In order to study the emergence of Bitcoin, we must first look at the history of money: how people movedfrom barter to commodity money, gold standard, fiat currency and finally cryptocurrency. It is in this order that we will discuss this.

</p>Prehistoric money

illustrations: BitNews

Barter is considered the original form of trade. In bartering, participants in a transaction directly exchange some goods or services for others without using a medium of exchange such as money.

Barter is not scalable.With the growth of the economy, individuals may specialize in the production of certain goods, and it becomes more difficult to find counterparties for direct exchange. The only way to get around this is indirect exchange, that is, a medium of exchange.

During the Neolithic Revolution, the humansociety moved from hunting and gathering to agriculture. Population growth stimulated trade, and the need for a medium of exchange became apparent. In the earliest cases of trading with money, the goods with the greatest utility and reliability in terms of reusability and liquidity became the ideal medium of exchange. In agricultural societies, livestock and plant products were ideal candidates for medium of exchange.

However, livestock and plant products havecertain disadvantages when it comes to using them as money. First, they are short-lived. For example, fruits spoil quickly and often cannot be kept for more than a month. Second, they are indivisible. For example, although livestock is very expensive and can be used in many ways, it is difficult to divide into parts.

As a consequence, people gradually switched to more durable and divisible means, such as, among others, shells, processed stones, salt, etc.

Qualities of ideal media of exchange

We now know that not everything can be a good medium of exchange. What are the key qualities of an ideal candidate for this role? Modern economists have proposed the following qualities:

- Adoption:Money is universally accepted due to its liquidity.

- Portability:Money is easy to move.

- Durability:Money doesn't wear out.

- Uniformity:Money has a uniform appearance.

- Divisibility:Money is divisible into smaller parts.

- Rarity:Money is scarce, and its supply is not so easy to increase.

- Recognition:Money is easy to distinguish.

- Stable cost:Money must have a stable value in day-to-day transactions.

Let's compare some of the earliest types of money by these criteria:

| Agricultural products | Seashells | Metals | |

| Adoption | Differently | Differently | Differently |

| Portability | Differently | Normal | Normal |

| Durability | Bad | Normal | Good |

| Uniformity | Bad | Bad | Good |

| Divisibility | Bad | Normal | Normal |

| Rarity | Differently | Differently | Differently |

| Recognizability | Bad | Bad | Normal |

| Stable cost | Differently | Differently | Differently |

Standardized coins

The earliest form of metallic money appearedin 1000 BC e. in China during the Zhou dynasty. These were small bronze knives and blades. The very first coins, apparently, independently appeared in India, China and on the coast of the Aegean Sea in the 7th century BC. e.

Zhou era coins

Coins represent the transition from other goods tometals, and they were produced by the authorities in a standardized form. Metals have many advantages over other means of exchange such as agricultural products and shells. In addition, the manufacture of coins required highly skilled labor, which made them more rare and therefore better suited for the role of money.

The earliest coins of the Western world are mostlyassociated with the Lydian kingdom in Asia Minor in the 7th century BC. e. - the period of the Iron Age. During the Hellenistic era, Greek culture spread over much of the world known at the time, and thanks to merchants, Greek coins were spread throughout Europe and the Middle East.

Lydian stater 610 BC : Yandex Zen

During the classical era, Greek coins reachedhigh technical and aesthetic quality. Large cities now produced a wide variety of fine silver and gold coins, most often featuring patron gods or legendary heroes on one side and a city symbol on the other. Also, inscriptions began to appear on coins, usually the names of the cities issuing them.

Banknotes

During the Tang Dynasty (618-917) Chinese merchantswanted to avoid the use of mountains of heavy copper coins in large trade transactions. They had a brilliant idea: to use credit receipts, where one party promises to pay the other a specified amount before the expiration of a certain period.

First paper money of the Tang Dynasty (618-907)

Then, during the Song Dynasty (960-1279), paper money appeared, but it did not replace metal coins, but was used on a par with them.Soon, the central government noticed the economic advantages of printing paper money and began to selectively grant monopoly rights to issue a kind of certificate of deposit.At the beginning of the 12th century, the equivalent of 26 million bundles of coins were issued annually(used as a currency unit, usually 1000 silver coins).

