Nick Carter's Thought Experiment on the "Fair" Launch of a New PoW Cryptocurrency withpre-sale of specialized ASIC miners, not tokens.

Disclaimer: The author of the article claims that there is no interest - personal or professional - in launching a new cryptocurrency, either now or in the future. This article is, for the most part, a thought experiment; the author did not mean a statement in support of any particular project. In addition, the author does not recommend or endorse the creation of any new cryptocurrencies of a basic level.

Foreword

The presence of ASIC miners in proof-of-work systems has always been controversial.its security (encouraging miners to bet long-term on the success of the protocol), but during the transition phase, the first ASIC hardware manufacturer for the protocol receivesThis may lead to the existence of an informal form of seigniorage – the issuance of coinsProtocols with frequent forks are also at risk; Developers can actuallydefine the PoW function of the network, which allows them to monetize their influence on the protocol.This is a potentially very insidious form of corruption that negates the "fairness" that PoW is known for.GPU-mining blockchains also have an undesirable property: they can be attacked by renting standard equipment for a short time.GPU coin mining does not require a long-term investment, as the equipment can be reused for other purposes, it can be sold after use, or initially simply rented.

Realizing these issues, I began to think about howan ASIC launch of a new cryptocurrency network could occur. Not because I am personally personally interested in this somehow, it’s just interesting for me to reflect on the compromises that arise. The culmination of my moods was this tweet:

It's only a matter of time (<12 months) until we see a fair launch with an exotic PoW released by a dev team that has also made ASICs that work exclusively with that PoW.No details of the algorithm will be released until genesis block.

— nic carter (@nic__carter) May 9, 2018

@nic_carter: This is just a matter of time. In no more than 12 months, we should see a fair launch with an exotic PoW from a development team that will also sell specialized ASICs to work exclusively with this protocol. In this case, no detailed information about the algorithm will be provided until the genesis block.

About a month later, Obelisk (a subsidiaryNebulous) announced the launch of a commercial service called Launchpad, which is designed to facilitate the launch of new PoW networks through the use of ready-made custom ASICs.

I've quoted my old tweet here to show that I've been thinking about this for a long time, and I'm not writing this out of opportunistic motives, wanting to give "moral support" to a particular project.Most of this article was written quite a long time ago, but I was in no hurry to finish it, believing that the topic of PoW launches is not very relevant and unlikely to attractI have a lot of interest in myself.

In fact, I missed the deadlines - for 12months after the tweet, as far as I know, such projects have not been launched. However, my attention was drawn to the fact that today several teams are already considering the possibility of such launches. And then I decided that my thoughts on this topic could be useful to someone. Not in the interests of any particular project, but because it gives us an interesting basis for assessing the problems that are crucial for the social scalability and security of these networks, whether it is Bitcoin or other PoW blockchains.

If someone is going to launch a new publicblockchain, I am firmly convinced that PoW without premining is the best way to do this for a number of reasons, which I will discuss later in this article. At the same time, the GPU launch, in my opinion, is becoming an increasingly complex and risky task. I can not stop someone who decided to launch their own blockchain. But I think that a careful analysis of the inevitable trade-offs may encourage developers to approach this issue more responsibly, or at least to explore other parts of the protocol design area.

I understand that some may be disappointed by the fact that I'm talking about how to launch another basic blockchain.In that case, I would recommend just closing this article without any regrets.To be clear, while I believe that the existence of Bitcoin is probably sufficient, as far as non-state money is concerned, that doesn't mean that I want to rule out the possibility of some other PoW blockchain forever.I don't see why we would need another blockchain like thisnowbut I find it hard to believe that bitcoin isboth the first and last viable blockchain forever and ever. And I'm not afraid of competition. I believe that Bitcoin has its own unique advantages, and the launch of smaller networks does not compete with it and certainly does not make it worse. Since for me the appearance at one point of another notable PoW blockchain is quite obvious, it is worth thinking in advance about the best ways to launch them.

Once again, to completely eliminate misunderstanding or ambiguity: I do not support the launch of any particular project or coin, nor do I support new PoW launches in general.In fact, I'm far from encouraging anyone to create a new blockchain – as a rule, it is expensive or impractical and turns into another "Potemkin village".But at the same time, I do not rule out the potential existence of a new blockchain sometime in the future.

Introduction

New cryptocurrencies face strangeparadox: they usually need a certain authoritative subject who will lead the development, will manage the launch process and coordinate the development during the earliest and most important period for the development of the project. Typically, creating an advanced differentiated protocol requires significant upfront investment in research and development. All this, as a rule, requires organizational and financial efforts of one subject.

That being said, of course, explicit corporate support (or a more subtle model like "let's pretend there's no pulling the strings") is a critical point of centralization.This means that opponents have obvious buttons that they can click onIn fact, any person or group hostile to the network willIn addition, these administrative entities often abandonNot only does it have a significant portion of the total issue, but it also has special decision-making powers, trademark rights, and veto power over future development directions.As in the quote from Engels about the "withering state" as the end result of a socialist utopia, the declared "path to decentralization" in the monetary protocols turns out to be more of a purely rhetorical device.

To truly make a commitmentgive up power, the founders of these projects should be prepared to work in conditions of austerity and the likely irrelevance of their efforts. It is sometimes said that Satoshi’s best idea, apart from creating Bitcoin, was to leave the project. Unfortunately, since then, almost none of the creators of cryptocurrency systems has followed his example, preferring self-interest and the desire to join the global financial elite in the person of their senior colleagues - managers of central banks.

