Valuation is the analytical process by which the current or projectedthe value of an asset or company.There are many different assessment methods. Each can produce a different result, and some methods may be more appropriate than others for a particular asset class or type of company. (Definitions - Investopedia.) Traditionally, financial analysts base their analysis on the financial statements of the company. However, cryptoassets do not have such information, and traditional methods in relation to them are mostly inapplicable.

It is therefore critical that the industry continues to explore and develop new methods for valuing crypto assets as it attracts institutional investors.

In this article, we'll start by touching a little on the basics of token economics before moving on to known methods for valuing crypto assets.

Price, offer and market capitalization

The most basic estimate of the value of a cryptocurrency is to calculate its market capitalization using the following equation:

Where:

MC = market capitalization;

P = unit price;

S = quantity supplied.

Here is a snapshot of the state of the market as of November 4, 2019:

Sentence

In the case of shares, the number of shares issuedin public circulation (or held by the company), determined at the IPO. Similarly, for a cryptocurrency, the amount of tokens issued to the public (or held by a company/fund) is determined by the company/fund during the ICO process.

Some coins may have inflationaryproposal, implying the release of new coins through mining. Some may have a deflationary supply, meaning the periodic destruction of a portion of the coins. In a word, there are many options for various organization of the token offer.

The offer is controlled by a company / fund or a known token algorithm. Typically, the market does not control this variable.

Price

Price is the agreed transaction price betweenbuyers and sellers in the market. It is the most intuitive value used to calculate profit and loss, rate of return, and economic performance of an asset. This variable fluctuates every day due to the activity in the market.

However, the price of some tokens with exchange ratepegged to fiat currencies (or other assets) may be outside the influence of market activity in the crypto ecosystem. Examples of such tokens include Tether (USDT), which is pegged to the US dollar, or Paxo Gold (PAXG), pegged to the price of gold.

Market capitalization

Market capitalization is calculated simplyby multiplying the price of a cryptoasset by the volume of its supply. This metric is used to compare, rank and analyze various tokens. It can also represent the aggregate value (in dollar terms) of funds “locked” in a particular token. Market cap can also be used to compare the size of the cryptocurrency market with the total capitalization of other markets (such as stocks or commodities).

Token Supply and Inflation

As I said, there are many options for different organization of the token offer. We'll break them down below, one by one.

Token offer

The token offer includes an importantinformation about how many tokens have been or will be created and how many of them are currently circulating in the secondary market. But the term "token offer" is also found in other terms:

- Number of tokens in circulation (current supply): number of tokens in circulation at the momentt... In some ICO projects, a significant amount of tokens can be locked in the wallets of the project team; they are not counted as available in circulation.

- Maximum supply of tokens (total issue volume):fixed value, maximum quantityproject coins that can be created. This value is determined before the first digital coin is issued. For example, for Bitcoin, the total supply is 21 million coins.

- Unlimited offer:this applies to tokens with an inflationary model and an unlimited total supply. For example, Ethereum and EOS.

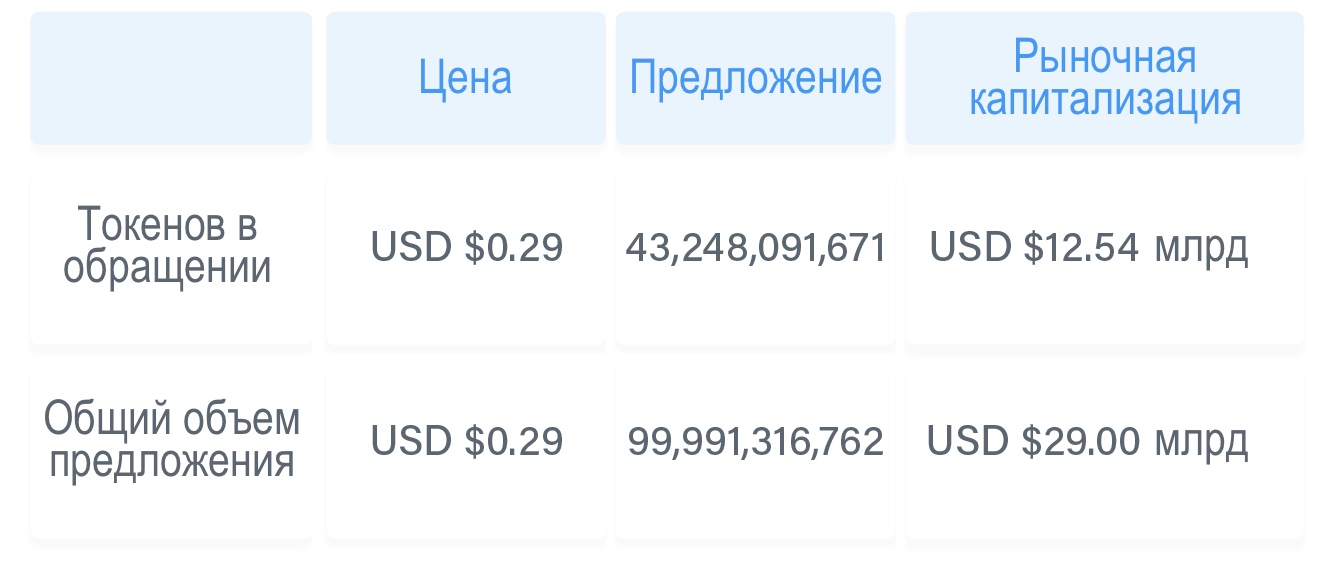

There is a debate about whether the calculation should bemarket capitalization to use the number of tokens in circulation or the total supply of tokens. XRP is a good example, where a company (Ripple Labs) holds over 60% of the tokens. As of 4 November 2019:

From this example, it can be seen that which offer is used to calculate the capitalization can have a significant impact on the valuation of the token.

In most cases, to calculate capitalizationthe number of tokens in circulation should be used. Tokens that are not available in circulation (not yet issued or blocked) are equivalent to nonexistent ones, and do not have any effect on the supply and demand curve of the market, and therefore should not be taken into account when calculating market capitalization.

Inflation

Token supply is not permanentnumber, it can constantly change. The current supply can be increased by mining, staking (PoS mining) or the release of tokens of the project founders (or investors). This creates supply inflation.

This is not a new phenomenon, it is also characteristic of fiatcurrencies. All central banks use the money supply (and its inflation) as a tool for managing the economy. The best-known examples are the “quantitative easing” policy during the 2009 sub-prime lending crisis or the overshadowed by stimulus measures during the coronavirus pandemic.

