It seems like everyone loves gold.hard money, all that… Once upon a time it was like that. Now it's difficultimagine any other asset that would have as many distorted and emotional associations associated with gold…

"It's a hedge against inflation!" someone will say automatically.

So how did this hedge work last year, with7% inflation in the US and comparable or higher worldwide? Gold almost hit an anti-record for the worst return in six years, and net capital inflows into exchange-traded funds for gold were negative.

Maybe we should ask Ray Dalio of Bridgewater for advice?

“In the long run, the price of goldapproximately equal to the total amount of money in circulation divided by the size of the gold reserve. If the market price of gold deviates significantly from this level, this may indicate a good buying or selling opportunity.”

To be fair, this quote is from 2011, but in this form it's hardly a useful practice anyway:

- How exactly is the long term defined here?

- When should you buy and sell?

- What is considered a “significant” deviation in the market price of gold?

- Do bank reserves count as "money in circulation"?

In general, there is still a lot to discuss here…

So what actually affects the price of gold?

The willingness to hold capital in gold depends on the rate of return available in alternative assets.

The idea is not new. This idea was emphasized in a 1985 articleGibson's Paradox & The Gold Standard(PDF) - more than 35 years ago.

Why is gold an asset for doomers?

It is in demand mainly when market prospects look bleak, or better, completely hopeless. Time for chart:

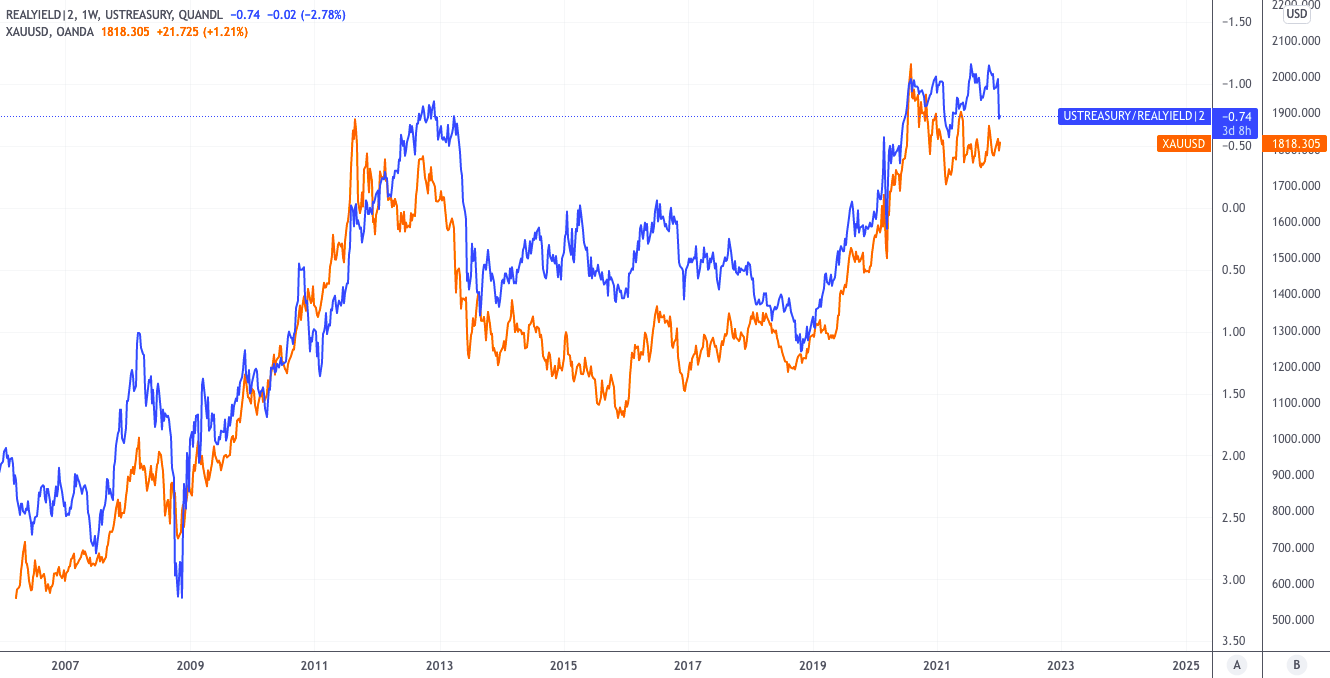

This is a gold price chart overlaid on the 10-yearreal(after inflation) yield on US Treasury bonds. For greater clarity, the real return axis is inverted.

