The data shows that the rally around Bitcoin has gone well beyond its spot price against the dollar:In just 17 days, the value of MicroStrategy (MSTR) shares fell from $ 1,300 to $ 620 dollars.

The BTC price correction affects not only individual hodlers - it also affects the interests of large players who have not invested in bitcoin directly.

According to the results of March 5, the shares of MicroStrategy, which owns more than 91 thousand BTC, more than halved in just three weeks.

MicroStrategy keeps buying BTC

On the day the company confirmed it had addedadding another 210 BTC worth $10 million to its reserves, MicroStrategy shares hit a local low of $537 on the CBOE. At its peak in February, MSTR traded at just above $1,300.

This volatility is a consequence of bitcoin's ups and downs in the last bull rally, which saw strong fluctuations in both directions.

$ MSTR (red) and BTC / USD (blue) charts. : TradingView

However, since the start of purchasing BTC on the company's balance sheet in August last year, the impact of bitcoin on its share price remains a turning factor. Before this move, the MSTR traded just above $ 100.

“They now hold 91,064 BTC on their balance,” Anthony Pompliano, co-founder of the Morgan Creek Digital fund, comments on the latest purchase.

“This may be one of the greatest manifestations of strong conviction in the history of the stock market.” - Anthony Pompliano

Arthur Hayes: recovery in bond yields may prompt some investors to "exit bitcoin"

The fruits of such “conviction” can manifest themselves inthe entirety of the market is well beyond the short term as Bitcoin's bull cycle faces macroeconomic headwinds.

According to Arthur Hayes, ex-CEO of crypto derivatives giant BitMEX, the policies of central banks in some extreme circumstances could lead to capital flight from cryptocurrencies.

The reason, as he explained in his new postThis week is that the Fed may choose to hike rates, which will hurt investors across the board, but periods of record low rates are also likely, creating conditions for a surge in volatility.

“I don’t have a model to accurately estimate the ratioin between, but at a high level, if global fiat liquidity can again make real gains in government bonds, it will exit bitcoin and the crypto market, ”he writes.

“The whole point of this exercise is tomaintain or increase purchasing power in relation to energy. If this can be achieved with the most liquid asset, government bonds, then liquidity will take the path of least resistance. ”- Arthur Hayes.

If such a scenario comes true, Bitcoin will be inmore dependent on its technological idea, which, according to Hayes, will make a much less impression without a lot of money on board.

“I cannot appreciate the current technological value of Bitcoin, but it is much lower than its current rate to fiat,” - Arthur Hayes.

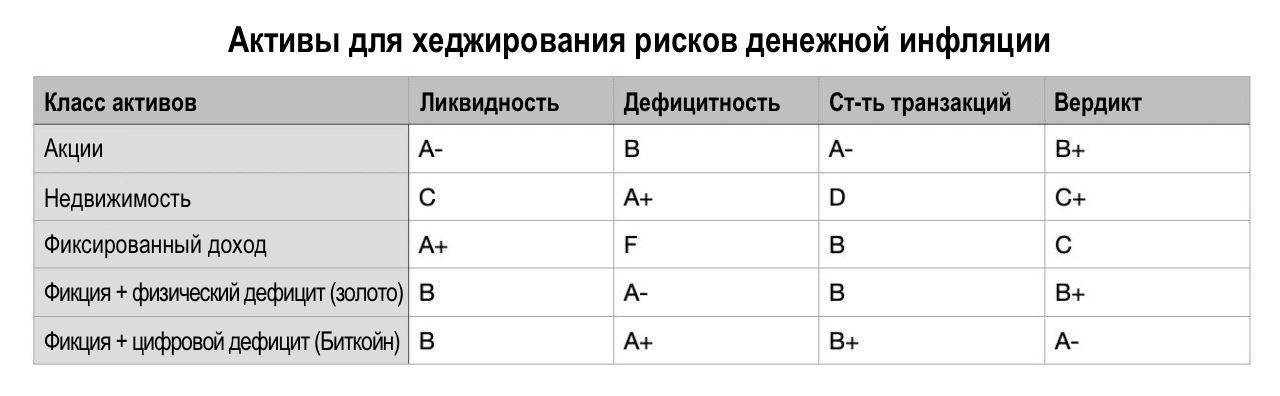

Anti-inflationary options table by Arthur Hayes. : David Venturi / Twitter

To counter this risk, investors must benefit from both the unprecedented potential of cryptocurrencies and the future volatility of central bank base rates.

</p>