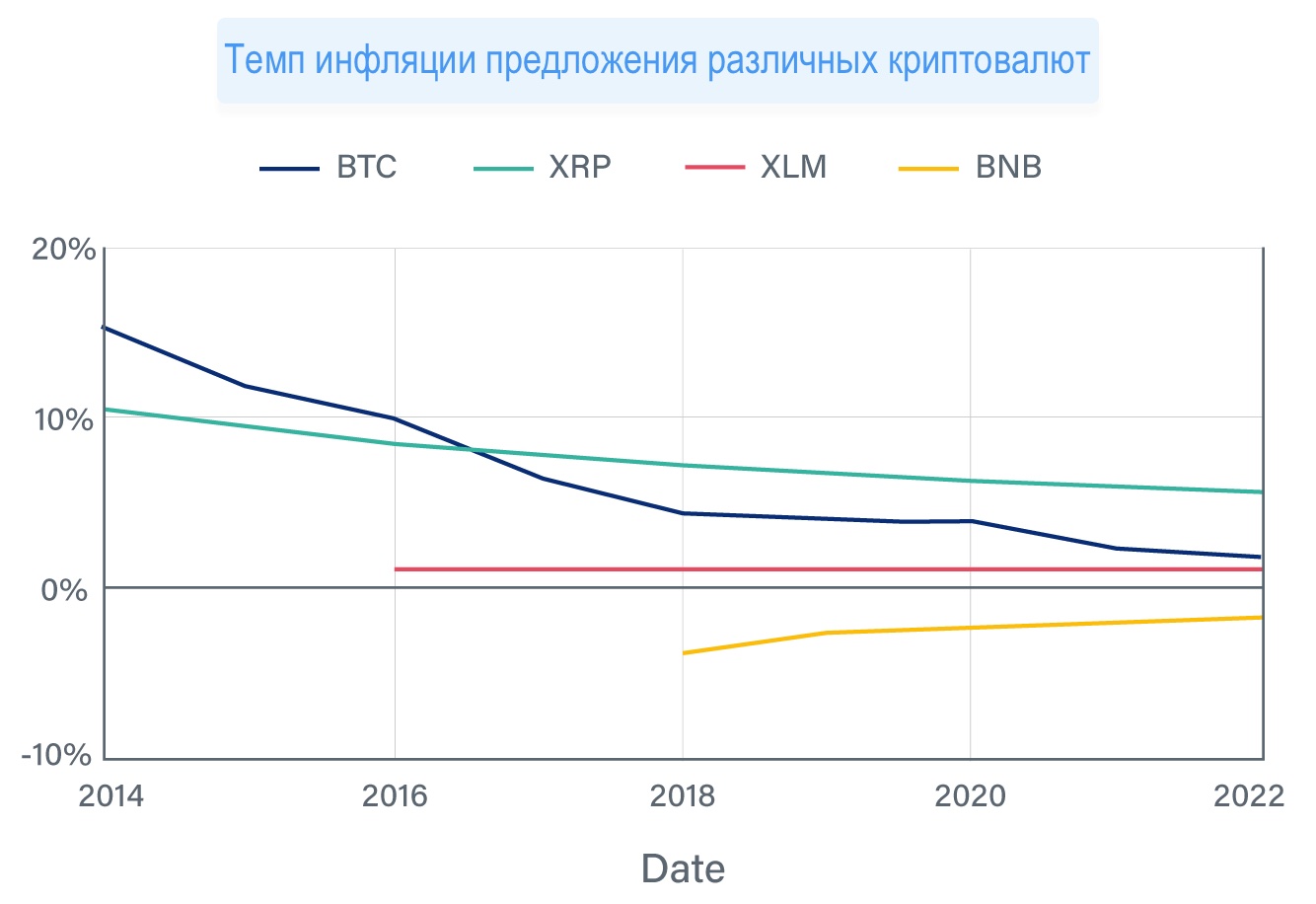

Here are some examples of the inflation rate of the supply of individual cryptocurrencies:

Different cryptocurrency projects have differentinflationary model. For example, Bitcoin's inflation rate drops sharply at 4-year intervals due to halvings. Stellar, meanwhile, has a stable inflation rate of 1%. Some cryptocurrencies may even be deflationary, like Binance Coin, whose supply shrinks as coins are “burned” quarterly.

With a constant value of market capitalization,the higher the inflation rate of the supply of an asset, the weaker its price dynamics. Hence, the inflation rate is an important factor when considering the potential cost-effectiveness of a cryptoasset.

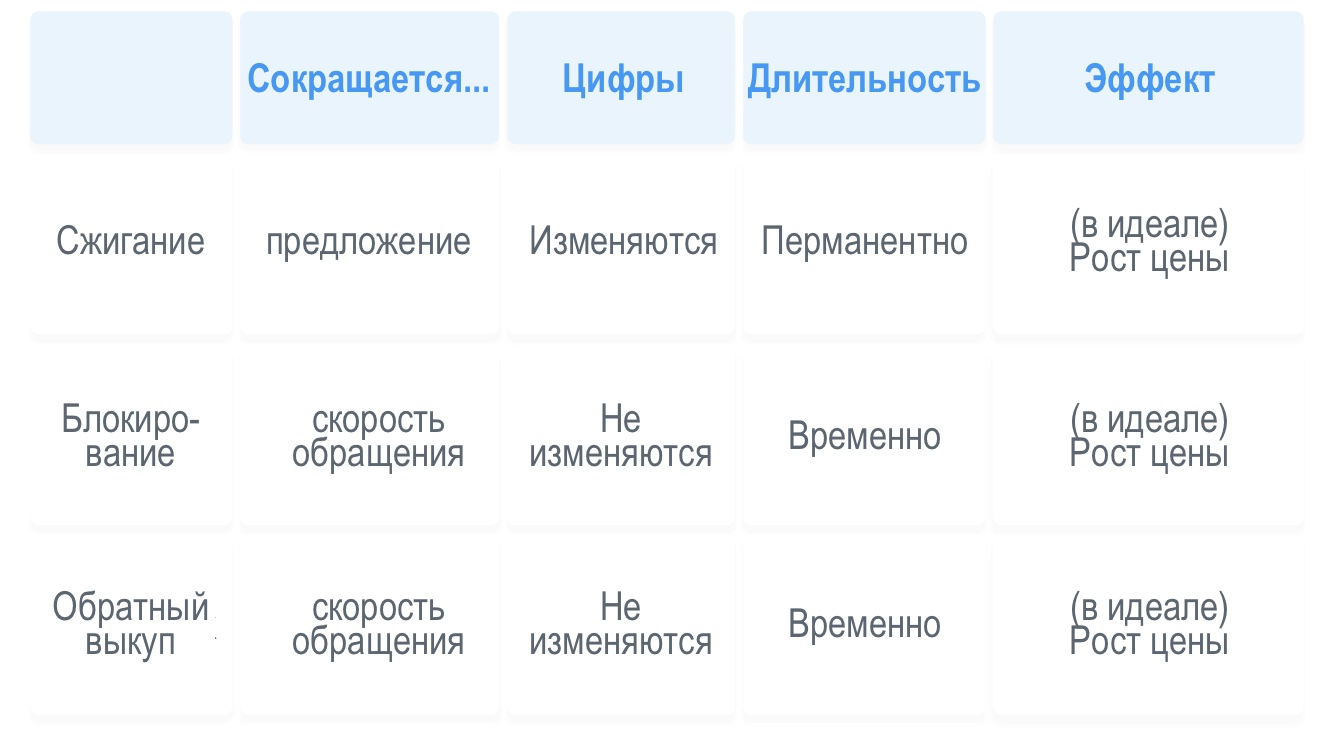

Burning, blocking and redemption of coins

We talked about "coin burning" and the link between this phenomenon and deflationary supply of tokens. So what is it?

Burning coins

Coin burning is a process in which a certain amount of coins is sent to an address with an unknown private key, which essentially results in a permanent reduction in the supply of the token.

Binance is a notable example.Coin (BNB). Binance “burns” an amount of BNB equivalent to 20% of the exchange's net profit on a quarterly basis. This is fueling the rise in BNB's price and reinforcing investor confidence in the asset's price as its supply gradually shrinks and the company's profits support the token's price.

Blocking coins

Blocking is another way (temporary)to reduce the supply of tokens. It can be implemented through smart contracts or through a centralized exchange. Blocked tokens cannot be sold or transferred to another owner for a certain period. In return, their owners are compensated with various benefits - this can be exclusive access to certain products / services or a reward for staking certain cryptocurrencies like BTC, ETH, LTC or CRO.

Unlike burning coins, whichimplies a permanent reduction in the circulating supply, blocking has only a temporary effect, as a result of which some tokens will not be traded on the market for a certain period. That is, blocking actually decreases the token's circulation rate, not its supply. In addition, the blocking does not change the nominal amount of coins in circulation.