As real yields move further bynegative territory, the attractiveness of gold (and its price) will generally rise. Unless there are alternatives to gold on the market that offer better rates of return…

Despite the fact that real profitability is in the pastyear remained deeply negative, the market offered many other options for obtaining returns above the inflation rate. The most obvious example is the S&P with a return of +25% for 2021.

The potential for high returns in equities implied no demand for gold. Between August 2020 and April 2021, gold fell by almost 20%.

The stock market outlook for 2022 is not that clear, so...maybe, this year will be better for gold. Much will depend on the mode in which the market is located.

There are those who say the economy will continuegrow. Growth will slow down compared to the previous year, but will still be ahead of pre-Covid rates. Others believe the economy will slow significantly more. The Fed will play a significant role in this by temporarily putting an end to the rise. Between these modes tooenoughspace and possible gradations.

In a positive scenario, it is difficult to imagine a strong strengthening of gold, except for occasional episodes of growth against the background of the relative weakness of the dollar.

With the economy slowing down, gold could regain its attractiveness in the eyes of investors as capital piles up in bonds, pushing yields lower.

In the end, an asset with zero return will look more attractive than bonds withnegativeprofitability.

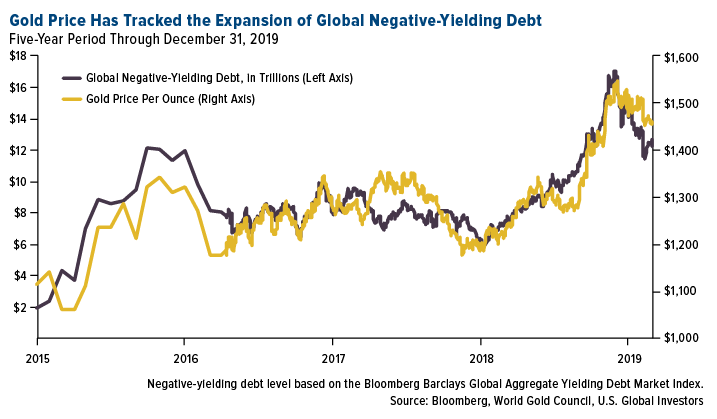

The price of gold follows the growth of global debt fromnegative yield (five-year period up to December 31, 2019). The yellow graph is the price of gold per ounce (right scale), the black graph is negative-yielding global debt (left scale).

When it comes to gold, it makes sense to try to imagine what a professional manager would do in response to the question: “Should I buy gold?”

If higher returns are clearly available elsewhere, then the answer is probably no.

In times of uncertainty and slowdowngrowth, when the prospects for significant growth in equities and other asset classes seem dim, nominal yields on bonds fall, often into negative territory.

In such a situation, your imaginary middle manager might start thinking something like this:

…and a rally may form in gold.

In summary:

- Gold is an asset for doomers.

- When economic growth slows, capital flows into bonds, lowering overall bond yields.

- A huge mountain of negative bondsprofitability and lack of economic growth mean limited opportunities for profitability elsewhere ==> buying gold with zero return is the “lesser evil”least potentially unprofitableoption.

Why did I decide to translate this little article about gold for you?

The idea is simple: logically it seems that the narrative of Bitcoin as digital gold, if viable, should have some noticeable effect in a situation favorable to physical gold.

In addition, this seems to be a favorable background for at least a temporary weakening of the correlation of bitcoin with the stock market (especially on falls).

Weakening correlation with risky assets in thisyear looks desirable and, it feels, logically possible, since it becomes too obvious to the “public”. As Cred and DonAlt noted in the Technical Roundup the other day, “When crypto Twitter dog token traders start to get a little too interested in the macro agenda, the market is likely approaching at least a short-term reversal.”

Suchhopiumto your feed.

Well, if during stagnation or a decrease in globaleconomy, gold will get its rally, and bitcoin will continue to be traded as a risky asset, then, probably, this narrative (“digital gold”) can be slowly written off as scrap and look for a new idea. (Also, on the one hand, not to get used to ...)

P.S. I do not promise to support any discussion, but it would be interesting to see constructive and reasonable thoughts in the comments.

BitNews disclaim responsibility for anyinvestment recommendations that may be contained in this article. All the opinions expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading on crypto markets involve the risk of losing the invested funds. Based on the data provided, you make investment decisions in a balanced, responsible manner and at your own risk.

Based on source