In the first article in this series, I presented a simple heuristic for understanding hash power as an asset class. INmining, everything is interconnected. To get a complete picture of market dynamics, you need to look deeper into the interactions between the underlying forces.

In this article, I'll start by breakingthe mining market cycle into four archetypal stages, each of which is characterized by clear price trends, equipment potential and market sentiment. We will explore the driving forces in each scenario and I will try to show how hardware response time and hash power reflexivity play a role in shaping these macrocycles.

With a number of specific examples andtheoretical arguments I intend to provide some guidelines for understanding the different investment conditions in the mining market. Finally, we will discuss the growing importance of commissions in calculating mining profitability, new opportunities associated with the development of the commission market, and how deeply the transition of commissions to the status of the main variable changes the dynamics of the hash power market.

“When events have thinking participants, the subjectis no longer limited to facts alone, but also includes the perceptions of the participants. Causality does not lead directly from fact to fact, but from fact to perception and from perception to fact. "

George Soros,"Alchemy of Finance"

Mining cycles

Hashpower market dynamics are determinedthe interaction of exogenous and endogenous factors such as price trends, hash power reflexivity, equipment response times, and commissions. While the logic that connects them may seem simple enough, the unpredictability of each variable makes it difficult to create timeless generalizations.

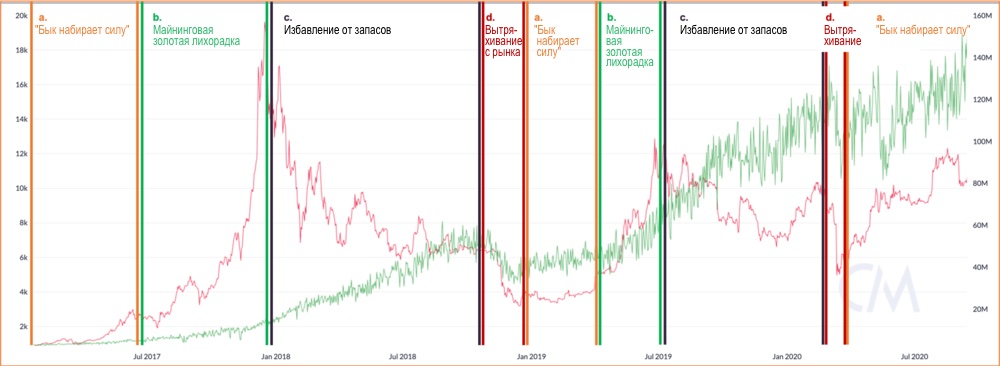

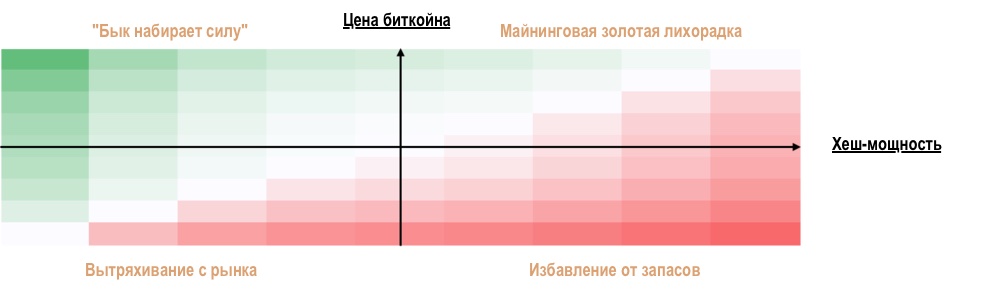

As a result, periodically arisingmicropatterns may not make any sense at all, as if price and hash power exist in completely different coordinate systems. Nevertheless, the actual profitability of mining can be traced. Based on how the impact of the market on the historical profitability of bitcoin mining changes, there are four archetypal stages in a recurring mining boom and bust cycle:

(and: Bitcoin,CoinMetrics)

The cycle is characterized by vectors of price and hashingpower moving in different directions at different speeds. Based on the Antminer S19 Pro specifications, we can illustrate how mining profitability on this hardware changes in each of the following scenarios:

"The bull is gaining strength"

The price is ahead of the growth of the overall hash rate.

