In Russia, transactions with cryptocurrency are not yet regulated by law, and thereforethey don't violate anything.However, on January 1, 2020, a law on lifting a number of restrictions on foreign exchange transactions comes into force, and this fall the law “On Digital Financial Assets” regulating the cryptocurrency market may be adopted.

How is it legal to acquire or sell cryptocurrency during the legislative vacuum and not violate the currency, tax and criminal laws of the Russian Federation?

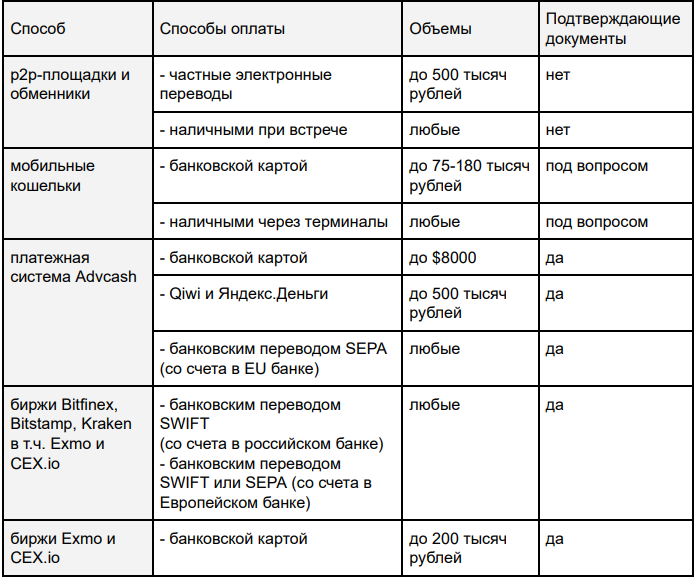

Cryptocurrency purchase

If you do not have the task of legalizing cryptocurrency and income, then you can purchase cryptocurrency within 6 million rubles by any means and without serious consequences.

A purchase within 75-180 thousand rubles can be paid by credit card in popular mobile applications freely available in the AppStore and GooglePlay.

Closing a deal for any amount and on favorable conditions is possible through exchangers and p2p sites, but you will need to follow safety measures and not rely on supporting documents.

It is possible to carry out average transactions in volume throughpayment systems, for example, AdvCash and Payeer, which are conveniently replenished through Qiwi and Yandex.Money, but they require identification, and commissions and rates are not encouraging there.

Perhaps the best way to purchasecryptocurrencies - directly on cryptocurrency exchanges (Binance, Exmo, Huobi, CEX.io, Poloniex, Kraken, Bitfinex, Bitstamp and others), they work with Russian residents, close transactions at market rates and offer reasonable commissions for depositing and withdrawing fiat funds.

Deposit replenishment on exchanges is carried out throughbank transfer. Unfortunately, Russian banks are disloyal to outgoing foreign currency payments in general, and for the purchase of cryptocurrency in particular. The fact is that the Central Bank of the Russian Federation and Rosfinmonitoring in their letters regard transactions with cryptocurrencies as questionable, and for banks such letters are de facto law. The actions of banks may be expressed in the requirement to provide supporting documents, restriction of transactions on the account, and possibly in refusal to further service.

It is preferable to have an account with a foreign bank, inideally in European, to use the types of transfers SWIFT and SEPA. This account can be used as a transit account - that is, first withdraw funds to it from your account with a Russian bank, and only then transfer from it to the exchange. Of course, this account must be declared in the tax, submit annual reports and use in full compliance with Russian currency legislation.

It is very likely that the moment will come whenhe will want to sell cryptocurrency in order to declare and legalize income or part of it. For legalization, an individual will need to submit a 3-NDFL declaration, attach documents confirming the purchase and sale, and pay tax. If documents for the purchase of cryptocurrency are available, the tax can be paid on the difference between the sale and purchase prices. If there are no supporting documents, you will have to pay tax on the entire sale amount.