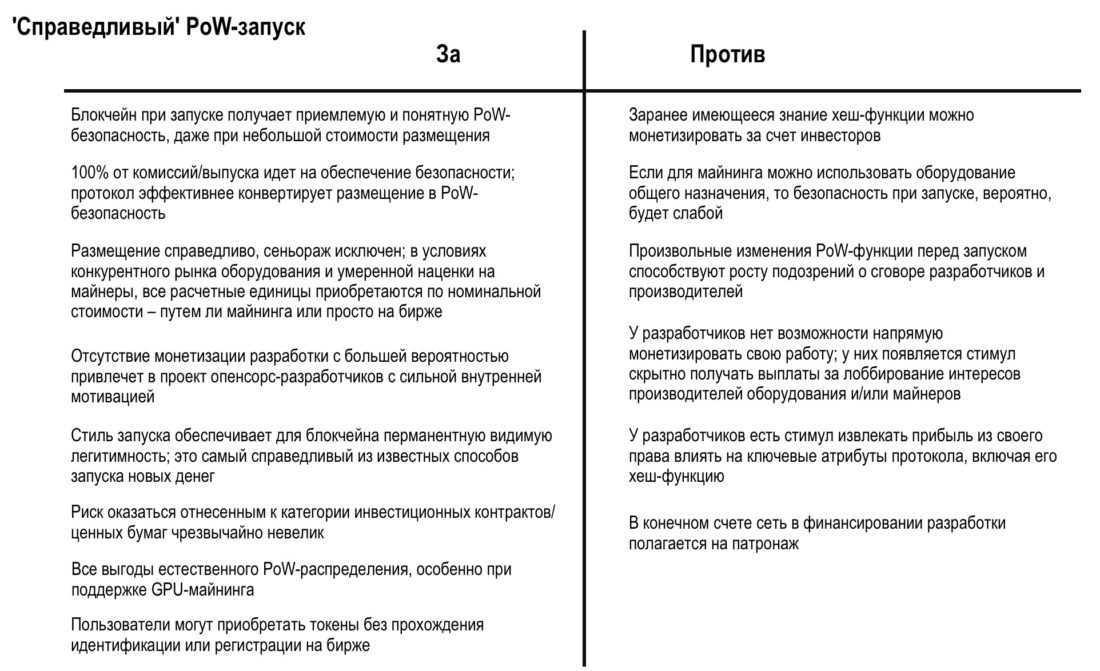

Over the years, many models have been tested.protocol financing: BitcoinTalk premine, more sophisticated ICO scheme, remuneration to the founders, veiled premin with the publication of whitepaper retroactively, instagram and joint fork. Purists will say that nothing but a fair PoW launch (guaranteeing no seigniorage even for developers) can provide the founding team with sufficient legitimacy to create a worldwide protocol.

This statement makes sense: if the world switches to a neutral cryptocurrency protocol, it is highly unlikely that future Koin buyers will find it acceptable to enrich the founders who have reserved twenty or more percent of this global currency for free. Seigniorage and, in a more general sense, a distinct sense of injustice, or even deception, leave a particularly unpleasant aftertaste. Rather, it is, and not some technical flaws, in my opinion, that will cause the death of most of these base-level protocols with high throughput, supported by venture capital. These are not just regular startups, but attempts to create money systems competing for user trust, neutrality, as well as in the field of institutional stability and justice. Private capital is concentrated in the hands of a few and distributed unfairly, but you do not have to use Uber stocks to buy bread. When it comes to something as important as money, justice is crucial. A deeply unfair launch is akin to an unremovable ugly miasm that poisons both the project itself and its perception from the outside.

Particularly attractive launch with proof-of-workIt lies not only in the level of distribution achieved through the possibility of mining at home (although this is a powerful and underestimated property). No, the most important feature of a fair PoW launch is that in this model it is impossible to purchase coins at a rate below the market. You can either buy them on the market or get them in exchange for the energy consumed; no one has the right to an insider deal. Compare this with the pre-mining of ERC20 tokens by a development team, which then gradually drops its tokens onto the market over the course of several years. Outwardly, this can be presented as the same PoW. But this is not so, because this team received all its tokens for $ 0. It would be at least somewhat similar to a PoW launch if the project developers took the money from the sale of their coins and burned them.

Of course, the downside of a "fair launch" is that the network is difficult to monetize, especially in the early stages.It's good if developers are willing to work out of idealistic or altruistic reasons.Bitcoin, having acquired systemic importance, eventually managed to attract patrons as well.Today, a rich and diverse group of patrons subsidizes the work of dozens of Bitcoin Core developers, ensuring the smooth operation of the network and the long-term development of the infrastructure.This is perhaps the ideal model, but Bitcoin has a number of significant advantages: it appeared first, playscritical role for the entire industry and is not behind itToday, any new cryptocurrency struggles to stand out from the rest.Getting enough momentum for long-term viability through patronage or donations is not an easy task.And at the initial R&D stage, it's almost impossible to raise funding without selling some form of future rights to the protocol's tokens.Here, many can point to the example of Grin.Having made a rather anachronistic decision in favor of a fair PoW launch focused on GPU mining, Grin faced monetization difficulties as a result.The flow of donations so far has been rather meager.For many, this is a cautionary tale.

Of course, those who smugly ridiculeweaknesses of the fair launch model often have the intention of promoting their own launch models. And let the one without premine be the first to throw a stone at them. Even with all the funding issues, Grin's chances of becoming a meaningful monetary asset are not burdened by securities law violations, the risk of the founder's arrest, or the frustration of a community that venture capitalists dump their tokens on at every opportunity (if you don't believe me, read documentation of crypto funds on raising funds regarding token strategies). All these phrases about the low «time to liquidity» should be understood as

«We plan to close our position on the token at a public auction because we want to provide ourselves with risk-free income and dump this asset as quickly as possible».