Mining is most profitable when its complexitylags far behind the price rally. The “gaining bull” phase usually occurs after long periods of relatively low volatility, when the price is just starting to gain momentum, while the rest of the market is not yet sure which direction the price will move next. The hashing power grows much slower than the price. The increase in hash power is mainly associated with expectations of strong price growth on the part of miners or with the activity of those who have access to extremely cheap energy sources. For example, in the period from January to April 2019, the price of bitcoin was weakened after the "hash power war" between BCH and BSV, which also fell in time during the dry season in China. Enterprising miners bought used hardware that was sold cheaply on the secondary market. Some have also managed to take advantage of this opportunity through synthetic contracts or cloud mining.

Sometimes exogenous factors can even lead toa decrease in hash power, despite an upward price trend. This is often due to physical conditions, such as weather disasters and floods, leading to the shutdown of large data centers. The 2020 rainy season flooding in Sichuan was particularly devastating. However, these are all temporary reductions, usually won back over time.

Another special situation that can causelowering hashing power is a hard fork. After Bitmain announced the first ASICs for Monero, the developers of this cryptocurrency decided to switch hashing algorithms every 6 months. Every time the network changes its algorithm, some of its hashing power is lost. But the hard forks initiated by the developers happen not only in anti-ASIC projects. Sia's developers embrace ASIC mining in general, but have been hardforking to take Bitmain and Canaan machines out of the game.

(and: Monero,CoinMetrics)

Exceptional situations can temporarily halt the growth of hashing power, but with the continuation of the general upward trend and the strengthening of the positive sentiment of the participants, the demand for hash power increases.

Mining gold rush

The rapid rise in price, the increase in hash power is gaining momentum.

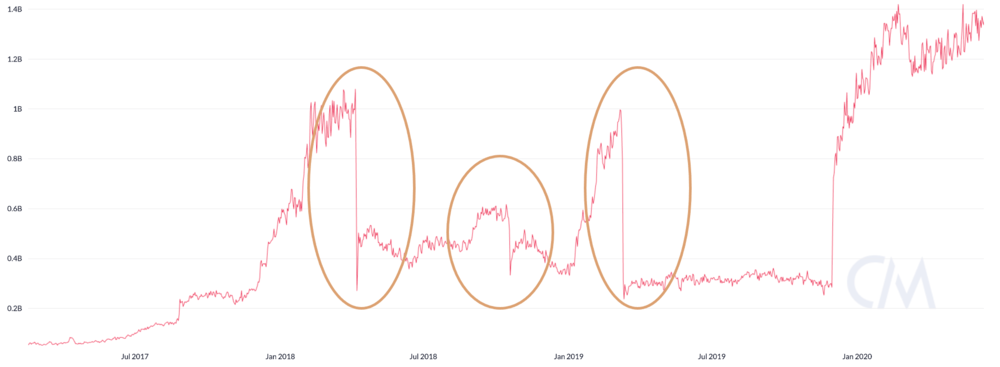

Once the bullish formation has been confirmed,people are becoming much more willing to buy mining equipment. New cars sell out almost immediately. Large miners place large orders with manufacturers so that their shipments are a priority. In a previous article, I wrote about the approximate assessment of mining machines based on the metricdays to break even... The faster the equipment pays for itself, the more expensiveit is evaluated by sellers. The price of the coin is growing rapidly, the demand for new miners is following it, but the hash rate has not yet picked up momentum. During such periods, manufacturers rake in astronomical profits. Both the secondary hardware market and the cloud mining market are traded at a premium.

This is equally true for ASICs and forGPU mining. In 2016-2017, AMD and Nvidia benefited greatly from the explosive growth of Ethereum. Miners were ready to overpay just to get their hands on all the available GPUs. At some point, the supply deficit was so great that Nvidia even asked retailers to release no more than two cards per hand. In today's market, with DeFi once again bringing Ethereum to the spotlight, manufacturers are rushing to roll out ASICs for ETH.

On the wave of hype, FOMO spreads very easilyamong miners. Positive bias continues to self-replicate and intensify, and expectations grow even faster. Young altcoins making their way through this phase for the first time could attract the attention of ASIC producers.