Supporting documents are an agreement andpayment documents. For example, an offer from the site and screenshots from your personal account can replace the contract. An account or card statement from a Russian bank or payment system is definitely a payment document. But screenshots from LocalBitcoins and checks from obscure terminals are unlikely. The question is of course debatable, but they will have to prove their case in court.

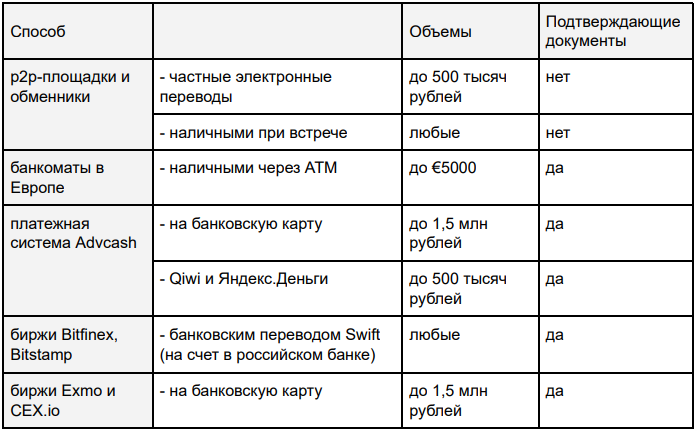

Cryptocurrency Sale

Selling cryptocurrencies is harder than buying. And it is not so much a matter of technology and economics, but rather of compliance with currency and tax laws. For the legal sale of cryptocurrency, you need to take care of supporting documents and pay taxes.

The Ministry of Finance and the Federal Tax Service in their letters adhere toposition that cryptocurrency is property, and therefore, when selling it, an individual needs to pay income tax. This means that at the end of the year, an individual independently submits a declaration and pays tax. Everything can be done remotely through the taxpayer’s personal account on nalog.ru.

There is an opinion that documentsconfirming the sale, there are fewer requirements to be presented, since this amount is voluntarily declared by the taxpayer. However, it is recommended to treat them as seriously as documents for the purchase of cryptocurrency, since both amounts are involved in determining the tax base and, therefore, can be cross-checked by the tax authority. The statute of limitations for tax offenses is 3 years in theory and up to 5 years in practice.

Legal withdrawal of medium and large amounts is possibleonly to a bank account. Until the end of 2019, it is impossible to withdraw funds from the sale of cryptocurrency to your foreign account, at least if you are a Russian resident. This operation is not included in the list of permitted operations in accordance with 173-ФЗ “On currency regulation and currency control”. In case of violation, a penalty of 75-100% of the transaction amount is provided. However, from January 1, 2020, amendments to the 173-ФЗ will come into effect, and the rules of the game will change.

The good news is that it will be possible to fullyuse foreign accounts and withdraw funds from the sale of cryptocurrency to them without any penalties. But only if this bank account is opened in a bank in the territory of a FATF or OECD member country, and the country exchanges tax information (financial information or country reports) with the Russian Federation. For clarity and convenience, the list of such countries is summarized in a single table.

The bad news is that you need to declareThere will be accounts not only in banks, but also in other financial market organizations. The definition of this term is provided by the Federal Tax Service, the Ministry of Finance and the Central Bank in the document, but with the caveat that the list is not exhaustive. If you follow the letter of the law, then you need to declare any accounts, including:

- in credit organizations, including payment systems;

- with professional participants in the securities market, including brokers and trustees;

- in investment funds and any other structures that accept from clients both cash and financial assets for storage, management, investment or any transactions.

Therefore, it makes sense to declare accountsforeign payment systems and exchanges until February 2020. At least open in countries that exchange tax information with the Russian Federation and turnover or balances for which exceeded 600 thousand rubles.

