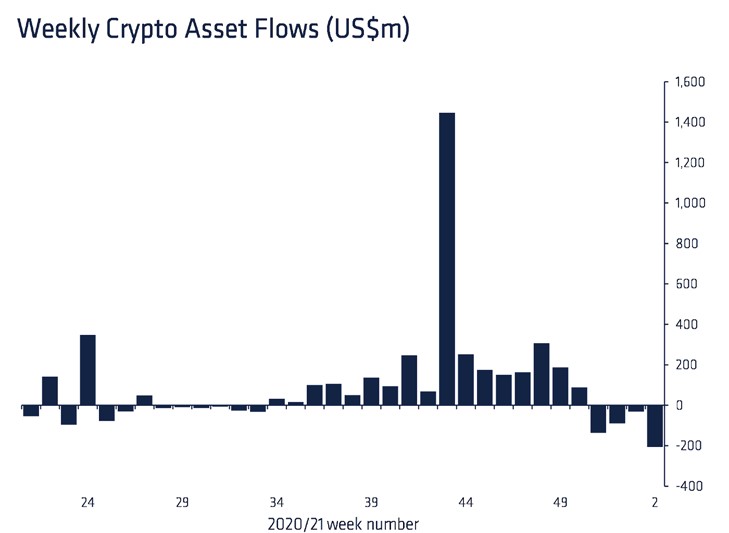

Against the backdrop of a protracted decline in the market for digital assets, investors are increasingly susceptible to bearish sentiment and are actively withdrawing funds from cryptocurrency funds.

According to CoinShares, in the first seven days of JanuaryIn 2022, there was a record outflow of capital from investment products, amounting to $207 million. At the same time, funds focused on Bitcoin lost $107 million, and funds based on Ethereum – $39 million

According to the company's estimates, negative dynamics in cash flows has continued for the fourth month in a row. During this time, investors in totalwithdrew $465 million from bitcoin funds and $180 million from ethereum funds.

Analysts believe that increased outflowtriggered by a Federal Reserve report released last week that warned of the threat of increased dollar inflation. This conclusion sowed fear among investors who began to fear a tightening of US fiscal policy. Many believe that it was the weakening of regulatory measures that contributed to the success of the crypto market over the past 1.5 years.

Despite the outflow of capital, CoinShares notes the continued high activity of investors. Over the past month, crypto investment products accounted for 25% of total bitcoin trading volume.

Let us recall that a record influx of assets into crypto funds was observed in October 2021, when they attracted almost $1.5 billion in one week.

</p>