At the beginning of 2019, rumors of hundreds of millions of investmentsthe Grin spread like wildfire. Venture capitalists have rushed to fund target GPU mining companies. Soon after the project launched the mainnet, the complexity of mining increased dramatically, and manufacturers such as Innosilicon and Obelisk rushed to develop the first ASICs for it. The rest is history: the project did not justify the hype formed around it, and the manufacturers did not collect enough pre-orders to launch the ASIC into production.

Disposal of stocks

The price is falling, the growth rate of hashpower is still high.

As Howard Marks said, “whatever bringsextraordinary profits, will attract additional capital until overflow occurs. " The most devastating effect of an unfolding bull market is drainage of stocks.

This is a common occurrence after a strong bull market.accompanied by overproduction of equipment. In 2017, manufacturers such as Bitmain misjudged the duration of the current bull market and produced an excessive number of mining machines in 2018. As a result, they had to get rid of inventory, gradually lowering equipment prices. To sell off the extra chips, Bitmain began to release even dubious products like home Wi-Fi routers with a mining function. As a result, despite the fall in prices, the hash rate continued to rise for several months, until the overall mining profitability was completely exhausted.

During the same period, many GPU farms became unprofitabledue to exponential growth of hash power competition. ASIC miners for altcoins (Dash, Zcash, etc.) were released onto the market against the backdrop of a collapse in altcoin prices. The bear market hit the equipment supply chain so quickly that they had little time to react. Nvidia published "disappointing" financial results, and the rhetoric of the company's founder Jensen Huang changed from"The cryptoindustry will become an important driver of our business"during the 2017 peak at“Let's stop, please. I don't want anyone else to buy cryptocurrencies, ok? Enough. Enough. Or at least buy Bitcoin, not Ethereum. "

Draining stocks due to overproductionoccurs in many markets that are prone to high latency. For example, about a decade ago, the New York City luxury real estate market was dominated by an epic bullish trend driven by demand from generous overseas buyers. Developers rushed to launch new projects. Purchasing power has declined dramatically in recent years for a variety of reasons, including tightening foreign exchange controls, but these new luxury properties are just becoming available to the market and developers are facing big problems selling and settling them.

Shaking out the market

Price falls, hash power falls.

Sometimes the profitability of mining falls below thatthreshold value when it becomes unprofitable for miners to continue their activities. Chinese miners call this the "shutdown cost". In a traditional market, when a correction begins, negative bias can snowball and lead to a downtrend. But since hash power is self-referencing, the more hashing power leaves the market, the more “concentrated” the remaining hash power becomes.

This is why in Bitcoin these over-corrections areusually ephemeral. In Bitcoin mining, the threshold is buffered by the expectations of miners regarding future profitability. They believe that the chances of recovery are high, and therefore they are ready to extract at a loss or even increase the number of cars while the market goes through the phase of "shaking out". In smaller networks teeming with speculative miners, this kind of surrender is common.

Instruments showing poor performancetoo long, eventually become cheap and attractive. The same cycle will repeat itself over and over because of what John Kenneth Galbraith calls "the extreme brevity of financial memory."

Platonic allegory of market fundamentals

Why the hashpower market has thesecycles? Intuitively, hashrate growth and price trends are interconnected. So why don't changes in price lead to corresponding changes in hashpower? In other words, why is the hashpower market ineffective?

Conceptually, the market is an aggregator of information,transforming the perception of participants into price information. The faster the price absorbs new information, the more efficient the market is. In a theoretical equilibrium state, the complexity of the network should approach the level at which most miners will work close to the break-even point.

In one of Satoshi's early posts on BitcoinTalkwrote: “The price of any commodity tends to gravitate towards the cost of production.If the price is below cost, productionslows down. If the price is higher than the cost of production, then profit can be generated from this difference by producing and selling more units of the product. At the same time, increasing production volumes will increase the complexity and resource intensity of the process, bringing the cost of generation closer to the selling price.”

However, today's bitcoin market is far from passively reflecting the cost of "mining" it. Very rarely, one can observe the type of balance that Satoshi imagined.

While for most physical goodsSupply is largely driven by production and demand by consumption, speculation pushes crypto investors to make decisions based on expectations about the future price of Bitcoin rather than current supply and demand curves. Thus, calculating the cost of mining at any given time gives very little information about the market.

