Impressive fall of FTX and Sam Bankman-Freed. A serious blow to the reputation of the cryptocurrency.

Quick Collapsecryptocurrency exchange created by billionaire Sam Bankman-Fried suggests that no company in the free, lightly regulated crypto industry is safe.

Sam Bankman-Fried was an extremely important person in cryptocurrency.

The floppy-haired, 30-year-old former billionaire known as sbf is the founder of ftx, then the third-largest exchange in the industry.

When cryptocurrency prices started earlier this yearcollapsed, he attacked loans for Voyager and BlockFi, transferring hundreds of millions of dollars to the lending businesses, and bought assets from Three Arrows, a cryptocurrency hedge fund.

Many have seen the new John Morgan, the banker who saved the American financial system in 1907.

Bankman-Fried also spent millions of dollars of his vast fortune, which was worth $26 billion at its peak, to support political campaigns to regulate cryptocurrency.

He planned to give away most of the rest, supporting effective altruism, a movement that encourages charitable donations to protect the future of humanity.

Politically engaged, outwardly altruistic, clearly not a crypto-bro: many thought that sbf was the man who could save the industry from itself, a reputation he hardly discouraged.

After rumors that ftx could beinsufficiently liquid began to circulate, clients withdrew $650 million in assets from the exchange on November 7, before it stopped meeting requests.

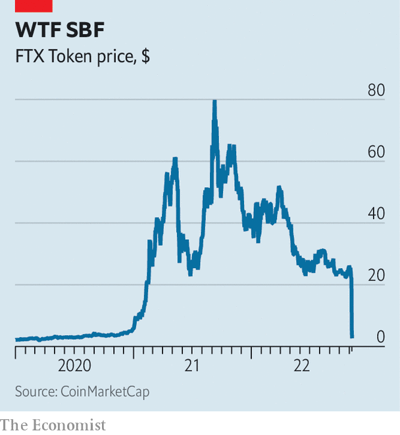

The value of the ftx token, the firm's profit-sharing mechanism, has fallen 90% since November 4 (see chart).

On November 8, Bankman-Fried and Changpeng Zhao, the head of Binance, the largest cryptocurrency exchange, announced that Zhao's firm had signed a letter of intent to buy ftx.

Then the next day Binance pulled out after looking at ftx reports.

Bankman-Fried reportedly told investors that ftx was facing an $8 billion deficit and that without additional capital it would go bankrupt.

He is now worth less than $1 billion, a 94% drop, the biggest single-day drop on record, according to Bloomberg Wealth.

The carnage spreads to other parts of the industry.

Bitcoin fell 19% since November 8 to $16,600at the time of writing. The importance of ftx to the broader ecosystem is such that JPMorgan Chase has warned that cryptocurrency markets could face a “cascade” of deleveraging and company bankruptcies, and that there is a dwindling pool of strong institutions capable of stepping in to rescue these in trouble.

The damage to the reputation of the industry is likely to be significant.

What happened?

Two stories were circulated, both partly Shakespearean.

The first is competition, and the second is arrogance.

Let's start with the rivalry between Bankman-Fried and Zhao.

Bankman-Fried owns three companies: the global exchange ftx, the American exchange ftx.us; and Alameda Research Crypto Trading Fund.

In theory, these are separate objects.

But the connection between Alameda and ftx remained unclear for a long time.

On November 2, news website CoinDesk reported that tokens issued by ftx accounted for two-fifths of Alameda's assets and were worth $5.8 billion.

This amount was almost double the market capitalization of the tokens, and part of it was marked as collateral, raising concerns that Alameda had borrowed funds against them, possibly from ftx itself.

Apparently, in response, Zhao tweeted that he was liquidating Binance's assets in ftx tokens, which were worth more than half a billion dollars at the time.

That he later decided to buy up the firm led many to believe that he had orchestrated the chaos by casting doubt on ftx to trigger a sell-off.

It seemed like a plausible story.

There's little love lost between Bankman-Fried and Zhao.

The Binance boss has long stated that his firm's headquarters are “nowhere.”

It is banned from providing some services in countries including the UK due to a lack of compliance information.

Bankman-Freed is reported to have incited Zhao to do so.

But the apparent size of the hole in ftx's balance sheet indicates that the problems were much deeper than the initial rumors about competitors.

The details of what went wrong at the ftx and Alameda offices are still unclear. An exchange that is between a buyer and a seller and takes a spread should not be an easy business to fail.

He is not usually raided as he simply holds assets on behalf of investors.

However, problems may arise when suchfirms provide loans, allowing clients to buy “on margin,” or lend out crypto tokens they hold on behalf of investors in exchange for collateral, such as cash or other tokens.

Apparently, ftx allowed Alameda to borrow clients' assets by placing ftx tokens (issued by the exchange itself) as collateral.

As ftx tokens fell in value, the firm no longer had enough assets to cover its obligations to clients, leading to a downward spiral.

Bloomberg suggests that both Alameda and ftx are now as low as $1. Venture capital firm Sequoia told investors it had written off its stake on the exchange to zero.

Reports on November 9 suggested thatThe Securities and Exchange Commission, America's top financial regulator, several months ago began investigating ftx's handling of funds, as well as ties between the Bankman-Fried firms.

It is also reported that the US Department of Justice is investigating the firm.

The loss will have wider consequences.

Cryptocurrency winter previously brought only thosethe types of victims one might expect, including a poorly designed stablecoin, a hedge fund, and several platforms that issued risky loans.

That this happened because of ftx, a well-established business, and Bankman-Fried is a huge blow.

This has caused other institutions to struggle to reassure customers. Coinbase sent encouraging messages to the press.

However, the price of its shares has lost a fifth of its value in recent days and is close to historical lows.

The collapse of ftx may be enough to reverse interest in cryptocurrency from institutions, ordinary people and sometimes the government.

Institutional investors, including Singaporean wealth fund Temasek;

Japanese technology investment group SoftBank; and Canada's Ontario Teachers' Pension Plan have all jumped into the industry with stakes in ftx.

Lawmakers will now look at cryptocurrencies with even more suspicion. Whatever the exact cause of ftx's collapse, this story has already become a tragedy for the industry.

P.S. Support the channel: https://boosty.to/kolesnikov

Telegram https://t.me/kudaidem2

VK https://vk.com/id170715284

Zen https://zen.yandex.ru/id/6228a9bdb2ff024222e4cab2

Youtube https://www.youtube.com/channel/UCrTyPO-n1ccPnf2mjMsUaJA

Sign up to stay in touch and stay up to date.