The definition of "digital gold" in relation to bitcoin is already firmly in the lexicon, and it is questionablefew are ready for approval, even if the price charts of the first cryptocurrency have recently given plenty of reasons for skepticism.

Numerous works and studies arethe definition has been repeatedly confirmed, but scientific thought does not stand still. A new quite interesting theory was proposed by the famous financial theorist and researcher in the field of cryptocurrencies Nick Bhatia.

In his opinion, the scope of “digital gold” for Bitcoin is too tight and it would be correct to talk about cryptocurrency as digital treasury bonds.

Traditional Treasury Bonds (Treasurybonds) today are one of the most popular instruments among investors who, in times of geopolitical and economic uncertainty, are in search of risk-free assets.

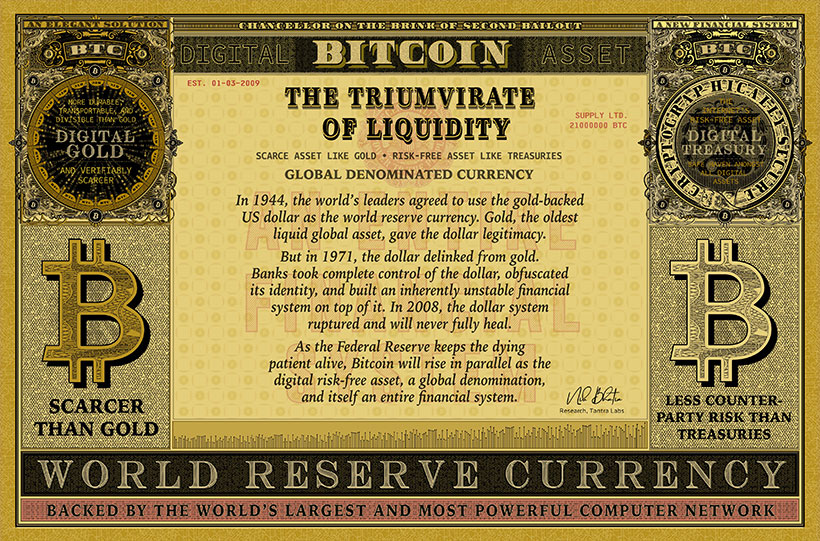

Of paramount importance in thisensuring the liquidity of such assets, and bonds issued by central banks or other state financial bodies offer it in full. However, will only Treasury bonds be the choice of investors in the not-so-distant future? Nick Bhatia believes that the most sophisticated investors will opt for gold and bitcoin, calling these three tools the “triumvirate of global liquidity”.

Below is a shortened adaptedthe translation of an economist’s article on this topic, where he gives arguments in defense of his theory, and also explains why bitcoin can rightfully be considered a risk-free asset of the future.

Triumvirate of global liquidityUS treasury bonds, gold and bitcoin. They, the author is convinced, are powerful safe haven assets, protecting their owners from the risks of the existing credit monetary system, which has a high share of borrowed funds.

At the same time, he emphasizes, of the 300 trillion dollars of financial assets around the world, only 32 trillion are in this corridor of security and liquidity.

“In just eight years of its existence, Bitcoin has amazingly captured 1% of the total market value of this trio of assets.[In December 2017, BTC capitalization exceeded $ 320 billion - approx.]but it was only a glimpse of the future.

In the next step, the market value of bitcoinwill come close to $ 9 trillion in gold, which will allow him to realize himself as digital gold. After that, Bitcoin is transformed into digital treasury bonds and will replace them as a global risk-free asset, and ultimately will receive the status of a global reserve currency.

Replacing the dollar as the world's reserve currency is an ambitious goal, but it will be realized only as a by-product of bitcoin, embodying digital treasury bonds. ”- writes Nick Bhatia.

Gold as a source of dollar legitimacy

He also notes that gold is the originala global liquid asset, money with a thousand-year history, and it was the backing of gold that gave the US dollar legitimacy. It culminated in the Bretton Woods Agreement of 1944, where world leaders designated the dollar as the world's reserve currency.

“Even though gold is officiallyis no longer an anchor of global finance, central banks still keep it as a global asset-refuge, most likely as insurance against a dollar system failure. Today, the gold reserves of world central banks exceed $ 1 trillion, "- the author reminds.

