For many of those who are new to the topic of cryptocurrencies, and especially Bitcoin,perplexitythe very concept of halving Bitcoin and the fact that investors are preparing to “cram full” with this cryptocurrency. In this article I will try to put everything on the shelves for the uninitiated.

So what exactly is bitcoin halving?

It's about software reductionnew bitcoins that can be mined and put into circulation. Such reductions occur every four years. Bitcoin was designed to behave very differently from the fiat money we are used to today, which is also subject to inflation. It was assumed that the behavior of this virtual currency would resemble the behavior of precious metals, such as gold, which cannot be counterfeited or whose stock cannot be increased artificially. Similarly, bitcoins are scarce and can be considered the digital equivalent of gold. Bitcoin has also been nicknamed “digital gold,” because the underlying blockchain technology ensures that Bitcoin cannot be simply taken and “multiplied,” increasing its supply beyond that programmed amount of 21 million units. Just as gold bullion goes into circulation after it was physically mined from the earth, bitcoins are put into circulation through a process called digital mining (or mining), which also requires considerable effort. The difference between these processes is that instead of physical labor, digital mining uses the energy received from many computers dispersed throughout the globe.

A brief overview of what mining is

Bitcoin blockchain has been programmed to work in10-minute cycles, in other words, every ten minutes, one of the many miners “extracts” a new block in the Bitcoin network. All transactions that have occurred in the last ten minutes are taken from the transaction pool by some miner, a transaction block is formed from them, it is packed and added to the blockchain chain. The incentive for the miner to invest all that money and energy in this extremely competitive activity is the opportunity to get a reward for completing the block. Back in 2009, when Bitcoin was just launched, the reward was more significant than today, since Satoshi Nakamoto understood that in order for Bitcoin to succeed as a secure method of payment, its network must develop rapidly. Accelerated growth will prevent such attacks on Bitcoin as double spending and a high frequency of attacks on the network itself. The more miners, the higher the hash rate, and the more processing power will be available to make the network more secure.

Back to Bitcoin Halving

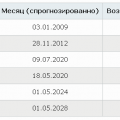

The block reward at the initial stage was the mosthigh and amounted to 50 bitcoins per block found, and the difficulty level of finding a new block was very low. The large volume of bitcoins released into circulation in the early stages served to attract miners to launch the network and ensure its security. Currently, the difficulty level of mining is much higher, and the Bitcoin reward is much lower. This ensures control over the supply (supply) of Bitcoin, allowing it to avoid the same pitfalls inherent in regular fiat currency, which is prone to inflation. Bitcoin software has a built-in “halving” mechanism that cuts the block reward in half every 210,000 blocks mined, which is exactly what happens every four years. Since its inception in 2009, Bitcoin has already gone through 3 halvings, with a fourth still to come, set to occur around May 2020. It will reduce the block reward to 6.25 bitcoins.

Forecasts for Bitcoin for 2020

Halving, according to observations, affects the priceBitcoin, and it is expected that he will push Bitcoin to his next bullish cycle. If we consider this process solely from the point of view of supply and demand, then as the supply of bitcoins decreases, the number of wallets in the Bitcoin network continues to increase. On cryptocurrency exchanges around the world, such as Binance, Coinbase and PayBito, among many others, there is an active trading in bitcoins. From the point of view of mathematics, this will certainly lead to an increase in the value of Bitcoin in the future. Here are the Bitcoin price forecasts for 2020 from two well-known names in the cryptocurrency space:

Osato Avan-Nomayo

Osato Evan-Nomayo is an analyst at the Bitcoinist portal and his forecast is based on the fact that the Bitcoin mining reward in 2020 will drop from 12.5 BTC to 6.25 BTC.

In 2012, Bitcoin mining awarddecreased from 50 bitcoins to 25 bitcoins and then to 12.5 bitcoins in 2016. The historical price chart of Bitcoin shows that shortly after these two events, the price of Bitcoin reached astounding heights.

For example, the next year after the firstreduction in mining rewards, the price of Bitcoin rose to an unprecedented $1,000. And in the year following the second reduction in the mining reward, its price reached a record $19,500. Analysts at Bitcoinist predict Bitcoin's price to rise to an all-time high of $20,000 in 2020.

Fran Strajnar

CEO of Brave New Coin – organizationCryptocurrency Researcher Fran Strainer predicts that the price of Bitcoin will reach a whopping $200,000 in 2020. To support his prediction, Strainer cites the inverse relationship between supply and demand for Bitcoin - the rate of adoption is increasing, more and more people are using the Bitcoin network, downloading applications and creating e-wallets, while the supply of Bitcoins in circulation is declining. As a result, the price of Bitcoin will obviously increase.

Another contributing factor to the increaseThe value of this cryptocurrency is its use in real life, which can be observed in Japan, where more than 200,000 stores accept Bitcoin as a means of payment. Despite the fact that in accordance with previously established models, the price of Bitcoin may rise in 2020, it is best to conduct your own research before investing in it.

</p>