Analysts at Coin Metrics presented a report this Tuesday in which they examined the reaction of bitcoin toUS-Iran conflict and the status of cryptocurrency as a safe asset.

Discussion of the status of Bitcoin as safeAn asset in times of increasing geopolitical risks and economic uncertainty lasts almost from the very moment the cryptocurrency appeared. Despite the opinion that Bitcoin reacts positively to certain events, and the fascinating stories that fundamental properties will make it a safe asset, the set of empirical evidence until recent events was not convincing.

Recent events that have significantly expanded this set mean a military conflict between the United States and Iran.

The main events of the US-Iran conflict

Consider the three main events that led to increased tension and the subsequent de-escalation of the conflict.

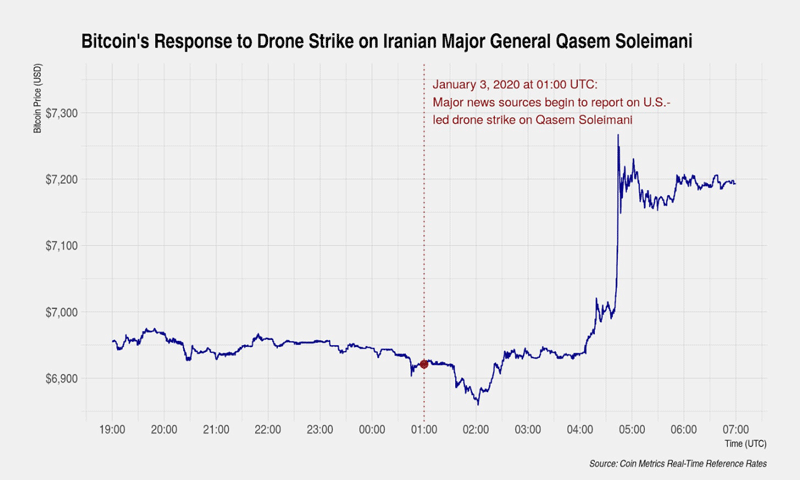

- January 3, 2020 at 04:00 MSCs, major news sources began reporting that the United States launched a missile strike, which killed a senior Iranian general, Qassem Suleimani. The blow itself occurred three hours before, and the first publications were not full of details.

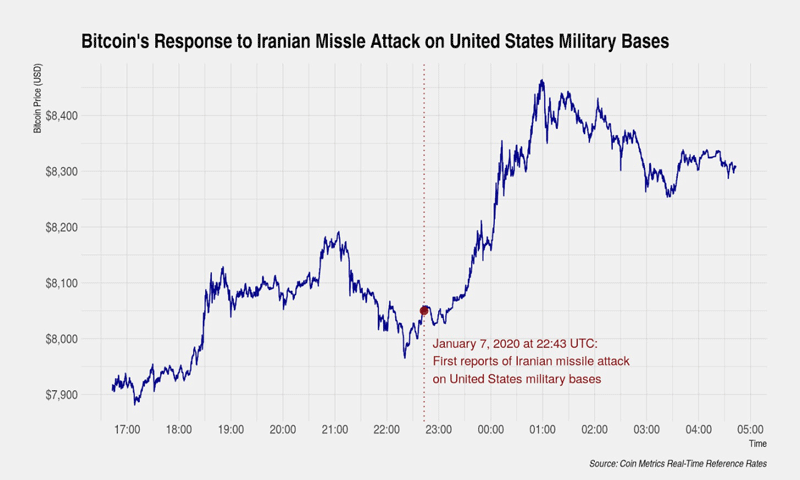

- On January 8, 2020, at 01:43 Moscow time, Iran launched a missile attack on American bases in Iraq. This event marked an extreme aggravation of relations between the two states.

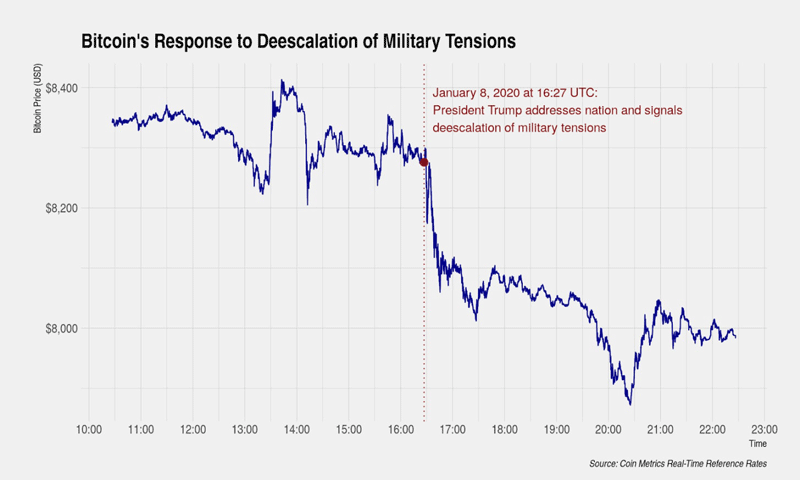

- January 8, 2020 at 19:27 MSC US President Donald Trump addressed the nation, saying that as a result, not a single American was hurt, but "Iran seems to be retreating." He also said that the United States is ready for peace with all who are striving for this. This statement was taken as confirmation of the cessation of the active phase of hostilities.

