Article Reading Time:

2 minutes.

International Monetary Fund (IMF) released a report calling cryptocurrencies “open” and “adaptive,” making them the key to an ideal monetary system.

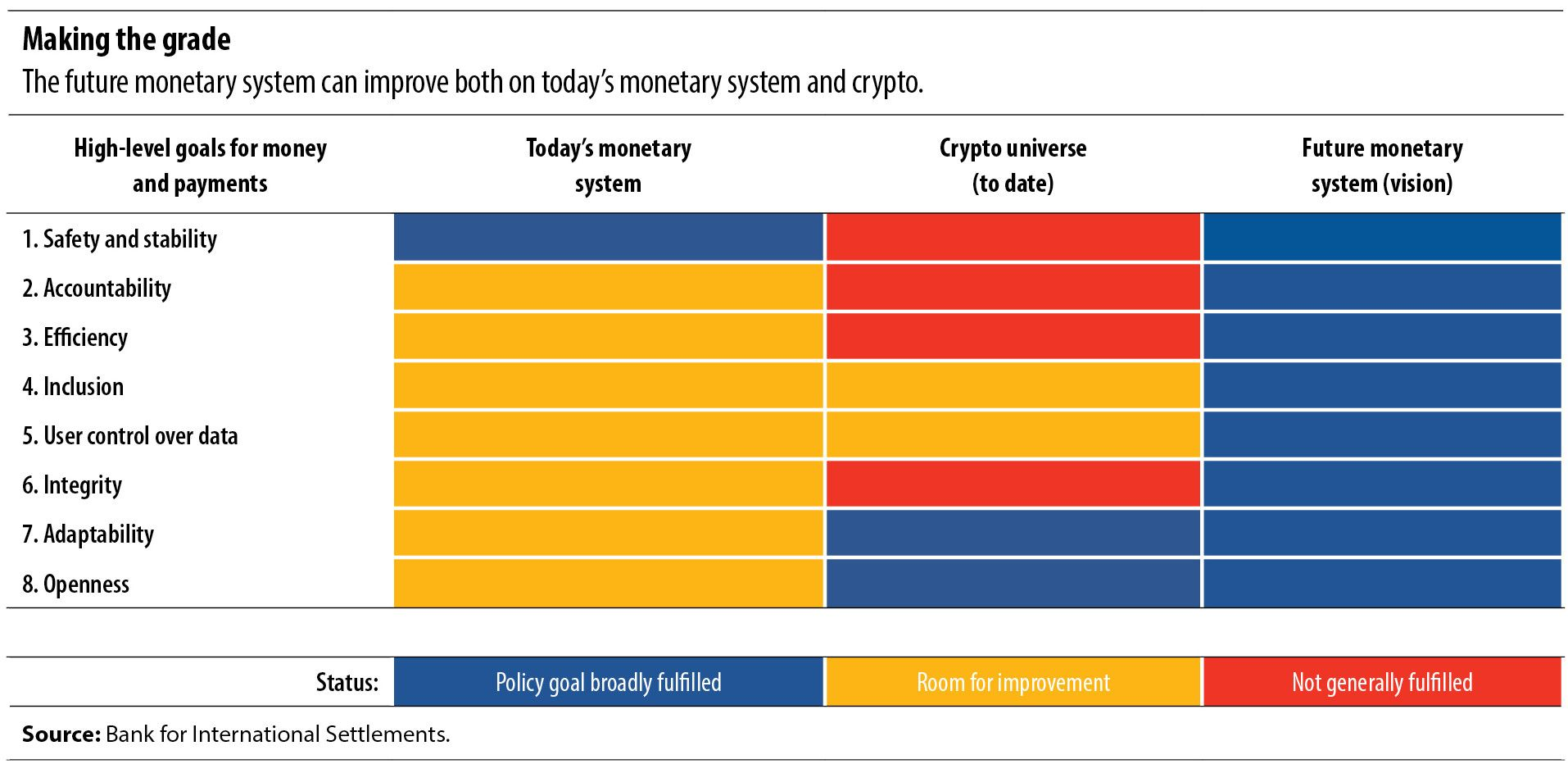

IMF analysts noted that the traditionalThe monetary system is good only in its stability and security, but in all other respects it can be improved. Cryptocurrencies, in turn, are highly innovative, open and can adapt to changing conditions in financial markets. This makes them the key to creating a future ideal monetary system.

</p>At the same time, cryptocurrencies, according to analysts,IMF, there are also significant disadvantages, including a lack of stability, efficiency and opportunities for integration into the current financial system. Indeed, the collapse of the Terra ecosystem shook up the entire cryptocurrency industry, but had virtually no impact on the traditional financial system.

Therefore, the report notes, when creating a future financial system, it is necessary to combine the advantages of traditional money and cryptocurrencies. This is possible by creating government-owned cryptocurrencies (CBDC).

“CBDC can provide new technicalcapabilities including programmability, composability and tokenization, which will open up useful capabilities for end users. Additionally, they can act as digital money, making payments fast and secure, with transaction fees as low as 0.2%. Many central banks are already working on such projects. At the global level, government-owned cryptocurrencies can enable direct transactions between different central banks. Digital technologies promise a bright future for the monetary system,” IMF analysts write.

Interestingly, at the end of July, the IMF warned the Central Bank of Kenya against the introduction of a state digital currency.