All it took was another return to prices last seen about a month ago, and lo and behold...bears wake up from hibernation. But does this situation really look that bad for Bitcoin?

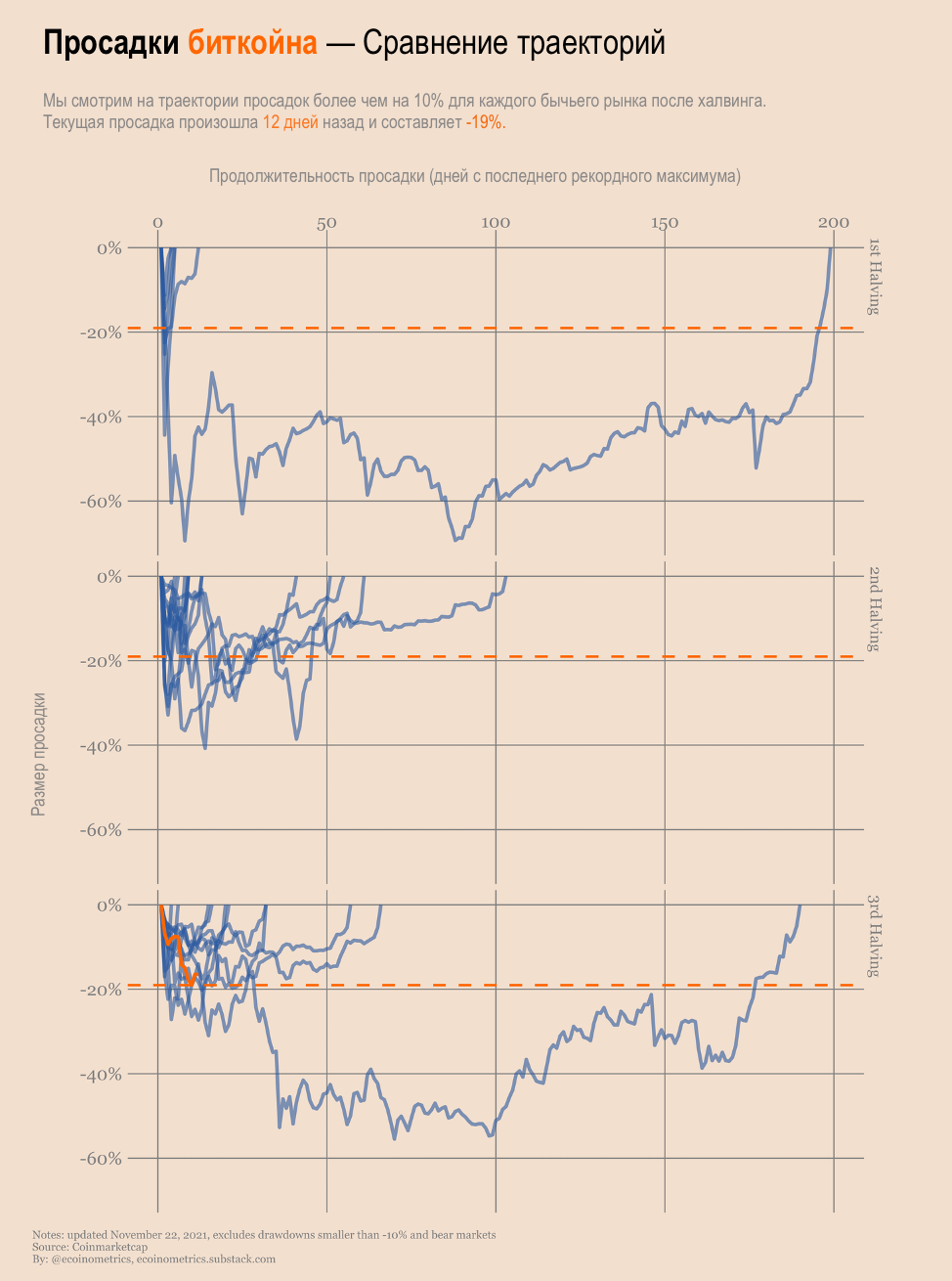

To be honest, I didn’t expect to have to analyze Bitcoin drawdown charts so soon. But the market is what it is, and let's put the current decline in context.

Where are we:

• the current drawdown has been going on for 12 days,

• the bottom was -19% from the all-time high of $69 thousand.