During the first two events, futures prices onoil and gold showed an instant positive reaction, during the third - a negative one. This indicates a high degree of efficiency of markets and the speed of response to the information of their participants.

In relation to bitcoin, we will consider each event individually.

US rocket strike

Major news sources began reportingthat the United States launched a missile strike on January 3 at 04:00 Moscow time. Initially, the information was transmitted on Twitter, and the time of publication of news in the media indicates that it became widely known about them by 05:00 Moscow time. At this point, oil and gold futures have already shown significant growth.

Although many observers indicate a reactionBitcoin as confirmation of its status as a safe asset, with a closer look, you can notice that the bitcoin market began to move only after 07:00 Moscow time.

One explanation suggests that participantsThe market began to move the price of bitcoin up amid increasing geopolitical uncertainty, but due to the low efficiency of the market, this happened with a delay.

Another explanation completely rejects the connection.Bitcoin market behavior with geopolitical events. Bitcoin did not move, while gold and oil futures were already actively growing, despite the cryptocurrency market being accessible around the clock.

Bitcoin has historically experienced sharp fluctuationscourse without visible catalysts. As a rule, such movements occur simultaneously with the forced liquidation of large volumes of positions in futures products, which affect the short-term behavior of the market.

Despite the loud claims that the rise in the price of bitcoin was caused by a US missile strike, the possibility of a lack of connection between these events cannot be ruled out.

Iran missile strike

The previous event reflects a potentially lowthe efficiency of the bitcoin market and the inability of its participants to quickly respond to world news in normal conditions. Iran’s missile strike, in turn, indicates how quickly this effectiveness can increase.

In response to U.S. actions, Iran released severalmissiles at US military bases in Iraq. The initial messages again contained a small number of details, and all the information was circulated by journalists on Twitter before being published by major news sources. The first known message on this topic was recorded on January 8 at 01:43 Moscow time.

Bitcoin behavior against the background of a previous eventmay have several explanations, however, the market reaction to the Iranian strike was much more unambiguous. Firstly, Bitcoin began to grow along with oil and gold futures without noticeable delay. Secondly, in the following hours the price rose gradually - the dynamics clearly differed from situations when there is a sharp jump due to mass liquidations. In fact, there was a small number of liquidations of positions on BitMEX, although the price experienced a rather significant rise.

The available evidence clearly indicates a connection between the behavior of Bitcoin and the escalation of the military conflict, and confirms the theory of a safe asset.

De-escalation of military conflict

Trump's statement was taken asevidence of the cessation of the active phase of hostilities. This is probably the most convincing confirmation of the direct relationship between the behavior of the bitcoin market and events in the world. Price changes against the background of previous events can be monitored over a period of several hours, but in this case, the reaction is measured in minutes.

Trump began his speech on January 8 at 19:27 Moscow time. Bitcoin, along with the assets of the traditional financial market, immediately responded to his words.

This event, along with two others describedabove indicates that under certain conditions the efficiency of the bitcoin market can increase and reach levels that are usually observed in the markets of traditional financial assets. The conditions were ideal for the optimal reaction of market participants, because they were already attracted by the conflict, and Trump's speech was known in advance.

Probably we could observe the most significantconfirmation of the theory of bitcoin as a safe asset in the entire eleven-year history of cryptocurrency. This is a key moment for the development of Bitcoin as a full asset class. Why did these events have such a strong impact on the bitcoin market? There may be reasons for the first and second order.

The first-order reason is the increase in political uncertainty against the backdrop of a military conflict. Such uncertainty makes safe assets, such as gold, more attractive to investors.

In addition, these events triggered a short-term, buta significant reduction in the nominal interest rate, taking into account inflation. The nominal rate partially fell due to the outflow of funds from US government bonds to safe assets. Expected inflation also increased, while market participants began to include in the prices the possibility of disruption of oil supplies. All this reduces the cost of choosing non-interest bearing investment assets such as bitcoin. The increase in inflation also leads to an increase in the attractiveness of assets that can serve as a means of accumulation, which again include bitcoin.

It is worth noting, however, that cleanmacroeconomic data, not accompanied by an increase in geopolitical uncertainty and reflecting significant changes in the real interest rate, in the past did not affect the price of bitcoin. Such events include, for example, meetings of the Federal Committee for Open Market Operations of the US Federal Reserve, the publication of data on the level of employment in the United States and other important indicators, such as the PMI in the US manufacturing sector.

Taken together, these events have caused extremelyindicative reaction from the bitcoin market. As a first-order factor, Bitcoin attracted capital flows that went into safe assets amid increasing geopolitical uncertainty. Moreover, in the future, bitcoin may begin to respond to changes in the real interest rate and macroeconomic events that lead to such changes.

And finally, these events can underlieMarket efficiency research is applicable to the upcoming halving, the issue of reflecting on the price of cryptocurrency continues to excite the minds of traders. Now we know that the market can react slowly under normal conditions, however, in special circumstances, when its participants are attracted by the significance of future events, the reaction efficiency increases sharply and approaches the level of the largest financial markets.

</p> 5

/

5

(

1

voice

)