Eurodollars

In the 1950s, a new form appeared in Europedollar, called Eurodollars. They were used to facilitate interbank settlements outside the United States and the Federal Reserve System. As Eurodollars grew in popularity, banks in London, Zurich, Montreal and Tokyo were able to create an international settlement currency outside of any regulatory framework.

By 1971, excessive dollar payments forgold depleted the reserves of the United States. In order to protect its stocks of safe haven assets in the world, the United States stopped all conversion of the dollar into gold, and the dollar officially lost support. However, it continues to be trusted by global financial participants as the ultimate unit of account.

Treasury bonds

Nick Bhatia goes on to ask how investors could safely keep dollar reserves if they were no longer backed by risk-free assets.

In this context, he recalls that bankingDeposits are essentially loans issued to banks and are associated with high risks of default. The export of cash in packs of $ 100 in trucks is also not considered, especially since dollars can no longer be converted into the underlying asset. Thus, for those who want to insure themselves against risks, deposits and cash are simply not an acceptable investment.

The solution for the safe storage of dollars was the purchase of US Treasury bonds. This market is currently valued at $ 23 trillion.

The dollar is losing its identity

Between 1971 and 2007, banks establishedfull control over the dollar and built on it an initially unstable financial system. Eurodollars grew both in supply and in their sophistication. Banks ceased to finance themselves through deposits; instead, they used US treasury bonds as collateral, borrowing dollars from each other for accounting purposes.

Bhatia emphasizes that treasury bondsbecame the most sought-after global asset, not only because of the strength of the US government as a counterparty, but also because, in combination with a bank license, their security liabilities made it possible to create unlimited money.

“The dollar has lost all its former identityan asset for which gold can be claimed, and has become a purely banking obligation, a loan for an overly burdened financial system. Now, banks use US treasury bonds, not dollars, as their risk-free asset, collateral anchor and main leverage. ”- writes the author.

The collapse of the dollar system

In 2007, banks began to lackfinancing. The culture of quickly issuing secured loans has become history, and banks have no longer been able to scroll forward their growing debts. Prior to this, they relied on their ability to constantly issue new debts, and when confidence in them shook, the same thing happened with their solvency.

As Bhatia notes, for decadesUS dollars and Eurodollars coexisted with virtually no conflict: the Federal Reserve Funds and the London Interbank Loan Rate for Eurodollars (LIBOR), the interest rate of each type of dollar, was generally a mirror image of each other. However, already in August 2007, LIBOR drifted higher in relation to the federal funds rate, which was a sign of acute credit risk in the Eurodollar system.

“Over time, it became clear that the problemwasn’t acute: banks began to recede from each other when the global dollar system reached an inflection point. This divergence in interest rates foreshadowed the subsequent cascade of dollar financing deficits and the collapse of banks. The ten-year free play of making money irretrievably cracked. ”

In 2008, the Federal Reserve(The Fed) came to the aid of the world by injecting liquidity into the entire system. The decision was made not to differentiate between dollar and eurodollar liabilities and to throw a lifeline to any bank or central bank in need of assistance by holding reserves at home and providing currency swaps abroad.

US Treasury Bonds Liquidity Demandincreased dramatically as they became a guarantee of security. However, at the same time, the world was trapped in a dollar trap, even if the long-term viability of the dollar as a world reserve currency was irrefutably questionable.

Permanent malfunction

The financial system is infected with a chronic disease,which is not going anywhere. The dollar is no longer exclusively the national currency of the United States - today it is an international banking instrument without restrictions, form or ability to support itself.

The system is in decline because the contractioninterbank liabilities leads to a repeated liquidity shortage for borrowers. Banks prefer not to provide secured liquidity to other banks, even if the treasury bonds themselves are pledged. This is the last warning sign that banks no longer trust each other.

In addition, the Fed always helps out the system inas a lender of last resort, forever eliminating any motivation for banks to provide liquidity to each other. By default, the Fed's response is to create bank reserves in US dollars, but this does not solve the main problem of broken interbank trust. The Fed only provides an anesthetic mechanism, keeping the dying patient alive until able to do so.

Bitcoin as Digital Gold and Digital Treasury Bonds

Where is the way out, Nick Bhatia asks, and he answers it himself, saying that the solution to the nightmare in which the modern banking system is located should be sought in bitcoin.