It's a lot? It's unusual? How does this compare to previous corrections?

See for yourself.

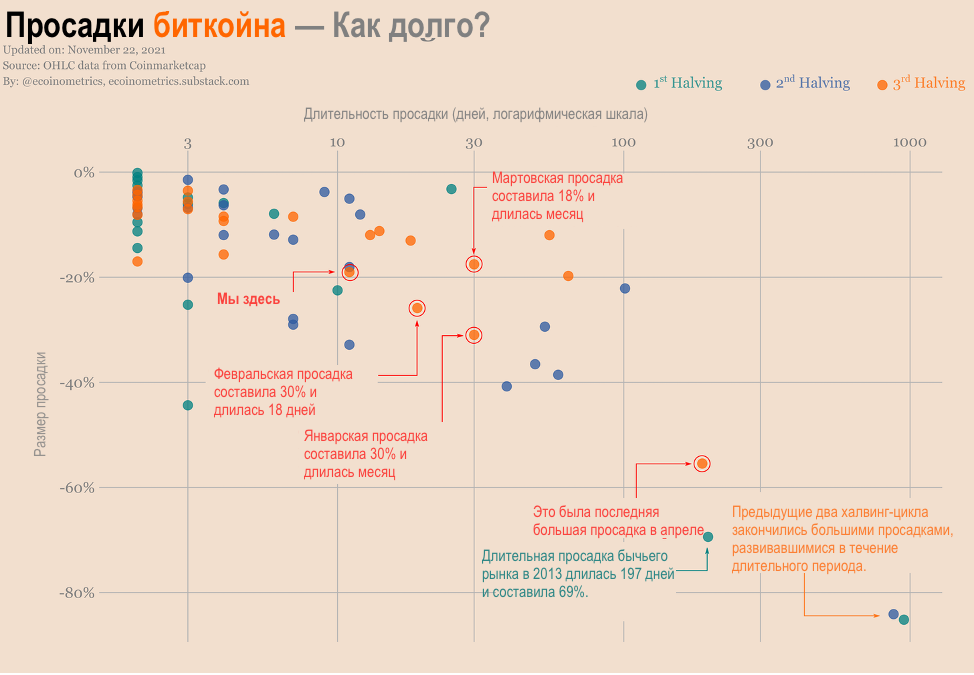

No, this is not a particularly large drawdown.No, this is not a particularly unusual drawdown trajectory. In fact, we had several drawdowns during the current cycle that occurred in the same range as this one.

Take a look for yourself.

Basically, this is a common thing for Bitcoin. Does it suck that we get another drawdown instead of a much larger all-time high? Oh sure.

You won't be able to form a parabolic leg that provokes FOMO just by touching $ 69K.

I'm sure Elon Musk has several buy orders ready when the price touches $69,420… so BTC will need to put in a little more effort...

Jokes aside. Despite the correction, the market situation does not look so bad.