In the XIII century, paper money became known inEurope thanks to the stories of travelers like Marco Polo and Guillaume de Rubruck. In particular, paper money in the Yuan Empire is described in the chapter of the book "The Journey of Marco Polo" entitled "How the Great Khan makes certain pieces of paper from the bark of trees and distributes them throughout his country as money." In medieval Italy and Flanders, due to the insecurity and impracticality of transporting large sums of money over long distances, traders began to write promissory notes. At first, they were personal, but soon turned into written orders to pay a certain amount to anyone who presented them. These promissory notes can be considered the predecessors of the usual banknotes.

Modern banknotes are based on the assumption that money is determined by social and legal consensus.The value of a gold coin does not reflect some inherent property of the metal, but merely the mechanism of supply and demand in a society that exchanges goods in a free market.This new outlook contributed to the issuance of banknotes at the end of the 17th century.Economist Nicholas Barbon wrote that money is"Imaginary value set by law for the convenience of exchange".

The first bank to start issuing banknotes forpermanent basis, became the Bank of England. Established in 1694 to raise money for the war with France, the bank in 1695 began issuing banknotes promising to pay the bearer the amount indicated on them on demand. Initially, they were written out manually, so that any amount could be indicated, and were issued in exchange for a deposit or as a loan. Gradually, the transition to banknotes of a fixed denomination began, and in 1745 banknotes with denominations from £ 20 to £ 1000 were already printed. Fully printed banknotes, which did not require the name of the recipient and the signature of the cashier, first appeared in 1855.

Commodity, representation and fiat money

The value of commodity money is based on the materialfrom which they are made. Commodity money consists of something that is valuable or useful in itself (intrinsic value) and also has value in purchasing goods.

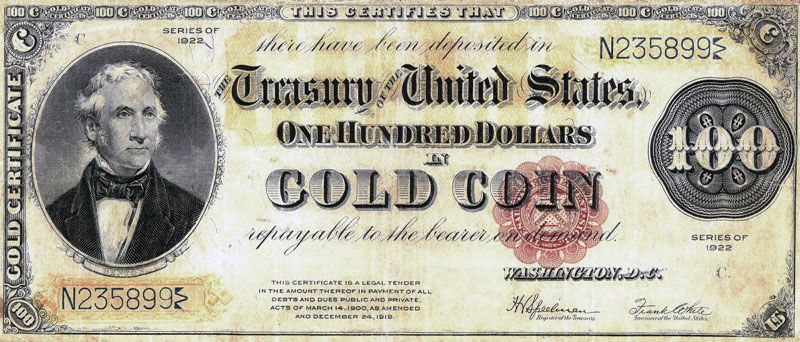

Representative money is a medium of exchange,often printed on paper, representing something of value, but of little or no value in and of itself. Unlike fiat money, which is not backed by any goods, the face value of real representation money must be backed by something with its own value.

Fiat money is a currency that has noits own value, but declared in money by a decree of the authorities. Fiat money has no useful value. They have value only because the government supports it or the participants in the exchange agree with it.

Let's classify the various money used in history:

| Commodity money | Representation money | Fiat money | |

| Agricultural commodities | + | ||

| Metal coins | + | ||

| Banknotes | + | ||

| Fiat currency | + |

Throughout history, money has gradually been acceptedmore and more abstract form. The earliest forms of money, such as agricultural commodities and shells, were specific in that they represented immediate utility that could be consumed. In other words, these are consumer goods. Later, they switched to coins made from a material (metal), which is a capital resource (used in the manufacture of tools).

The appearance of banknotes marked the transition from commoditymoney for representation, since they only represent the coins with which they are provided, but in themselves have no value. After the abolition of the gold standard, banknotes turned into fiat money, not backed by anything and having no value of their own.

gold standard

Since the notes were secured by metalcoins, their value was still determined by the supply and demand of the metal. Some metals (for example, copper) are very easy to mine, so they gradually lost their status as ideal money. As a result, there are only two candidates left, which are difficult to mine: silver and gold.