Market participants always perceive newinformation through the prism of their own biases. It's like guessing the shape of a multidimensional object by examining its surface in a system with fewer dimensions. This is a Platonic allegory of a cave applied to market fundamentals.

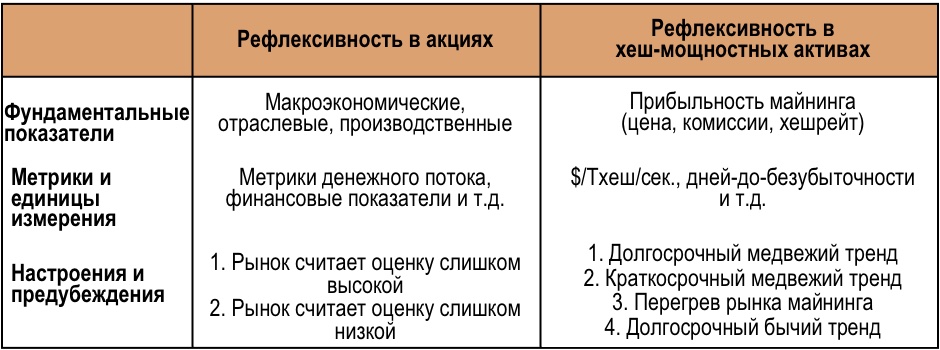

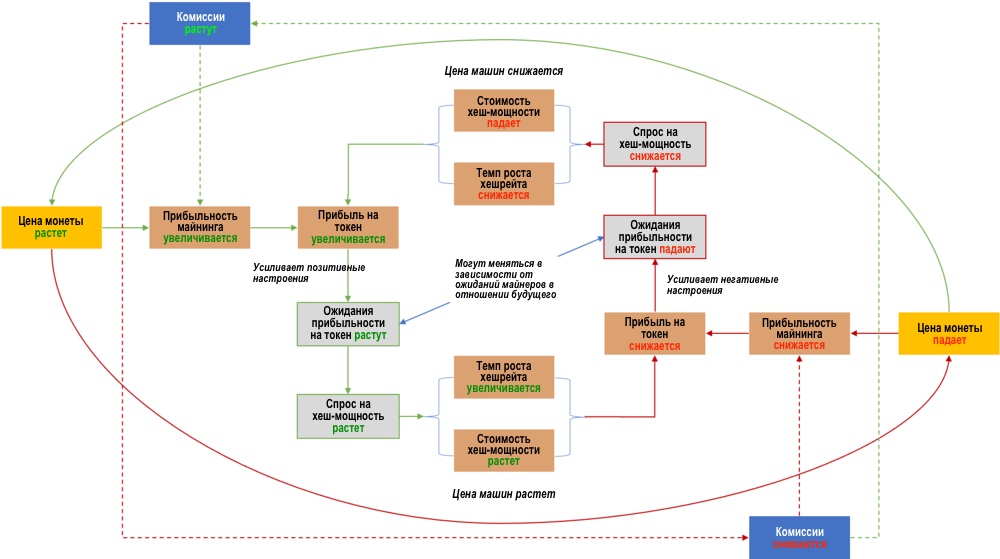

Along with cognitive error comes andreflexivity. Reflexivity is an iterative process: the market, as a melting pot of preconceived perceptions, always misrepresents reality. As investors place bets in the market, price changes begin to affect market fundamentals (such as company capitalization), which in turn affect price, thus forming a reflexive feedback loop.

Instead of focusing onhypothetically, a more practical approach is to study the process of change. Reflexivity theory has grown in popularity over the years. Its patterns have been widely observed in the markets of stocks, currencies, cryptoassets and even mining.

Reflexivity in hash power

How does reflexivity work in the hashpower market?

It's no secret that the demand for hashing powerdetermined by the value of the coins it produces. Buy and sell decisions are based on the market participant's own expectations regarding the future profitability of mining. Equity investors base their expectations about the future price of a stock on the results of their macro, industry and company analysis. Hashpower investors form their expectations regarding the future profitability of mining, assessing the growth trends in the price of coins, commissions and network hashrate.

