About the Bitcoin laundering scheme of the PlusToken pyramid and the impact of massive sales on the price of the first cryptocurrencysays ForkLog Hub resident Pavel Gromov, also known as «Crypto Chief». In light of the current collapse and movements in PlusToken wallets, the topic is extremely relevant.

</p>On February 11, 2020, the media reported that 11,999 BTC came in from the cluster of the Chinese pyramid Plustoken, which has been putting pressure on the market for a long time.

The first move took place on the same day, February 11th. 11,999 BTCs were sent from the wallet, which lay motionless from September 21, 2019.

</p>According to the ErgoBTC researcher, the original wallet was part of the PlusToken cluster and was marked with all the tools for analyzing the blockchain.

Initial Wallet Balance Changes, Bitaps Data

After that, the bitcoins again moved thatattracted the attention of PeckShields vice president Chiyachi Wu and the community. However, public interest was not enough for a long time, and only researchers with a small audience on social networks continued to monitor the development of the situation.

</p>In preparation for mixing, the coins were crushedin small parts to different addresses, since mixing a large amount — a very difficult task. Those behind the movement of funds most likely used wallets with built-in mixers and their liquidity pools. In order to completely clear such a significant amount, there is too little liquidity in wallets, but the «break and interfere» justified himself.

</p>The reader should understand that centralizedexchanges use tools from analytical companies that assign a Risk Score to transactions. Based on this assessment, the exchange determines whether the transaction is «clean» or «dirty». If assets are moved from an address marked in red, the recipient addresses will also be included in the cluster. However, this does not happen instantly; attackers have room for quick mixing and subsequent sale before the transactions are flagged. Exchanges are interested in high volumes, so most often they do not take action unless there is a red flag.

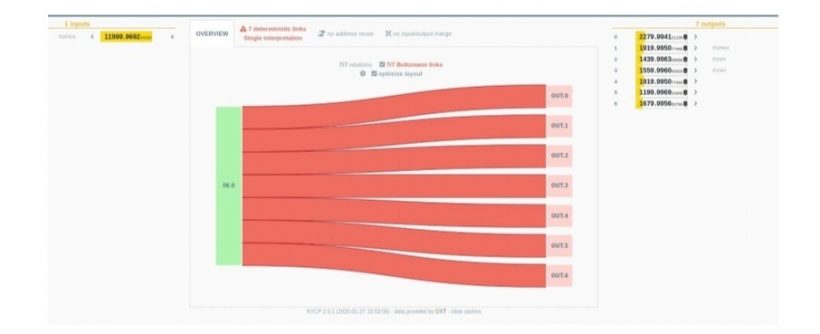

Start crushing, KYCP data

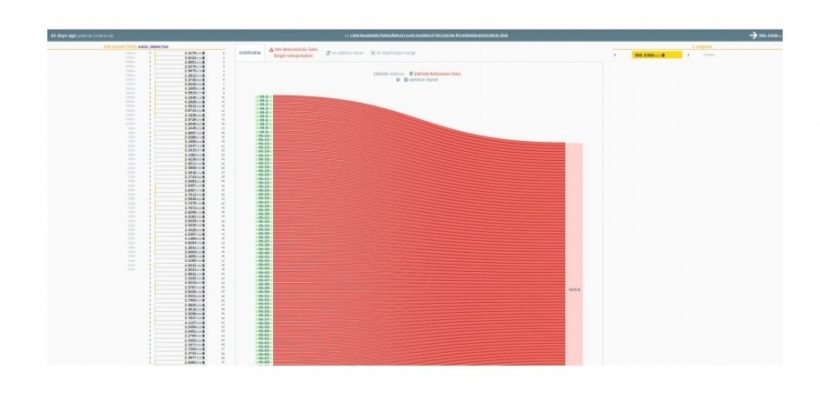

Returning to the PlusToken cluster, it is necessaryadd that bitcoins were split into 1-5 BTC. Using the KYCP service, I was able to track the path of the «branches» outputs — after mixing, the coins were collected in wallets of 300-400 BTC. The algorithm of actions was identical, which speaks in favor of a single owner.

One of the “branches” of the final transactions, which can be considered the completion of the “mix” of 11,999 BTC, KYCP data

At the time of writing, these clusters are still not marked in the free oxt.me service. I assume that at the time of transfers, service providers for exchanges did not manage to assign them a red risk level.

After the aggregation of relatively large amounts in wallets, coins began to be sent to exchanges.

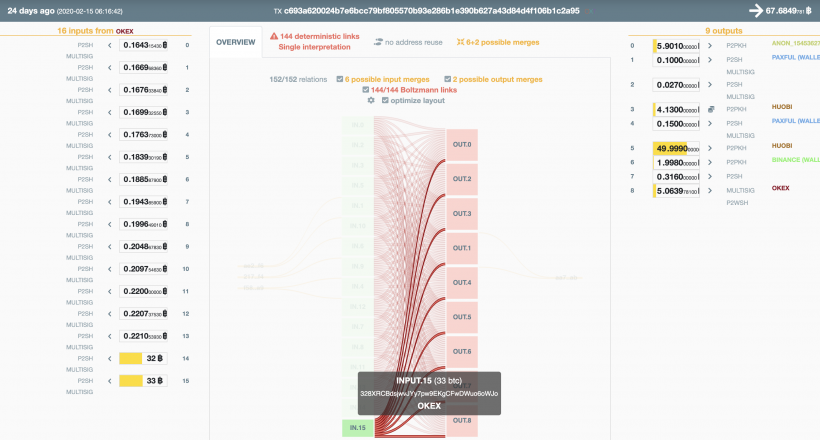

Follow the link to see how bitcoinsAfter mixing, PlusToken fell into the OKEx exchange in batches of 20-50 coins. From this particular wallet, the last portion of 55 BTC went to the OKEx exchange on February 28.

According to ErgoBTC, in the first half of February50% of PlusToken funds transferred through OKEx. At the same time, Huobi received only 25% directly (45% directly and indirectly). This means that only 5% absorbed other services.

</p>Disappointing conclusions

11,999 BTC of the PlusToken pyramid, despiteThe attention of the media and the community managed to get on exchanges for sale. Probably one of the main reasons is the insufficiently fast process of calculating the level of risk and the careless attitude of trading floors to checking incoming transactions.

Another interesting nuance is the mechanismoutput to OKEx. For visualization follow the link. Hover over IN15 with 33 BTC from the PlusToken pyramid cluster. It is clearly seen that the exchange worked as a classic mixing service, adding a gray entrance to the rest of the white ones. On the right you will see the recipients.

KYCP data

Comparing the February movements of PlusToken funds and the dynamics of the Bitcoin exchange rate, we can draw a reasonable conclusion about the strong pressure of these sales on the market.

BTC / USD, TradingView data

In the summer of 2019, they stopped the rise in the price of bitcoin, now, apparently, a similar story has happened.

By mixing PlusToken inputs, exchanges set a precedent. Now there is no point in dividing the bitcoins of the pyramid into dirty and white, since they have already been washed.

Disclaimer

This material reflects the private opinion of the author and does not necessarily coincide with the position of the ForkLog editorial staff.