The gold or silver standard is a monetary system where the standard economic unit of account is based on a fixed amount of gold or silver.

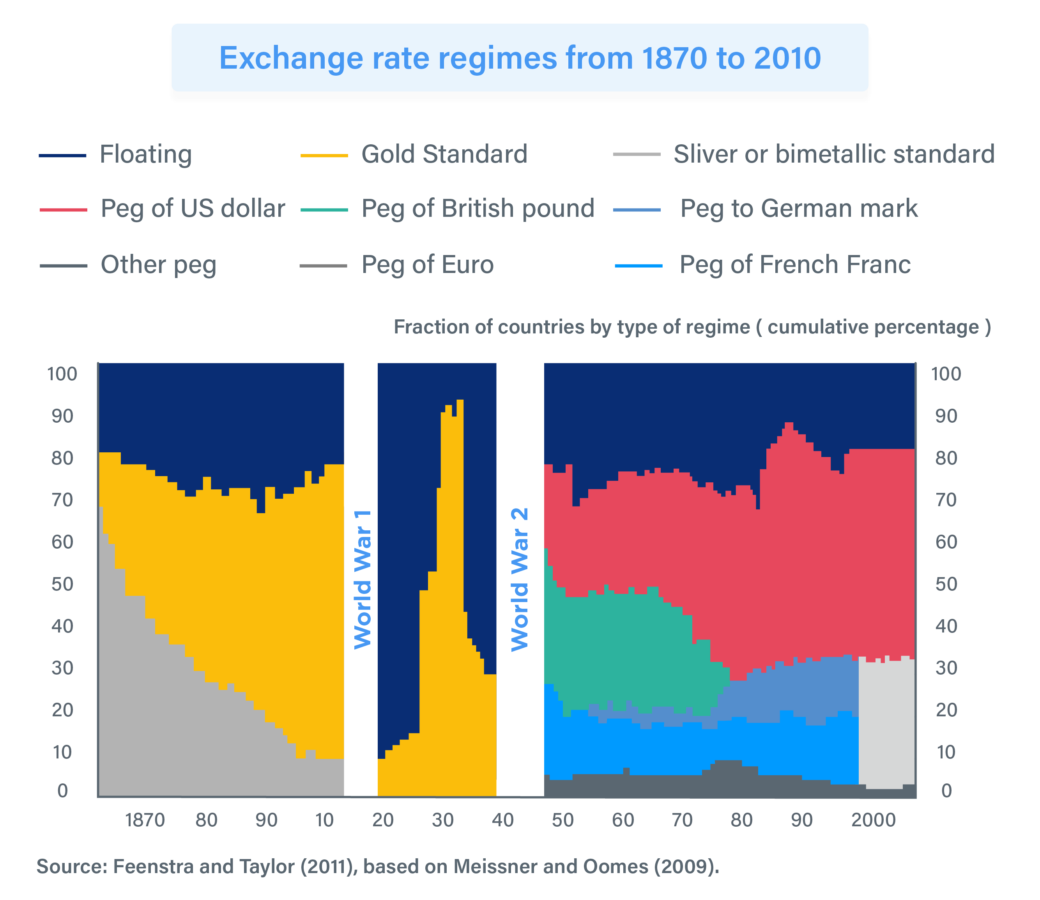

The history of international monetary relations from 1870 to 1939. can be described as the rise and fall of the gold standard.

In 1870 g.about 15% of countries adhered to the gold standard, but by 1913 this figure had grown to 70%. This was the first era of globalization, when goods, capital and people began to move more actively between countries. The fixed exchange rate favored international trade, and therefore more and more countries were adopting a single standard.

Someone might ask:Why get attached to gold? In the 1870s, most countries still used the silver standard. One of the reasons for the switch to gold was the network effect. Since the dominant Great Britain at that time used the gold standard, it was also accepted by all of its colonies. And for other countries, the use of the gold standard made it cheaper to trade with the British colonies. As more and more states adopted the gold standard, it created an avalanche effect and brought all countries to a uniform standard.

