Although 2020 was a memorable year for Bitcoin, December remains unbeatable in terms ofestablished records. After rallying to the previous all-time high on November 30, BTC gained another 62% over the next 30 days, having a value of $ 29,300 at the end of the year.

In this situation, the market expected at leastshort-term correction, however, the price continued to rise and on January 8 set a new all-time high above $ 42,000. It is believed that this rise in Bitcoin was due to several factors.

The liquidation of short positions in the previous week caused some price turbulence, but some investors continued to bet after consolidating during the 2nd week of the month.

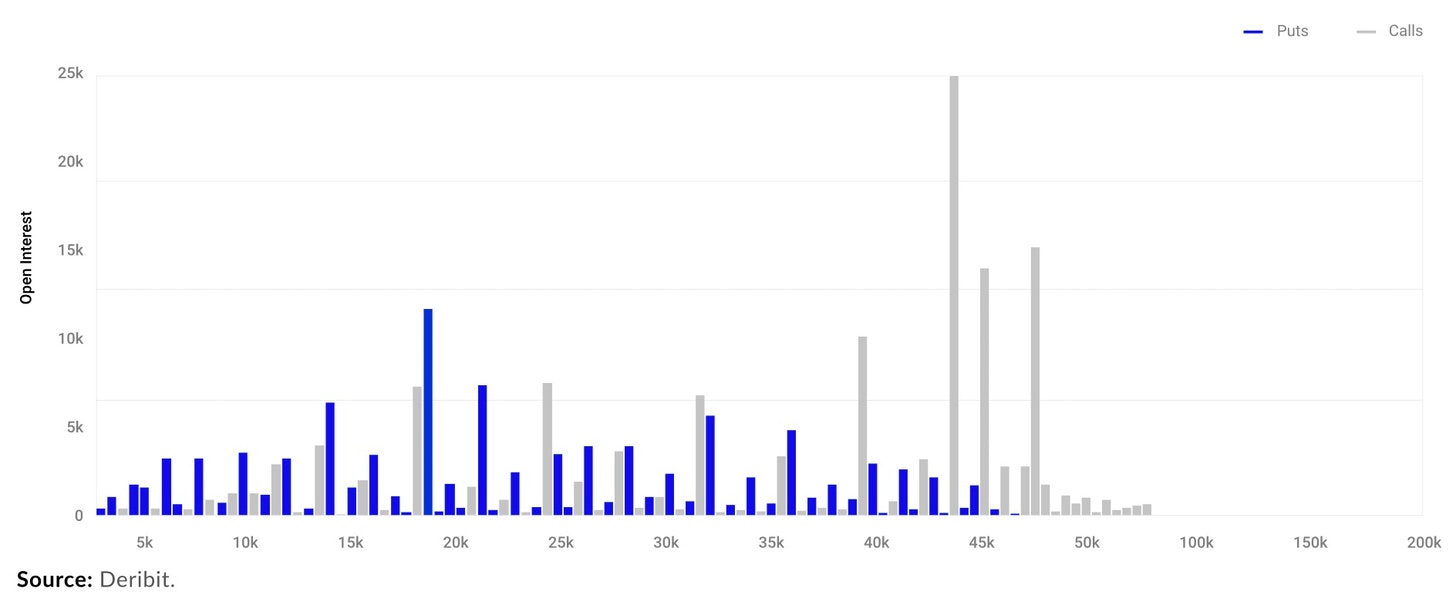

</p>Further price increases led to the emergence of a phenomenon called "gamma compression" in the market.

A "gamma squeeze" occurs after many options increase the price of an asset because option sellers need to hedge their trades on the underlying asset.

Higher short liquidation triggered a subsequent gamma squeeze that could lead to further price escalation by the end of December 2020.

Since January 9, Bitcoin markets have largelyslowed down, which caused a reboot of the market. For this reason, significantly fewer traders were betting on another rally, which underscores the fall in longs on crypto exchanges.