Redemption

Sometimes a company / foundation may need to buy back its tokens from the current owners.

Redemption of tokens is essentially the same asredemption of shares by public companies and reduces the number of assets available in circulation. All other things being equal, if the supply of coins decreases, this puts upward pressure on their price.

Offer and price

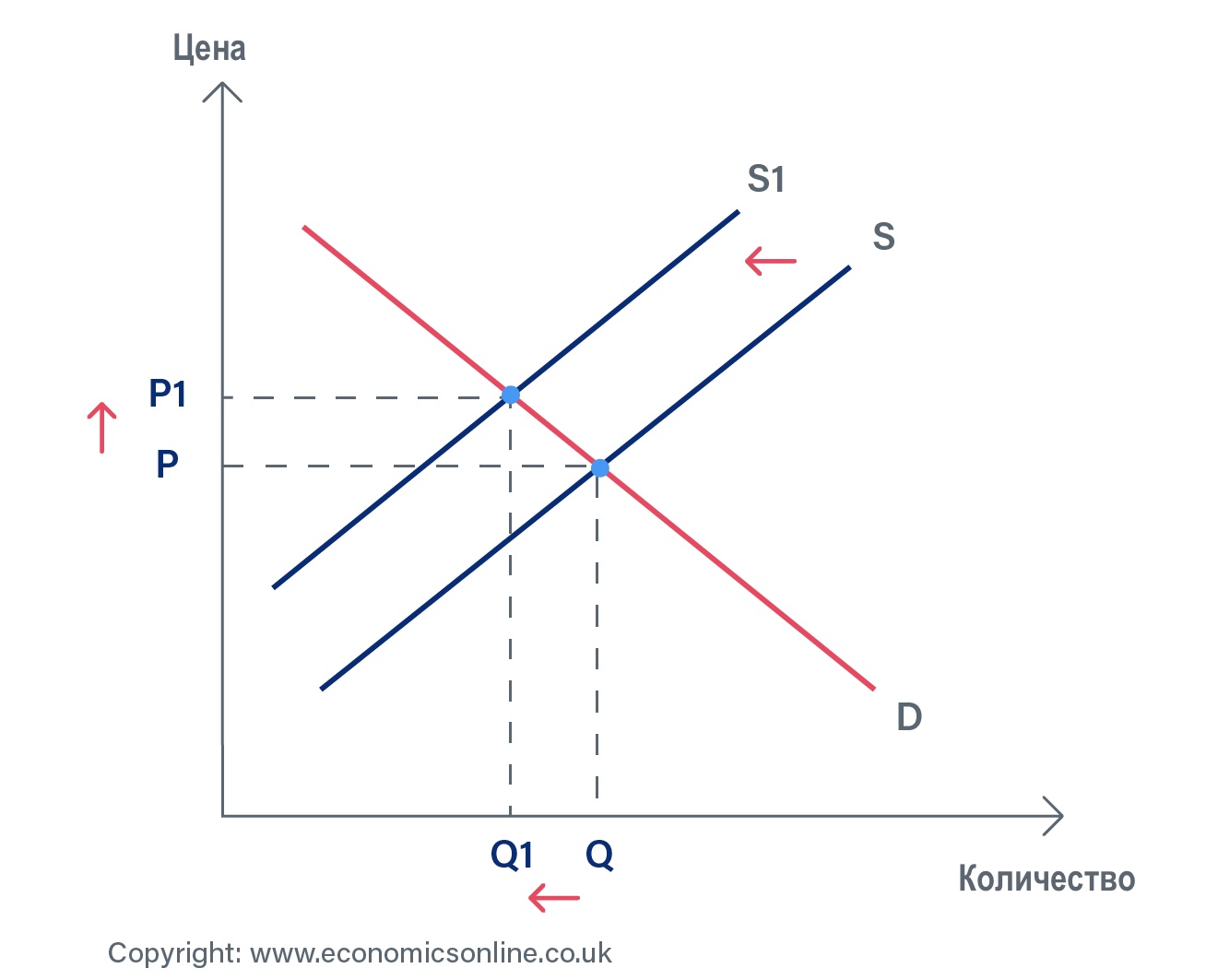

All of the above examples are options for reducing the supply of tokens. The relationship between supply and price can be easily illustrated using the classic supply and demand curve:

If supply decreases from S to S1, demandmay fall, but the price will rise from P to P1. This applies to all burn, block and buyback events of cryptocurrency tokens. However, it should be noted that the supply reduced by blocking or buying back coins can be returned to circulation when the company unlocks or sells tokens.

Introduction to Financial Valuation

Before moving on to the valuation of cryptoassets, it is helpful to gain some understanding of how traditional assets - bonds, stocks, and options - are valued.

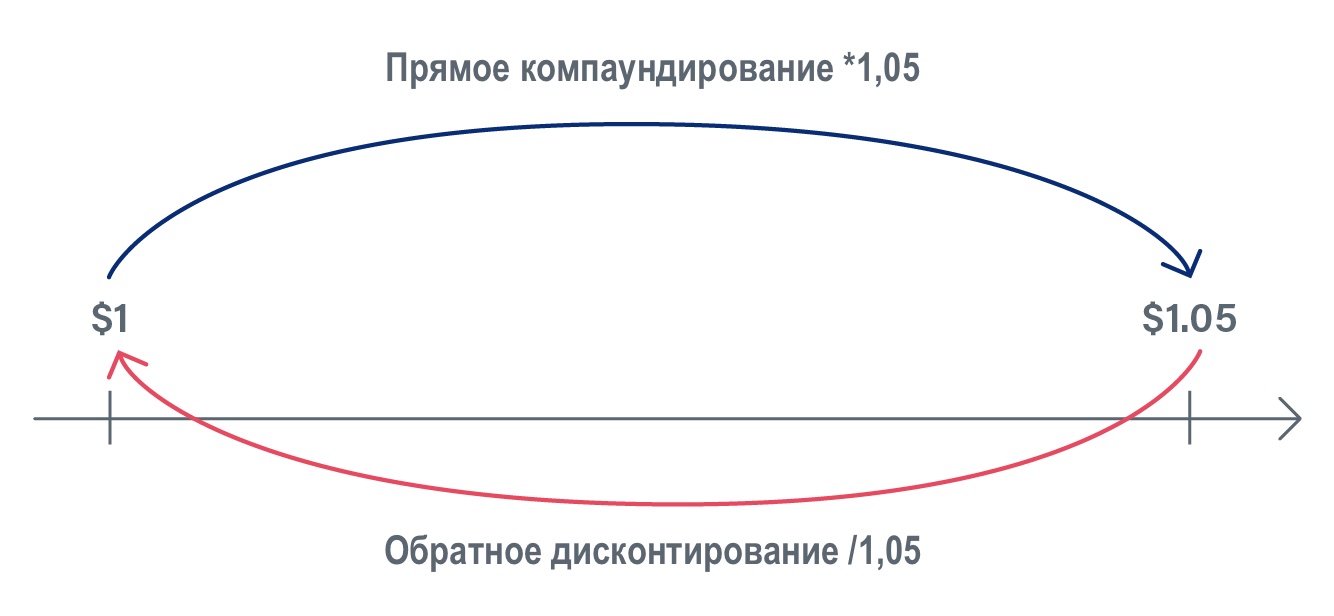

Time value of money

The concept of the time value of money impliesthat money currently available is of greater value than an identical amount in the future because of its potential return. This key principle of finance says: if money can bring interest, then any amount will have the more value, the sooner it is received. The time value of money is sometimes also referred to as present value. (Investopedia)

The formula for calculating the present present value is as follows:

For example, at an annual rate of 5%, $ 1 pera savings account will cost $ 1.05 per year. Conversely, if a $ 1.05 payment is delayed by one year, its discounted value is $ 1 because you will lose interest that could have been earned if it were in your account. This is also called opportunity cost.

