How can you gain exposure to the mining market without purchasing equipment using syntheticcontracts and financial instruments? What are the features of these tools? How to structure such a portfolio?

“The scientific method seeks to understand things asas they are, while alchemy tries to achieve the desired state of affairs. In other words, if the main goal of science is truth, then the goal of alchemy is operational success. "

George Soros,"Alchemy of Finance"

The economic value of hashing power

Bitcoin is a new computing paradigm.It abstracts data storage, communication, and computation from separate, specialized hardware. All nodes independently verify each transaction, new blocks and select the blockchain branch with the highest computing power. Bitcoin achieves state replication without any central coordination. But the design of this system has clear tradeoffs: to provide all participants with a complete database, redundant messages and duplicate stored data are required. Redundancy is inevitable no matter how optimized the network is to improve performance. The purpose of this system is not to increase efficiency in comparison with traditional distributed computing, but to formalize and completely open the processes performed.

Why do we need a computational paradigm that is highly redundant, inefficient, and completely transparent?

In a traditional distributed system, nodes andthe coordination rules between them are controlled by the organization that provides data storage and access services. On the other hand, in the Bitcoin network, consensus and transaction rules are enforced uniformly despite the heterogeneity of the nodes. Transactions are initiated sporadically by anonymous participants from all over the world and at varying network speeds. Without a single source of time or some kind of authoritative coordinator, it is impossible to determine at what point in time a transaction occurs. Bitcoin solves the complex problem of timing with a proof-of-work algorithm, a mechanism that can prove that a certain amount of computing power has been used over a period of time. As Grigory Trubetskoy explained, "the difficulty of finding a suitable hash serves as a clock." Thanks to the progress of these decentralized clocks, blocks of transactions are time-stamped, which allows the p2p network to efficiently coordinate its work. Hashing power crystallizes the sequence of transactions in the ledger, allowing Bitcoin to automate trust, and independently facilitates the transfer and storage of value by providing strong guarantees.

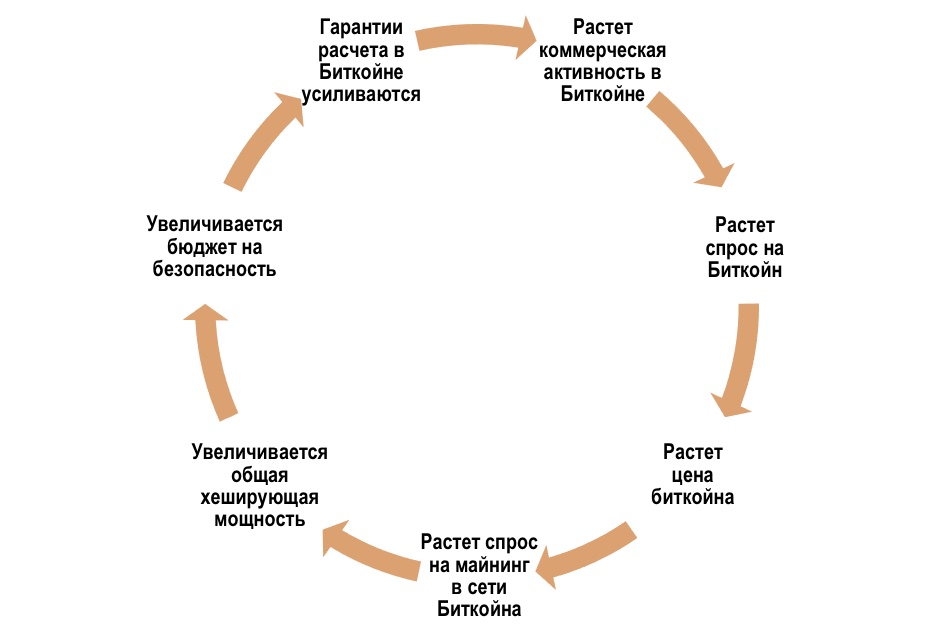

The guarantee of settlement is the most important condition for growth andlong-term viability of the network. The guarantee of settlement, or economic completeness, is considered reliable if the order of transactions is resistant to falsification. As the blockchain grows and the hashing power of the network accumulates, the energy invested increases the economic weight of the block. The cost of acquiring 51% + of the global hashing capacity could be too high compared to the potential benefit of carrying out an attack on the network.

All economic activity flows intosettlement network. In his article “The Economy of Bitcoin as a Settlement Network,” Seyfedin Ammus argues that Bitcoin's ability to handle large settlements compares favorably with similar settlements between central banks and financial institutions because Bitcoin transactions are cheaper, more verifiable, and not subject to counterparty risks. The Fedwire system processes over $ 2 trillion daily. However, only a limited number of charter banks can benefit from the value accumulated as a result of economic activity at the higher levels. In Bitcoin, anyone can maintain the pulse of the network by contributing in the form of the computations they make, and in return receive a reward in the form of a fraction of its economic value. Hashing powers ensure the security of the Bitcoin network, and their economic value, in turn, is determined primarily by the activities performed on the network. This is how the Bitcoin paradigm connects energy with digital information. This is the duality of the nature of hashing power - like yin and yang.

