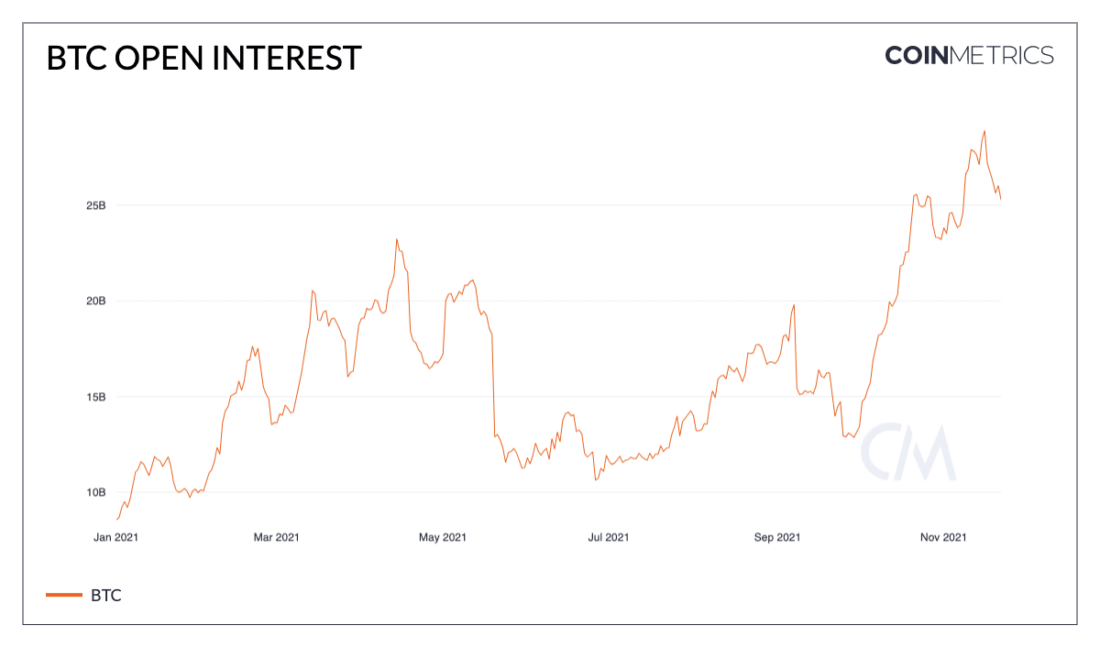

As for the state of the crypto market, the openInterest in both BTC and ETH has grown steadily over the past few months and has set new all-time highs this past week. "Open Interest" refers to the total amount of active futures contracts for an asset. An increase in open interest implies an increase in the volume of open contracts, which signals an inflow of capital into the market.

BTC open interest (source:Coin Metrics’ Formula Builder)

Open interest can often serve as wella good proxy variable for the level of leverage (leverage) in the market, since many futures contracts tend to be leveraged. In part, the rise in open interest in BTC could be attributed to the launch of the first US Bitcoin futures ETF, although it is highly likely that it is largely due to the increase in leverage amid the associated optimism in the market. Rising leverage in the market means that smaller price fluctuations can trigger more volatility by liquidating “over-credited” positions in the futures markets. With the price decline last week, open interest also began to decline due to the pressure on active long positions.

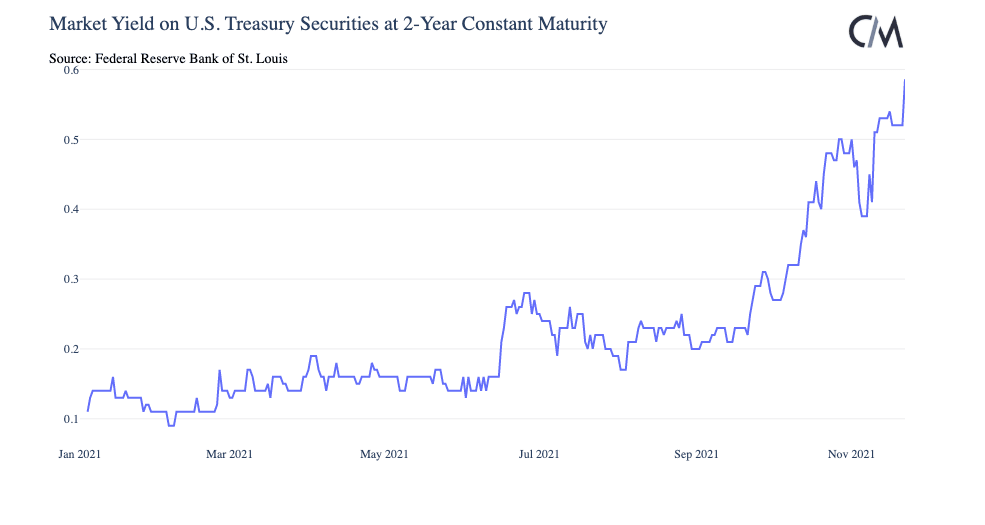

In the short term, additionalthe pressure on the crypto market can also be exerted by changes in macroeconomic conditions. The yields on US bonds, especially short-maturity Treasuries, have surged in recent weeks. On two-year bonds, the yield rose from 0.24% as of September 22 to almost 0.60% as of November 23, amid growing expectations of further interest rate hikes. The appointment of incumbent Fed Chairman Jerome Powell to a second term also boosted yields. Since cryptoassets, like high-growth tech stocks, are generally perceived as risky assets, an increase in the “risk-free” rate can lead to a reallocation of capital in financial markets.