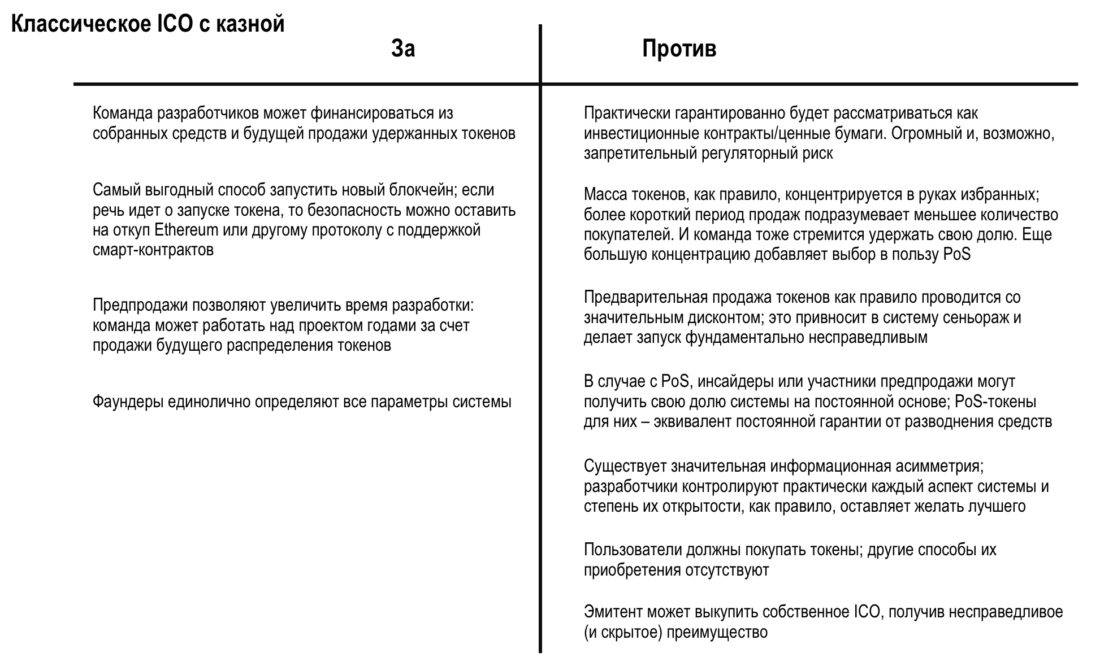

ICO, whose era dates back to 2014–2018., were, for the most part, a catastrophic financial instrument. I have never met an ICO that seemed to me to be conducted responsibly and for people. Once they were limited in their ability to attract funds from private investors, they lost their only advantage: wide and free distribution (note that this is implied by default when PoW is launched). Problems with ICOs, especially those that opt for an authoritarian proof-of-stake model (instead of PoW in the early stages, so wisely chosen by Ethereum), are numerous:

- Insiders can redeem tokens on their owncrowdsale and thus secretly receive an arbitrarily high share of the issue for free (since they can also raise funds allocated for crowdsale);

- Buyers can receive tokens at any ratelow prices, because they are not created in an expensive way through the proof-of-work algorithm, but simply from nothing. Thus, closed rounds preceding public sales often represent sheer seigniorage;

- Tokens are often a strange combinationan informal investment contract and game coins used to gain access to network resources. As a result, speculation supplants its intended use, and this leads to the emergence of extremely confusing theories of value accumulation;

- Tokens sold to the public (directly or indirectly,as in the case of Telegram), they are very reminiscent of investment contracts in the most reasonable jurisdictions, and as a result, issuers are subject to securities laws, whether they like it or not;

- Issuers retaining a large shareToken offers, as a rule, retain their authority on the network, especially in the proof-of-stake model. This makes it difficult to decentralize power, as issuers tend to resist a reduction in their share in the network;

- Early backers can take disproportionately large shares of the issue, essentially for free, and then hold on to themwithout any overhead on an ongoing basisif the network follows the PoS model. This potentially reduces the dispersion of tokens, as PoS miners are not forced to sell their coins. In PoW protocols, in contrast, miners are forced to constantly spend tokens and invest in order to maintain proportional power in the network. Whereas in PoS, maintaining your share is simply a matter of the cost of maintaining a functioning server.

My main argument is this:The main problem in managing the new monetary commodity is not technical. Of course, your blockchain must have compelling technical advantages. But ultimately the difficulty lies in overcoming the «wall of indifference». Initially, no one cares about your system. In the future, you will need tens, maybe hundreds of millions of people to support a mature project. If you give early investors access to a significant portion of the supply at a discount, and then give them strong guarantees against dilution (while expecting future users touseyour network as working capital andtolerate some dilution, effectively subsidizing the passive position of early buyers), then you risk creating a clearly unfair system in which the winners are determined by the arbitrary history of the network.

Attracting at least someone to such a networkseems to me extremely unlikely. Why should future users choose your blockchain rather than the equivalent network with fair launch and distribution, in which each owner of the coins received them for some real work, and not just due to their proximity to the founding team?

However, for ICO, premine, and coin modelscontributions to the founders have an important advantage: the ability to subsidize work on the protocol even before its launch. If it is naive to assume that not all cryptocurrency protocols have ever been launched in the last year that will ever exist, then we can even say that subsidizing work on the protocol before its launch is a desirable property. So, is it possible to start the Koin when combining the desired properties from different approaches, while avoiding the worst of them? I think it is possible. Let's look at three popular models:

There's definitely more to this example«for» than «against». In the US, selling rights to cryptocurrency, especially to the general public, seems to be out of favor with securities regulators. This is not recommended. Additionally, providing early backers or large holders with ongoing, low-cost guarantees against dilution reduces token dispersion, limiting their distribution. Thanks to the transparency of blockchains, we have a pretty good idea about this. (I would like to see a serious research paper devoted to comparing the dispersion of token distribution in PoS and PoW networks.)

Classic. The model used in Bitcoin, Litecoin, Monero and Grin. A reasonable approach, but difficult to support at startup and relying on community funding or patronage in ongoing support. It’s very effective and adapted to survive, if you can cope with the accompanying difficulties, but it requires great community involvement in gaining momentum. It seems that over time, this approach becomes less and less viable, especially given the increase in interest rates financially. In my opinion, it is expected that almost any GPU launch today will be at risk that insiders with knowledge of how the algorithm works will secretly create ASIC miners for it.

