Despite the fact that money is one of the most ancient and important technologies, many still do not understand what it isOver the past 100 years, humanity has made many mistakes with money, the consequences of which are felt today.

</p>Previously, we used stable money that retains its value, but today only unstable money is in circulation, which constantly loses value and is subject to manipulation.

People have forgotten what money really is and how it works, so first you need to understand their basic principles.

What is money?

First of all, money is the technology by which people movevalue in space and time.

As the development of human society has found that it is beneficial for the whole group when each participant specializes in their business.The transition to specializations led to the emergence of many types of products and services, which took more and more time and energy to create.

In more primitive societies there was a barter system, in which it is easy to track who owes whom how much.But as society developed, more and more goods and services appeared, and the exchange of everything in a row became almost impossible.

How does a tailor buy a bread for her family if the baker doesn't need a new suit?And how many loaves of bread will make a new suit?Would the suit then cost less than a loaf of bread?discount in loaves for a suit of poor quality?

There are already many problems with two products.

When the number of products (n) in the economy increases, the amount of relative value of all products equalsn²"Every product has value relative to all others.

But if we use money as an intermediary for the exchange of all goods, then the value of each product is measured only in money, that is, the number of pricesngoods equalsn. It's much more effective.

Let's go back to the original definition of money.Money expresses the cost of each product relative to others.

The next question arises: what can be used as money?good money?

Today, these issues are as relevant as they were at the time of thefirst use of money in history.

Consider the properties of money and the advantages of some types of money over others.

Properties of money

There is a popular misconception that money is a product of collective fantasy, illusion, or something that people have agreed to consider valuable for no reason.

The main properties of money are associated with the ability to use them as a means of exchange of value. What are these properties?

As stated earlier, money must have the ability to movevalueVspaceandtime.

These three concepts are extremely important. Let's consider each of them separately.

Value.An item has value if it is relatively difficult to produce or has a limited supply. Leaves cannot be used as money, because they literally grow on trees.

Space.For efficient movement in spacemoney should be portable and easily divisible for large and small transactions. Real estate is a great long-term store of value, but it is nearly impossible to divide or move.

Time.To effectively move value through timemoney must be reliable and have a limited supply. There is no point in storing money in the form of grain, since it will spoil in just one winter. If grain production begins to increase, the relative cost per unit will decrease over time.

For money to be freely exchanged, it must have the same shape: each unit must have the same value as all the others.

The last property of money is popularity. It makes no sense to keep money in a currency that no one accepts, because it cannot be used to exchange value.

We examined the basic properties that money should have. Now let's move on to the types of money that have been used for many centuries.

What has humanity used as money?

Since the invention of money - about 5000 yearsBC e. - people used a variety of items to exchange value. Some of them meet the criteria listed above and have survived in society, while others quickly fell out of use. For millennia, people have used different kinds of money that went through a process of trial and error. The money most suitable for the established criteria gradually crowded out competitors.

It is worth noting that market forces act onmoney, like other goods. But it is only recently that money and value have come to be determined by the marketplace, such as millions of individual transactions. Market forces slowly moved or eliminated currencies depending on how efficiently the money performed its function. With the development of monetary technology, currencies are becoming more efficient and reliable.

The first mention of using homelivestock and grain as money appeared about 7,000 - 10,000 years ago. These products had obvious shortcomings, so people switched to more reliable, mobile, and divisible media of exchange. A sophisticated production of weapons, jewelry, animal skins, carved stones and shells began, which easily replaced the old forms of money.

People used these items as money for millennia, until metals and metal coins appeared. Minted coins surpassed other types of money in all characteristics.

Coins of Ancient Greece. : Ancient.ru

Manufacturing technology significantlyimproved, and coins began to be used as money almost all over the world. Of all monetary metals, only gold has proven its relevance and value many times. This is due only to the most important property of money - the limited supply. More precisely, with the ratio of the volume of the stock to the volume of production (S2F - "stock-to-flow").

It may sound discouraging, but S2F isit is simply an indicator of the scarcity of a product. It is the ratio of the number of new units produced (production) to the volume of existing reserves (stock). The higher the indicator, for example, the less production is relative to the stock, the more limited the stock of goods. This property of money is called "hardness."

Gold has the highest S2F of any other metal as gold is limited and difficult to mine.

Gold has been mined for thousands of years and the existing supply is known, so gold hassteadilylimited stock.

Stability is a key property of limited stock.

There is no point in money that is only limited in supply for a short period of time and then increases.

The S2F index of gold has been stable for centuries.

: "A Brief History of Money"

This is due to the fact that the development of mining technologiesbalanced by the growing complexity of mining increasingly rare deposits. Gold growth is almost impossible to change dramatically. Its value has been incredibly stable for centuries - longer than any other type of money.

Value and money are relative concepts,therefore it is very important to have a yardstick of value that remains stable in an ever-changing environment. The importance of this fact is almost impossible to overestimate.

