Cryptocurrency exchanges offer a variety of instruments for investors, including futures and options, butIt is important to know about funding for sales positions and other fees.

Trading Bitcoin Futures (BTC) Mayseem easy at first glance, but there are a number of commissions that investors who seek to make big profits from transactions with high leverage are ignored.

In addition to trading fees, investors should also be aware of the variable funding rate that many exchange fees, and even seller and buyer fees, must account for.

Let's look at three things every crypto trader should know about trading Bitcoin futures.

Funding level

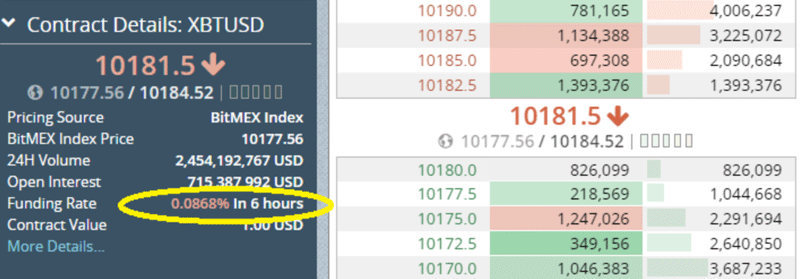

When trading Bitcoin futures(BTC) There are many hidden costs. The most basic aspect here is the financing rate levied on all futures without expiration dates. These instruments are also known as “perpetual swaps”, and such fees apply on every exchange.

The funding rate may not matter to short-term traders operating with low leverage, as it is charged every 8 hours and rarely exceeds 0.2%.

However, for a long-term investor thisalmost 20% per month, a significant reduction in any expected profit. This fee varies depending on the demand for leverage from long buyers to short sellers.

As shown in the above image, positive numbers indicate that buyers will pay that commission to sellers and vice versa when the funding level is negative.

Fees include borrowings.

Traders usually ignore trading feescryptocurrency, since 0.075% seems like a rather low commission, but it’s important to note that these costs are charged in advance depending on the total amount of the position.

An investor depositing 0.01 BTC will pay the same$3,000 in transaction fees, the same as another trader depositing 1 BTC. This adds 0.075%*3’000 = $2.25, reducing margin and potential profit.

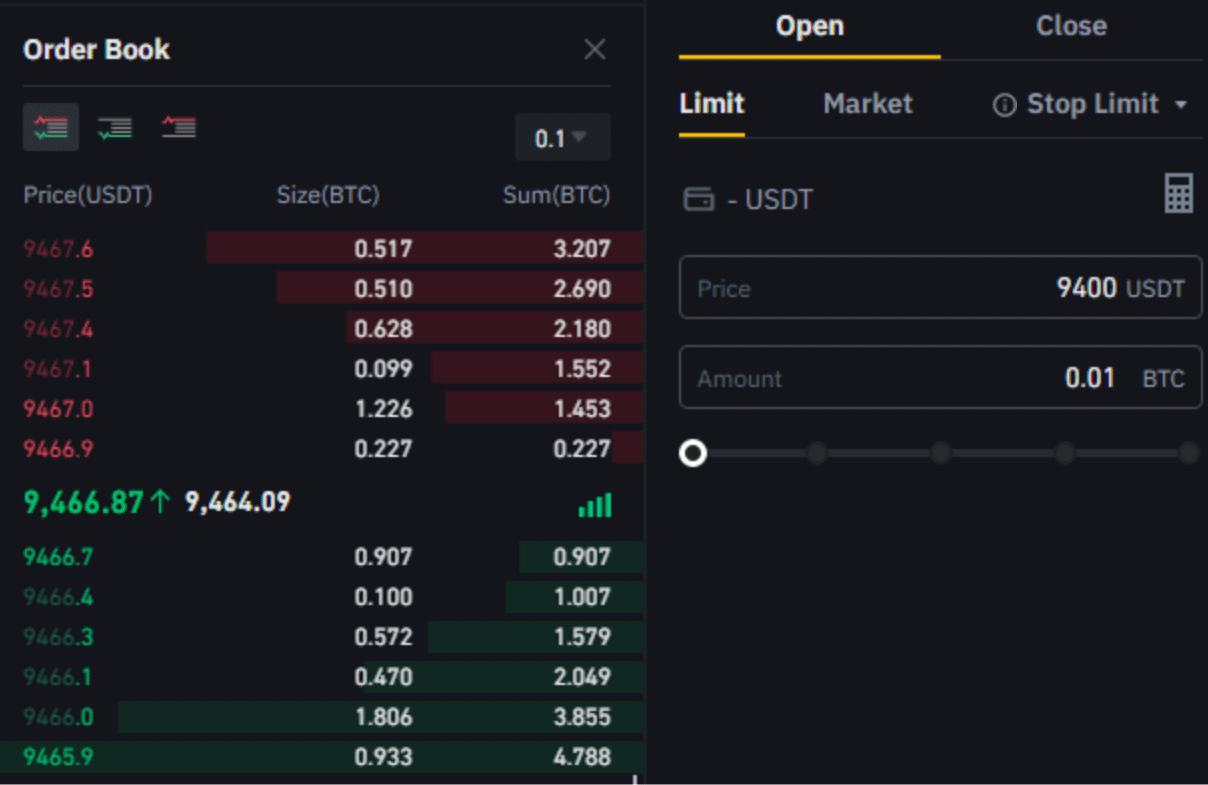

There are also other fees associated withtrading, such as manufacturer’s orders, which must be included in the register of exchange orders above or below market levels. There are also fees for orders that are subject to immediate execution.