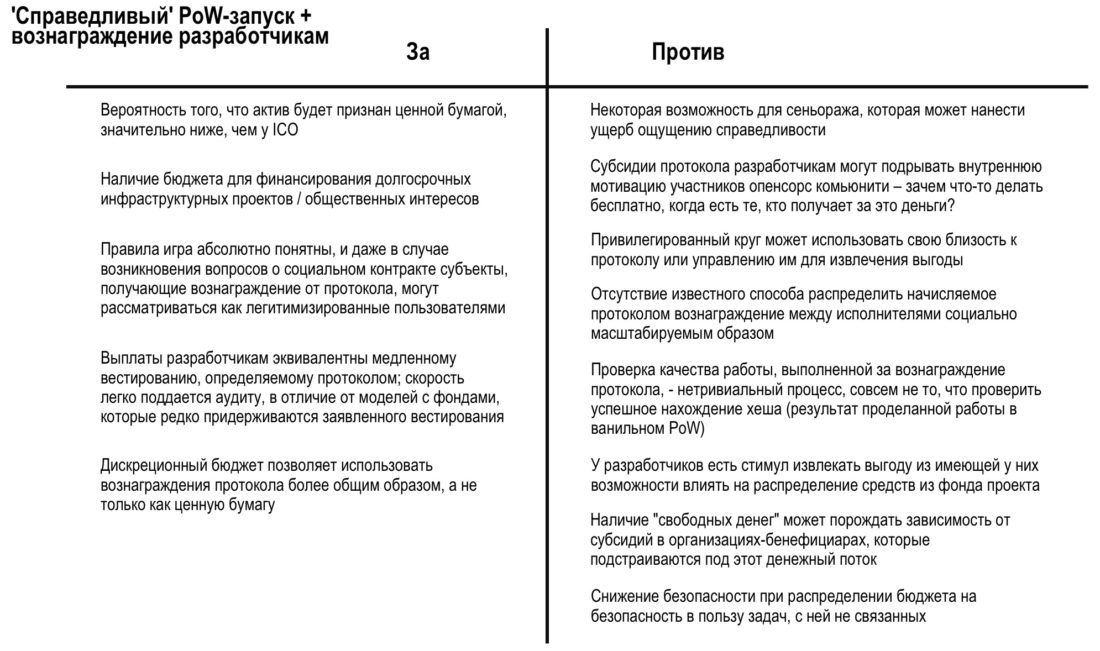

This hybrid model was first applied inZcash. In essence, it is the equivalent of an empowered premine. It balances participants' incentives better than pure premine, since pre-distributed deductions are blocked for several years. However, this proposal also has its own problems: in the case of Zcash, the disagreement raised the question of whether the administrator should receive additional remuneration guaranteed to him at the protocol level. The seigniorage crane is very difficult to turn off when it is already active.

Here you may wonder why I am not campaigningjust for a fair launch with vanilla PoW. Judging by this section, the superiority of this approach seems quite obvious. But he also has his own problems. I think it's worth being realistic about GPU PoW launches. Let's take a look at a couple of recent research on the topic.

Why fair GPU launches are probably a relic of the past

I followed the Grin launch quite closely andI must admit that it was like the last nostalgic outing of the previous era. Looking at how events are developing, I felt a longing for almost the Proust sense. It was as if he dipped a cookie into tea and transferred back to the good old days of PoW launches, in 2012-2014.

Rumors of «$100 million in venture capitalcapital in the accounts of an offshore company» were exaggerated, but the launch was definitely problematic. Initially hoping to maintain ASIC-resilience on an ongoing basis, the developers eventually took a more pragmatic approach, envisioning a smooth transition to ASIC mining dominance, but with the hope of wider adoption of GPU mining in the early stages. Grin had a period of GPU mining, but some miners are now telling me that ASICs - or at least other more efficient hardware (FPGAs) - have begun to capture a significant share of the network's overall hashrate, somewhat ahead of schedule. This isn't exactly a failure of the idea, but it does serve to illustrate the enormous complexity inherent in ASIC resistance.

You create a huge number of peoplefinancial incentive to predict changes in the PoW algorithm or lobby for the adoption of the desired decision within the developer community. The Grin developers showed some indecision regarding the final model for PoW (the discussion was, of course, quite intense), and this uncertainty caused a lot of gnashing of teeth and attempts to lobby their interests. In general, resources would be spent much more efficiently if they did not have to be allocated for lobbying the preferred hash function among developers. In the end, the developers took the utmost care and created a blockchain that was initially ASIC resistant, but failed to stop this flow. They did not choose ASIC initially, as they naively hoped that the GPUs would dominate the early stages of Grin's development (and due to the difficulty of coordinating this model with a distributed, non-corporate team), however ASIC (or at least FPGA) still appeared on the network.

Most ASIC resistant networks collidewith the same problems. They actually create a huge financial incentive for teams to create an FGPA or ASIC and secretly apply them in the hope that they will not be discovered. Su Zhu has expressed it well here:

Every coin which is targeting GPU-mining is being stealth FPGA-mined at the very least, if not ASIC-mined already.

There is some analogy here to exchanges w / speedbumps vs HFT. The speedbumps mean the game theory is more complex, but in the end fastest players still win.

— Su Zhu (@zhusu) December 26, 2019

@zhusu: In every mine with GPU mining, there is hidden mining, at least on FPGA, if not on ASIC. Here you can draw an analogy with exchanges that limit opportunities for high-frequency trading. Their speed limits show that game theory is not so simple, but in the end the fastest players always win.

It is logical to assume that future teams will learn from this lesson and reluctantly will release algorithms immediately with the expectation of ASIC mining.

Sentence

After such a long introduction, I will finally share my idea. To begin with, let's recall what we really would like to optimize:

- We would like to limit seigniorage; that is, wewe want almost every participant to be able to receive tokens at market value, perhaps with relatively few exceptions to this rule;

- We want the distribution period to be as long as possible;

- If early network support provides any advantage, then it should be temporary and decrease over time;

- Taking an influential, competent position in the system should be costly; extending the terms of such influence should not be free;

- The position of the early patron of the network alone should not provide permanent special protection against the erosion of capital;

- We want the system to work in accordance with current US securities laws, that is, we want to separate the investment agreement and the asset issued by the protocol;

- We want the network to be protected (from a crypto-economic point of view) from the very moment of release;

- We want the team of founders to have the opportunity to consciously relinquish their authority and minimize their own impact on the network;

- We want to inspire a sense of fairness of the network and minimize the information asymmetry that occurs when it starts.

