Article Reading Time:

2 minutes.

The number of cryptocurrency platforms in the Forbes Fintech 50 list decreased this year from nine to five, the financial and economic magazine notes.

This year was marked by a decline in the marketthe value of cryptocurrencies by $1.4 trillion amid the collapse of FTX in November last year. Also this year, several other major players declared themselves bankrupt - crypto lenders Genesis and BlockFi, as well as the multibillion-dollar hedge fund Three Arrows Capital. Nine cryptocurrency and blockchain companies, including FTX, were on the Fintech 50 list last year, but the number of participants has now been reduced to five.

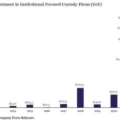

Among the firms included in the 2023 list are:include development platform Web3 Alchemy, analytics platform Chainalysis, cryptocurrency storage technology provider Fireblocks, blockchain infrastructure provider Paxos, and tax compliance company TaxBit. This suggests that there is still high demand, including from governments, for infrastructure, cryptanalytics and service providers in the crypto industry, Forbes writes.

In fact, these firms attracted a total ofcomplexity of $3.1 billion in 2023. Alchemy generates over $150 billion in annual cryptocurrency turnover. Chainalysis, which launched back in 2014, has become a major tool in crypto investigations by both government and the private sector. And Fireblocks has grown from a cryptocurrency storage technology provider to a full-service platform that supports approximately 130 million crypto wallets.

New this year, TaxBit, which is basedin Utah, has already become a key partner of the US Internal Revenue Service (IRS). The $1.3 billion firm is also partnering with TurboTax to help users easily add cryptocurrency gains and losses to their tax returns.

Recently, the Securities and Exchange CommissionThe US (SEC) has taken decisive action against the leading crypto exchanges in the country. The SEC sued Coinbase on Tuesday, accusing the company of acting as an unregistered broker and exchange. The Commission also accused the largest cryptocurrency exchange, Binance, and its founder of creating a “web of deception,” inflating trading volume, diverting client assets and trading in unregistered securities.