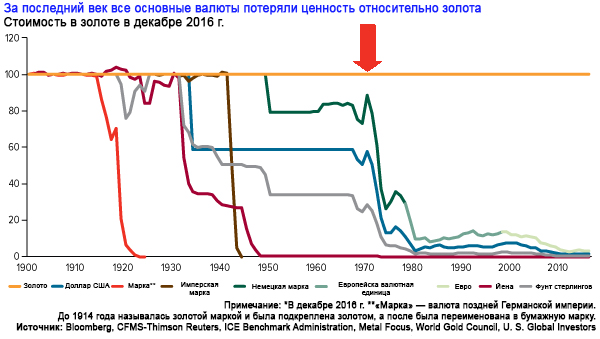

All other currencies in human history have beenmore prone to inflation and manipulation. The regulation of currency production inevitably leads to hyperinflation and loss of the value of money. If at the beginning of inflation, the currency competes with gold, then the whole value will instantly be in the harder asset.

Permanent and dependent stock has made gold the safest money in history. The rest of the money was too impractical or inflationary due to the volatility of the increase in stock.

What happened to gold? Why are we still not using it as money? How did gold stop being money and what does it mean for modern money?

The fall of divine money and the rise of fiat currencies

I'm not a religious person, but I like it whengold is called "the money of God." If I were the generous creator of our planet and I had to choose the perfect material for money, then gold is the most suitable option. It has incredibly stable growth in an ever-changing world. It's hard to make money better than gold. But it is still possible, because gold has one significant drawback. Over time, gold becomes centralized, making it unbalanced and useless.

In the 17th and 18th centuries, Italian bankers decidedstore clients' gold, and in return, issue paper certificates that could be exchanged for metal reserves. Soon, traders and private individuals began exchanging certificates like real gold, since paper is easier to move and divide than metal.

The paper-based value representation system has worked well in Europe for hundreds of years.

Chronology of the use of leading international currencies. : engcoms.com

Everything was fine until the largest banks startedstore so much gold that the states were relatively easy to take it under, which means they got the gold itself By the beginning of the 20th century, a number of European countries controlled most of the world's money supply. Certificates, the value of which was theoretically determined by gold, became the official currency of these countries.

The main disadvantage of such a system wasthe fact that countries could print huge quantities of banknotes that were not backed by gold from their vaults. This approach is called fractional bank provisioning. It helps to exceed the limited supply of gold and produce value out of thin air. Governments have increased the inflation of banknotes so much that they have ceased to have anything to do with the gold that should be backed up.

: “A Brief History of Money. or Everything you need to know about bitcoin "

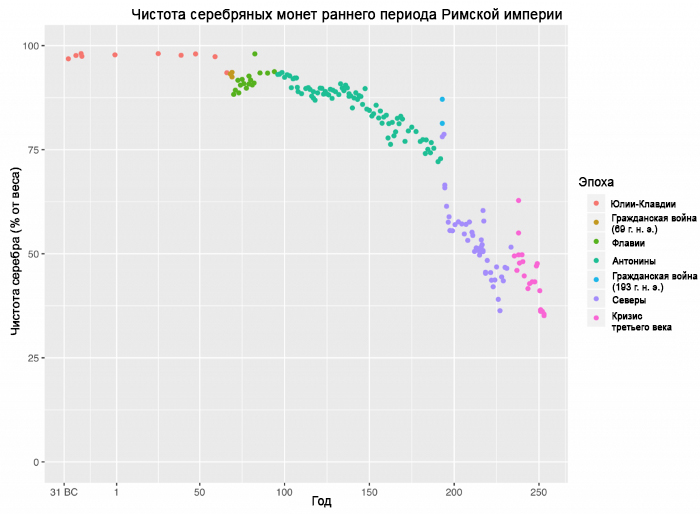

If a large number of citizens demanded frombanks their gold, the right to which the banknotes give, they would very quickly find that their money has no value. The countries engaged in this practice had to say goodbye to the gold standard to avoid economic collapse. The transition from the gold standard began in 1914 with the outbreak of the First World War and ended in 1971.

This means that for at least 50 years the value of the world currency has been secured not by gold, but by a government promise.

: Wfthappenedin1971.com

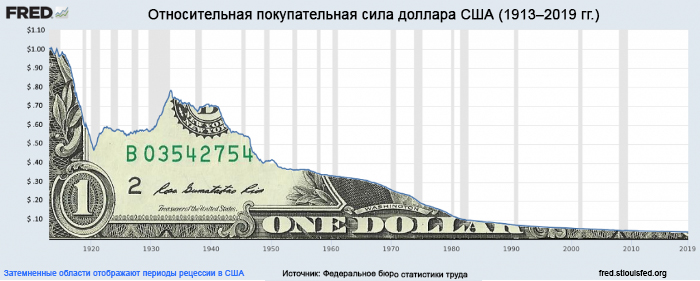

Of course, banknotes still have most of theproperties of money. They are more divisible and more mobile than gold. But fiat currency lacks the primary ingredient that has ensured gold's superiority over the centuries - the unconditional and permanent complexity of production. The production of fiat currency is limited only by the government's promise not to increase inflation. This promise is constantly being broken. Since 1913, the US dollar has lost 96% of its value due to inflation.