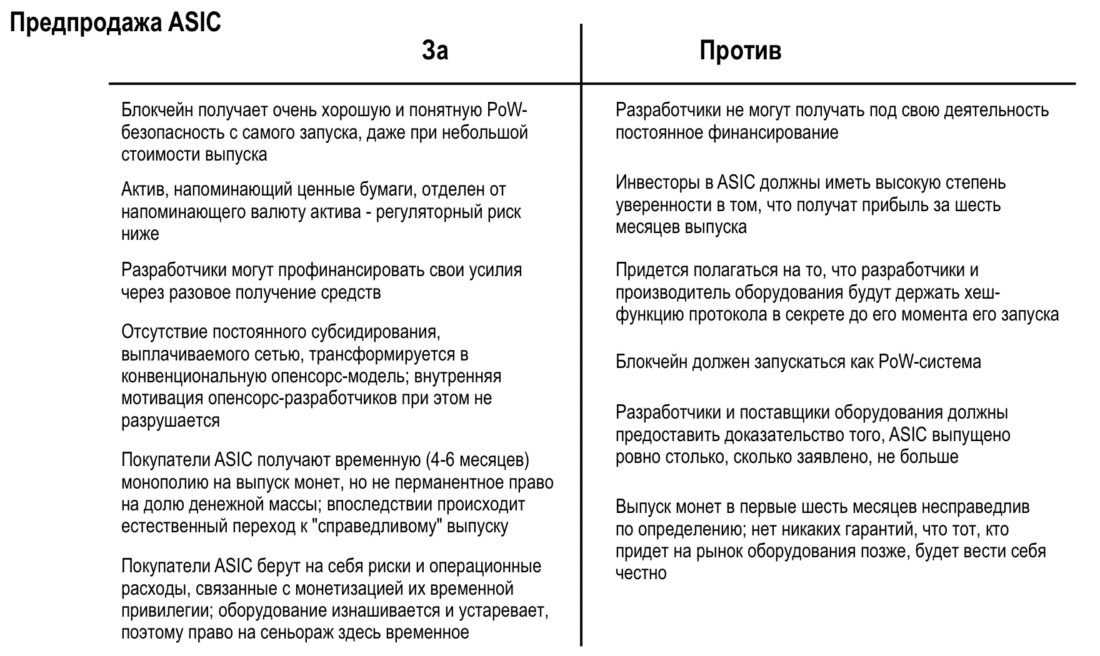

I believe that almost all of these qualities can be achieved in a model that has not yet been tested before:

ASIC Presale Model

Main idea:

- Some developers are creating a new cryptocurrency protocol;

- In order to finance this, they do not sell the rights to tokens, but the exclusive use of physical ASIC miners;

- Together with trusted supply chain partners, the founders produce these ASICs before launching the network;

- Produced ASICs are sold to investors or, morebetter, a community of users who want to actively support the network in the early stages of development. Perhaps this part is subject to securities law, although I did not conduct a legal analysis. I have no confidence in this regard. Sales of equipment are recorded as revenue for the corporation issuing it;

- ASICs are configured to work with a unique hash function not used in other blockchains;

- Developers keep this hash function secret until launch;

- When the network starts, the hash function is revealed, and among the manufacturers of ASIC miners, the race begins for the creation of a second generation ASIC;

- Within 4-6 months, the first batch, due to the emergence of new ASICs, becomes obsolete and the temporary monopoly on the issued token offer, which was used by early miners, is destroyed;

- Over time, the advantage of early miners is completely blurred;

- The developers, for their part, undertakeneverdo not change the PoW function;

- Developers either hold a small amountcoins, or they don’t have them at all and can, if necessary, exit the project or adapt the experience of RedHat (a commercial approach to working with an open source product) to blockchain management without preserving explicit authority in the protocol.

Let's look at the pros and cons of such a model.

I think that the main advantages of the model with the presale of ASIC miners are as follows:

ASIC layer security since network startup

This is a big advantage over fairPoW launch with GPU. As we learn more about the PoW security model, it becomes clear that all networks, except the largest blockchains with GPU mining, are simply unsafe. Ethereum is probably the exception, since it has such a large share of the existing GPUs in mining that it is almost impossible to sell or lease as many GPUs as would be a significant network threat. In addition to the fundamental difficulty in obtaining sufficient hashing power, this also means that a successful attack on Ethereum will lead to a significant reduction in the cost of GPUs around the world, which is also a strong deterrent for any attacker when considering the possibility of such an attack. However, with the exception of Ethereum, the vast majority of GPU mining coins are at risk of attacking the network using leased equipment, and we have seen many examples. If you think that using specialized mining equipment increases network security, then you will prefer a model with ASIC mining. This approach provides you with reinforced concrete protection from the moment the genesis block is released.

An element reminiscent of investment contracts, reliably separated from real coins

In the case of an ICO, you have tokens thatpre-sold to customers. If they are understood as investment contracts or securities, this potentially compromises the entire volume of token issuance and limits their circulation on exchanges. There is an opinion that investment contracts only includerightsfor future tokens, andtokens themselvesare not investment contracts.By this logic, ETH in pre-sale is considered to be the subject of an investment contract, whereas outstanding units of ETH on an already functioning blockchain are not securities. I don't really understand this division and find it forced to say the least. In my opinion, it will be simpler and clearer to completely separate one from the other.

In the case of pre-sale ASIC you are veryclearly separate the investment contract from the coins themselves. If something here resembles securities, then these are ASIC miners sold to investors (although, as already noted, it is quite possible that securities cannot be attributed to them either, since end users must independently manage them and supply electricity, which contradicts the criterion Howie on the profit earned through the actions of third parties). The fact that the tokens themselves do not belong to securities, in my opinion, is quite obvious, since they are issued by the protocol as with a normal fair launch. I think we have enough evidence that SEC does not classify tokens with a fair PoW launch as securities. This gives potential users the confidence that trading in an asset will not be suddenly limited by the regulator to the range of sites accredited for trading token-stocks, and this is one of the model’s greatest advantages.