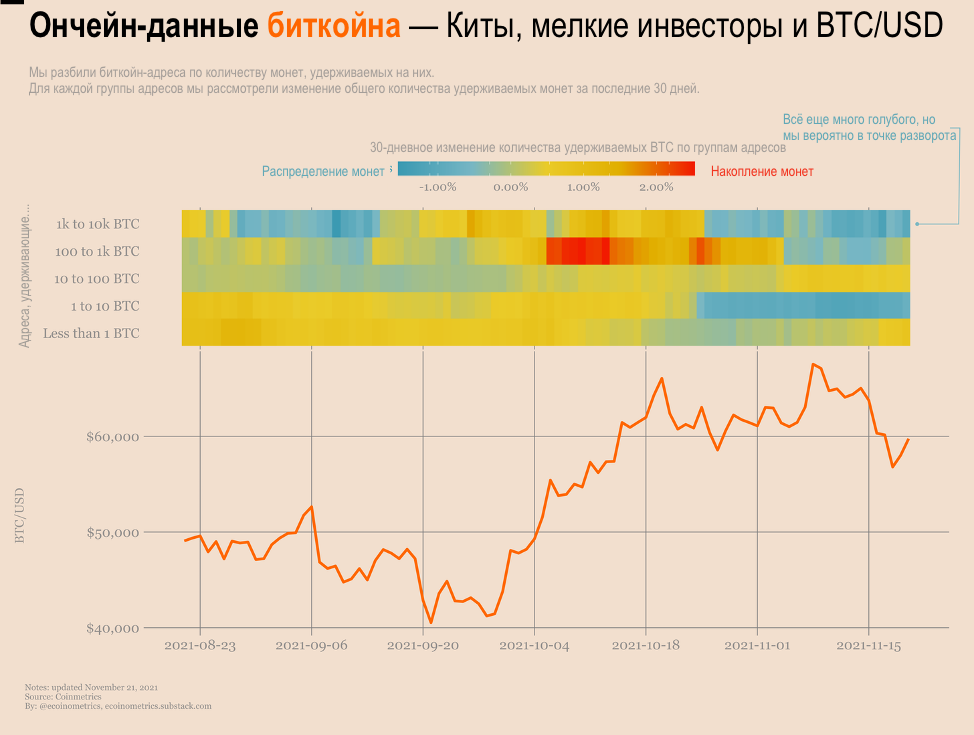

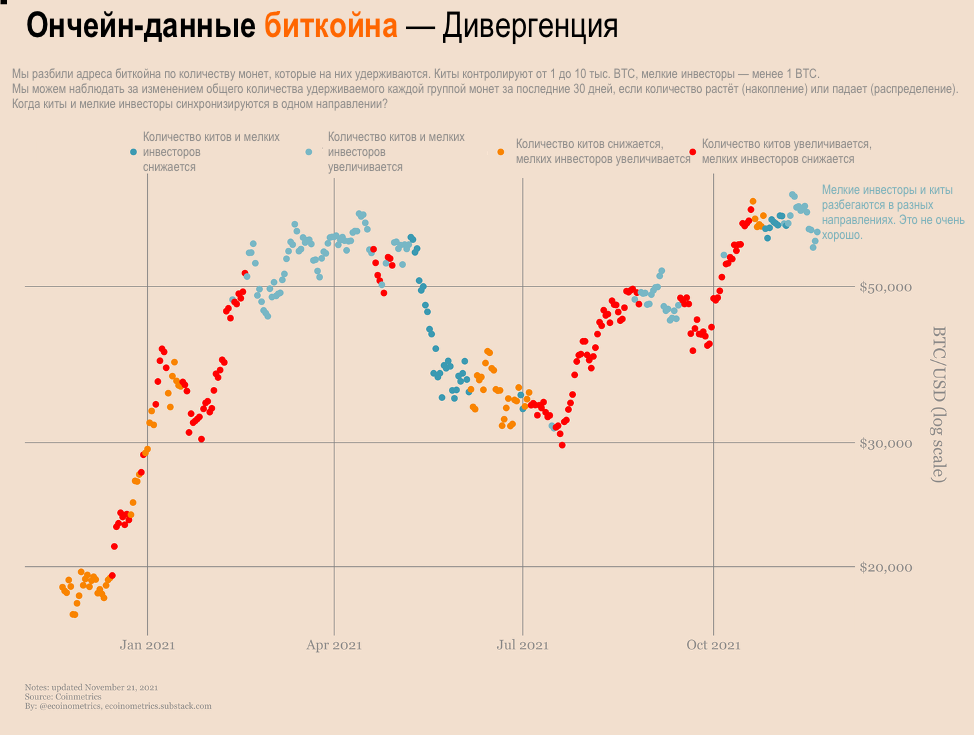

The main problem remains that whales have not been putting much buying pressure on Bitcoin lately.

If you look at the graph below, you can see that over the past 30 days, addresses that control from 1,000 to 10,000 BTC, as well as those who control from 1 to 10 BTC, have distributed coins.

You have to be careful how you interpret this. After all, distributing coins does not necessarily mean selling them.

Let's say you're a whale with an address that controls5 thousand BTC. You decide to move some coins from this address to another, which only has 50 BTC. In this case, you are distributing the coins, and of course, this transaction did not affect the price in any way.

This is why you don't need to be too straightforward when reading the above graph. The only situations that can be interpreted with a high degree of confidence are:

- All (or most) address segmentsaccumulate coins. In this case, everyone is actively increasing the amount of coins they control, which means there is a lot of pressure from buyers in the market.

- All (or most) of the address segments distribute coins. In this case, everyone is actively trying to sell their coins.

Anything in between these extremesmore difficult to interpret. This is why I always say what it takes to get whales to buy again. Because if that were the case, we would be in the first configuration, which is naturally bullish.