: St Louis Fed

Taking into account the events of 2020, we can say that thisthe trend will only intensify and the government will print more trillions of dollars than ever to fight COVID-19. The supply of money is unlimited, but 1 / ∞ will always be zero.

History teaches that the average lifespan of a fiat currency is 27 years. The longest-used pound sterling has lost 99.5% of its value in more than 300 years of its existence.

It is possible to write a separate article about inflation, but one thing is worth mentioning in this publication:

If a person or a group of people can increase currency inflation, they will.

As they say, absolute power corruptsabsolutut.Absolute power over the money of society will leadonly one to one - those who control the cash mass will bemanipulate her for her own purposes.

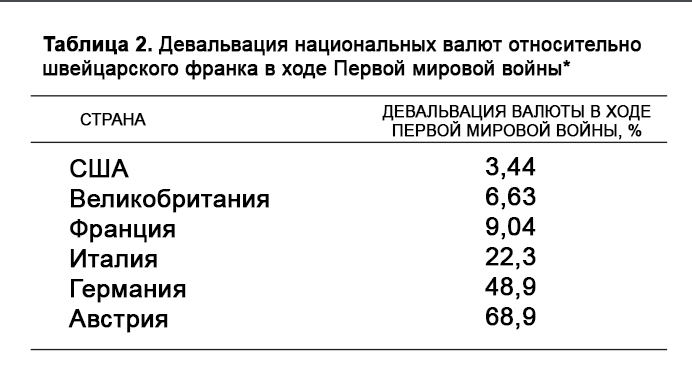

The rulers of Rome gradually cut silver coins, and in 200 years their money lost 60% of its value.

: Wikipedia

The cutting of coins by the rulers was sopervasive and so effective in creating value at the expense of citizens that it became popular around the world, from England to Rome, India and China, and has been practiced for millennia.

That is why money should have internal permanent properties that will helpto combat greed and short-term manipulation.

Best money

The transition from the gold standard has led to serious consequences in society.

The modern economy is based on subjectinflation of fiat currency, which cannot be used for savings and is profitable to store in the short term. We live in a world of impulsive consumerism.

Inequality is now greater than ever andcontinues to grow. The stock market is booming, wages stay the same, all kinds of debt are swelling, and most families don't even have $ 500 to spare for unexpected expenses.

All this is depressing, but despite all the negative news, there is a ray of light in this dark kingdom.

Bitcoin.

Bitcoin emerged from the ruins of the 2008 financial crash and became an alternative to the existing order, a way to avoid the imminent death of the current fiat system.

The end of fiat money is approaching and will happen due to hyperinflation, revolution or other reasons. Recent events confirm this.

Bitcoin is still in its early stagesdevelopment is facing the first challenges. But if you study it a little, it becomes clear what Bitcoin really is - it is not PayPal 2.0, not a way to launder money earned from drug trafficking, and not a pyramid scheme.

Bitcoin isthe best money in existence.

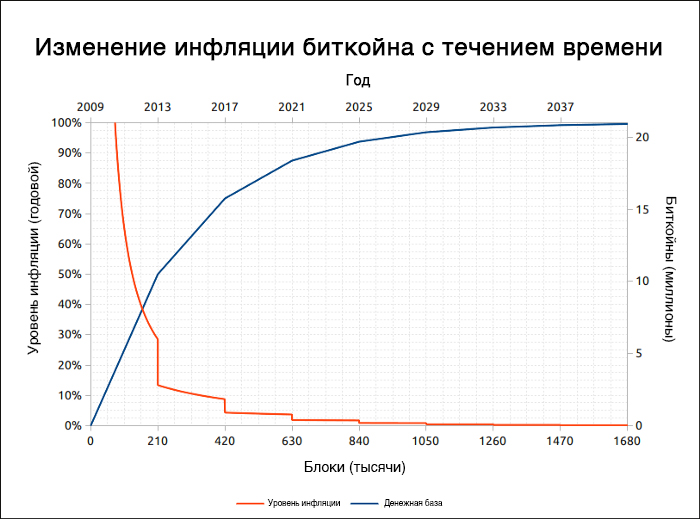

Better than current fiat currencies, better than gold,better than any money that ever existed. Bitcoin has a reliable rarity - a total of 21 million bitcoins will be issued, and their production schedule is transparent and based on decreasing growth.

Bitcoin production has halved in 2020, and Bitcoin's S2F is equal to the S2F of gold, the only asset with the same rarity.

But production will not stop there. It will shrink every four years, and around 2140 a total of 21 million bitcoins will be issued.

: Bitcoinblockhalf.com

The Bitcoin issuance process is governed byautomatic code that cannot be changed. Bitcoin will soon become the rarest asset in the world. It is protected by the most powerful open source peer-to-peer computer network. The only downside to Bitcoin is time. Gold has been around for 5,000 years, and bitcoin is only 11. An unknown inventor of this cryptocurrency under the pseudonym Satoshi Nakamoto endowed his creation with the properties that turned bitcoin into the best money in the world. In another 11 years, bitcoin will reach its full potential.

</p>