Token PoW Distribution + Limited Development Financing

Benefits of PoW Distribution Not YetThey are documented in detail, but in my understanding it is quite obvious that it provides the best dispersion of the token offer volume. This model compares favorably with the vanilla PoW launch in that it gives the authors of the project the opportunity to receive funding for research and development, as well as to cover the administrative costs incurred when launching a new blockchain. And all this without violating securities laws. Pretty cool.

Arbitrary distribution period length

Many have already drawn attention to the fact that whendistribution of new money, the factor of randomness in the timing of distribution generates randomness, which limits the dispersion of the currency. In other words, the short issuance period—and some ICOs took place in a matter of minutes—guarantees a highly concentrated supply of coins. A longer release period allows more people to receive their tokens. It is partly this understanding that explains the annual duration of the EOS ICO, which was a pretty smart idea (if you do not pay attention to the fact that there was a constant outflow of funds from crowdsale wallets, which served as the basis for the conspiracy theory about recycling collected funds back into the ICO). If you think about it, the annual EOS token sale was somewhat reminiscent of a PoW launch (except that the tokens participating in it were not burned). Proof-of-work ensures extended phasefreedistribution, although gradual reductionBlock rewards mean that most coins are released early. The Bitcoin emission will last more than 100 years, but more than 80% of the coins have already been mined.

Comparing PoW launch with standard ICO,it is clear that unlimited access to the new ICO is not possible. Tezos already faced this problem, with a crowdsale conducted without any KYC procedures, and the subsequent forced identification of depositors, necessary to unlock the acquired tokens. I believe that all subsequent ICOs (as far as they will still be held) will follow this example. The difference between PoW is that you get tokens from the protocol. Although ASIC vendors may ask for personal customer data, in general, mining is a much less controlled environment than ICOs or crowdsales. Add to this the fact that electricity is globally much more affordable than access to capital markets, and PoW will look even more attractive. The protocol, which sells coins for electricity for a long time, is an extremely powerful means of distributing an asset to a global audience. So far, no one has come up with a better way.

The rules of the game are very clear.

One of the biggest problems with PoW blockchains intoday is uncertainty, especially with regard to changing hash functions. Where there is ambiguity, uncertainty, disputes arise, lobbying and the opportunity for developers to use their privileged status in the system. As a rule, this has a detrimental effect, reducing social scalability, as well as the level of trust in the system. If it turns out that a small group of people is abusing special access to the protocol in the mercenary interests, then the credibility of the system will be compromised. One alternative is to simply set up a PoW function and make a commitment to never change it (that is, in fact, a Bitcoin option; that’s why, by the way, Bitcoin should never change its PoW algorithm, unless something truly catastrophic happens). Here's what you need to implement this model. No debate, no lobbying, no covert exploitation.

The initial advantage depreciates over time, providing the system with natural dispersion

Unlike, for example, a PoS token withpresale, the initial balance of forces in a system with ASIC-launch changes significantly over time. Initially, the few elected have almost exclusive rights to issued tokens. But this advantage is limited in time, and the emergence of new ASIC models - or even just the amortization of old equipment - destroy it. I want to emphasize that I consider this a useful property. Too much power provided to the early interests of the network, plus the ability to maintain this power for free and forever, is a harmful feature that contributes to the degeneration of the network. This greatly prevents the dispersion of the user base. PoW is useful here. It stimulates constant sales by miners, leveling the privilege of proximity to the protocol. What can not be said about staking, or PoS mining. Although in the case of the ASIC launch, we have a small privileged group at an early stage, subsequently its advantage quickly depreciates.

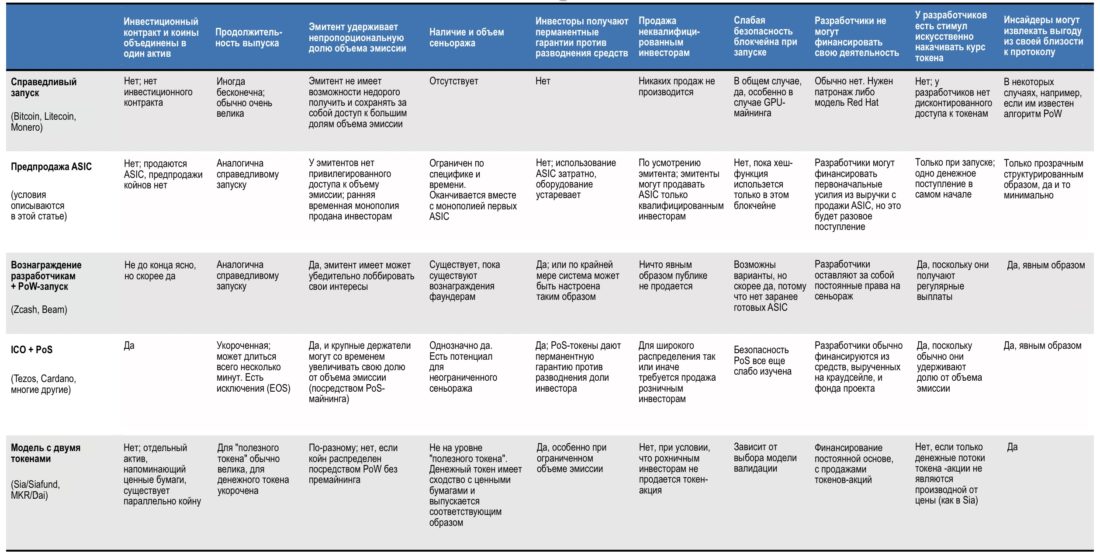

Let us now combine all of the above into one large table to visually compare alternative methods of starting the network.

Although I think it’s interesting andAn attractive model for launching a new network, of course, there are still some open questions to it, especially in the absence of examples of its practical implementation. Here are some of my questions:

- Is it possible to get enough margin from the sale of ASICs to be a profitable business?

- What is the shape of the supply curve in which a temporary monopoly on it will be perceived by future users as acceptable?