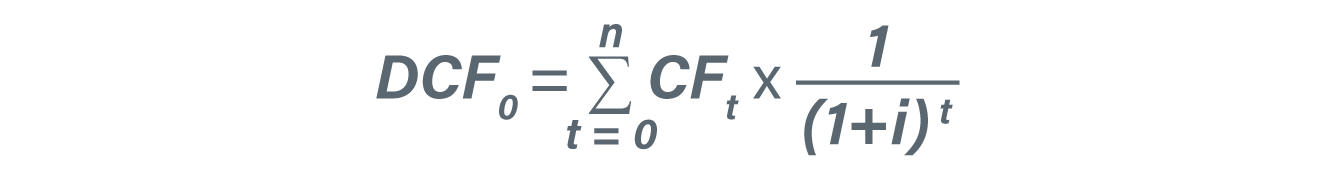

Discounted Cash Flow Model

Discounting cash flows is a methodused to estimate the value of investments based on their future cash flows (Investopedia). This financial valuation method is widely used for fixed income assets, stocks (in the form of a dividend discounted model), or even derivatives.

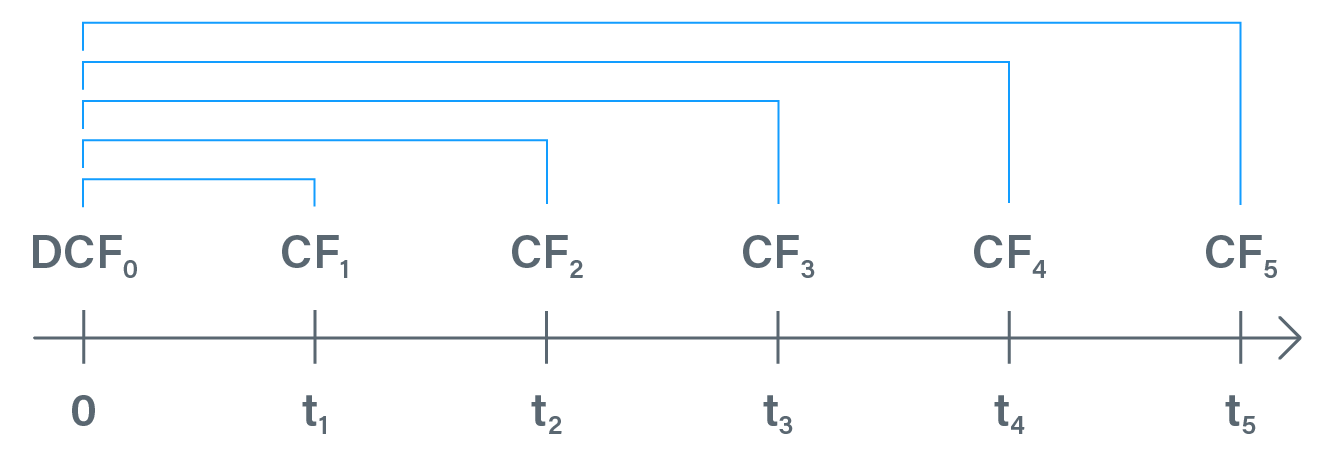

If the interest rate isi, and future cash flows at each point in timetare equal to CFt, then the discounted cash flow formula at time 0 will look like this:

The discounted cash flow model is essentially the sum of the present present value for all future cash flows. See example below:

Bonds

A bond is an instrument with a fixedincome, which is a loan provided by an investor to a borrower. Typically, such a financing instrument is used by companies, municipalities, states and sovereign governments to finance projects and operations. Bonds are usually valued using a discounted cash flow model.

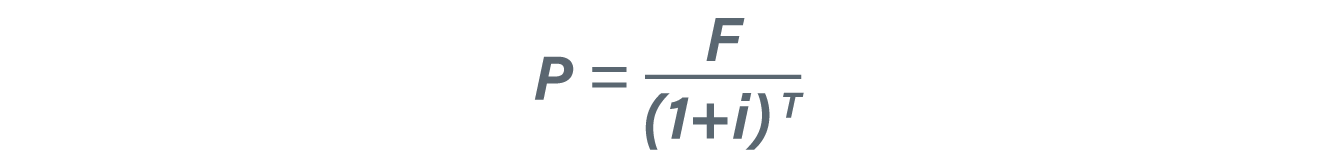

Zero coupon bond

Some bonds do not offer any coupon payments, but are instead sold to investors at a discount off par. The formula for calculating the cost is shown below:

Coupon bonds

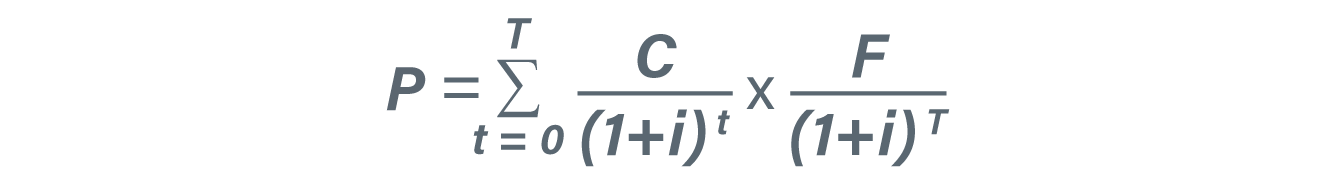

For coupon bonds, the (discounted) coupon value is simply added to the par value:

Where:

C= periodic coupon payment;

i= discount rate;

F= nominal, or nominal, value of the bond;

t= time;

T= number of periods until the bond's maturity date.

Promotions

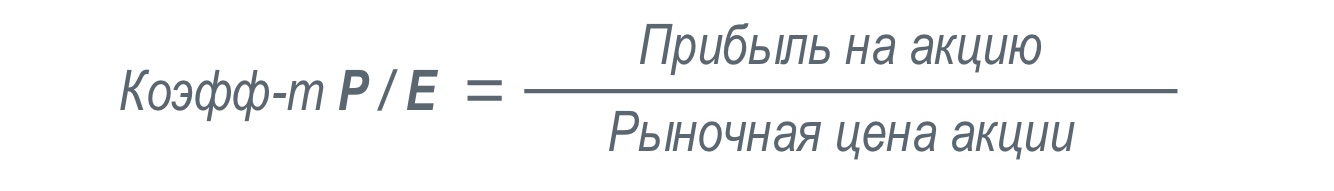

A share means a share of ownership inpublic company. One common way to value a stock is to analyze a company's P / E (price / earnings) ratio to determine how accurately the stock price reflects projected earnings per share. The formula is shown below:

Price to Earnings Ratio (P / E Ratio)

The ratio gives the dollar amount that an investor can expect to invest in a company in order to receive a dollar from that company's profits.

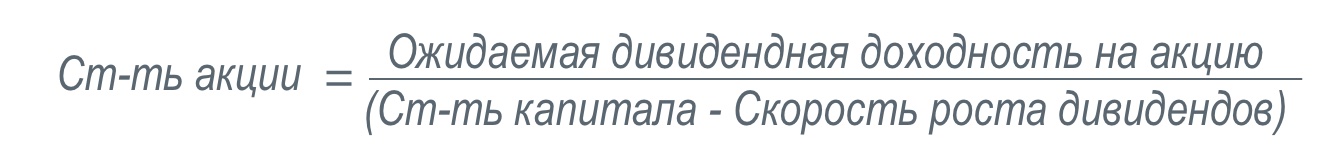

Dividend Discounting Model

Another way to estimate the value of shares is the dividend discount model. In it, the value of a share is calculated by the discounted amount of all future dividend payments on it.