Market yield on 2-year US Treasury bonds (source:FRED)

However, inflation also continues to rise, and the priceBTC appears to be responding to new inflation data coming from the US. Despite the interrupted BTC uptrend, teams continue to actively build new products, including the new decentralized exchange from Square, which recently published its whitepaper (PDF).

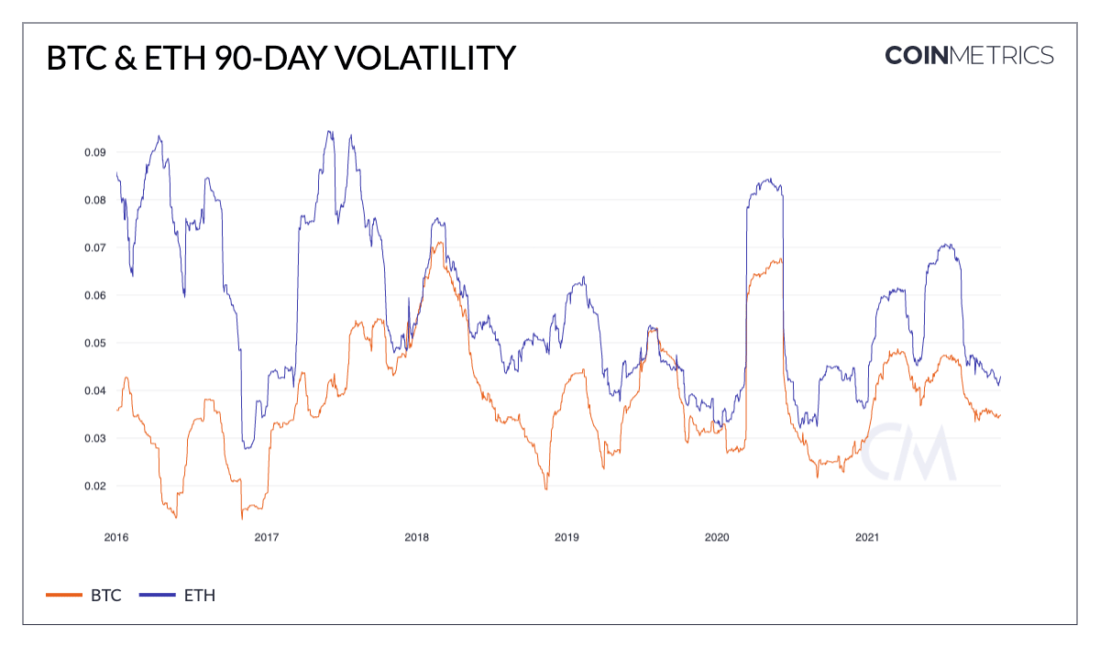

And although the situation on the crypto market may seemturbulent, volatility (as measured by daily log returns over a 90-day moving period) remains relatively low for both BTC and ETH today, and is extremely far from all-time highs recorded earlier this year.

90-day volatility for BTC and ETH (source:Coin Metrics' Formula Builder)

Taproot statistics

November 14, at block 709 632, it was officialA Bitcoin update called Taproot has been activated. Taproot brings support for new scripts to Bitcoin and lays the foundation for the creation of new, more complex smart contracts, while increasing the security and privacy of the network. For detailed and in-depth information about Taproot, I recommend checking out the following articles:

- Taproot: a new era for Bitcoin

- Preparing to activate Taproot

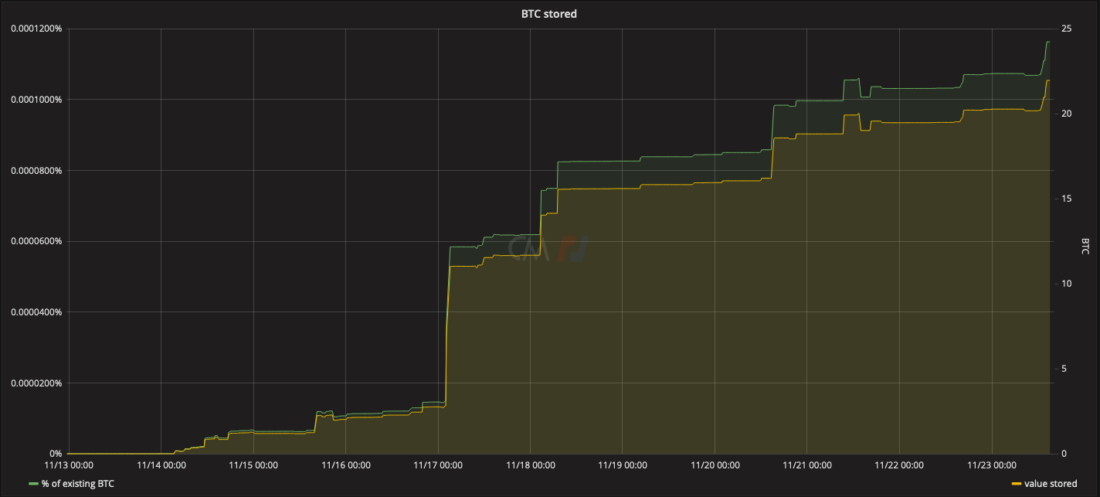

The actual usage statistics are still very modest: today, just over 20 BTC are stored on P2TR outputs.

: txstats.io

You can track your current Taproot usage at txstats.io.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>