The digital asset management company is ready to file an application with the US Securities and Exchange Commissionafter the regulator defines the cryptocurrency market.

Public Relations Director GrayscaleInvestments Jennifer Rosenthal confirmed on Twitter the company's stance on converting the Grayscale Bitcoin Trust and other crypto funds into ETFs. According to Rosenthal, the company will be ready to submit an application to the US Securities and Exchange Commission (SEC) after the regulator gives a clear and formal definition of the cryptocurrency market.

.@Grayscale’s position has always been clear:we are 100% committed to converting $GBTC — and our product family — into ETFs, when the SEC has *formally* expressed their requisite comfort with the underlying Bitcoin market.

— Jennifer Rosenthal (@jenn_rosenthal) October 18, 2021

Rosenthal also commented on the launch of tradingthe first US Bitcoin ETF from ProShares to begin trading on the New York Stock Exchange (NYSE) on October 19. Rosenthal called this event historic and important not only for bitcoin, but for the entire cryptocurrency industry.

In early August, Grayscale Investments hiredformer head of index provider Alerian David LaValle, who took over as head of ETFs to work on converting the Grayscale Bitcoin Trust and the company's other funds into ETFs. Grayscale also announced plans to hire a dozen more specialists to work on the ETF.

In April, the CEO of GrayscaleInvestments Michael Sonnenschein announced plans to convert Grayscale crypto funds into ETFs. After the conversion, the Grayscale Bitcoin Trust will become the third largest commodity ETF, he said.

The Grayscale Bitcoin Trust functions similarly to ETFs in that it is secured and priced at bitcoin. It is not registered with the SEC, so only accredited investors have access to it.

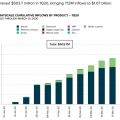

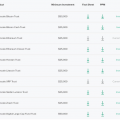

Grayscale Investments is a company that managesdigital assets, which allows accredited US investors to purchase cryptocurrency investment products in a regulated environment through traditional market instruments.

</p></p>