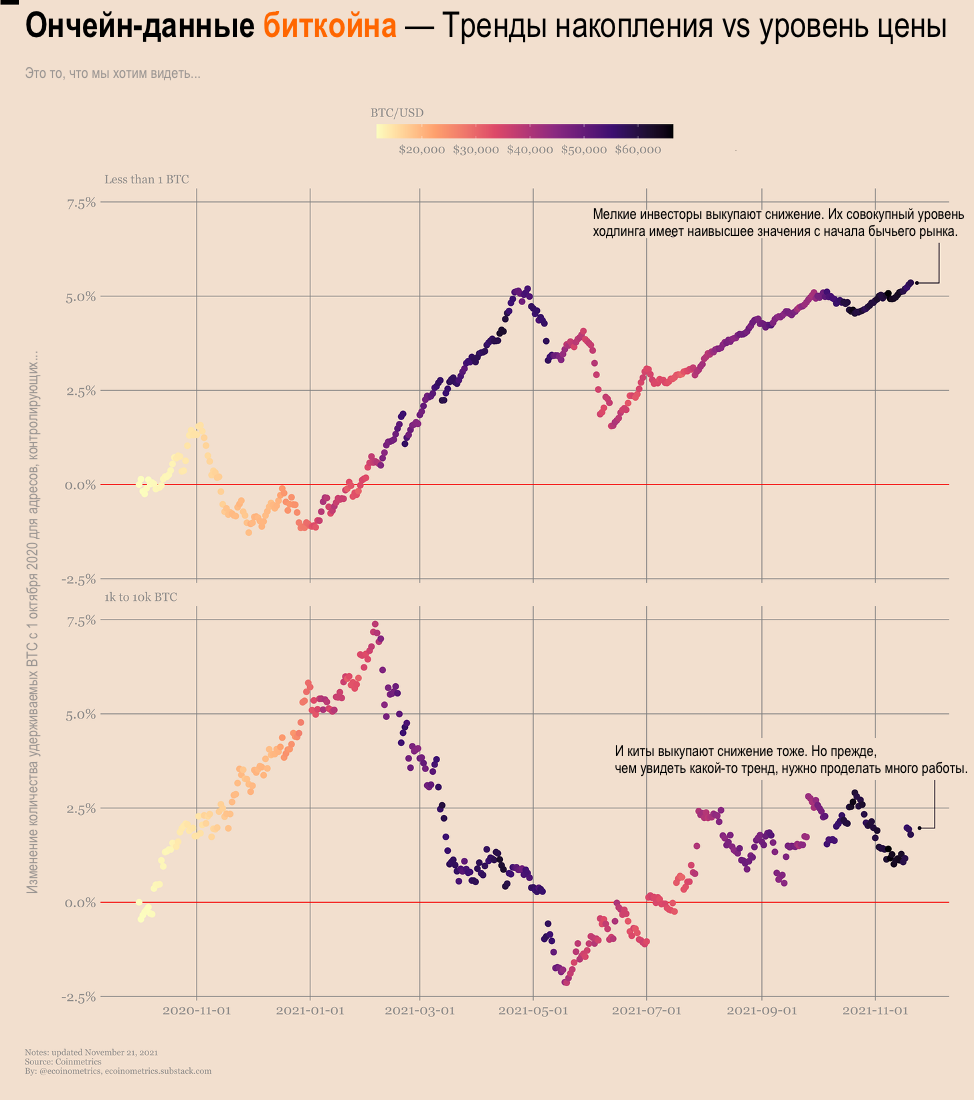

Since the fall, small players have been buying BTC. In fact, their cumulative hodling is now at its highest level since the bull market began last October.

The whales have also been redeeming the fall for at least the last couple of days. But as you can see in the chart below, their accumulation pattern looks less clear.

On the one hand, this is good. We kind of have a clear diagnosis of what's not enough. There is no mystery as to why we are not currently seeing a new parabolic leg.

On the other hand, who knows what the whales are up to ...