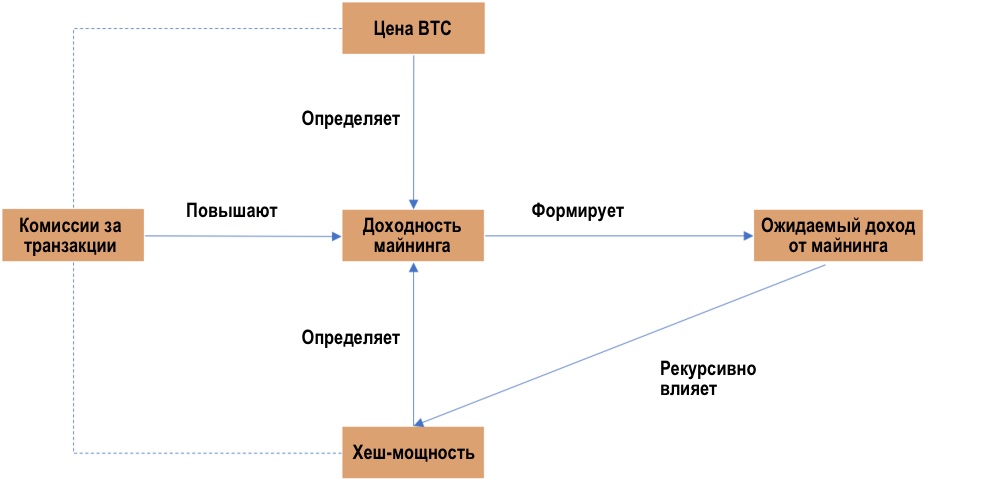

Everyone has their own (often flawed) heuristic fordefining expectations regarding price trends. For hashrate growth, on the other hand, it is much more difficult to build models. One reason is that it is dynamically recursive: the more hashpower that flows into the market, the more diluted each unit becomes. The changes lead to an adjustment in expectations and thus recursively affect the current mining profitability. Every participant in the hashpower market is constantly changing the rest of the market.

This means that the most scientific waypredicting hashrate growth is collecting sales data from manufacturers, large miners, service providers and distributors. But the mining machine business tends to have very little disclosure. Getting accurate and up-to-date data takes a truly tremendous amount of effort. Since it is difficult to reliably establish expectations for hashrate growth and commission income is still overshadowed by block rewards, naturally, future price expectations become the de facto main driver. After all, why would anyone spend so much capital and energy on mining if they are not optimistic about the future price?

Collecting mining data is not an easy task, but is it possible to unravel the structure of the relationship between price trend and hash rate growth?

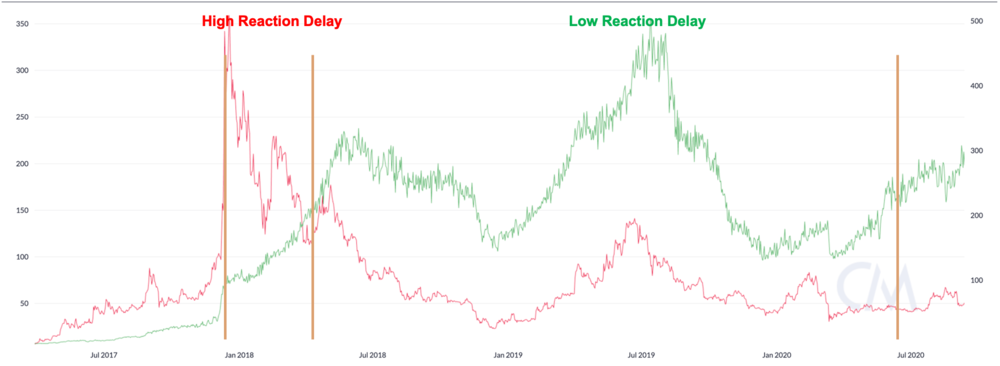

As shown in the description of the four phases of the market, oftenwe see discrepancies in hashpower and price. Capital markets are spreading rapidly. The production and delivery of equipment is a slow process. The hashpower market is the opposite of what is idealized in the efficient market hypothesis. This makes pure correlation analysis useless. You need to request data at different time scales.