The model is applicable only to companies that pay dividends on a regular basis, but not to companies with staggering or no dividend growth.

Options

An option is a contract that gives the buyer the right tobut not an obligation to buy or sell an underlying asset (share or index) at a specified price on or before a specified date. Pricing an option requires complex calculations, and one of the most common approaches to pricing an option is the Black-Scholes model.

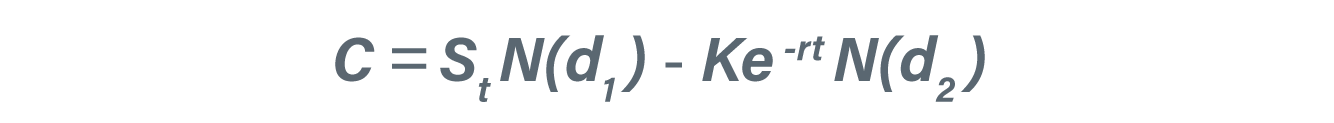

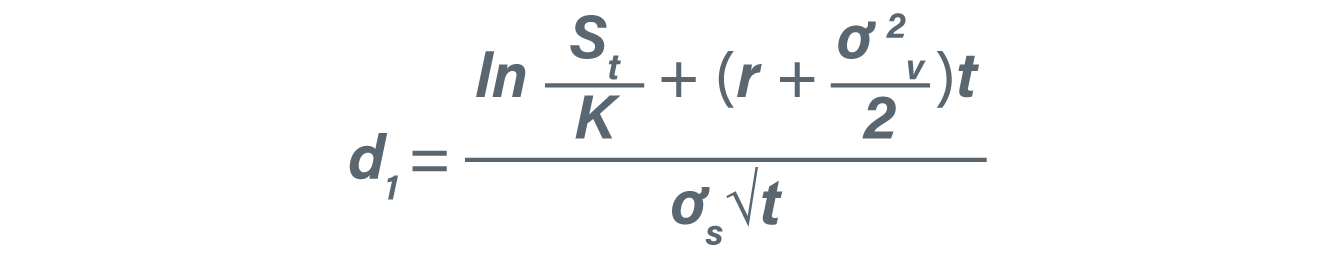

Black - Scholes equation

The Black-Scholes equation is a mathematicalmodel for determining the price of an option contract. It estimates the change in financial instruments over time and derives a call option price based on the expected volatility of the underlying asset.

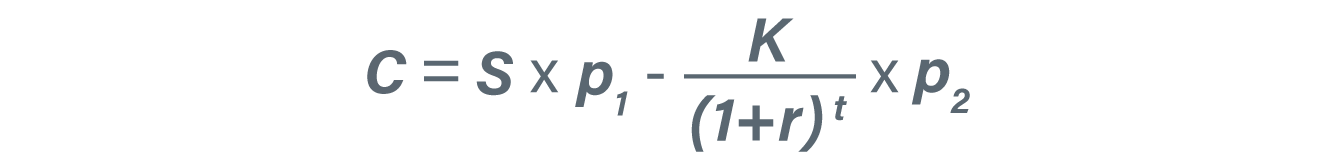

The call option price is calculated byweighting the current price of the underlying asset by the probability that the share price will be higher than the strike price and subtracting the probability-weighted present value of the strike price:

Where:

C= call option price;

S= current price of the share (or other underlying asset);

K= strike price;

r= risk-free interest rate;

t= time to maturity;

N= normal distribution.

To make it easier to understand the equation, you can bring it to the following form:

From this equation it can be clearly understood thatthe call option value at expiration is equal to the spot price of the underlying minus the present value of the strike price, taking into account the likelihood that the option will be higher than the current share price based on our expectations.

N (d1) and N (d2) represent the standardized normal distribution of the probability that the random variable will be less thand1Andd2, respectively.

The Black-Scholes model uses several assumptions:

- the option can only be exercised upon expiration, i.e. European;

- effective market conditions;

- there are no transaction costs;

- constant risk-free rate and volatility;

- normally distributed return on the underlying asset.

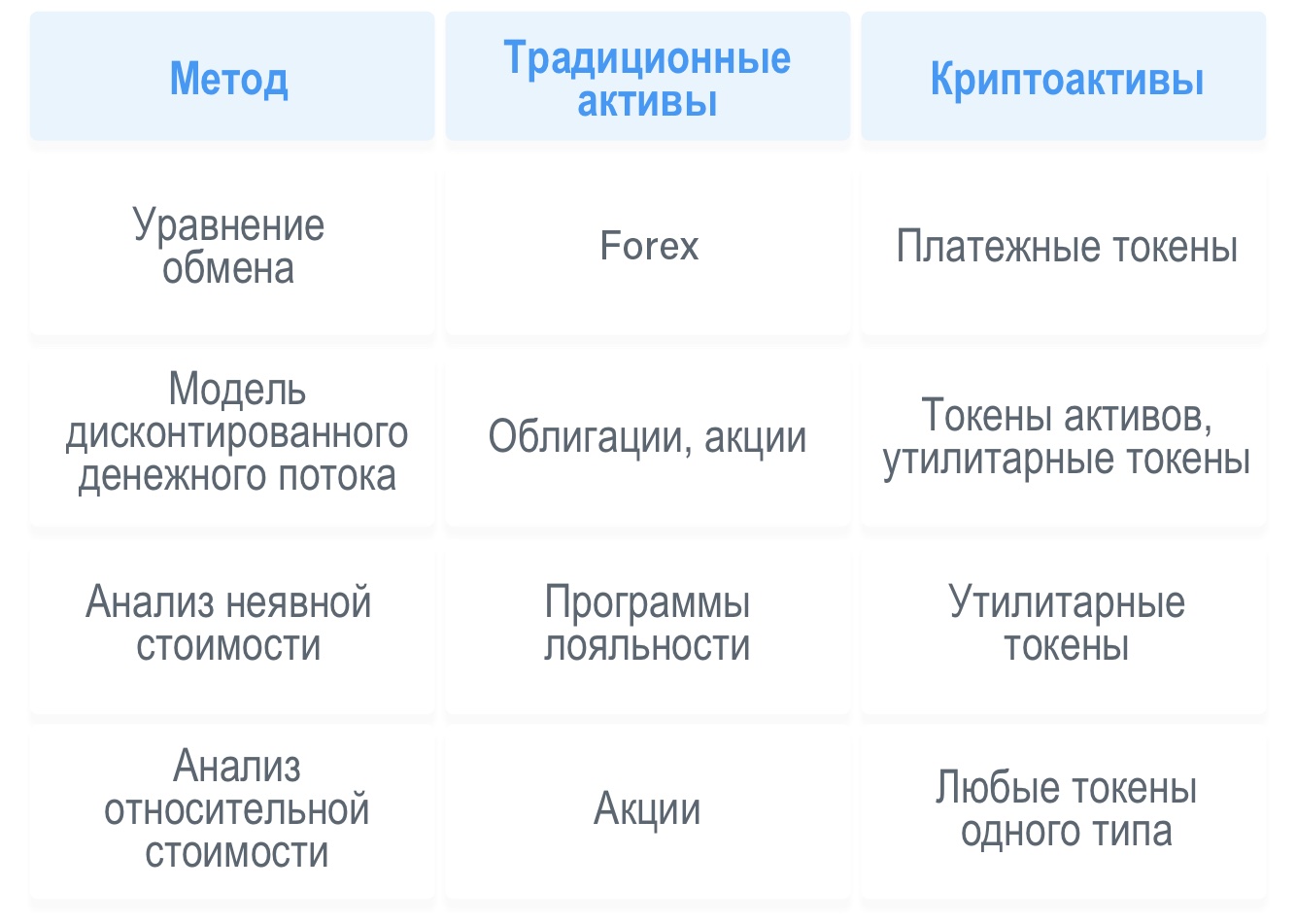

Introduction to the valuation of cryptoassets

In traditional finance, there are a number of asset valuation models and methodologies that can be used to value cryptoassets as well. We have summarized them in the following table:

There are no universal equations for evaluating cryptoassets. Different cryptocurrencies have different characteristics and therefore require different approaches to their valuation.

