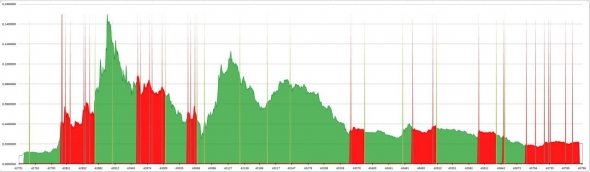

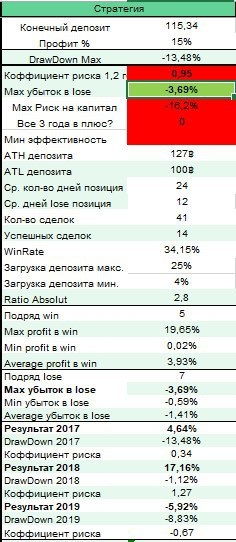

Finally, I finished the strategy tester (reverse directional movement).

60 versions where I debugged the jambs...a lot of holes, then one then the other) But after going through the reconciliation with pens all over the schedule, everything clearly coincides and is even better, without bias and emotions. Just figures.

I tested ETHBTC in hard mode, this is where all the most pessimistic scenarios, black swans, etc. are taken into account. If everything is ok in it, then in reality it should be even better.

The results ... such a thing ... if before I tested with the btcusd handles it was more pleasant there, then here it is not very. Perhaps the matter is paired with btc, but rather in the non-optimal logic.

Tomorrow I’ll put in BTCUSD and see what’s there. If it gets better, I’ll bring ETHUSD, just for fun.

But in general, while I was modeling everything with my hands on the chart, I found several ideas for the upgrade.

The first is to include trailing only after a breakout of support/resistance, and a true impulse, not a tail, and a breakout of 0.5 of the self-written modernized analogue of ATR.

The second thing that should be the main idea, go intopose in parts, with a short flight of stairs, up to the reverse point, against movement during the correction of directional movement. Then the volume of the position increases, which gives more fat closures, and moose only slightly swell.

Third, further if the deal is going, then we also increase during the correction (we need to think about the risks and the expectation)

Fourth, partial exit via TP, the further we move, the smaller the position volume, and we are loaded into corrections after 3 points.

Also, having TPs placed, in moments of wild tails, if it is in our direction, we will get a profile white swan, which nullifies the losses partially on the same black one.

As long as the ideas are those who trade trends, I will be grateful for ideas and work threads, pluses to everyone and good night

——-

How I build my hedge fund, research, deals and problems along the way, I write everything in my small telegram blog, I will be glad to subscribe - t.me/drsombre