Not declaring invoices is not recommended. The Federal Tax Service automatically receives information on the availability of foreign accounts, turnover and balances in the framework of the automatic exchange of tax information (CRS). Any regulated financial institution (payment system, exchanger, exchange) sends information about foreign beneficiaries to the tax service of its country, and then from the tax authority of its country the information is sent to the Federal Tax Service of Russia once a year or more often upon request.

Here are just a few of the famous payment systems:

- Advcash (IFSC license, Belize),

- e-Payments (FCA license, UK),

- Payeer (FSC License, Vanuatu),

- Transferwise (licensed by BaFin, Germany and FCA, UK),

- Payoneer (license FinCEN, US and FSC, Gibraltar).

For incoming currency payments to a Russian accountthe bank will request supporting documents, since according to letters from the Central Bank of the Russian Federation and Rosfinmonitoring, transactions with cryptocurrencies are questionable in the sense of Federal Law 115 “On combating the legalization (laundering) of income.” The outcome of the case will depend on the amount, the bank, the availability of premium/private banking service levels and the quality of document preparation.

Similarly, the bank may requestsupporting documents for incoming transactions on the card account. This may not happen immediately, but when AML/CFT triggers are triggered. It is worth keeping in mind that the Federal Tax Service has a working mechanism for obtaining information about questionable transactions along the chain Bank (payment system) → Central Bank → Rosfinmonitoring → Federal Tax Service. According to the interdepartmental agreement, such information is transmitted automatically as it is identified.

You can sell cryptocurrency in an exchanger or onp2p-site, but then there will be no legal protection opportunities, and supporting documents in the form of screenshots may be rejected due to the blocking of an Internet resource in the Russian Federation, or because of the inability to identify the other side of the transaction.

Courts in their decisions are inclined to believe thatsuch operations are anonymous and are performed by the parties at your own risk. Law enforcement agencies consider any cryptocurrency transactions as potentially illegal. And if the exchange amount exceeds 6 million rubles and there are no documents confirming the legality of the origin of the funds, then if the circumstances are unsuccessful, there is a risk of falling under Art. 174 of the Criminal Code "Legalization (laundering) of funds."

We summarize the information

At the moment, all methods of acquisitioncryptocurrencies are legal in terms of law. If you plan only to buy cryptocurrency and keep it forever, do not pay it and do not put it in fiat, then nothing more is needed. In the case of the adoption of a law regulating the circulation of cryptocurrencies, some restrictions will probably appear.

If you plan to sell cryptocurrency andto legalize part of the income, then you need to worry about supporting documents every time you buy and sell cryptocurrency, this is useful for the bank and tax.

To work with large volumes will be usefulgo to premium banking, get a personal manager and talk to him about your intentions to buy and sell cryptocurrency using a Russian account.

Receive funds from a foreign bank in 2019not recommended, since the fine for violating currency laws is 75-100% of the amount. Starting in 2020, for accounts from the list of approved countries, these sanctions are lifted and can be used freely. A good time to find a European bank, go and open an account.

Starting from 2020, you need to declare accountsin any foreign payment systems and exchanges. If you do not declare - a fine of 5,000 rubles, if you do not submit reports - a fine of 20 thousand rubles annually, and if you withdraw funds to such accounts - a fine of 75-100% of the amount. There is only one conclusion: you can actively use accounts only in those financial institutions that are registered in one of the permitted countries, and you can submit a notification before February 1, 2020.

When selling a cryptocurrency, income arises, andtherefore, until April 30, 2020, you must submit a 3-NDFL declaration to nalog.ru and pay 13% tax by July 15. If you do not pay taxes, then a penalty (7.25% / 300 per day) + a fine of 20-40% of the amount will be charged on the amount of non-payment. Penalty is charged for the whole time and has no upper limit.

And if you need to work with particularly largevolumes at minimum fees and risks, it makes sense to build a scheme with a foreign company in one of the crypto-friendly jurisdictions (Estonia, Malta, Switzerland, Gibraltar, etc.), but that's another story.

</p>