Hash power asset class

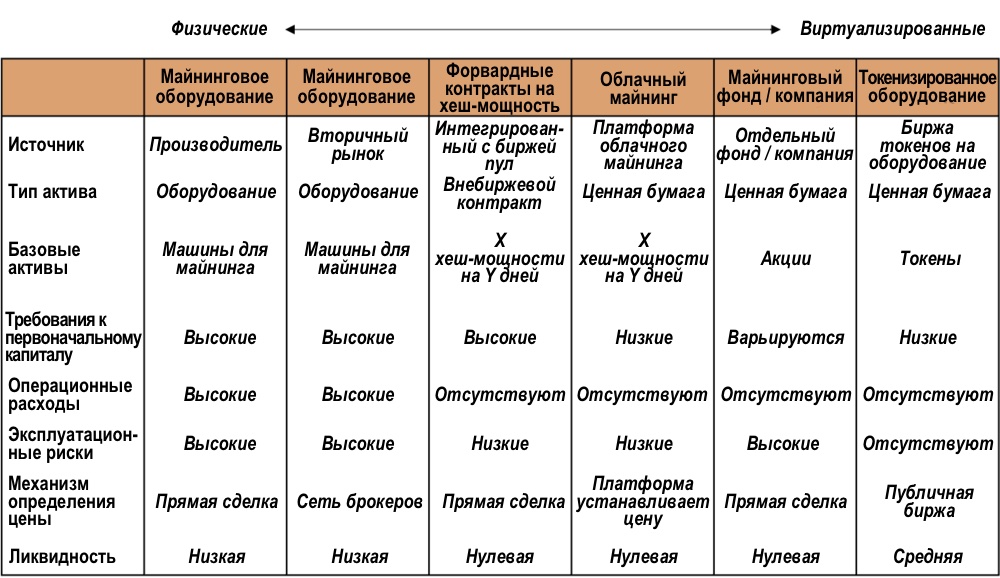

We classify all assets that producehashing power in exchange for cryptocurrency, and synthetic contracts / financial instruments that mimic the profitability of mining, as part of a class of hash-power assets, that is, assets based on the generation and use of hashing power. Despite their short history, investing in this asset class has become popular. To meet the demand, a number of specialized financial instruments have been created - vertical institutional mining projects, infrastructure and service providers, and mining-related financial contracts. In this section, I will describe the key characteristics of the different types of hash power assets, their nature as financial instruments, and the challenges each market vector faces today.

I. Market of computers

Unlike purely digital products, theycreate, physical attributes such as equipment characteristics and location significantly affect the activities of mining enterprises. Hashpower production involves many exogenous factors such as chip design, supply chain, energy source, and maintenance.

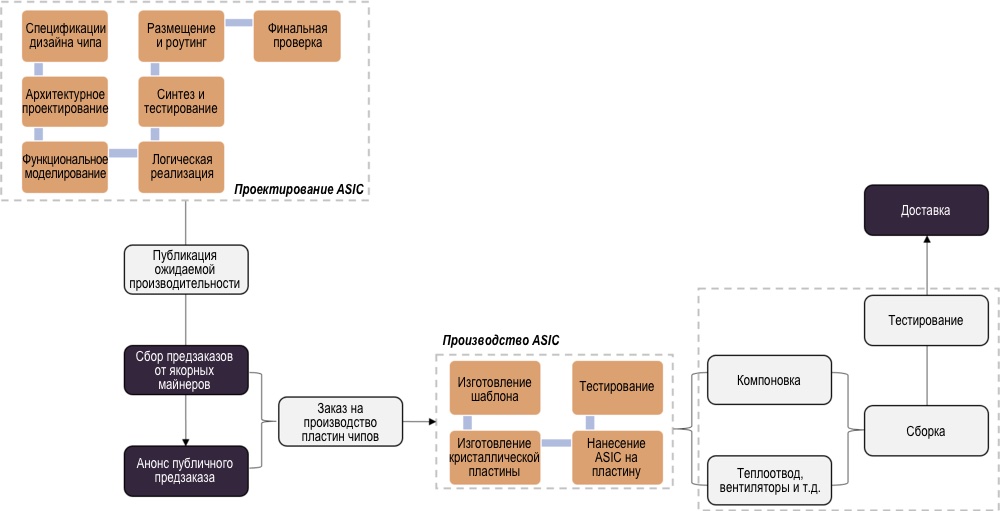

New product launches are usually planned forperiod right before the monsoon season in Sichuan province and it usually sells out instantly. Manufacturers are targeting requests from major miners and distributors to collect pre-orders, and only a small percentage of products are released for online retail distribution. New generation cars usually become available about 6 months after the announcement. Buying new cars from manufacturers is like buying fixed-term contracts for the supply of oil before the 1980s. These are contracts in which the seller of oil agrees to supply the buyer with a certain amount of oil at the scheduled time, and the price is determined unilaterally by the oil company.

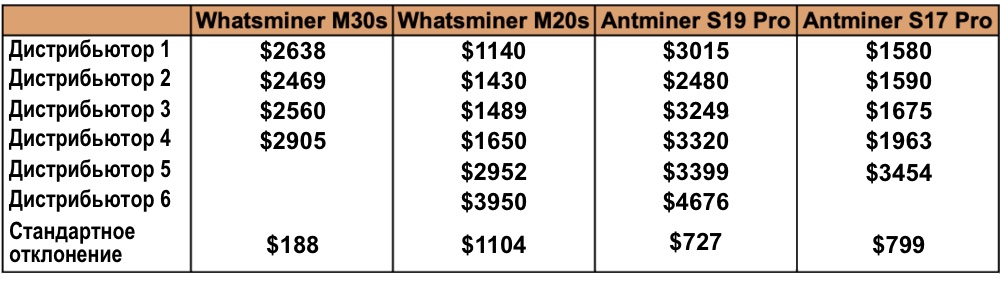

After 2018, manufacturers have become much morebe careful about inventory management. They start assembling miners only after orders have been confirmed and aggregated, and buyers usually have to wait 2-3 months before shipment. Since only a relatively small fraction of the product is released to the general public, retail customers often have to purchase it through distributors for an additional premium. The upside, however, is that they can get the equipment faster if the distributor has it in stock. Depending on the location of the distributor and the stocks at his disposal, the price of the same model can vary significantly:

(:asicminervalue.com)

There is also a fairly large marketused cars. Trading them requires significant experience. Information on the secondary market is distributed extremely asymmetrically. Transactions often take place between users and sellers, on average, have a much better understanding of the properties of the equipment than buyers. Used cars are usually out of warranty for a long time. It is not uncommon for them to have a hash rate lower than expected. Not to mention cases of outright fraud on the part of sellers. When purchasing from distributors or from the aftermarket, it is important to select reliable distributors and reputable channels, and to sign appropriate contracts with guaranteed compensation in the event of a delay in delivery or non-compliance with expected equipment performance.