However, not all countries that have joined the goldstandard, benefited from it. The benefits were often less pronounced than the costs, especially during periods of deflation or recession. Countries that fought in World War I needed funding, and the gold standard discouraged this because it takes a proportionate amount of gold to print more money. Consequently, most countries simply started printing money to finance the war, which caused their currencies to float freely from 1914 to the 1920s.

In the late 1920s - early 1930s,return to the gold standard thanks to the British Gold Standard Act of 1925. Many other countries followed Britain. However, the return to the gold standard has led to recessions, unemployment and deflation in these economies. This state of affairs continued until the Great Depression (1929-1939) forced countries to abandon the gold standard.

September 19, 1931Britain was forced to abolish the gold standard due to speculative attacks on the pound. The £ 50,000,000 loans from the American and French central banks were not enough, as they were depleted in a matter of weeks due to the large outflow of gold to the other side of the Atlantic Ocean. The British have benefited from this cancellation. Now they could use monetary policy to stimulate the economy. Australia and New Zealand had already dropped the standard by then, and Canada followed shortly thereafter.

Countries that remained on the gold standard(for example, France and Switzerland), paid dearly for it. Compared to 1929, floating-currency countries in 1935 had productivity 26% higher, and countries that introduced capital controls were 21% more productive than countries that remained on the gold standard.

Impossible triad

The impossible triad, or trilemma, is a concept in international economics that it is impossible to simultaneously support the following three conditions:

- Fixed exchange rate;

- Free movement of capital;

- Independent monetary policy.

Impossible triad. : livejournal.com

This hypothesis is based on the uncovered conditioninterest rate parity and is supported by empirical studies showing that governments that tried to simultaneously pursue all three goals have failed. The concept was independently developed by John Marcus Fleming in 1962 and Robert Alexander Mundell in various articles in 1960-63.

Between 1870 and 1917, the countries that adopted the gold standard opted for a fixed exchange rate and free movement of capital(side a in the impossible trinity triangle)After 1931, most countries abandoned theThey either used a peg to the U.S. dollar.(or British pound or French franc)(party a) or adhered to the Bretton Woods system(fixed rate and independent monetary policy - party c)or had a floating currency(free capital movement and independent monetary policy - side b).

"Intermediate" options are also possible, suchas a managed floating rate or anchoring with limited flexibility. Thus, monetary policy can be chosen on side a, b, or c, or it can be mixed.

Bretton Woods system

Participants of the Bretton Woods Conference. : gerchikco.com

The international monetary system of the 1930s waschaotic. Towards the end of World War II, policymakers from allied countries gathered in Bretton Woods in the United States to try to make the economy perform better after the war. The creators of the post-war order, notably Harry Dexter White and John Maynard Keynes, built a system that retained one key element of the gold standard - a fixed exchange rate - but used capital controls and therefore was consistent with side c.

Trilemma has been resolved in favor of stabilityexchange rate to help restore trade in the postwar period. Countries used a peg to the US dollar, making it the central currency, and the US the central country. The dollar, in turn, was pegged to gold at a fixed rate, the latest echo of the gold standard.

However, capital controls -difficult task. Already in the 1960s, control began to crack, and investors found ways to circumvent it and withdraw money from local and foreign currencies. Some even used accounting tricks to transfer money from one currency to another.

When capital mobility has increased and control is notcould contain it, as follows from the trilemma, countries that used the peg to the dollar risked losing autonomy in their monetary policy. This made them think about abandoning the dollar peg. In addition, it became apparent that American policy was focused exclusively on the interests of the United States, which no longer intended to convert dollars into gold.

Some countries have begun to devalue their currencies or have even removed their peg to the dollar.

The Bretton Woods system slowly disintegrated. Then the international monetary system entered the era of fiat currency.

Fiat currency

Fiat Currency Declared Money by Government Decreeand has no intrinsic value. Fiat money has no useful value and its value is based solely on the support of the authorities or on the agreement of the participants in the exchange.

Fiat money began to prevail in the 20th century. Since Richard Nixon un-pegged the dollar to gold in 1971, the fiat currency system has been used around the world.