- How can ASIC buyers be sure that no additional ASIC miners have been created?

- Can a one-time funding be enough to start an open source protocol business?

- Does the restriction of seigniorage exclude the possibility of creating a monetary asset?

- In this case, is ASIC equipment equivalent to investment contracts / securities?

- Is it possible to build an ASIC supply chain that does not focus on one or two organizations that receive one-sided control over equipment production?

How do you think? Is it worth a try or is it a waste of time? It would be interesting to know your reasoned judgments about this. In my opinion, the methods for launching blockchain networks are usually not adequately covered, and I hope that this post can start some discussion, regardless of whether the proposed model itself is recognized as viable or not.

Objections

Here I will discuss some objections to the proposed cryptocurrency network ASIC launch model.

If you apply this model to Bitcoin, then for six months of mining, 1.3 million BTC would be mined. This is an excessively large fraction of the total emissions.

The shape of the supply curve can be adjusted bydiscretion in order to allocate for monopolists in these first 4-6 months an arbitrary fraction of the volume of emissions. You can calculate the curve so that they get 0.1% of the total emission, or 99.5%. I think that the issuer is most likely to set a target value of 5-10% of the total issue, but this, of course, is only an assumption.

Why do you expect the benefit of using an initial ASIC batch to last 4-6 months? Why won't it last longer, giving buyers the first ASIC a permanent edge?

If the capitalization of the protocol isrelatively significant, the manufacturers of ASIC miners will inevitably begin to release new models for working with it. From communicating with familiar ASIC manufacturers, I know that the minimum period necessary to create a useful ASIC miner for a new cryptocurrency algorithm is about four months, although I would be interested to hear additional expert opinions on this subject. FPGA in this example would not be enough, because the presence of ASIC at the initial stage sets a pretty high bar in terms of competing equipment. In any case, the result is the same: I expect that the first miners will face competition no later than six months later.

ASICs in this example cannot really be equated with securities

This is not quite an objection, but I still wanted toto stipulate it separately. I admit that I do not know the exact answer to this question. Definitely, you need to add your own efforts to connect and maintain them (not to mention electricity) to the purchase of ASIC, so their value does not depend solely on the efforts of a third party. I am only suggesting that ASICs in this network launch model can, in principle, resemble an investment contract. I am not a lawyer, this is not legal advice. In any case, if ASICs here cannot be equated with securities, then the proposed launch model only benefits from this. Remember, we try not to be subject to securities laws.

Issuers give all power to ASIC manufacturers, who can create additional equipment and thereby compromise the launch model.

Such a risk certainly exists, thereforeASIC producers must be bound by contractual obligations or have exclusive trust from the token issuing team. The risk is that they secretly manufacture too many ASICs. There are potential ways to reduce this probability. I didn’t deal with this issue too deeply, but it seems to me that the project team could add a protocol like Google Authenticator, through which they will transmit to the miners the ciphertext that they will have to include in the coinbase outputs, and this will guarantee that blocks are formed only on authorized equipment. I am not sure about that. Perhaps someone smarter than me could offer a better way to guarantee mining only on authorized ASICs.

We don't need any more blockchains. Stop explaining to people how to issue new cryptocurrencies

I generally agree, but I will not stopto research these issues only because the idea of issuing new coins is not to everyone’s liking. At some point, there may be a reason enough to create the next blockchain. Who knows?

This launch is actually quite unfair, because you basically offer premine

Definitely not a premine.There is no pre-mining here. (Although I recognize the futility of the definitional debate. What we have are issuers monetizing their information advantage. They know what hash function will be used and sell this information in the form of specialized hardware. Mining itself depends on those who acquire these ASIC. They get a temporary monopoly. It's like a taxi license for six months. It's obviously unfair. But after watching the launch of Grin, the debate around ProgPoW and the numerous «ASIC-resistant» hard forks of Monero and Vertcoin, I absolutely It's clear that developers are extremely susceptible to lobbying for a particular PoW algorithm, I would rather have a hash functionneverdid not change so that the rules of the game were fixed and the return from lobbying interests was obviously zero.

So in this case we havetransparently unfairmodel, as opposed to (potentially)hidden unjustthat people naively consider fair. The second option would be a failure. Imagine a blockchain that would be resistant to mining on ASIC, then it conducted a hard fork in order to change the PoW algorithm, and later it would become clear that the developers have specialized mining equipment with a new algorithm, while everyone else continued to mine on the GPU. This is the exploitation of the community and the abuse of its trust. However, this situation is quite possible in ASIC-resistant coins, and I expect that sooner or later it will be realized one way or another. I propose a model with a time-limited, gradually leveled injustice, which over time becomes quite transparent and fair.

Developers should not think about monetization, they should be driven by altruistic motives. Otherwise, you destroy intrinsic motivation

To a large extent, I agree with that! I think that one of the most perverted consequences of the remuneration paid by the protocol itself is that volunteer developers lose their incentive to contribute to the protocol, leaving this to professionals who receive money for this directly from the protocol. This, in essence, turns an open project into a corporate one, and first of all deprives it of all the advantages of open source development.

Specifically in this configuration, monetizationdevelopment is very limited. Developers sell ASIC miners at a price that the market is willing to accept, and this is their only opportunity to monetize their access to the protocol. Later they may consider adopting the RedHat/COSS/Blockstream model where they can benefit from theirprotocol expertise. But still this model allows the initialissuers / developers to exit the project without destroying it. After all, they do not have permanent powers in the network, which would exist, for example, for an issuing team that retains a significant part of PoS tokens.

Developers within this model will not be able to monetize their activities sufficiently

In my opinion, excessive monetizationdevelopers of the monetary protocol they create is a very dangerous thing. After some threshold value, the processes are reoriented first of all to rent, and not to provide computing services at the price of consumed raw materials. Any abuse by developers of their own authority in the system, including extracting rent to a greater extent than is minimally necessary (and this amount may be zero), undermines the trust of users and increases the likelihood that they will switch to a less rent-oriented system. I don’t think at all that any monetization funded by the protocol may be optimal. But if one existed, I would suggest that it should be temporary, very limited and not give developers permanent authority in the system. The proposed model takes these restrictions into account.