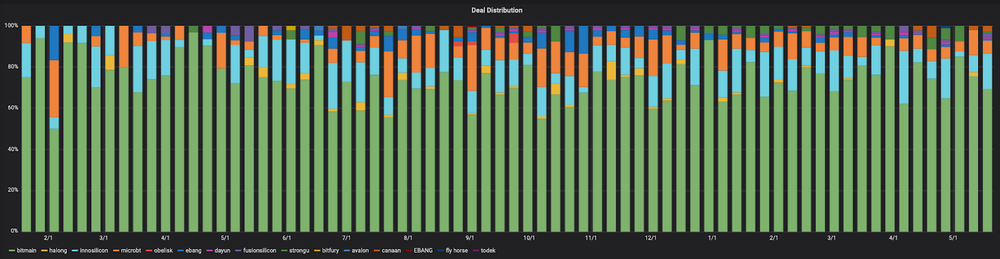

The mining machine market is notorious for itsilliquidity. Some cars are easier to find in secondary markets because they have been around longer or are produced in higher volumes. Mining machines are a commodity. Equally efficient equipment from different manufacturers may cost the same on manufacturers' websites. But when they enter the secondary market, the price is determined mainly by supply and demand. This is why, despite the fact that Whatsminer and Canaan have rapidly eaten away market share from Bitmain over the past two years, Bitmain machines continued to absolutely dominate the secondary market in 2020:

Distribution of transactions in the secondary market of mining equipment by manufacturer(: Luxor Mining)

II. Hash power parameters

The pricing of mining machines is influenced bymany factors. In this section, we will build a simple proxy model for calculating the hashpower cost and how it reacts to changes in the underlying variables.

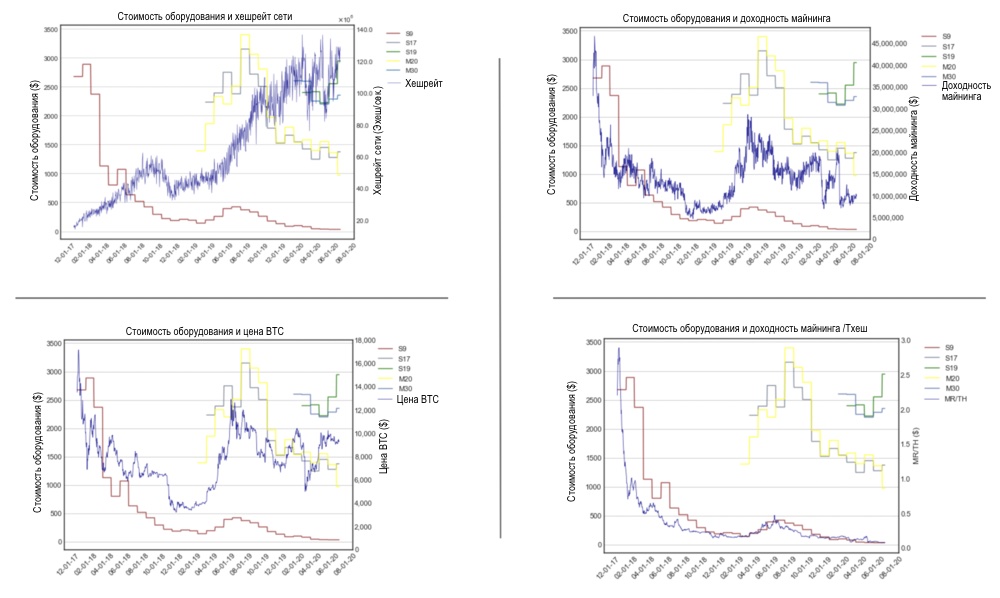

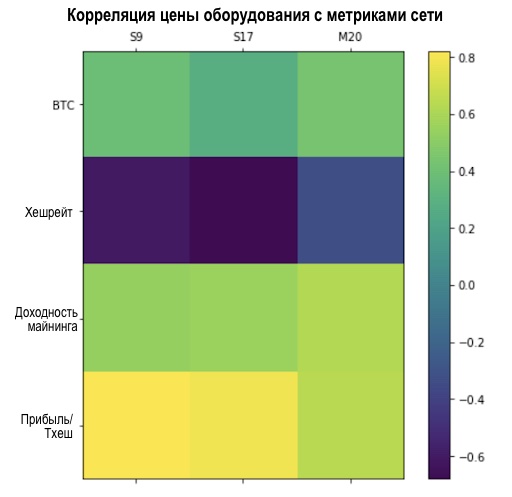

Hashpower price fluctuates depending onthe price of bitcoin, the hashing power of the network (technically difficult, but given that most pools calculate payouts based on the expected value, the hash rate can be considered a fairly good proxy variable) and the size of the transaction fees. Using mining hardware data from Hashrateindex, it is possible to compare how the prices of miners have historically moved against these variables.