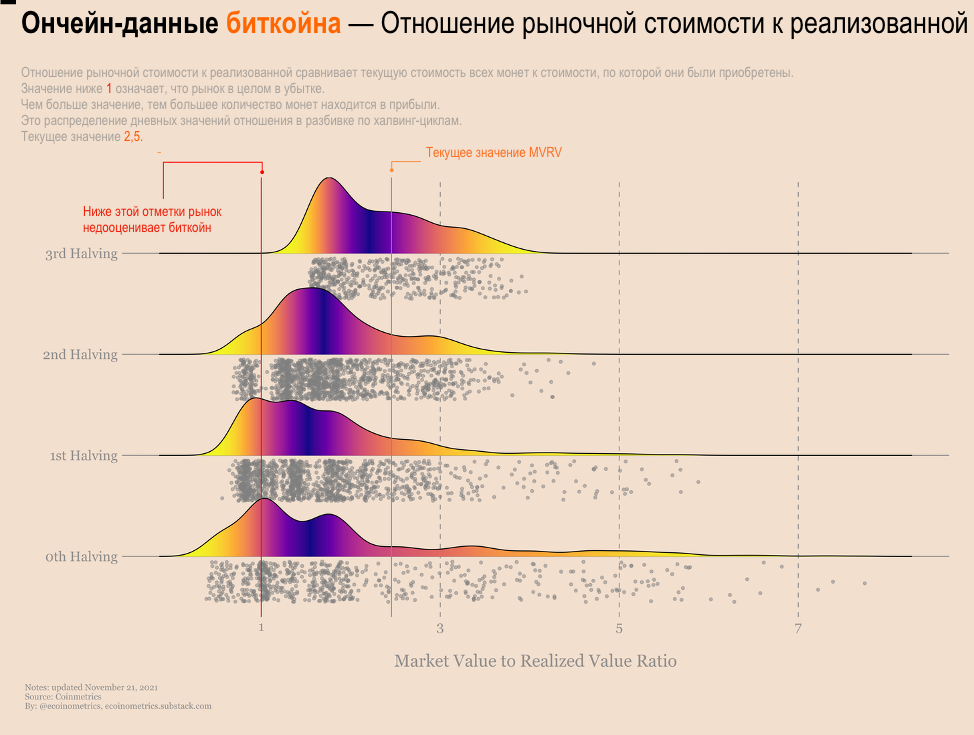

Considering that the unrealized profit indicatorthe market as a whole is not very high, it is unlikely that whales will want the price to drop significantly in the short term. And so if I had to guess, I'd say they might find the current price level attractive enough to start buying again.

But I don't have a crystal ball.When you add leverage that can be placed on crypto markets to the usual certainty of financial markets, it is very difficult to make any predictions in the short term.