The comprehensive analytical report (eng., PDF) published by BitOoda, the authors analyzed price and hashrate changes in 2019 and found that on average, it took 4-6 months from the start of the price rally to the moment when the hashrate began to follow the price increase.

Please note that this delay interval is notfixed. For each market move, the delay interval will vary depending on the available production capacity and the availability of equipment in the secondary markets. Different networks also have different response times.

Take Litecoin for example:between January and May 2018, it took a long time for its hashrate to react to the price change. But since July, changes in hashing power have become very synchronized with price movements.

(and: Litecoin,CoinMetrics)

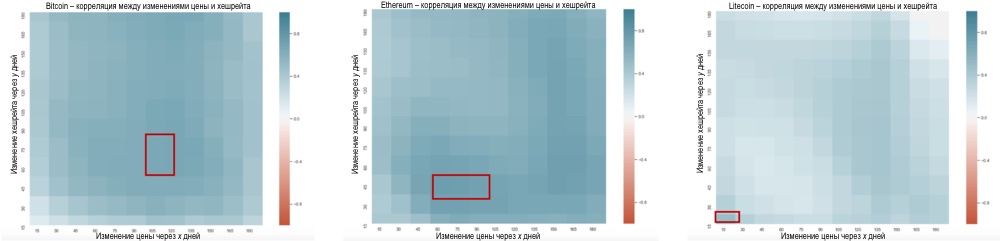

Extending the analysis to a longer period from2017 to 2020 for Bitcoin, Litecoin and Ethereum, I found that the average hash rate response time to price changes is 60-120, 30-60 and 15 days, respectively.

Process:

- Aggregated data for periods of 15 days:

- The columns in the dataset are the date (at the end of the 15-day period), the 15-day average price, and the 15-day average hash rate.

- For each 15-day period I calculated:

- % price change after 15, 30, 45, …, 180 days;

- % change in hashrate after 15, 30, 45, …, 180 days.

- Calculated the correlation between price change and hash rate change over different time periods.

- Read the matrix as:correlation between price changes for ‘y’ days and a change in hashrate after a period of ‘y’ days (after the period of ‘x’ days when the price change occurred).

In the future, I intend to study how the response periodchanges over time, and carefully analyze the underlying driving forces. For today, our next task is to assess the endogeneity of the hashpower market and build an index to measure reflexivity in various networks.

Response speed is inherently neithergood or bad quality. This is a function of the availability of hash power in the market at a given time. Some small networks that are dominated by general-purpose hardware mining have much faster response times on average. Their hashpower is more responsive to price ups and downs because the miners on these networks are less loyal. Compared to ASIC miners, they can easily switch to mining on a different network when it is profitable. Some mining pools offer an automatic network switching service, constantly switching power between several different networks in order to maximize profits.

Note that dominanceASIC mining does not necessarily make the network "value oriented" (eg Litecoin after 2019). Like the GPU mining dominated network, it is not entirely “speculative” (eg Ethereum). This is determined by the project itself and its community.

In most cases, the price change is preceded bychange in hashpower. Sometimes we can see the opposite in the altcoin markets, usually on the eve of halving or some special market events. Halving is one of the biggest recurring self-fulfilling prophecies in the world of cryptocurrencies, and post-halving rally expectations are prompting miners to prepare and hook up new mining machines in advance on the network. Sometimes coordinated pumping and dumping teams deployed hashing power to accumulate enough coins before overclocking their price for maximum profit.