: Shutterstock

Fiat money can be identified in the following ways:

- Any money declared by the authorities to be legal tender.

- Government-issued money that is not legally convertible into something else and does not have a fixed value relative to any objective standard.

- An essentially useless object that acts as a medium of exchange (another name is fiduciary money).

From the history we have reviewed, it is clear that fiatthe currency did not appear suddenly. Countries tried to adhere to the gold standard, but ultimately failed, as governments need flexibility and tools to regulate the economy, and the insolvency of the state can cost much more than the ability of the government to control the money supply.

However, when the government can print newmoney, another problem arises: the inflation tax. Imagine you have one dollar to buy an apple for. If the government prints another dollar, there will now be two dollars on the market, and you can only buy half an apple. The issue of a new currency is considered a tax on holders of the existing currency.

Subprime mortgage crisis and quantitative easing

America's subprime mortgage crisis -the national financial crisis in 2007-10. and significantly influenced the US recession in December 2007 - June 2009. It was triggered by the collapse in property prices following the collapse of the housing bubble, resulting in delinquent mortgages, foreclosures and depreciation of real estate securities.

The housing bubble that preceded the crisis was financed by mortgage-backed securities and collateralized debt, which initially offered higher interest rates(i.e. the best return)than government securities, andattractive risk assessments from rating agencies. Although the first signs of the crisis became apparent in 2007, several large financial institutions collapsed in September 2008, significantly disrupting credit flows to businesses and consumers and triggering a serious global recession.

The American solution to the recession wasquantitative easing. Quantitative easing is a monetary policy where the central bank buys a certain amount of government bonds or other financial assets in order to directly inject liquidity into the economy. The central bank buys financial assets from commercial banks and other financial institutions, thereby raising the prices of these assets and reducing their profitability, while increasing the money supply.

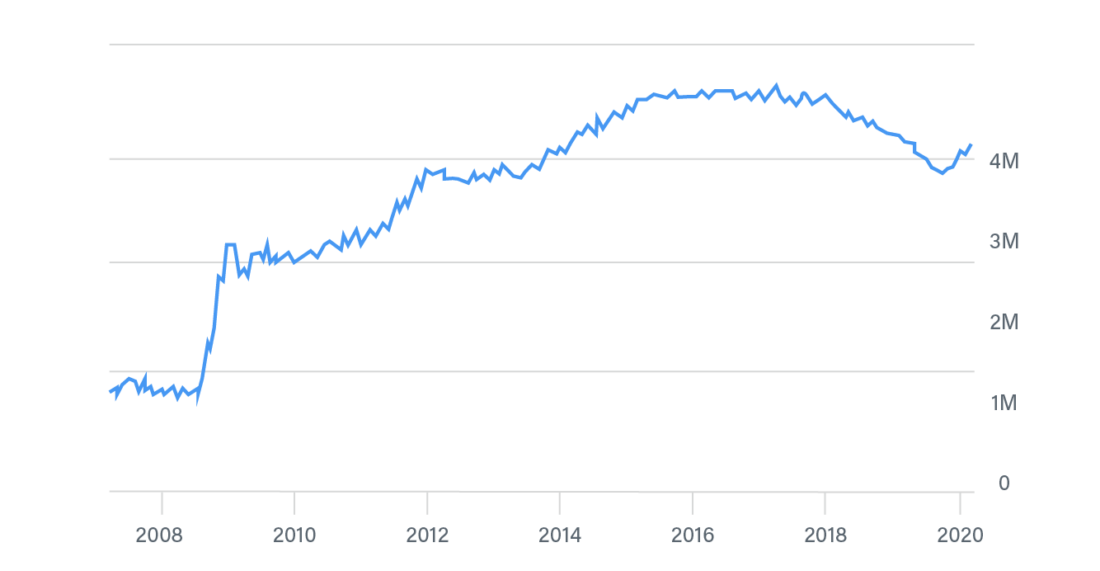

By March 2009The Federal Reserve System (FRS) bought back $ 1 trillion of bank debts, mortgage-backed securities and US Treasury bonds, and all that cash flowed to the market. In June 2010, this amount peaked at $ 1.35 trillion.