I will introduce four methods here:Equation of Exchange, Cash Flow Discounting Model, Implicit Value Analysis, and Relative Value Analysis. I will also explain how they can be used to value cryptoassets.

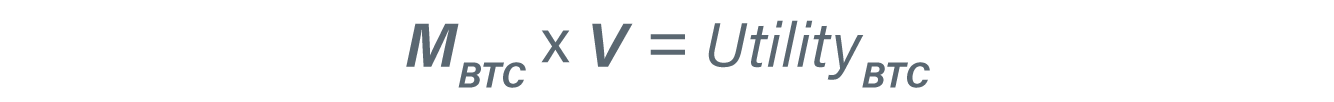

Equation of exchange

The exchange equation is an economic identity,which shows the relationship between the money supply, the velocity of money circulation, the price level and the index of expenses. The English classic economist John Stuart Mill derived the equation of exchange based on the earlier ideas of David Hume. The equation says that the total amount of money changing hands in the economy will always be equal to the total monetary value of goods and services changing hands in the economy (Investopedia).

Later economists often formulate it as follows:

Where:

M= money supply;

V= velocity of money circulation;

P x Q= nominal gross domestic product (GDP).

When evaluating crypto assets, we useP x Qto represent utility (i.e. GDP) -generated or required to use the token. For example, in Bitcoin it could be demand to use it for cross-border money transfers. In Ethereum, this could be the demand for ETH to pay for gas for the use of decentralized computing resources.

To use the above equation forvaluation of crypto assets, we need to change it a little because it will only be valid if we measure both sides of it in the same currency. For example, when applying the equation to Singapore, you need to measure everything in Singapore dollars (SGD):Mis the money supply SGD,Vis the circulation speed of SGD in Singapore, andP x Q— GDP of Singapore.

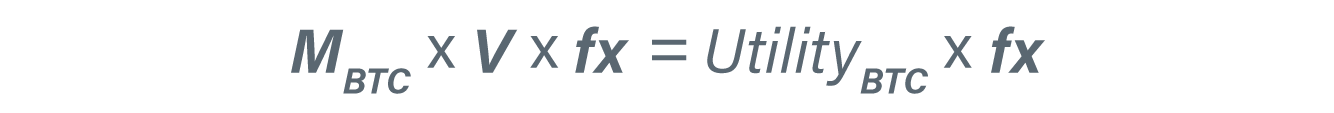

Now, suppose we apply this equation to Bitcoin, and measure everything in BTC:

Multiply both sides of the equation by the BTC / USD exchange rate (fx):

The BTC offer is known.The access speed can be proxied through on-chain activity. If we can estimate the size of Bitcoin's utility in USD, then we can give an estimate for the BTC / USD rate. This approach was first formalized by Chris Berniske in his post "Valuation of Cryptoassets" (original / translation).

The exchange equation is widely used to value various cryptocurrencies, including Bitcoin, Ripple (PDF), Filecoin, and others.

Discounted Cash Flow Model

Discounted Cash Flow Modelis not applicable for most cryptocurrencies (payment tokens in particular) since most of them do not generate obvious cash flow. However, tokens such as Binance Coin or Huobi Token (i.e. asset tokens) generate cash flows through a coin burn mechanism, which means they can be valued using a discounted cash flow model.

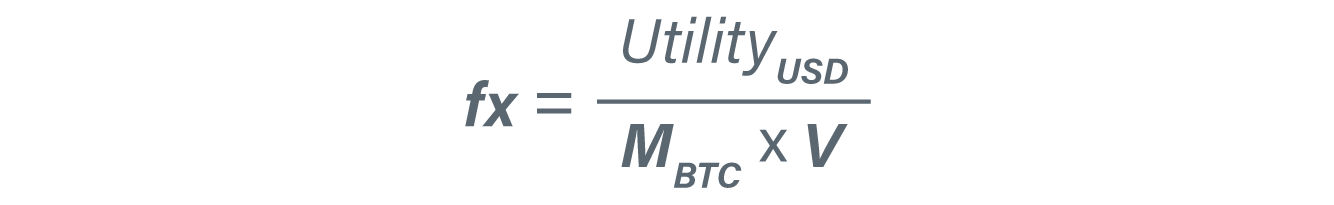

Let's assume we know the buyback amount (for tokens burned) for all future points in timet... We then know that the discounted cash flow for this ransom amount at time 0 will have a value of DCF0.

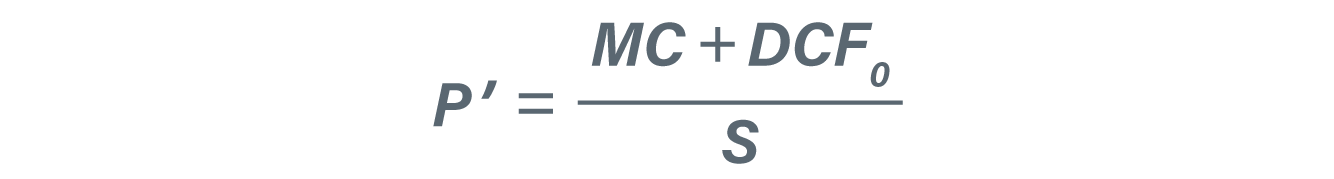

Let's assume the market capitalization (MC) is constant, by the equation:

S= volume of token supply;

P= token price.

Then we get:

Implicit cost analysis

If a digital asset is classified asutility token, its value is determined by the product or service that is accessed upon redemption - just like in flight mileage accrual programs, when you can pay part of the airfare with loyalty points.

When evaluating a utility token, one should take into account the value of all products, services, or benefits received when the token is redeemed or staked.

Let's denote the benefits obtained from owning tokens as:

The required investments to obtain these benefits are:

P= token price;

T= required number of tokens.

Then we get:

Note that there are many options for implicit cost analysis. Here are just a few of them:

- benefits may be provided at different points in time (therefore, discounting may be required);

- there may be different classes of tokens or modes of participation, with different investment requirements and different benefits;

- tokens required to obtain benefits canbe in various forms and states: in a steak (ownership does not change, tokens are simply blocked for a certain period), spent (ownership is returned to the service provider) or burned (permanent reduction in token supply).

All of this can affect the equation for calculating the cost, and its formulation must be approached with care.

Relative value analysis

Relative cost is a method of determiningthe value of an asset, which takes into account the value of other similar assets. This is in contrast to absolute value, where only intrinsic value is assessed without reference to other assets. The calculations used to measure the relative value of shares include the company's value ratio and the price-to-earnings ratio (Investopedia).