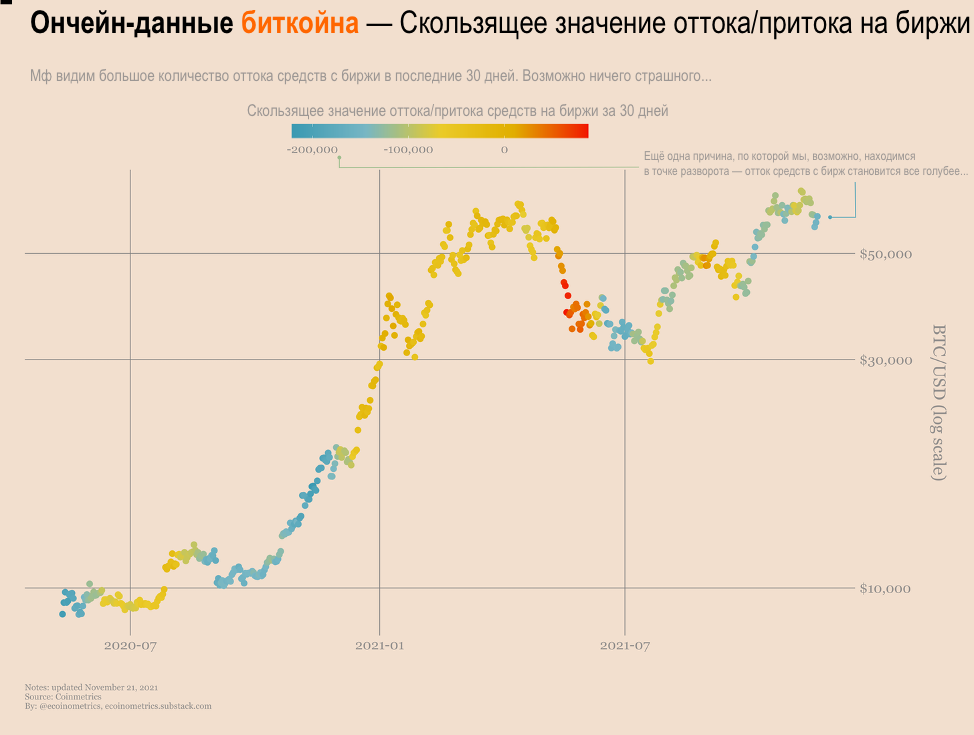

Long-term trends are another matter entirely.One thing hasn't changed in months. There are fewer and fewer bitcoins available for purchase on exchanges. This means that the logic of the supply shock still applies, which is why we are likely to see a parabolic move when the demand side of the equation is back in effect.

So no one knows how long it will take for Bitcoin to make another leap towards $ 100K. However, there are all the ingredients for this to happen.

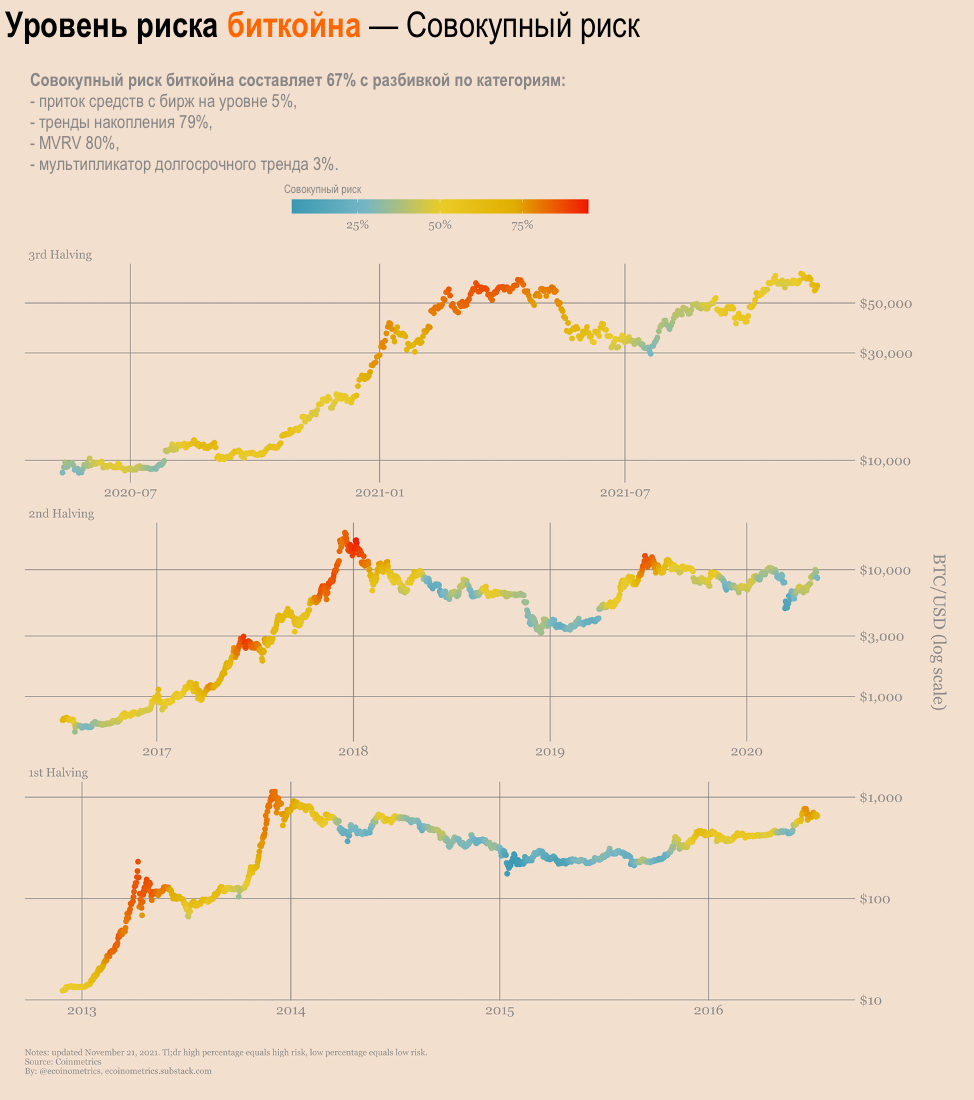

Using some historicalcomparisons to gauge where we are in this cycle, it looks more like bitcoin is in a second phase on its way to new highs rather than a decline after a breakout.