(data:Hashrateindex,Coinmetrics)

(S19 and M30 excluded from analysis due to their relatively short history)

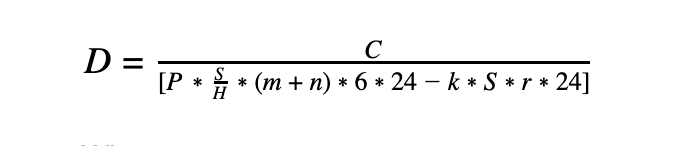

It is quite natural that the prices forminers correlate with profitability per unit of output. But that doesn't help us estimate the costs associated with producing hashpower. The most popular metric for calculating the cost of hashpower today, especially in the Chinese mining community, is “static days-to-breakeven”. It is easy to calculate and intuitive. Just as expected volatility is a proxy metric for valuing options, the number of days to break even has become a popular proxy variable for valuing mining hardware:

Where:

- D is the number of days to break even;

- C - initial capital costs;

- P is the current bitcoin price;

- S is the hash rate produced by the purchased equipment;

- H - hashrate of the network;

- m - block reward (coinbase), currently 6.25 BTC;

- n is the current average transaction fees per block;

- k is the efficiency ratio (J / T) of the equipment;

- r is the total cost of electricity ($ / kWh).

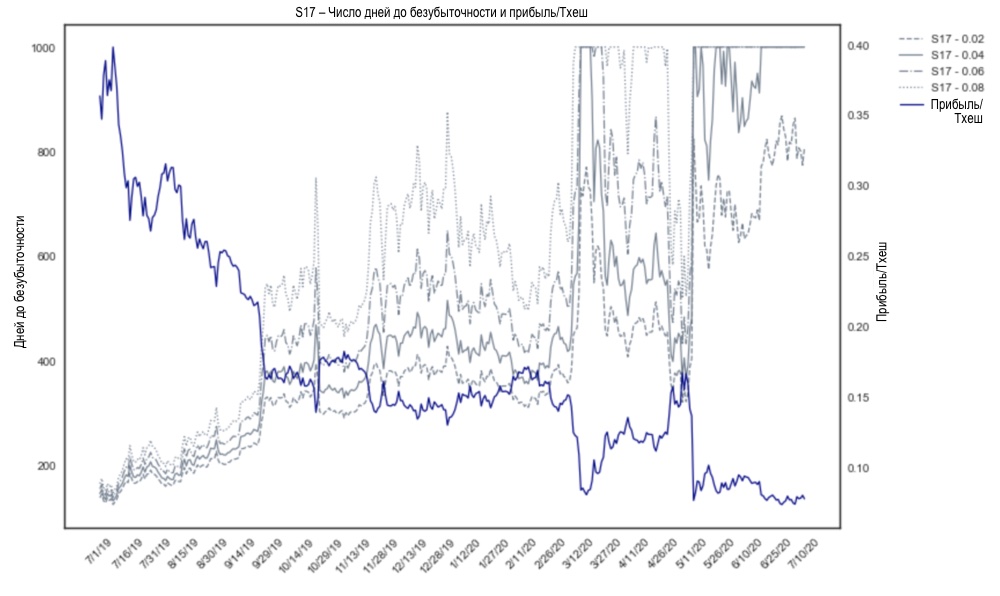

Test of the days to breakeven metric on historical data for model S17 at various valuesr(total energy costs):

This is a static indicator and does not capturethe values of the machine parameters when changing the basic variables. There are two main components to this metric: income and costs. Before investing in mining, most miners (I hope) understand their cost structure. Unit costs should be recorded over the life of the machines. Income, on the other hand, is determined by three random walks:

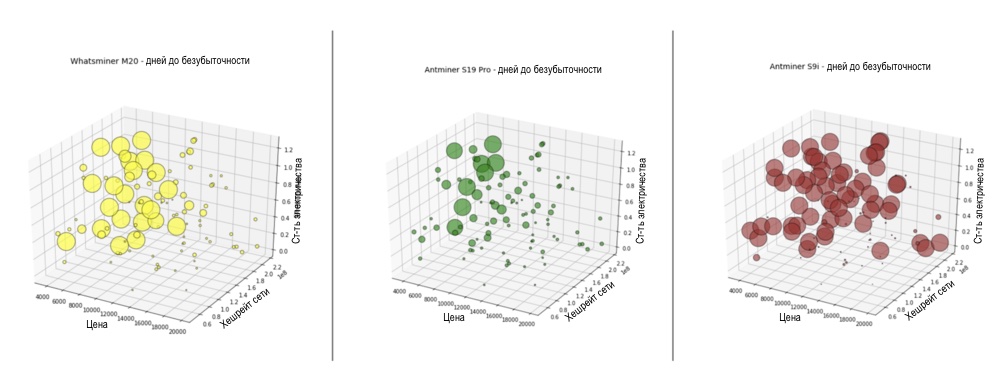

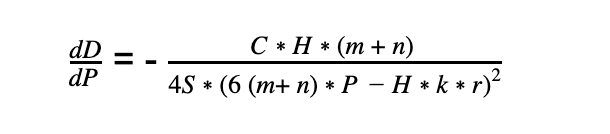

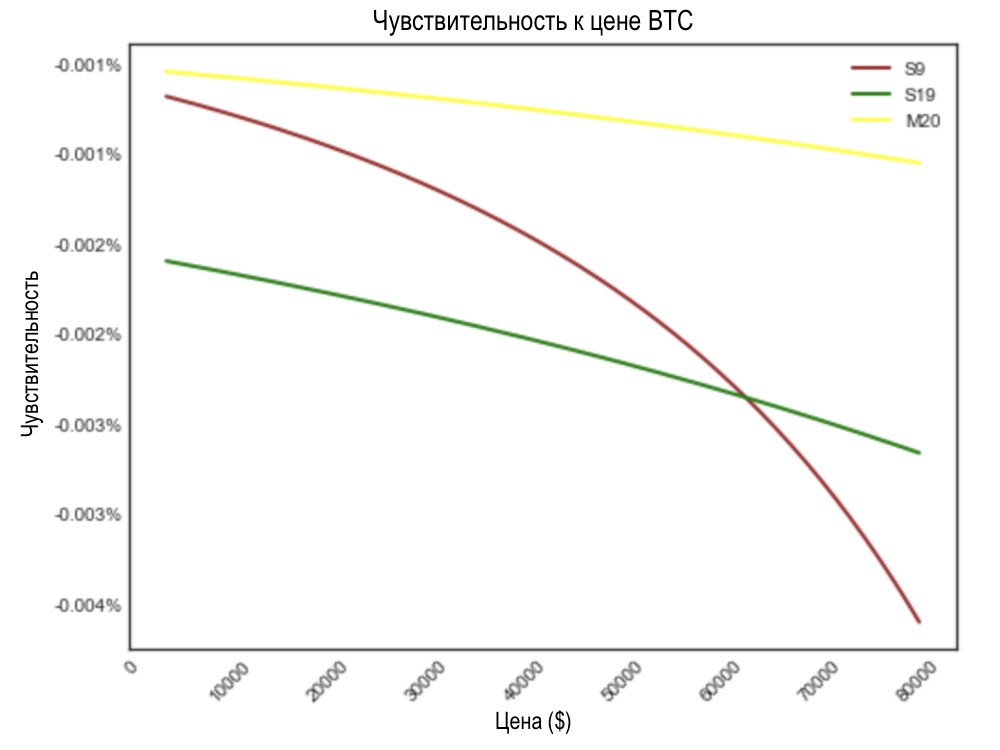

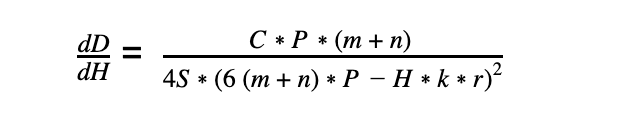

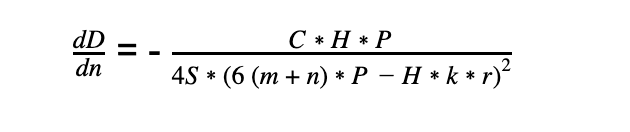

You can investigate the sensitivity of the day metricto break-even, taking its partial derivatives with respect to each variable. This is similar to the options delta, which measures how much the value of an option changes when the price of the underlying asset changes. The higher the absolute number of outputs, the faster the break-even metric responds to price changes. Price Sensitivity:

Using this formula, you can plot the sensitivity of the metric to the BTC price:

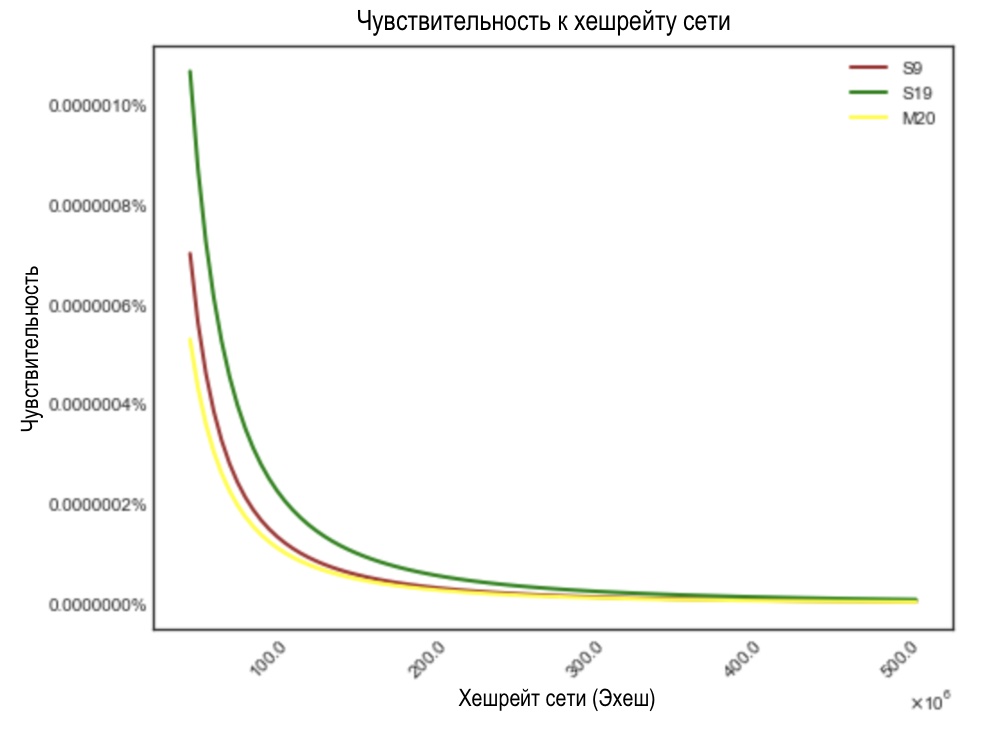

The graph shows that as prices riseBitcoin's days to breakeven metric is gradually becoming more sensitive to price changes. At the same time, the S9's sensitivity increases much faster than the other two models. Please note that price, network hash power and fees are all related. But in the absence of an explicit functiondH (p) / dpordf (p) / dpwe assume that the variables are independent. The same analysis can be applied to changing the hash power of the network:

Sensitivity to changes in network hash power:

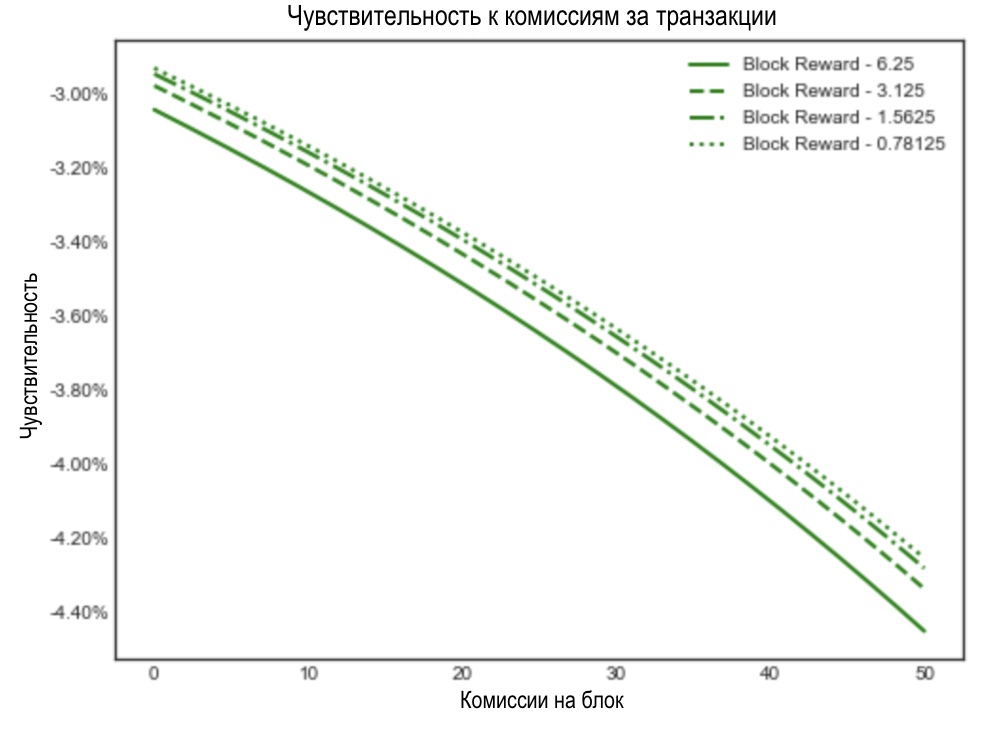

In the next step, let's considersensitivity to the average size of commissions per block with different coinbase rewards. As coinbase payments programmed into the protocol, transaction fees play an increasingly important role in miners' income. Sensitivity for S19 Pro:

Although the number of days to break even is simpleand an intuitive static measure of mining performance, it does not take into account the cost of using alternative machines and, as a result, is very volatile. In order to create a rigorous model for estimating the cost of hash power, one must also take into account future uncertainties, considering them as a multidimensional option or synthesizing them using a basket of different tools. These valuation approaches have their pros and cons. These tradeoffs and the mathematics of each methodology I intend to consider in detail in a future article on the architecture of the hashpower market. At the same time, I want to pay special attention to other "Greeks" of hash power, such as gamma (second derivative, sensitivity) and theta (reduction of time premium).

III. Synthetic hash power

In addition to the complexity of the financial assessment, the purchase andthe operation of mining equipment is fraught with many operational problems. These can be tricky for retail shoppers to deal with. An easier way to gain exposure to the mining market is to buy cloud mining contracts. Cloud mining is a primitive form of hashpower financial derivative that separates future production from current physical location. In this section, I will discuss several options for obtaining synthetic hashpower.

Over the years, arose and sank into oblivioncountless cloud mining projects. The dilemma of cloud mining is that it is obviously aimed at retail buyers, since it is more profitable for large miners to manage the machines themselves. Valuation of these contracts, however, requires substantial insider knowledge of the mining industry and expertise in evaluating complex options. This is largely why, while this concept represents a natural next step in the evolution of capital markets, most existing cloud mining projects are viewed as “fraudulent” (although many of them are fraudulent).

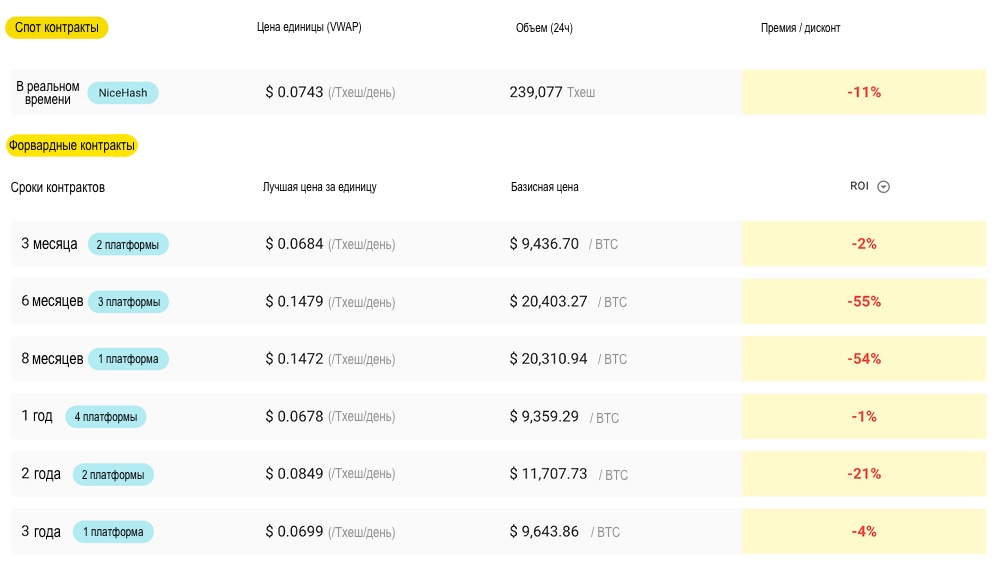

Immature and still relatively smallarea, the cloud mining market suffers from a complete lack of market standards. HoneyLemon Market is a great aggregator of data on the cloud mining market. From its dashboard, you can see wild contradictions in terms of contracts and prices on various platforms:

At the time of the survey (summer 2020), mostcloud mining contracts were deliberately unprofitable. Due to the operator's default premium to the cost of producing hashpower, making a profit from cloud mining is only possible in very specific market conditions. As a rule, after a long recession, the price trend begins to reverse into a natural rally (as in April - May 2019). The demand for hash power is suddenly increasing. Buying and installing hardware can take too long, so purchasing cloud mining contracts is becoming a faster way to build a position in this market. Through cloud mining, investors can also gain exposure in new markets not yet available on exchanges. In addition, hackers can rent a hashrate to carry out 51% attacks on small networks. This is a kind of hash-power Darwinism filtering out poorly designed PoW projects.

Another synthetic asset on the markethashpower is the tokens of computing machines. These are liquid tokens representing a stake in mining equipment. At the same time, traders speculate on the volatility of machines in the secondary market, and not on the digital coins produced with their help. While this concept has been around for a while, volumes have yet to show meaningful growth. Mainly because the multivariate nature of mining returns makes it difficult for speculators to form consensus on the value of “liquid machines”.

Experienced traders can structure portfoliossynthetic hash power. For example, a cloud mining contract can be purchased simultaneously with the opening of a long for futures on the expected hash rate on FTX and add short BTC spot futures to this. There are many creative ways to structure your mining portfolio using financial instruments. For foundations and trading firms not interested in purchasing and operating mining equipment, this is a cleaner way to gain exposure to the mining market.

Mining portfolio example:

(Depending on the magnitude of the fluctuations, "cloud mining long" is most likely not neutral when price and difficulty move in opposite directions)

In practice, structuring such a portfolio -a very delicate task. As the analysis of the sensitivity of the metric of days to break even shows, the sensitivity of mining indicators changes rapidly as the market develops. The hedge ratios for each instrument must be kept up to date. The management of such a portfolio requires careful monitoring and frequent adjustments. However, there are many limitations, such as low liquidity and unclear pricing. Traders need to understand exactly what slippage and discounting factors should be considered when calculating risk. By structuring a virtualized portfolio of hash power instead of starting a mining farm, the investor is effectively replacing the operational risks of mining with additional financial risks.

As for miners, the new wayto hedge their risks - these are forward contracts for the sale of hash power. Similar to renting hash power on cloud mining platforms, forward contracts allow miners to sell a fixed amount of hash power over a period of time at a predetermined price. Unlike cloud mining, they are usually structured outside of exchanges and have more customization flexibility. However, without a public benchmark, the forward market does not have any established pricing system. Each transaction becomes a subject of negotiations, and the parties inevitably assume some market risks. A recent high-profile success was BitOoda's deal with CoinMint, a large mining company based in New York.

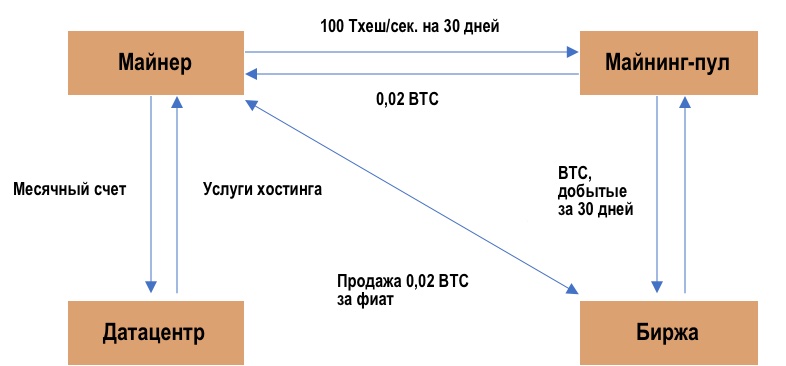

Deals like this will happen more and more often,as more and more exchanges and financial services are vertically integrated with mining pools. Mining pools are great aggregators of miner's traffic, but after years of development, they have evolved into commodity software. Everyone needs a trade flow of miners. With a deep pool of liquidity, exchanges have the ability to offer creative and potentially risky types of transactions in order to conquer the trade flow of miners. Miners can set parameters in such a way as to always sell a percentage of their hash power, fixing the payment of operating expenses, and the counterparty receives a stream of coins mined by these hash powers from the pool. For example, at the beginning of the month, a miner can conclude a pre-sale contract of 100 TH / sec. for a period of 30 days. Based on the expected increase in difficulty and projected fees, the pool proposes an advance of 0.02 BTC. The miner fixes the production of 100 Ths / sec. for the whole month, effectively transferring production risks to the pool.

(Figures are random and are just for illustration)

Binance, OKex and Huobi are actively expanding theirpools to capture that market share. I expect other leading exchanges to follow suit or merge with existing pool operators very soon. Some lending institutions and trading houses are also moving in this direction: Babel Finance has launched its Ethereum pool, Three Arrows Capital will offer structured products through Poolin. In the past, various layers of the cryptocurrency industry have been highly fragmented. Years of trial and error have standardized and commercialized key infrastructure layers. Some of these standalone infrastructures lack robust business models. Consolidation or verticalization is inevitable.