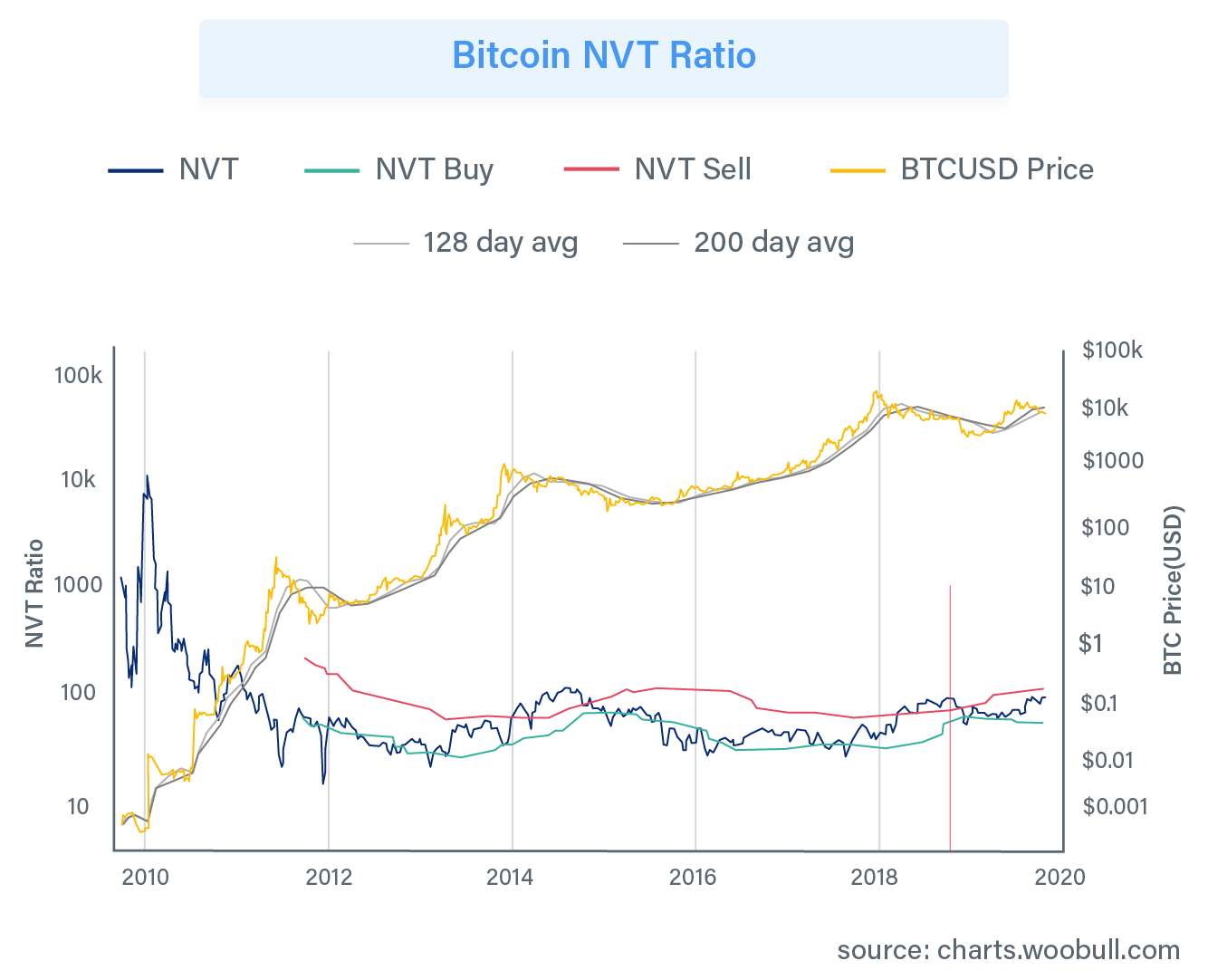

In relation to cryptoassets, in the absence ofbalance sheets or profit and loss statements, the ratio of price to yield is not applicable. Instead, in February 2017, cryptoasset researcher Willy Woo proposed a metric for the ratio of the network's value to the volume of transactions in it (NVT ratio) - first in a tweet, and later formalized this concept in an article (English).

This is how the NVT ratio chart for Bitcoin looks like:

In short, the NVT ratio attempts to relate the price of a token to the total value of transactions taking place on the network. The higher the ratio, the more speculative the asset is.

The NVT ratio only represents the relativecost. It can be used to compare current value with historical values, or to compare tokens of a similar type (for example, Ethereum versus EOS or Bitcoin versus Litecoin). However, unlike other methods we reviewed earlier, the NVT ratio cannot provide an absolute value for the fundamental value of cryptoassets.

Conclusion

Although we offer the above methods,It should be noted that models for assessing and determining the value of cryptoassets is still a very new topic and is still more related to the field of art than exact science. Any values calculated using these models should be taken and used for reference only.

All models are imprecise, but some are useful.Even though the final values obtained from these models are not to be considered accurate and reliable, I hope that during the analysis you will still gain some additional understanding of the cryptoassets under investigation.

J-curve of cryptoassets

In the previous section we talked in detail aboutexchange equationfirst adapted for cryptoassets by ChrisBerniske. In fact, Berniske did not stop there and expanded the model by formulating the hypothesis of the "J-curve of cryptoassets". Let's follow his thought step by step.

Measuring utility

To measure the utility of a token, Berniske used discounted value. He accepted a specific maturity date,T, then proxied the utility value of the token as of that date (in USD) and finally discounted it back to today. Formula:

Where:

PVEU= discounted value of expected utility;

UT = token utility;

vt = discount factor.

Hence, the price can be given by the exchange equation discussed in the previous chapter:

Where:

M= volume of token supply;

V= circulation speed of tokens.

It should be noted here that the measurement itselfutility is futuristic. In other words, the utility of the token is seen as immature today. To get a fair estimate of its current price, we must consider the future utility of the token and discount it back.

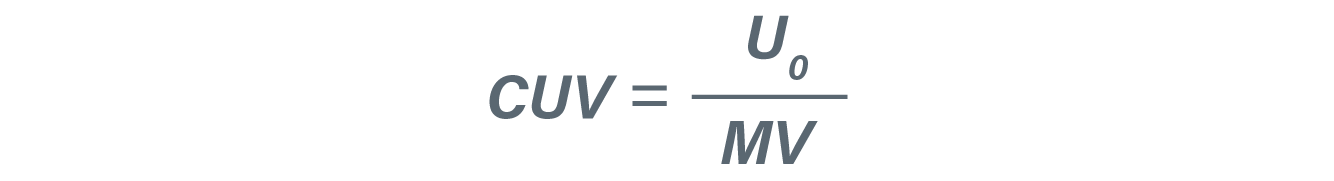

CUV and DEUV

Berniske then decomposed the token price into the "currentthe Current Utility Value (CUV) and the Discounted Expected Utility Value (DEUV). The idea is that the value of a token is made up of both of these components:

- the usefulness with which it can be used today and

- usefulness with which it can be used in the future.

A-priory,

Where:

U0 = current utility of the token,

M= volume of token supply;

V= circulation speed of tokens.