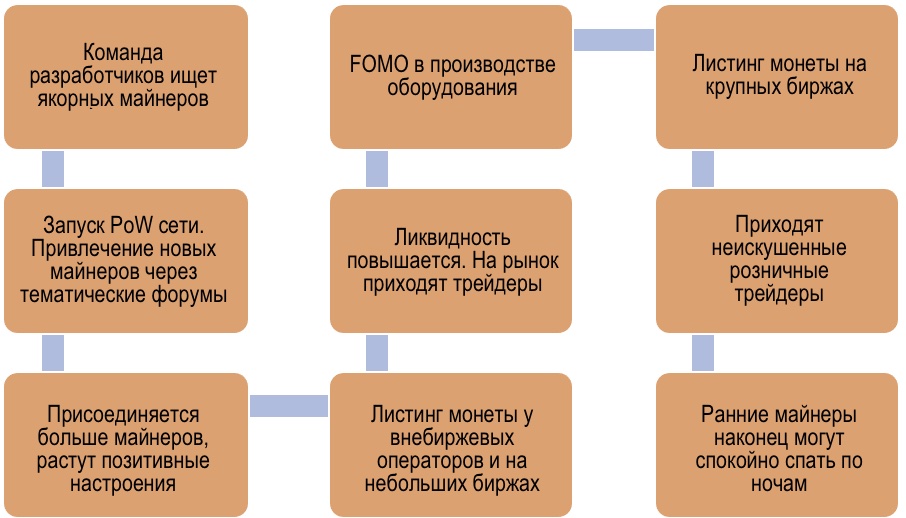

This game is also common among GPU miners,speculating on new projects. In the early days after launch, most coins are traded exclusively in over-the-counter markets with terrible liquidity. Miners do not have good channels to exit their positions - they continue to work at a loss until the development of the community gains momentum. As the community grows, larger exchanges will list the coin, giving early miners a chance to lock in some profit.

This does not mean that increasing the hashpowerwill lead to an increase in prices. This is a risky bet and there are plenty of examples of failure. Many stars must converge for such a robbery to be successful. Things can go wrong at every step of the process below:

GPU launch was popular between 2017 andearly 2019. Some analysts have suggested that proof-of-work may be a fairer launch model than ICOs that conclude agreements with venture capitalists for future token issuance. What constitutes a fair launch is a much broader topic. It is controversial even for DeFi projects that have nothing to do with proof-of-work. The launch method and acquired hash power does not guarantee a future price rally. Basically, this is a form of ICO with a higher entry barrier, the same casino with darts in the dark.

The response time of the equipment, regardless ofits duration is a source of endogeneity. This means that when modeling the influence of the price on the growth of the hash rate (or vice versa), this influence is likely to be underestimated or overestimated. Consequently, decisions based on inferences from such a model can have disastrous implications as inputs to investment decisions.

The moral of the story is that the relationshiphashpower and price does not imply a causal relationship between the two. One does not mechanically cause the other. These expectations of future mining income and expectations of hash power growth are constantly reinforcing each other.

The growing importance of commissions

To advance the macro model at the beginning of the article furtherOne step further, you need to make the main variable also the trend of changes in commissions. As mentioned above, today expectations regarding mining profitability are determined primarily by price trends. In August 2020, Ethereum miners made a total of $113 million in profit. The previous all-time high ($64 million) was recorded in January 2018. The exorbitant fees are due to the growing on-chain traffic of DeFi projects.

Introducing transaction fees asthe key variable opens up space for new analytic games. For example, arbitrage opportunities on Ethereum-based decentralized exchanges encourage competing bots to raise transaction fees, creating a kind of gas price auction (PGA, a form of front-running). Miners who control how transactions are processed can take advantage of these “auctions” through transaction optimization fees. This is part of the broader topic of "miner-extractable value" (MEV) - this is the name for the value that miners can earn directly from smart contracts. Over time, more services and infrastructure solutions (such as Sparkpool's Taichi Network) will emerge to optimize various aspects of the emerging commission market.

As commissions are a growing proportion ofmining income, this adds another dimension to mining profitability calculations. Both the expected price and the expected commissions will influence the expectations of market participants regarding the future profitability of mining:

Reflexivity theory is a useful heuristic forunderstanding the ebb and flow of hash power. However, this model cannot replace understanding the fundamental vulnerabilities in this market. As the mining industry industrializes, capital costs inevitably rise. Meanwhile, the share of commissions in miners' income is increasing, and the four archetypal phases described at the beginning of the article will expand to more complex scenarios in the future. The cumulative effect will lead to new problems and uncertainties in cash flow management.

After ten years of development, capital marketsstill suffer from a lack of standard terms and pricing heuristics. The industry needs good risk management practices and mature market mechanisms to ensure continued long-term investment in hashing power.

In the next article, we will discuss in detail the basic principles of risk management, creative financing and hedging strategies, and the long-term impact of financialization on the mining industry.

</p>