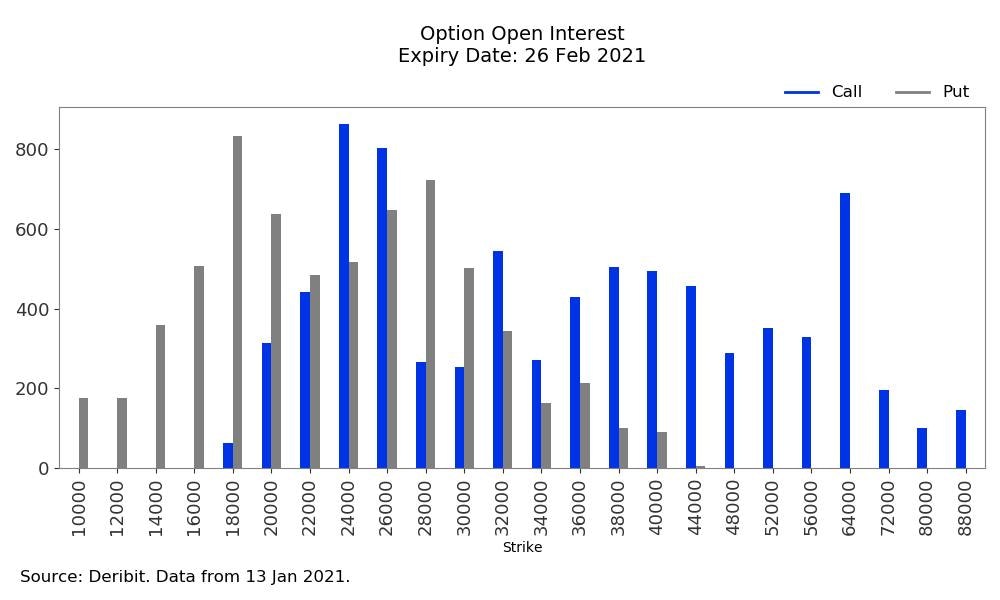

However, the current market structure may indicate another possible gamma compression in February.

Consistent with current CME timing spreads, the time frame is steeper and market expectations for the future are higher than current spot prices.

It is important to keep track of BTC options contracts in February, as most strike prices can lead to another gamma squeeze with massive buy options strikes at $ 64,000.

Rating of TOP-5 cryptocurrency exchanges

For the safe and convenient purchase of cryptocurrencies, we have prepared a rating of the most reliable and popular cryptocurrency exchanges that support the deposit and withdrawal of funds in rubles, hryvnias, dollars and euros.

The most reliable sites with the highest turnoverfunds, for several years the largest cryptocurrency exchange in the world has been Binance. The Binance platform is the most popular crypto-exchange in the CIS as well, since it has the maximum trading volumes and supports transfers in rubles from Visa / MasterCard bank cards and payment systems QIWI, Advcash, Payeer.

Especially for beginners, we have prepared a detailed guide: How to buy bitcoin on a crypto exchange for rubles?

| # | Cryptocurrency exchange | Official site | Site evaluation |

|---|---|---|---|

| 1 | Binance (Editor's Choice) | https://binance.com | 9.7 |

| 2 | Huobi | https://huobi.com | 7.5 |

| 3 | Exmo | https://exmo.me | 6.9 |

| 4 | Yobit | https://yobit.net | 6.3 |

| 5 | OKEx | https://okex.com | 6.1 |

The criteria by which the rating is set in our rating of crypto-exchanges:

- Work reliability— stability of access to all functions of the platform, including uninterrupted trading, deposits and withdrawals of funds, as well as the duration of the market and daily trading volume.

- Commissions– the amount of commission for trading operations within the platform and withdrawal of assets.

- Feedback and support– we analyze user reviews and the quality of technical support.

- Convenience of the interface– we evaluate the functionality and intuitiveness of the interface, possible errors and failures when working with the exchange.

- Platform Features– availability of additional features — futures, options, staking, etc.

- final grade– the average number of points for all indicators determines the place in the ranking.

Rate this publication