Therefore, we get:

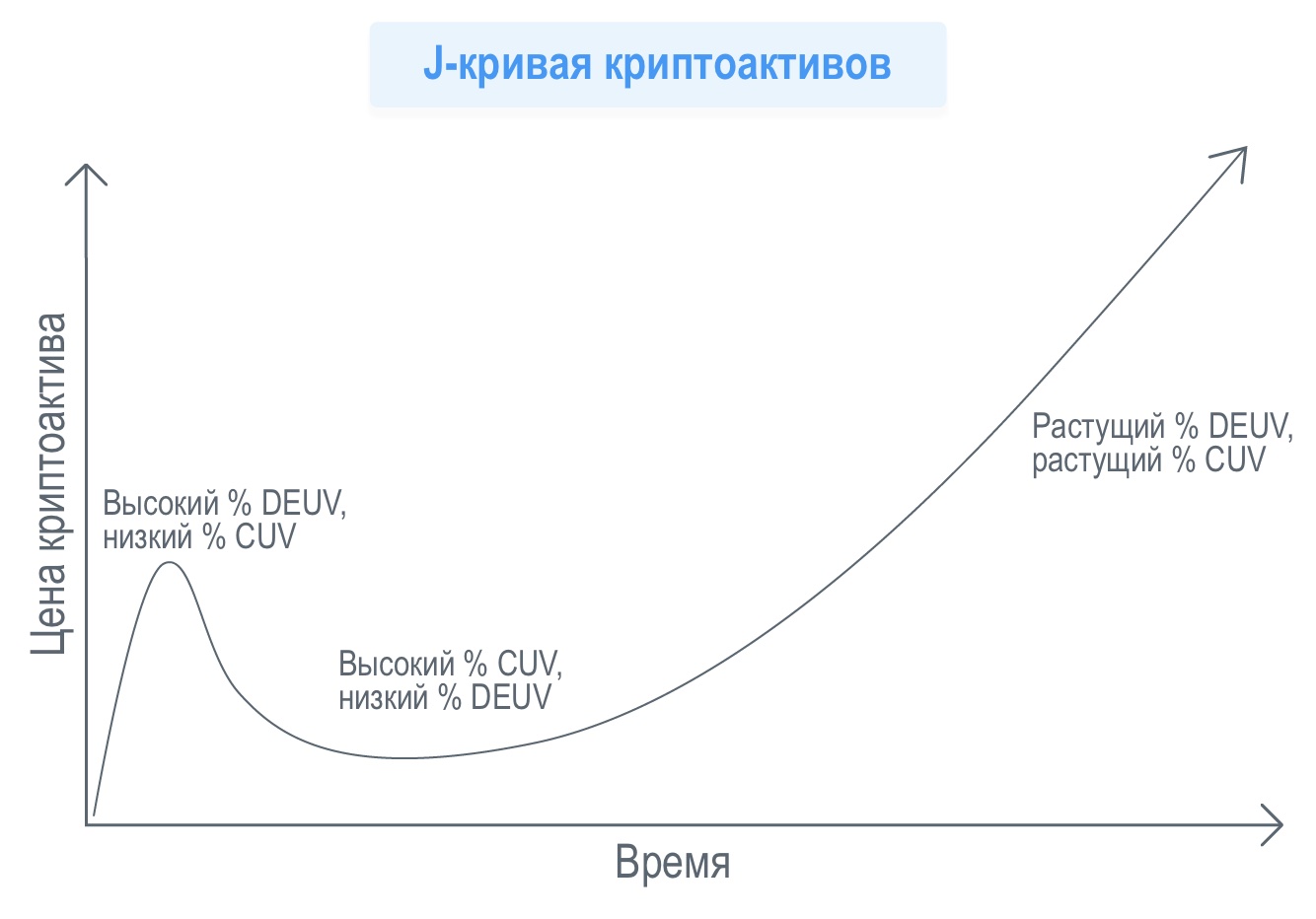

J-curve of cryptoassets

Berniske assumes that the enthusiasm forcryptoasset is initially high and, as a rule, continues to grow for some time. During this period, the CUV of the asset is minimal or completely absent if there is no protocol. Then the value of the asset turns out to be mainly due to its DEUV.

As the cryptoasset progresses, over timeenthusiasm around him may wane, putting pressure on DEUV. Since the system has not yet matured, the CUV value is low and a high CUV share results in a low price.

As usage increases, the system willmature gradually, and the CUV of the cryptoasset will gradually increase. CUV growth can be observed even when the DEUV token continues to shrink. In a bear market of sufficient strength, the price of an asset can shrink DEUV to zero, leaving only CUV and a greatly reduced price. Potentially, the market could even discount the asset to a trading point below the CUV, which is similar to trading a stock below book value.

The system will eventually mature when both CUV and DEUV expand and complete their full market cycle.

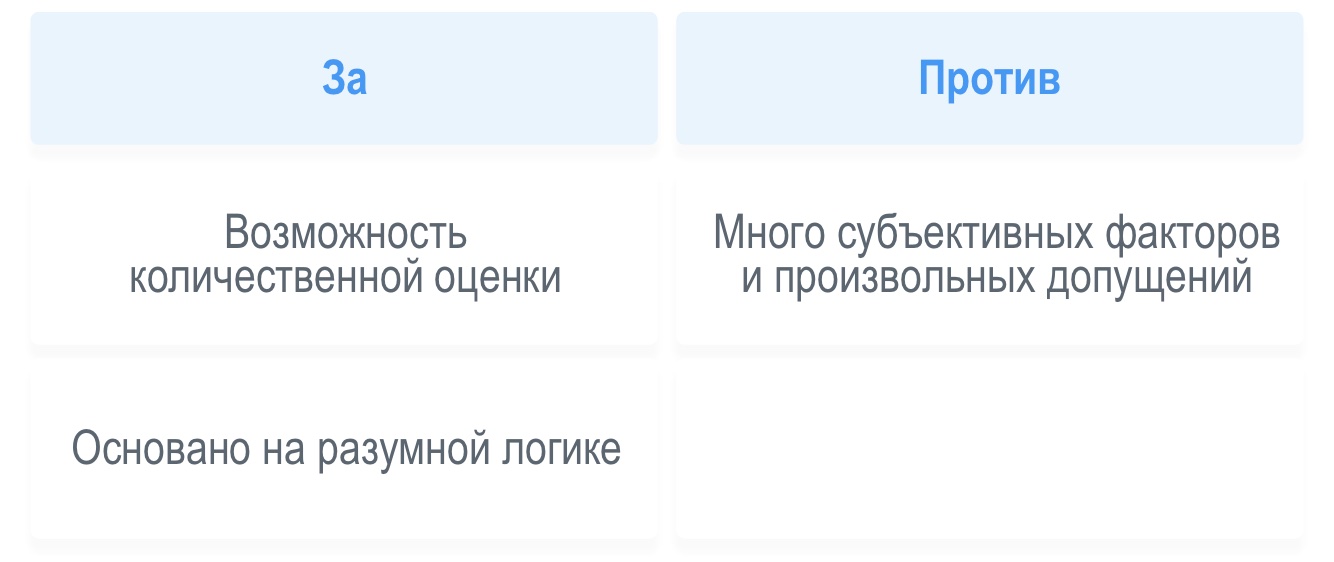

Limitations and caveats

While the valuation model and the J-Curve of cryptoassets provide some practical basis for analyzing cryptoassets, I would like to highlight some concerns and concerns:

- Arbitrary choice of ripening date.

- Berniske's example uses a ripening period of 30 years.

- What if the token is more focused on the short and medium term?

- At a high (eg 30%) discount rate, choosing a 10-year maturation period versus 30 years can significantly affect the result due to the discount difference.

- Only one use case is allowed.

- Berniske in his example suggested only one use case.

- What if a token has more than one potentially useful property and / or use case?

- It is difficult to measure the value of a utility in USD.

- Many arbitrary assumptions were used including target market, adoption curve, etc.

- Arbitrary discount rate.

- The discount rate has a significant impact on the discounted utility, but no reliable methodology for calculating the discount rate is provided.

- Berniske in his example simply chose an arbitrary discount rate of 30%.

- The reliability of the technology is not taken into account.

- No factors take into account the reliability of the technology and the capabilities of the project team.

- Probability of failure.

- A project may fail due to technology, execution, accident, etc.

To summarize, Berniske presented one of the firstcryptoasset valuation models, which may provide some insight into the direction of token valuation. But it probably cannot guarantee a good estimate of the value of the token, so it should be used with caution.

�

</p>