</span>conflict between the US and China, using Bitcoin" src="/wp-content/uploads/2019/10/36a529a00f360bd4259d5a21b3d14780.jpg" alt="Grayscale Study: Hedging the Risks of the US-China Trade Conflict with Bitcoin" /></p>

</strong>

Grayscale has published a study titled "Hedging the risks associated with the US-China trade conflict with Bitcoin".The author of the work, Matthew Beck, believes that cryptocurrency provides investors with unique opportunities and should be in every long-term portfolio.

The scale and frequency of crises are increasing

Over the past 60 years, Goldman Sachs has recorded 11 crises that have occurred in the financial markets of the United States, Europe and Asia.They have caused significant damage to the economy, for example, the S&P 500 stock index fell by almost 50% during the Global Financial Crisis (GFC), which began in October 2007 and ended in March 2009.

Over the past 10 years in the markethigh-risk assets (such as Bitcoin and gold) there is a bullish trend. Therefore, each investor must monitor the dynamics of changes in liquidity risk and be able to use hedging instruments before the onset of another crisis.

What is liquidity risk?

Liquidity risk is the risk of losses caused bymismatch of maturities of liabilities for assets and liabilities. An imbalance can manifest itself in the form of deflation or inflation. When the liquidity level is not high enough to service debt or stimulate economic growth, deflation occurs. Too high a liquidity ratio, on the contrary, leads to inflation.

Low diversification of mosttraditional investment portfolios does not protect the owner from liquidity risk, since it mainly includes only shares. The exchange rate of securities usually reacts negatively to pressure caused by deflation and inflation. Thus, the ability to correctly formulate a portfolio is one of the key skills that a successful financier must possess.

Non-linear increase in liquidity risk indicatordue to the dynamics of changes in financial leverage (leverage). In 2018, the amount of debt reached its maximum level over the past 10 years ($ 250 trillion), so there is a high probability of a liquidity crisis.

Bitcoin as a new risk hedge tool

Bitcoin can be used as:

- Means of savings;

- unit of account;

- investments in the development of blockchain technology.

The dynamics of changes in the BTC rate are often notcoincides with the indicators of the stock market, so the virtual currency reduces the risk of liquidity. The coin is not suitable for all investors, however, Grayscale employees believe that Bitcoin should be added to a long-term portfolio for a position of a stable strategic asset.

US-China trade conflict escalates

US-China Trade Crisisstarted in 2017. The conflict escalated on May 5, when Donald Trump announced an increase in trade duties on Chinese goods from 10% to 25%. In response to the actions of the Americans, Beijing also increased tariffs from 10% to 25%. Negotiations between the countries at the G20 summit did not lead to positive results, and on August 1, the U.S. President announced that the increased rate would begin on September 1, 2019.

The US and China account for about 40% ofglobal production, so the conflict between these states will affect the global economy. According to experts of the International Monetary Fund, a trade war between the countries will violate the international supply chain of products and jeopardize the predicted growth of the financial market. A crisis can cause a domino effect and lead to a decrease in liquidity.

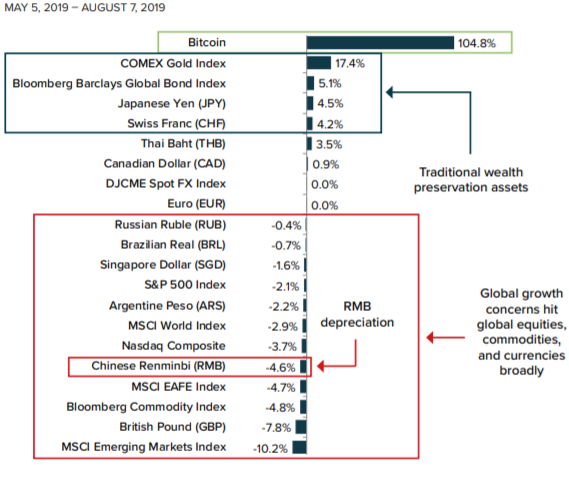

Between May 5 and August 7, investments in Bitcoin yielded a profit of 104.8%.Investments in 20 other assets (e.g., the ruble, the S&P 500, the British pound, the Bloomberg Commodity Index) turned out to be unprofitable by an average of -0.5%.Thus, traders who added BTC to their portfolio reduced their losses or made gains (depending on theshares of cryptocurrency in relation to other assets).