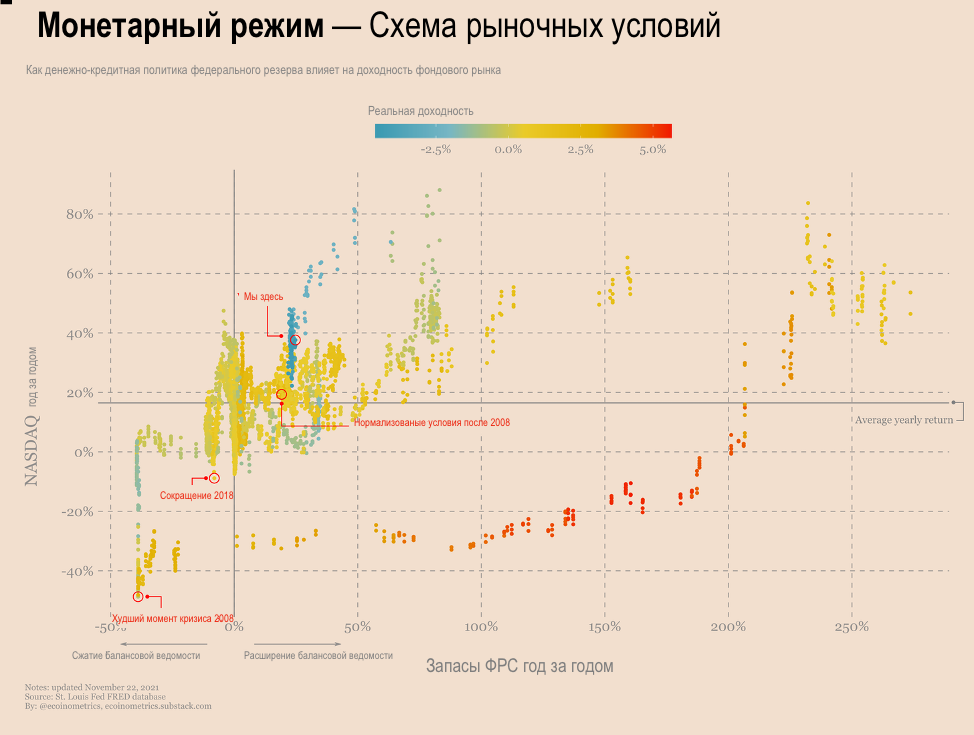

What really matters is what happensoutside of the bitcoin market. You can follow this link and also read here for more information on the topic, but in short, the Federal Reserve is in the process of winding down its asset buying program.

Historically, when the Federal Reserve slows down (or worsens, shrinks) its balance sheet expansion, the stock market yields lower.

So far, we are still doing well. But as we approach 0% on the horizontal axis, the risk of a stock market correction becomes significantly higher.

This is bad for Bitcoin.