In November 2010, the Fed announced a second round of quantitative easing and by the end of the second quarter of 2011 bought back US Treasury securities for $ 600 billion.

The third quantitative easing was announced on September 13, 2012. The Fed decided to launch a new perpetual program of purchases of mortgage-backed securities for $ 40 billion per month.

As you can see, from the beginning of the quantitativeeasing the Fed's balance sheet expanded rapidly. Before quantitative easing, it was $ 900 billion, and today it has reached $ 4 trillion. The difference between these values is the liquidity (i.e. the money supply) that has been poured into the economy.

Quantitative easing has resulted in manyproblems, in particular the inequality of income and wealth. British Prime Minister Theresa May openly criticized quantitative easing in July 2016 for its regressive effect: cannot afford his own home. " In 2012, a report by the Bank of England showed that it was mostly the rich who benefited from its quantitative easing policy and that 40% of the increase went to the 5% of the richest British households.

Bitcoin

Finally, bitcoin appears on the scene. It was created in 2008 by Satoshi Nakamoto, who expressed a vote of no confidence in central bank currencies:

“The main problem with traditional currency isthe trust you need to make it work. Trust that the central bank will not devalue the currency, but the history of fiat currencies is replete with examples of this trust being violated. We need to trust that banks will store our money and transfer it electronically, but they lend it, inflating one credit bubble after another, keeping only a small fraction in reserve. We must trust them with our confidentiality, trust that they will not allow impostors to empty our accounts. "

It is worth noting that Bitcoin is not the first attempt to create a digital currency.Before Bitcoin, there were DigiCash(founded in 1989 by cryptographer David Chaum)and E-gold(founded in 1996 by oncologist Douglas Jackson and attorney Barry Downey)... However, both projects failed due to centralization.

Is Bitcoin Perfect Money? Let's apply the criteria that we used before:

| Fiat currency | Bitcoin | |

| Adoption | Differently | Differently |

| Portability | Good | Good |

| Durability | Good | Good |

| Uniformity | Good | Good |

| Divisibility | Good | Good |

| Rarity | Bad | Good |

| Recognizability | Normal | Good |

| Stable cost | Differently | Differently |

As you can see, bitcoin is more perfecta candidate for the role of a medium of exchange than fiat currency. While fiat currency is more widely accepted and stable in value, these are subjective indicators that can change over time.

However, I would like to point out several disadvantages that hinder the use of bitcoin as money:

- Slow confirmation(it takes at least 1 hour to finally confirm the transaction);

- Limited bandwidth;

- Users require deep knowledge(for example, in managing private keys).

Money that has a physical form does not have these disadvantages. Therefore, we believe that for mass adoption of Bitcoin(and cryptocurrencies in general)As money, the problem of blockchain scalability must first be solved.

Bitcoin is also not a commodity money(since it does not have its own value), nor representative(it is not attached to anything that has a value of its own), nor fiat(it is not provided by the government)... It belongs to an independent category that we call decentralized money.

| Commodity money | Representation money | Fiat money | Decentralized money | |

| Metal coins | + | |||

| Banknotes | + | |||

| Fiat currency | + | |||

| Cryptocurrency | + |

Bitcoin's value is determined solely by the market equilibrium between the people who trade it. This is consistent with the subjective theory of money, which states:

“The value of a product is not determined by anycharacteristic property or the amount of labor going into its production, but the value that the acting individual attaches to him to achieve his goals. "

Bitcoin is "hard money".As Seyfedin Ammus points out in his book A Brief History of Money, for all other money, when its value rises, those who can produce it begin to produce more. Bitcoin's decentralized nature ensures that no one has the sole authority to create more coins out of thin air. Hence, another important characteristic of decentralized money is the scarcity that decentralization guarantees.

Thus, Bitcoin meets the majoritycriteria for ideal money. Its supply is fixed, unlike fiat currency. Bitcoin may take a while to become a true medium of exchange, but humanity's quest for better money has never stopped, and we believe that Bitcoin(and cryptocurrencies in general)– a very strong candidate for the role of money of the future.

</p>