Such a launch is too expensive. Issuers will not be able to finance themselves enough

This is a fair criticism.Instead of selling tokens that are created almost for free, developers have to sell specially produced equipment. ASIC miners are usually quite expensive. I suppose this may vary depending on the type of miners, but it would cost millions of dollars to produce the right amount of hardware at an acceptable level. In addition, in order to monetize the development and launch of the protocol through the sale of miners, issuers will have to set a fairly high price for the equipment. An interesting «evaluation» effect arises here. offers.

If expected in the first six months will bethere is a monopoly on the issue of ASIC and during this period 10 percent of the issue volume will be issued, the cost of a completely vague offer will be about 10 times more than buyers pay for ASIC. This sets the lower threshold value of the project assessment necessary for monetizing the activities of issuers. Suppose that a batch of 1,000 ASIC miners costs $ 5 million (although maybe a lot more - I don’t know much about hardware). Issuers also need to collect a decent amount for research and development of the protocol - say, another $ 5 million. So, from the retail sale of these ASICs they need to gain a total of $ 10 million, or $ 10,000 per piece of equipment. Suppose also that they decided to release 10% of the total issue in the first six months and believe that the monopoly on ASIC mining will continue during this period. This means that in order for issuers to receive sufficient margin, the market valuation of the blockchain at the time of the sale of ASIC should be $ 100 million.

Why go through all these difficulties in order to start in such an intricate way? Why not just have an ICO and save funds in the fund for long-term incentive matching?

Firstly, ICOs violate securities laws.securities in virtually all reasonable jurisdictions, and going offshore may not be enough to circumvent this problem, as many issuers are sure to discover in 2020. Here I propose an alternative to «fair» PoW launch, which has several advantages in comparison. This is not an alternative to ICO. I believe that since the SEC report on DAO (July 2017), ICOs have become largely unworkable from a regulatory perspective. In addition, I think that with an ICO launch it will be very difficult to create monetary assets for the long term.

This is just a hypothesis, but I'm sure thatThe most important property of the new monetary system is the wide dispersal of property. Initially, the Gini coefficient is unity, and the goal is to achieve a reasonable level of dispersion over time. I’m not talking about ideal equality now - it is unattainable, and it’s not even clear how it will work. In 2019, every adult gets an equal right to a share in the new monetary system? But what about future people? Not yet born children? Even if it were technically possible, global unconditional distribution would still be carried out primarily in favor of the people of today.

Airdrops / giveaways don't work too wellwell. A truly sad failure awaited Stellar's attempt to get as wide a distribution of its coins as possible. Something received free of charge, as a rule, is not appreciated by the recipient. There is nothing surprising. Proof-of-work is a potentially more advanced system. Miners must do some work to get their share. Mining requires them to invest personal time and effort. This distribution method is still underestimated. If Ethereum succeeds, it will happen largely because for more than five years it could have been mined on the GPU. Delaying the transition to PoS (which, as I said above, reduces the dispersion of the distribution of coins) was a saving solution for him. This is only my personal judgment, but it seems to me that the distribution properties of PoW are greatly underestimated. Many of the protocols with an insufficiently wide distribution have yet to do this Sisyphus work - to convince users to store the value in their currency.

ASIC production - very concentratedan industry whose winners are determined by the location of production and political ties. You propose to give these manufacturers leverage over the entire crypto industry

It is true that cryptocurrency productionASIC miners are pretty oligopolistic today. Here you can find out how this industry works from the point of view of the American manufacturer ASIC. What is interesting about the ASIC launch is that it actually takes power from large manufacturers such as Bitmain and returns it to the issuers of the coin. A fair GPU launch only creates the conditions for an arms race between major ASIC manufacturers for who will quickly launch their devices on the market. When ASICs are released, manufacturers try to actively influence developers so that they do not change the algorithm (see the debate around ProgPoW in Ethereum).

In the proposed model, the team works withthe manufacturer of his choice over creating an ASIC to launch the network, and the manufacturer subsequently has the opportunity to release equipment for a specific blockchain. Obviously, the benefits of early mining will not go to large ASIC producers. If it is, then it will be received by community members who purchase ASICs from issuers of coin. This is a pretty significant improvement. I would add that there is still a rather clumsy transition that every ASIC-resistant network will have to make sooner or later, when in the end they capitulate and accept ASIC mining as valid. Choosing in favor of ASIC resistance, holding a couple of planned hard forks and, ultimately, accepting the inevitability of ASIC mining - this scenario creates enormous ambiguity and uncertainty that ASIC manufacturers can and will try to take advantage of. The situation in which the rules are clearly defined before the start seems to me much more preferable.

Finally, there is the possibility of creating an ASIC,which are not so much dependent on the current supply chain specifics for today's ASIC miners under SHA-256. Bitcoin ASIC producers are highly dependent on foundries, which give privileges to large producers that are able to make significant prepayments and compete for distribution. Alternative technologies, such as optical proof-of-work, aim to establish more equitable production processes for ASIC miners. At least that’s what they say - I didn’t do my own check. If so, then such ASICs could be mass-produced with greater ease and in a wide variety of conditions.

The presence of any seigniorage makes the model unsuitable

I'm not quite sure what this can be calledseigniorage, because there is a possibility that ASIC buyers will lose money by actually paying $ 1.10 for every dollar they issue in the form of a mined coin. At a minimum, this is not a guaranteed seigniorage. ASIC buyers take some risk. However, if the model works well, then the cost of issuing coins for ASIC buyers will be below market value. If the perspective was different, they would not want to participate in this. So potentially seigniorage is present here. If you think that even the slightest seigniorage completely undermines the credibility of the project, then this model is not for you. But if you, like me, believe that moderate seigniorage can be very useful, even despite some damage in terms of the reliability of the project in the eyes of users, then this model may be attractive to you.

Why are you even wasting time thinking like this? We already have Bitcoin, and we do not need new blockchains

I reserve the right to think and write about everything that arouses my interest!

</p>