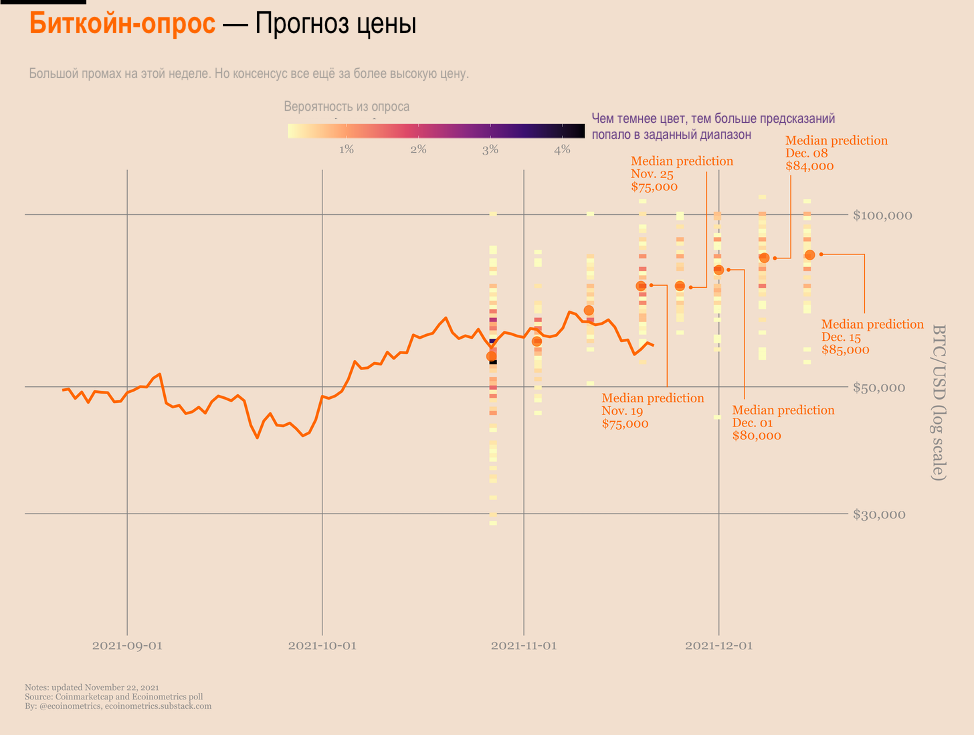

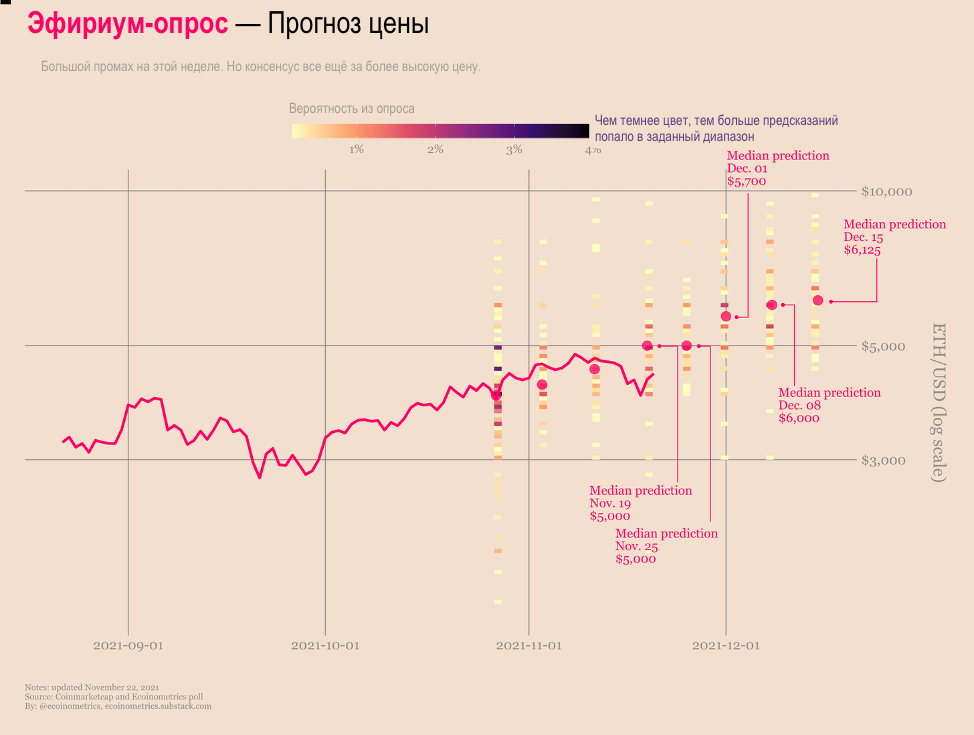

According to our survey on Twitter onforecasting prices, no one worries at the moment. Despite the fall and a rather significant missed last week's average forecast, people still believe that Bitcoin and Ethereum will rise in December.

«We didn't foresee this»

The sharp rise in inflation over the past year has stunned many economists. Almost no one noticed how it happened.

We've written extensively about the risk of continued high inflation following the central bank response to the COVID crisis.

Has inflation caught most economists by surprise? May be.

Has inflation caught the heads of central banks by surprise? I think not.

The point is that whatever they are going to do, central banks will have to deal with negative consequences:

• print a ton of money and get high inflation,

• don't print money and let the economy collapse.

Call me cynical, but I'm pretty sure thatmoderately high inflation is what the Federal Reserve is ideally suited to. Ultimately, this is exactly what it takes to deal with debt.

To devalue the dollar and inflate the national debt is the choice that has been made. Let's see if we can now keep the situation under control.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

</p>