Article Reading Time:

2 minutes.

Research agency Glassnode believes that market indicators suggest that in the current market, most traders are selling Bitcoin at a loss.

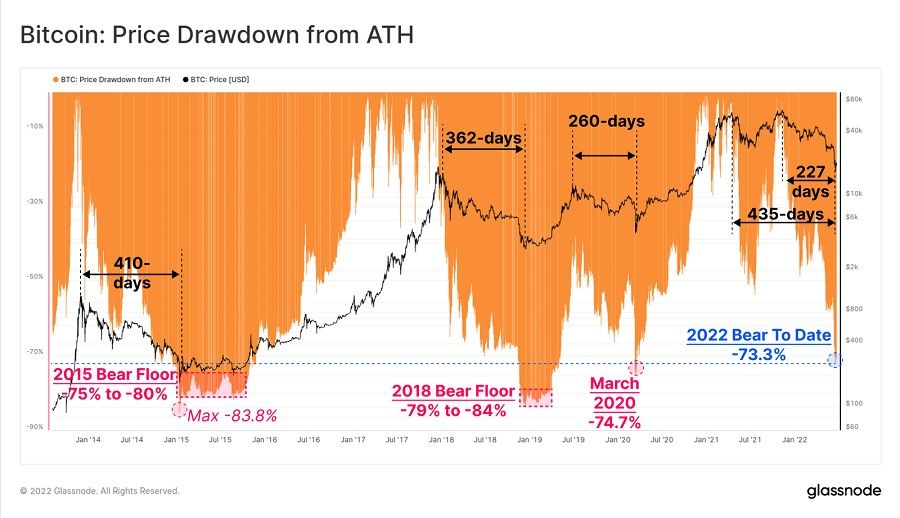

Analytics firm Glassnode reported that Bitcoin's current bearish trend is the worst ever recorded, as most holders are selling BTC at a loss.

In a report entitled "Bear of Historicalscale”, the first and most obvious sign of a bear market, Glassnode analysts called a drop in the spot price of Bitcoin below the 200-day moving average (MM) and an even more extreme scenario of the 200-week moving average (MA).

Glassnode notes that Bitcoin is falling lowerthe 200-day moving average is an extremely rare occurrence that has not occurred since 2015. MM takes into account price movements above and below the 200-day moving average to indicate overbought or oversold conditions.

</p>“Only 84 out of 4,160 trading days (2%)recorded a closing MM value below 0.5,” the report says. “For the first time in history, the 2021-2022 cycle recorded a lower MM value (0.487) than the previous cycle low (0.511).”

Confirmation of the seriousness of the current marketconditions was a drop in the spot price below the selling price, which forces traders to increasingly sell bitcoins at a loss. Glassnode analysts say this cascading effect is “typical of bear markets and market capitulations.”

The report notes that instances of spot prices trading below strike prices are rare - this is the third time in the last six years and the fifth time since Bitcoin's launch in 2009.

CNBC host Jim Cramer believes that Bitcoin may recover most of its losses in the coming months, but don't expect new price records.