Exchanges will also deduct another $2.25 from the trader's margin.to cover potential fees for liquidating a position. Assuming Bitcoin is at $10,000, an initial $100 deposit of 0.01 BTC now requires a 4.7% gain to become profitable, even after a $3,000 trade taking into account commission fees.

You can avoid such costs by using the commission of the maker (order creator), which means that orders cannot be executed at the market price.

Maker Fees Impact Profitability

In the order register below, placementpurchase orders in the amount of 9’400 US dollars will bring an order to pay for the maker's services. On the other hand, selling at 9’460 USDT will incur a 0.075% commission. Register of BTC futures orders on the Binance crypto exchange:

Most futures exchanges offernegative fee, which seems like a pretty good deal, as traders get paid for trading. This strategy may work for extremely conscious and cold-blooded investors, although this illusion of free money will almost certainly be harmful to most.

As soon as you place an order, the whole world will know about it. If there are enough buyers at a certain level, market makers are likely to get ahead of you by making an order a few cents better.

Even if one order cannot call suchActivity, algorithmic trading strategies (bots) track herd activity. Fulfilling orders on the market, everyone pays more commissions, but avoids having to bid 10 or 100 dollars higher for no price.

How To Benefit From Maker Commissions

For options with maturities exceeding a week,It makes sense to avoid paying commissions. Negative commissions should be seen as an incentive to stick to your goals and set your stop loss and take profit in advance, rather than using market orders.

This strategy has only positive consequences, for example, you can avoid monitoring prices throughout the day, and also helps the trader to adhere to the trading plan.

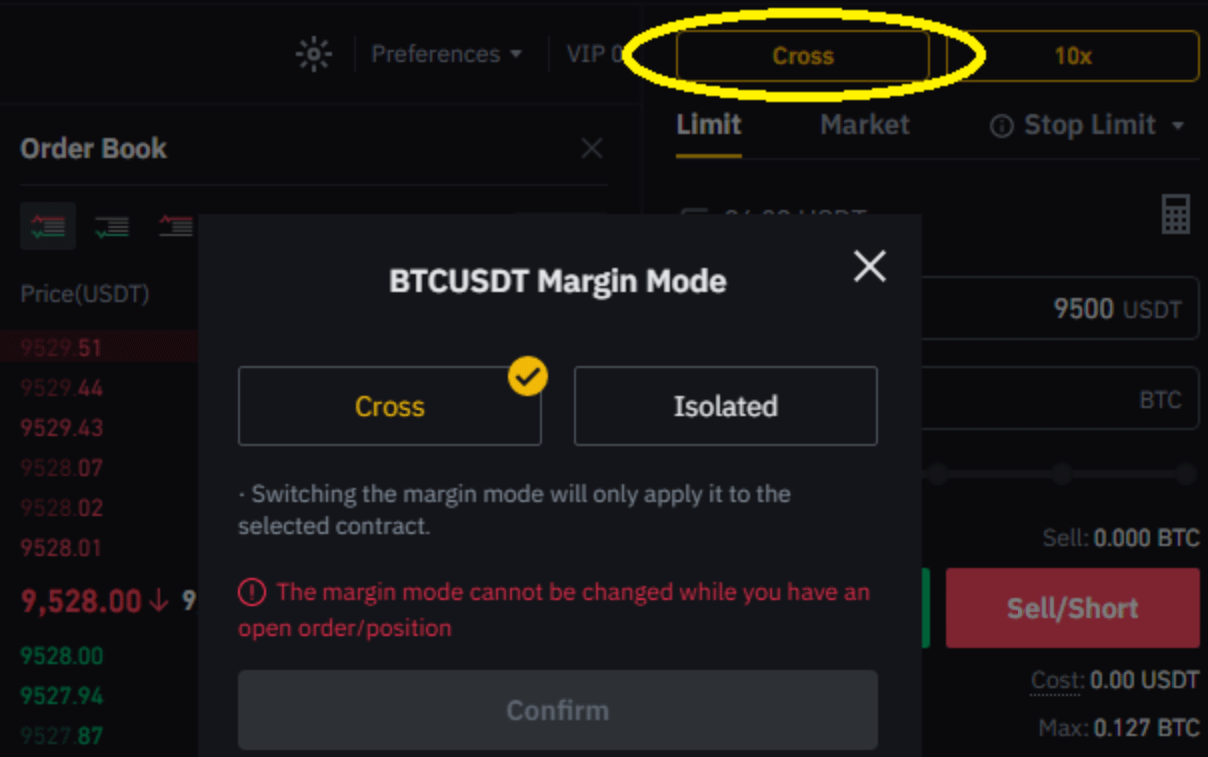

Cross margin as the best option

There are two ways to manage your margin, althoughThe default is cross margin. This option uses the entire amount deposited as collateral for each transaction, moving the balance to what is needed most. This is the best strategy for almost every trader, regardless of his experience.

By choosing an isolated margin, you can manually set the maximum allowable leverage for each contract.

This parameter will cause the automatic stop loss to be triggered earlier, which will lead to the movement of the execution to the automatic trading engine.

</p> 5

/

5

(

1

voice

)