IV. Hashpower investing tools

Investing in mining is a full-time jobyour bid. Most traditional investors and venture capitalists do not have the resources or expertise to work with mining hardware or structure complex virtualized hashpower portfolios. Among them, exposure to mining through specialized financial instruments or mining companies is more common. There was a boom in bloated GPU mining projects in early 2019, and rumors of deep-pocketed venture capitalists investing hundreds of millions of dollars in Grin spread like wildfire. GPU farms, already covered in dust by that time, were resurrected to ride this wave. Investors wanted to build large positions, but did not have the human resources or sufficient technical expertise to operate the mining equipment, which forced them to pool capital to finance mining ventures. Managers of specially created enterprises receive and launch mining equipment with the initial investment of venture investors, and in return receive a percentage of the profit from mining.

Investing in existing miningcompanies are also quite widespread. Some of them are already traded on the stock exchange. Mining companies generate huge volumes of digital coins every day. A mining enterprise is effective both as an equipment operator and as a liquid fund manager. Many well-capitalized mining projects have failed due to mismanagement of trading positions. A notorious example is Gigawatt in 2018. According to court documents, when it filed for bankruptcy, the company had "less than $50,000 in estimated assets while estimated liabilities were in the range of $10 million to $50 million."

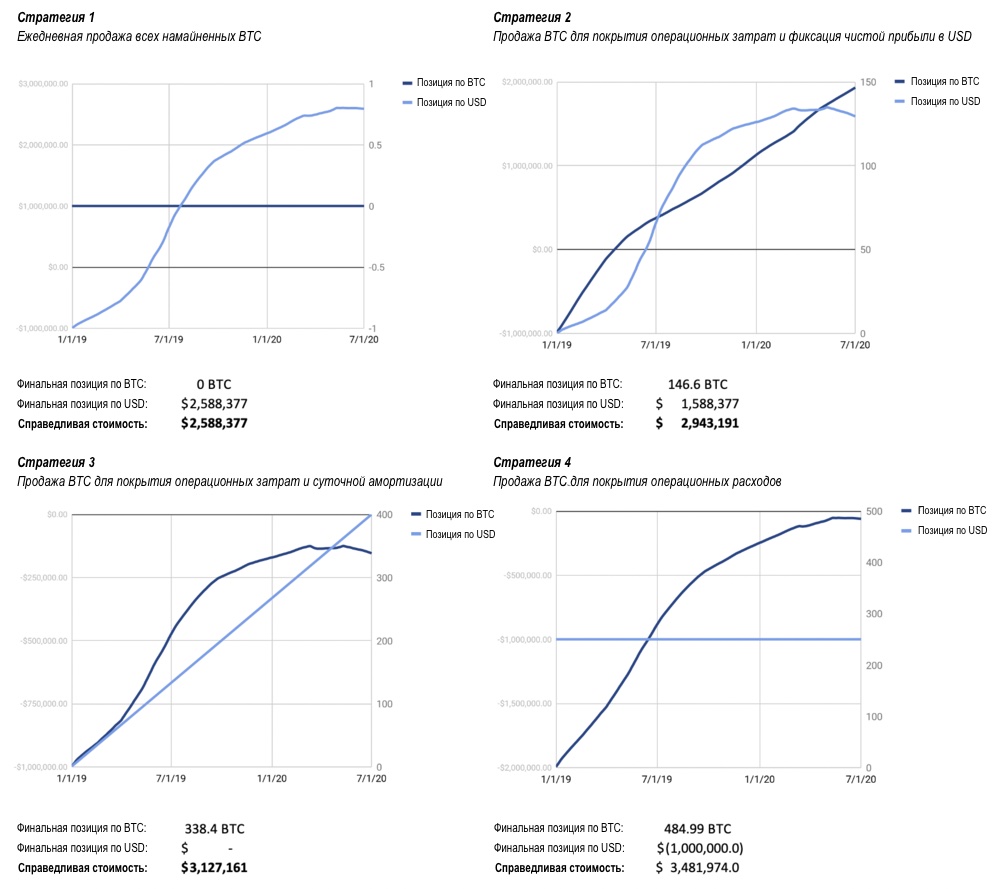

How operators manage cash flows,extremely important. Developing a sound sales strategy to counteract changes in market conditions is critical to the financial success of the fund / company. Below I will illustrate the results of four typical strategies:

Assumptions:

- Start date: 01.01.2019

- Evaluation date: 01.07.

- Initial investment: $ 1,000,000

- Number of mining machines: 4840 S9 units purchased at $206.6 per unit. Depreciate linearly over 18 months.

- Total hashing power: 67,761 Thesh/sec.

- Total energy consumption: 6389 kW

- Total electricity cost: $ 0.04 / kWh.

The strategies illustrated above representdifferent risk appetites for BTC / USD positions. Note that in a different market environment, the strategy that brings the most profit here may turn out to be the least profitable. Some miners prefer to hold on to the mined coins regardless of market conditions until they are absolutely forced to sell them. Depending on the manager's goal (accumulating BTC or trying to maximize dollar returns), the strategy needs to be optimized accordingly. Miners with experienced traders can also sell the rewards received and buy them back when the price of the coins falls below their cost, or use a combination of financial instruments such as secured lending or bitcoin futures to hedge against downside risks.

A quick summary of the hash power asset class:

In the next part of the article, I will describe the internalthe logic of variables that determine trends in mining, and show how reflexivity manifests itself in the hashing power market. We will also analyze the cyclical macro-patterns arising from these complex interactions and illustrate them with real market examples.

</p>